Are you eager to ensure your claim is settled smoothly and efficiently? Our guide on crafting the perfect claim settlement confirmation letter can help you navigate this crucial step. With clear language and concise details, your letter can pave the way for a swift resolution. Dive in to discover the key elements to include and examples that will enhance your writing!

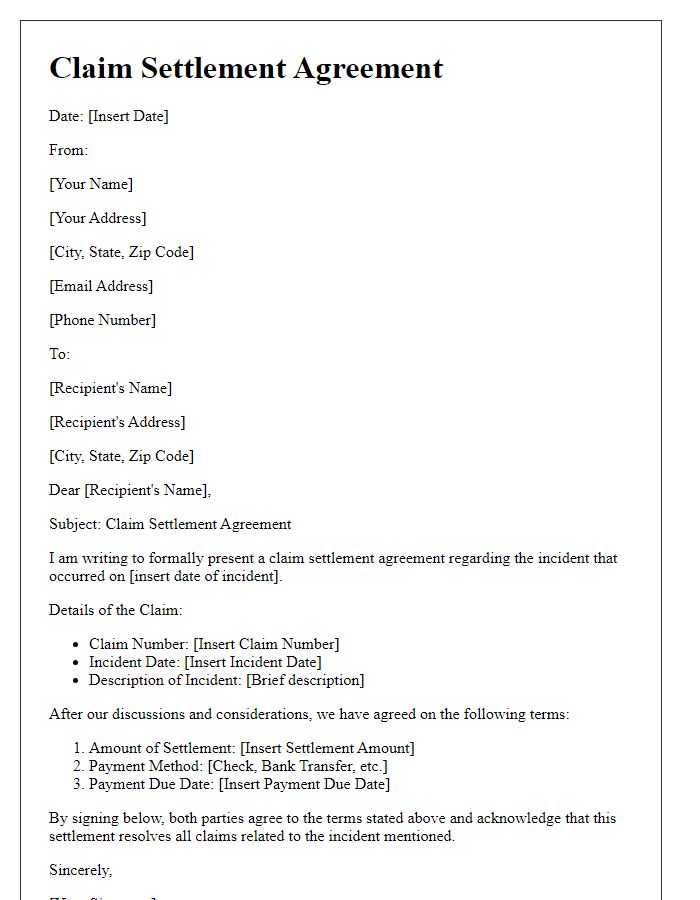

Claimant's details and policy number

Claim settlement confirmations provide essential information regarding the resolution of a claim. The claimant's details include the full name, contact information, and address of the policyholder. Each insurance policy is identified by a unique policy number, essential for tracking and reference throughout the claims process. Detailed analysis of the claim, event dates, and amounts settled are crucial for the claimant's understanding. Timely communication from the insurance provider enhances customer trust and satisfaction. Such confirmations typically highlight the nature of the claim, providing clarity on any agreed-upon compensation.

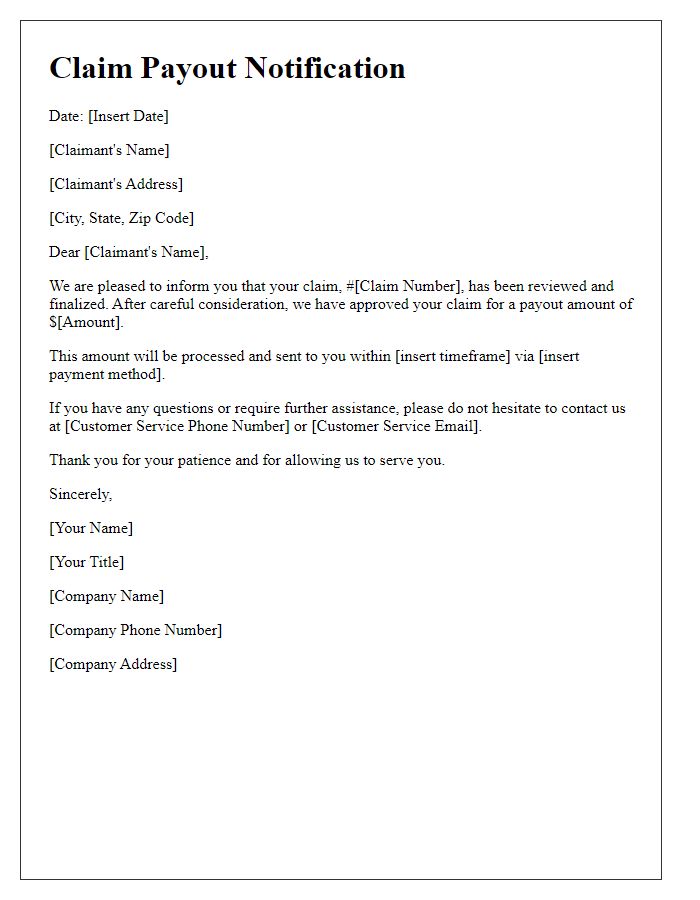

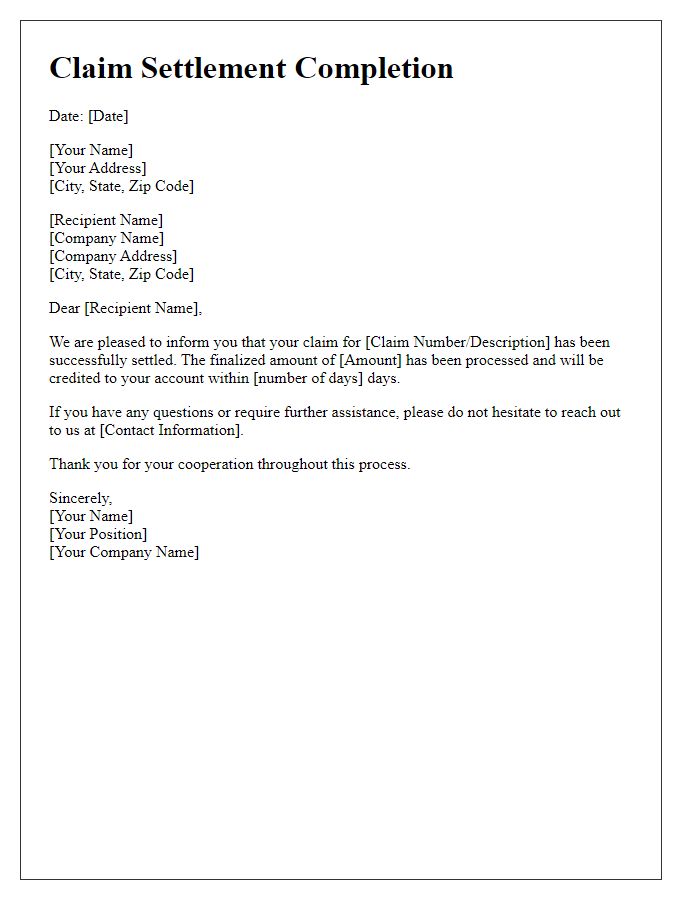

Acknowledgment of claim receipt and processing

Claim settlements are crucial for ensuring timely compensation for policyholders. Acknowledgment of claim receipt provides reassurance to claimants that their submissions are under review. For instance, insurance companies often send a notification within 24 to 48 hours of receiving claims, confirming the start of the processing phase. During this period, assessors evaluate the claim's validity based on policy terms, accident details, and applicable regulations. Efficient communication channels, such as customer service helplines or email updates, are essential for keeping claimants informed throughout the process. Ultimately, a streamlined acknowledgment process fosters trust and satisfaction among clients, enhancing overall customer experience.

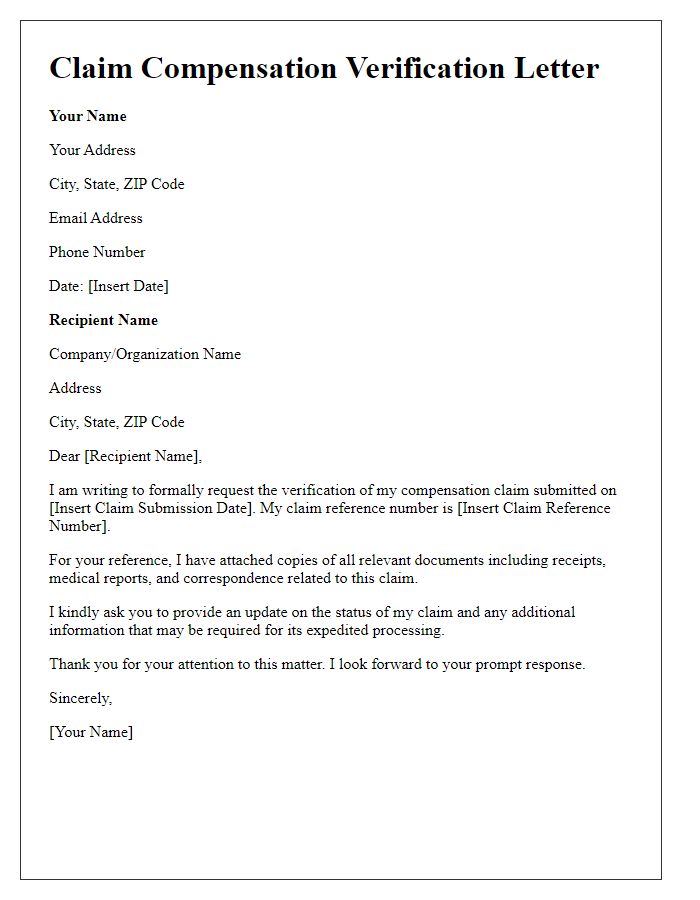

Settlement amount and breakdown

The successful settlement of an insurance claim can significantly alleviate financial stress during challenging times. Consider a settlement amount of $50,000 for a home insurance claim due to a fire incident in Chicago, Illinois, on July 15, 2023. This sum must include various breakdown components: $30,000 allocated for structural repairs of the property (including roofing and interior reconstruction), $10,000 for replacing personal belongings affected by the fire, and $10,000 for additional living expenses incurred while the property is uninhabitable. This thorough accounting ensures clarity and transparency, providing all parties with a comprehensive understanding of the settlement process and status.

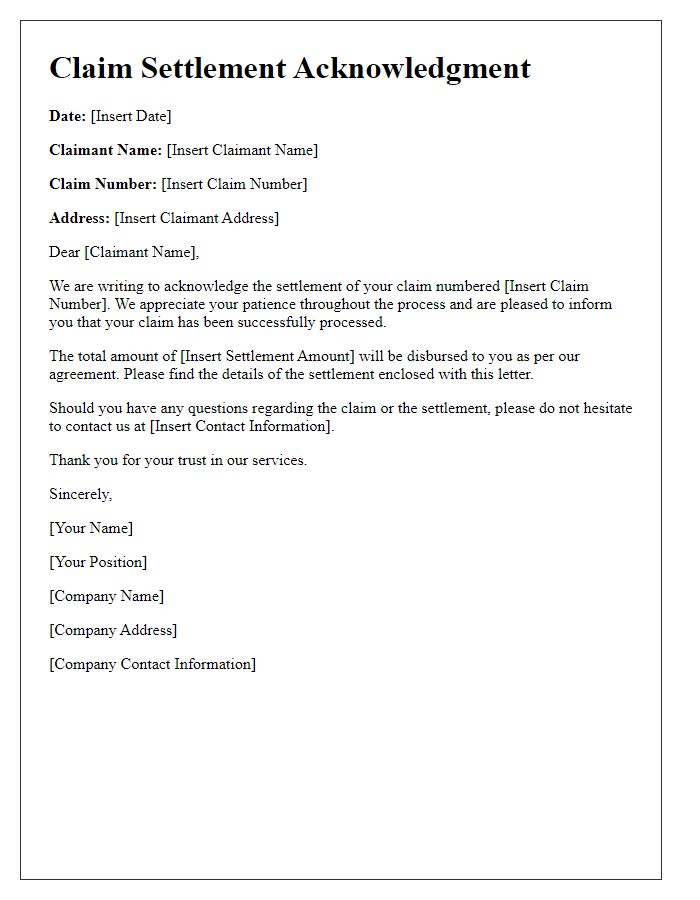

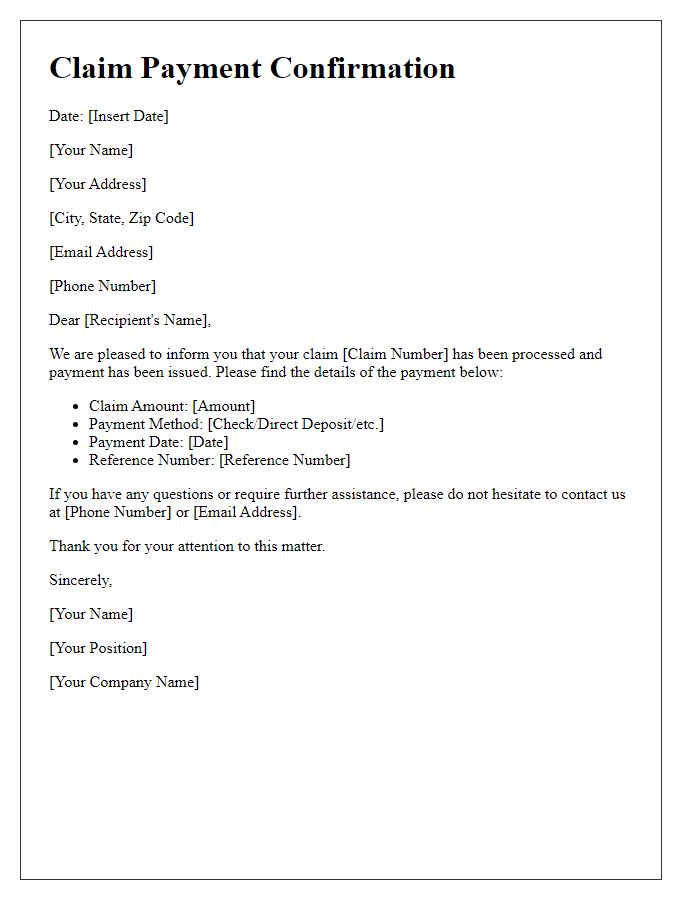

Payment method and timeline

Claim settlements typically involve the reimbursement process following an insurance claim or similar transaction. The confirmation of a claim settlement ensures that the claimant is notified regarding the payment method, which could include direct bank transfer, check issuance, or other electronic payment forms. Payment timelines usually vary, ranging from immediate processing to a few days, often dictated by the efficiency of the insurer or financial institution involved. Claimants must remain informed of any required documentation to facilitate smooth transactions, while understanding potential delays related to holidays or administrative processing times.

Contact information for further queries

In the context of a claim settlement confirmation process, maintaining open lines of communication is essential for addressing any further queries. Contact information must include specific details such as a dedicated claims representative's name and direct phone number for immediate assistance. Additionally, an official email address should be provided for written inquiries, ensuring timely responses. The address of the claims department (e.g., 123 Insurance Ave, Suite 456, City, State, Zip Code) can offer a physical point of contact, while mentioning business hours (e.g., Monday to Friday, 9 AM to 5 PM) can help set expectations for response times. Providing this detailed contact information enhances customer confidence and satisfaction in the claims process.

Comments