When life throws unexpected challenges our way, like an accident, having the right insurance coverage can provide some much-needed peace of mind. Filing a claim for accident insurance benefits doesn't have to be a daunting task; in fact, with the right approach, it can be quite straightforward. This article will guide you through the essential steps, tips, and a handy template to ensure your claim process is as smooth as possible. So, let's dive in and empower you to take control of your accident insurance benefits!

Claimant's personal information

Accident insurance benefit claims require substantial personal information for processing. Essential details include the claimant's full name, date of birth (typically in MM/DD/YYYY format), and Social Security Number (for identity verification). A permanent address is crucial, ensuring correspondence reaches the right individual. Contact details, such as phone number and email address, aid in timely communication regarding the claim's status. Additionally, policy number (assigned by the insurance provider) uniquely identifies the claim. If applicable, details about dependents (names and dates of birth) may be necessary to determine benefit distribution. Accurate and complete information streamlines the claims process, facilitating faster resolution.

Incident description and details

On December 15, 2023, at approximately 2:30 PM, I was involved in a motor vehicle accident on Maple Avenue, near the intersection with Oak Street in Springfield, Illinois. The incident occurred when another vehicle, a blue 2017 Honda Accord, failed to stop at a red traffic light, colliding with my car, a white 2015 Toyota Camry. The impact caused significant damage to the front passenger side of my vehicle, resulting in a need for extensive repairs costing an estimated $5,000. I sustained minor injuries, including whiplash and bruising, necessitating medical attention at Springfield General Hospital, where I received treatment on the same day. A police report was filed under report number 12345, documenting the details of the accident and identifying the Honda's driver as responsible for the collision. Witnesses at the scene corroborated my account, providing statements to the responding officers. This incident has significantly disrupted my daily life and work schedule, leading to additional expenses and inconveniences.

Policy number and insurance details

Accident insurance benefits provide critical financial support following unforeseen incidents. Policy numbers, such as XYZ123456, allow insurers to efficiently track claims and verify coverage details. Essential information includes the date of the accident, which could significantly enhance processing speed--an example being a workplace accident that occurred on January 15, 2023, at a manufacturing plant in Springfield. Additionally, accurate documentation of injuries sustained, such as broken bones or concussions, is crucial for justifying the claim. Specifying medical treatment received, such as emergency room visits at Springfield General Hospital, strengthens the claim. Policyholders must also note the required submission timeline, often within 30 days from the accident date, to ensure compliance with the insurance provider's regulations.

Itemized list of expenses

Accident insurance claims often require detailed documentation of expenses incurred due to the incident. An itemized list of expenses typically includes medical bills from hospitals or clinics, totaling amounts such as $2,500 for emergency room visits, $300 for follow-up doctor appointments, and $150 for prescribed medications. Rehabilitation costs may also be included, for instance, $600 for physical therapy sessions over six weeks. Additionally, expenses related to transportation to these appointments, such as $80 for taxi rides or mileage reimbursement calculated at 56 cents per mile, can be documented. Lost wages due to inability to work should be itemized as well, detailing calculations based on your average salary or hourly wage, such as $1,200 lost from two weeks off. Lastly, any costs for adaptive devices or modifications, like $150 for a cane or $1,000 for wheelchair accessibility at home, should be noted to provide a comprehensive overview of financial impact stemming from the accident.

Required documentation and evidence

To successfully file an accident insurance benefit claim, it is crucial to gather comprehensive documentation and evidence to support the claim. Key documents include a completed claim form, which outlines personal information and incident details. Medical records detailing the nature of injuries sustained--such as hospital discharge summaries or doctor notes--should be included to establish a clear link between the accident and medical treatment received. Police reports provide crucial corroboration of the accident circumstances and can enhance credibility, while photographs of the accident scene or injuries can visually substantiate the claim. Witness statements from individuals present during the incident can further validate the claim's authenticity. Additionally, any relevant financial documents--like bills for medical expenses or lost wages due to the accident--are essential to illustrate the financial impact. Collectively, this documentation helps form a robust foundation for the claim process, facilitating timely processing by the insurance company.

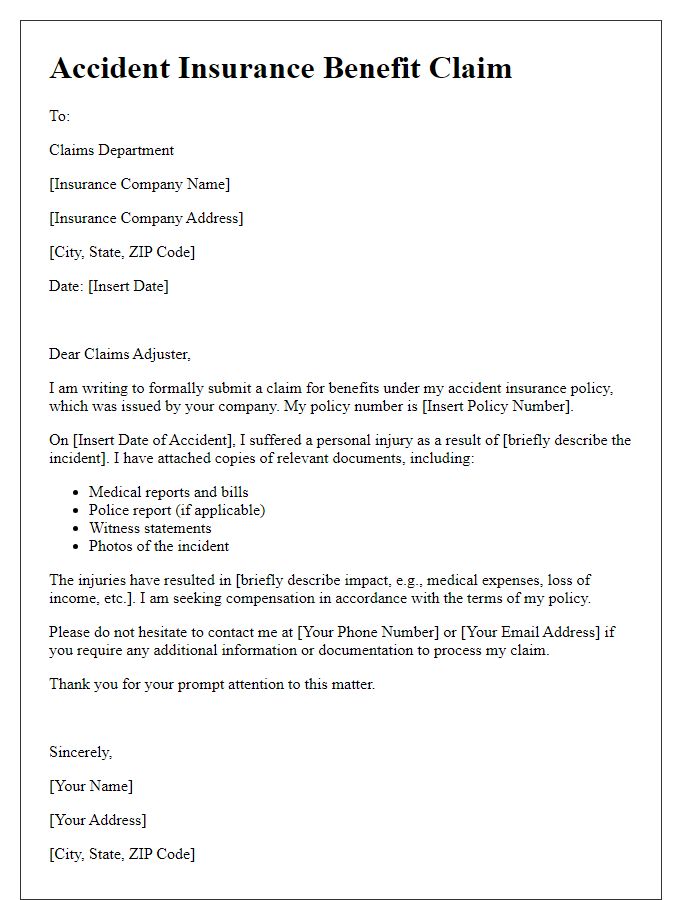

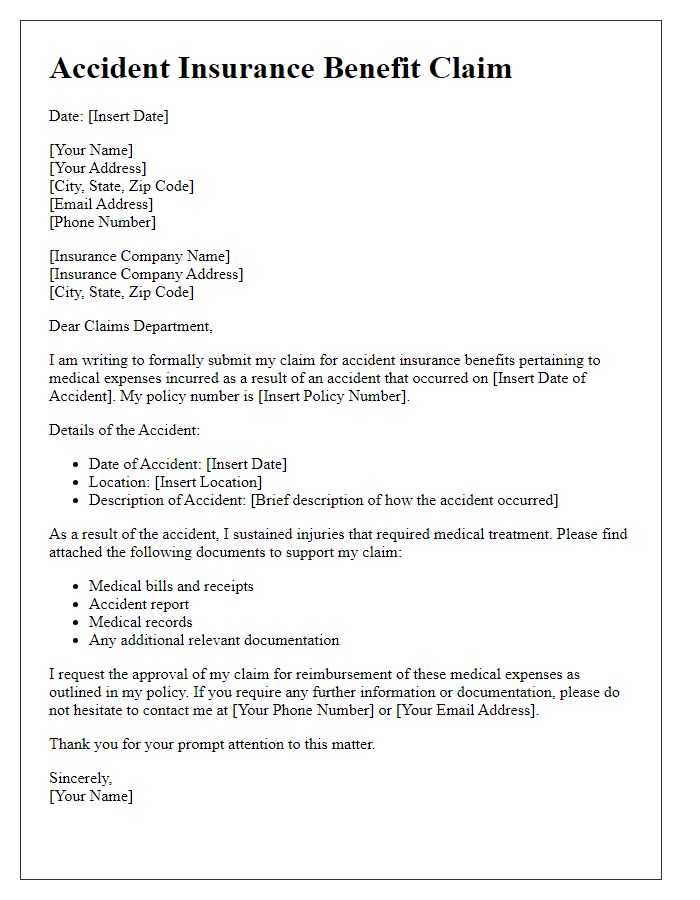

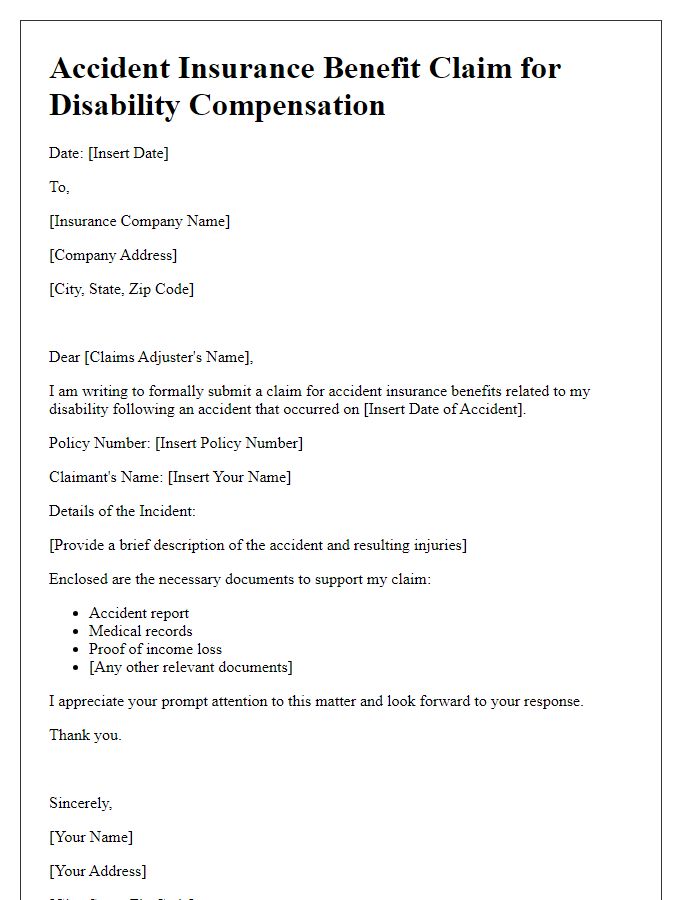

Letter Template For Accident Insurance Benefit Claim Samples

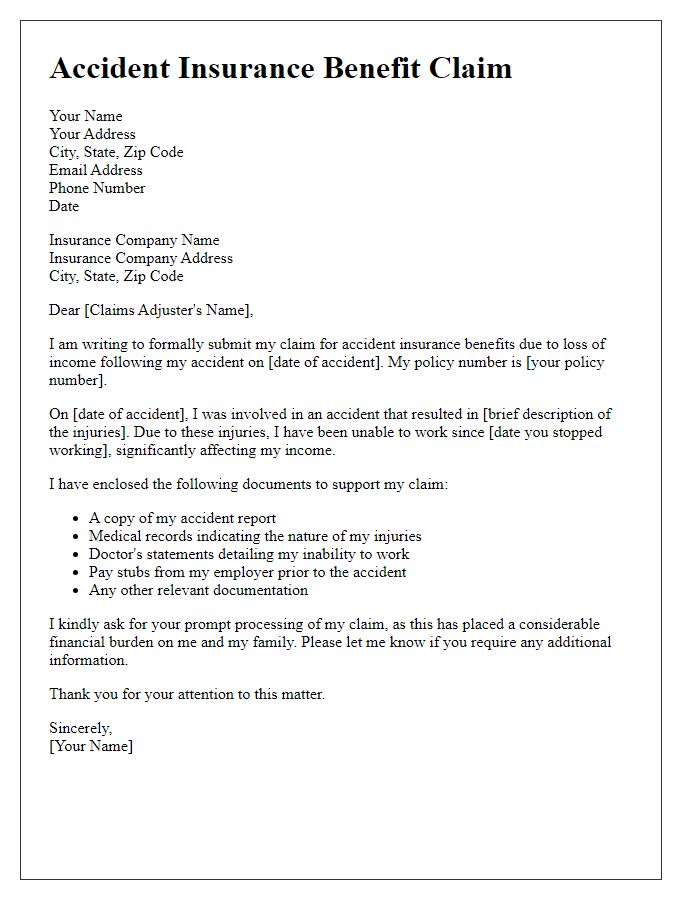

Letter template of accident insurance benefit claim for personal injury.

Letter template of accident insurance benefit claim for medical expenses.

Letter template of accident insurance benefit claim for disability compensation.

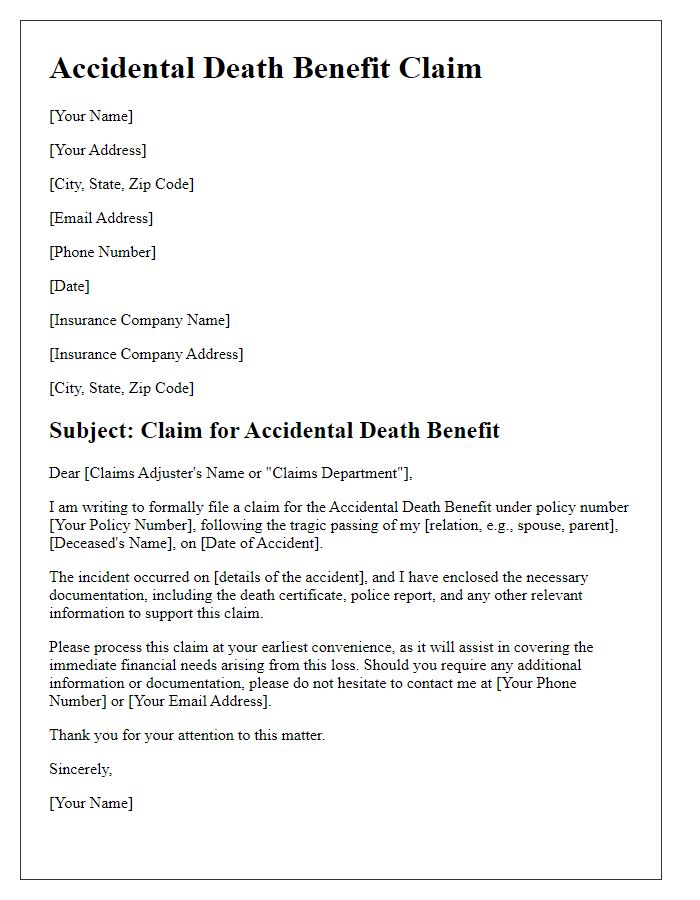

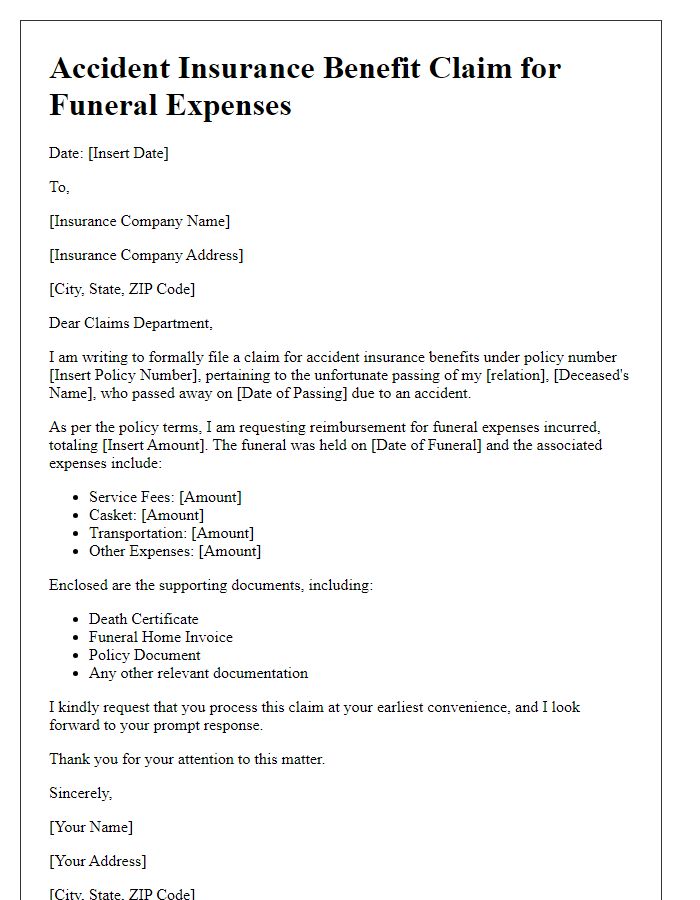

Letter template of accident insurance benefit claim for accidental death benefit.

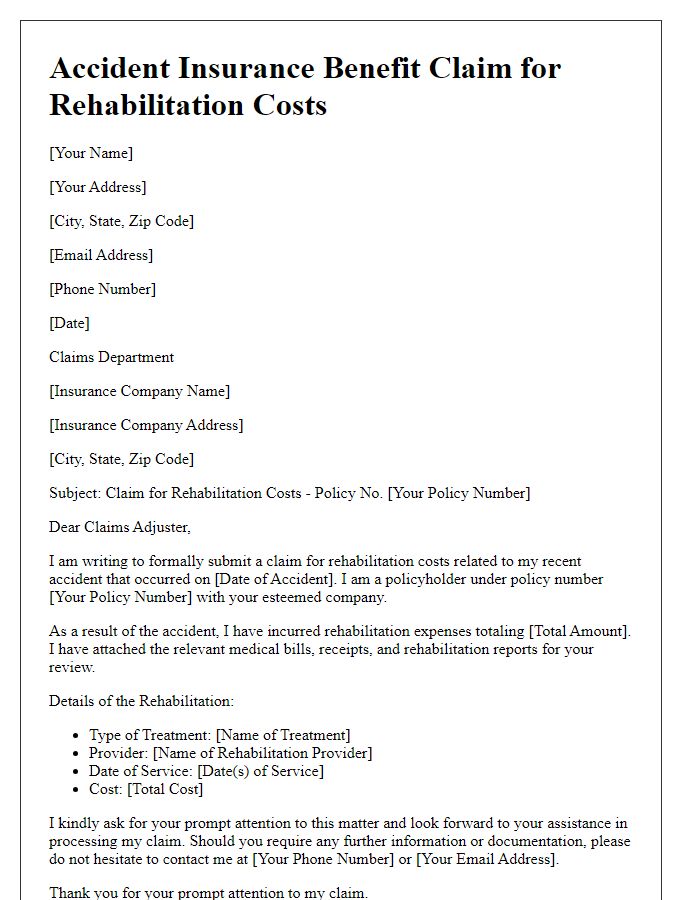

Letter template of accident insurance benefit claim for rehabilitation costs.

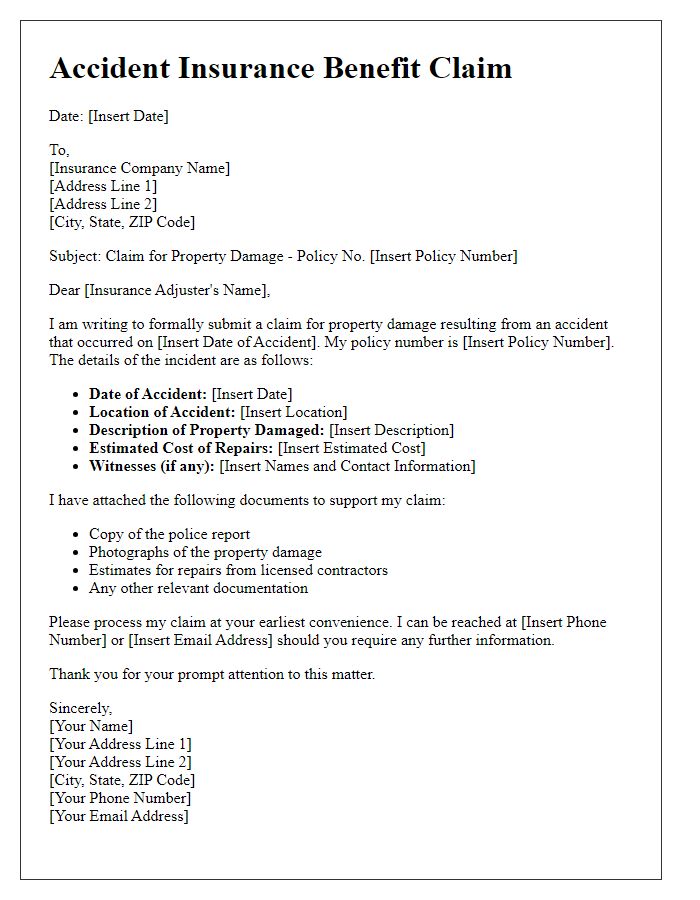

Letter template of accident insurance benefit claim for property damage.

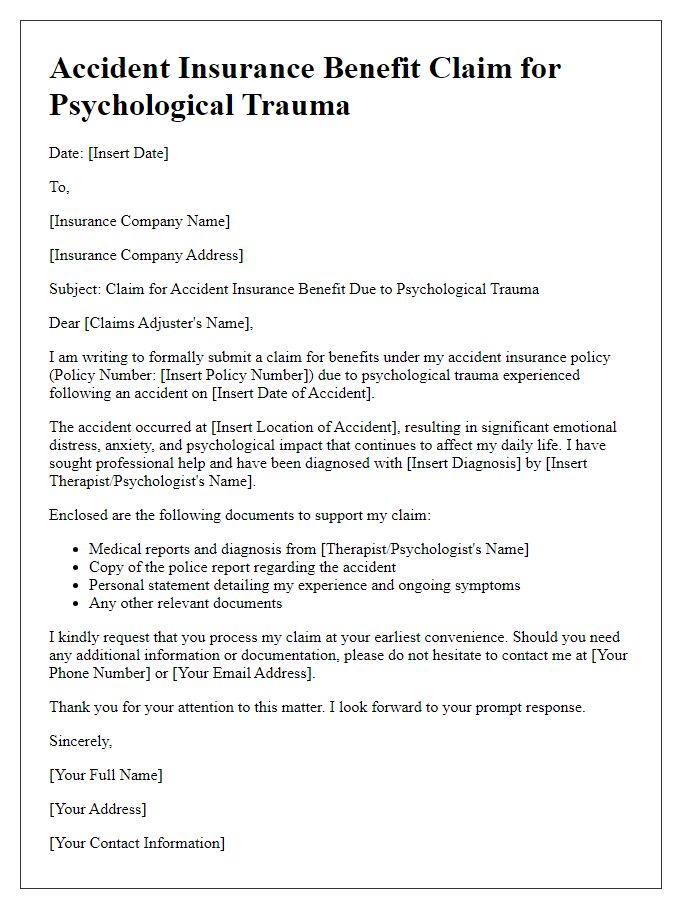

Letter template of accident insurance benefit claim for psychological trauma.

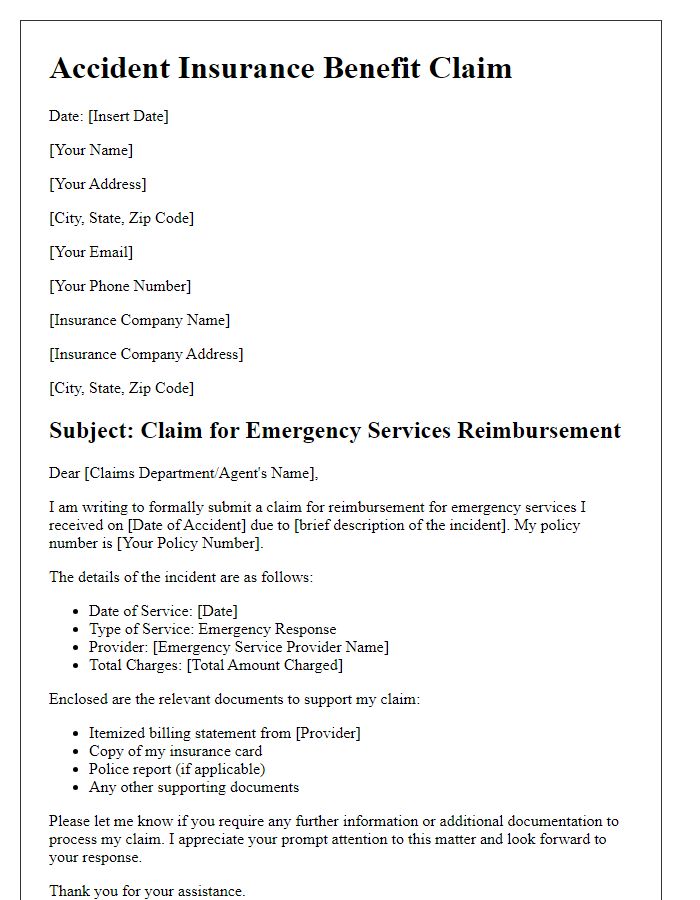

Letter template of accident insurance benefit claim for emergency services reimbursement.

Comments