When it comes to navigating the often complicated world of insurance co-payments, understanding the details can make all the difference. A co-payment, or co-pay, is a fixed amount you pay for specific services, like doctor visits or prescriptions, and can vary depending on your insurance plan. Knowing how and when to make these payments is essential for managing your healthcare expenses effectively. Curious to learn more about how to handle insurance co-payments and maximize your benefits? Read on!

Policyholder Information

Policyholder information acts as the foundational data necessary for insurance claim processing. This includes personal details such as full name (first and last), policy number (unique identifier of the insurance contract), date of birth (establishing eligibility), and contact information (phone number and mailing address). Additionally, the insurance provider typically requires the effective date of the policy (start date of coverage) and information on the insured items or services (specifics on what the policy covers, such as property, health, or auto). Accurate and complete policyholder information ensures efficient communication and settlement of co-payment obligations.

Policy Details and Coverage

Insurance co-payment refers to the shared financial responsibility between the insured individual and the insurance company concerning medical expenses. Typically, this co-payment amount can vary based on specific policy details, which are outlined in the insurance agreement. For instance, a common co-payment structure might include a percentage of the total medical bill, such as 20%, while the remaining 80% is covered by the insurance provider. Policyholders should review their individual coverage details, including in-network versus out-of-network providers, which can significantly affect co-payment amounts. Additionally, it's essential to consider limits on specific treatments or services, such as annual caps on physical therapy that might restrict total reimbursement. Understanding these factors ensures better financial planning and informed healthcare decisions.

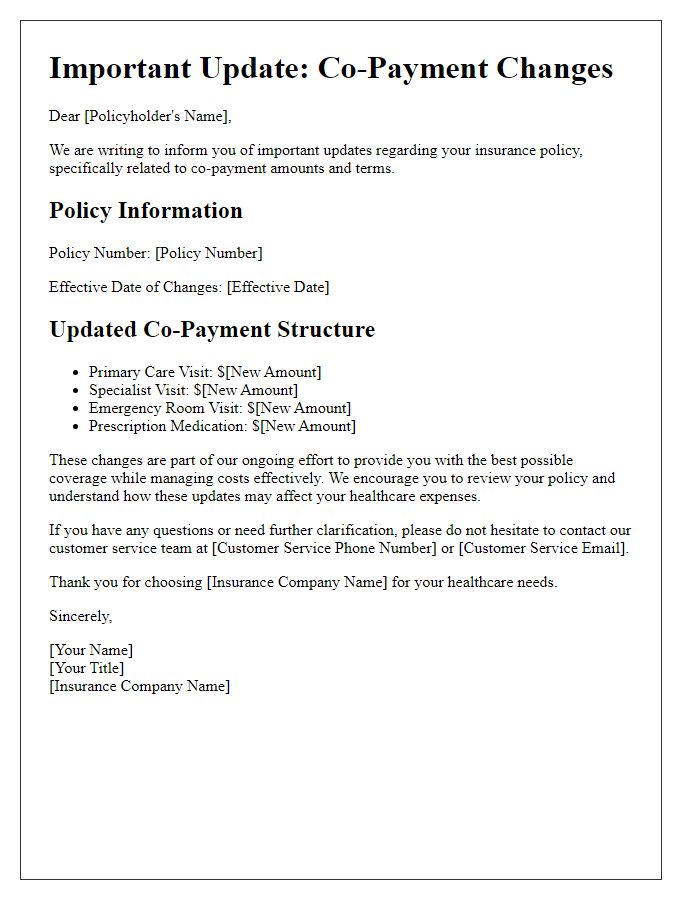

Explanation of Co-Payment Terms

Understanding co-payment terms in health insurance is crucial for policyholders navigating their medical expenses. A co-payment, often referred to as a co-pay, is a fixed amount paid by the insured individual at the time of receiving medical services, such as doctor's visits or prescription medications. Typically, co-payment amounts can vary depending on the type of service, with primary care visits often requiring lower co-payments compared to specialist consultations. Insurance plans, like Health Maintenance Organizations (HMOs) or Preferred Provider Organizations (PPOs), may specify different co-payment rates; for instance, a HMO may charge a $20 co-pay for a general practitioner visit, while a PPO might have a $30 co-pay for the same service. It is essential to review your specific policy documents, as many plans also include a cap on annual co-payments, ensuring that once a certain limit is reached, the insured may not incur additional out-of-pocket costs for covered services. Understanding these terms enables individuals to better plan for their healthcare expenditures and avoid unexpected financial burdens.

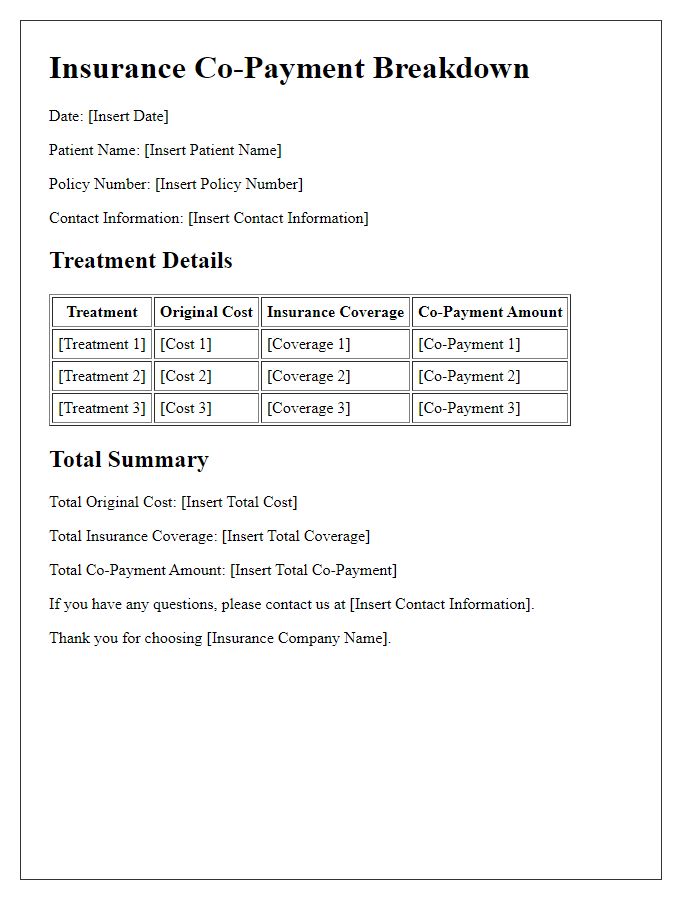

Itemized Cost Breakdown

Insurance co-payment involves specific shared expenses during medical care. Co-pay rates can vary significantly by insurance provider and plan type, often ranging from $10 to $50 per visit. Understanding your itemized cost breakdown is essential. For example, hospital visits may include costs such as admission fees averaging $1,500, physician consultations typically costing $300, and diagnostic tests like an MRI, which can reach $2,000. Each of these costs can be subject to a co-pay, whereby the insurance covers a substantial percentage, leaving the patient responsible for a smaller share. Furthermore, understanding these costs ensures that patients are prepared for out-of-pocket expenses and can navigate their financial responsibilities effectively.

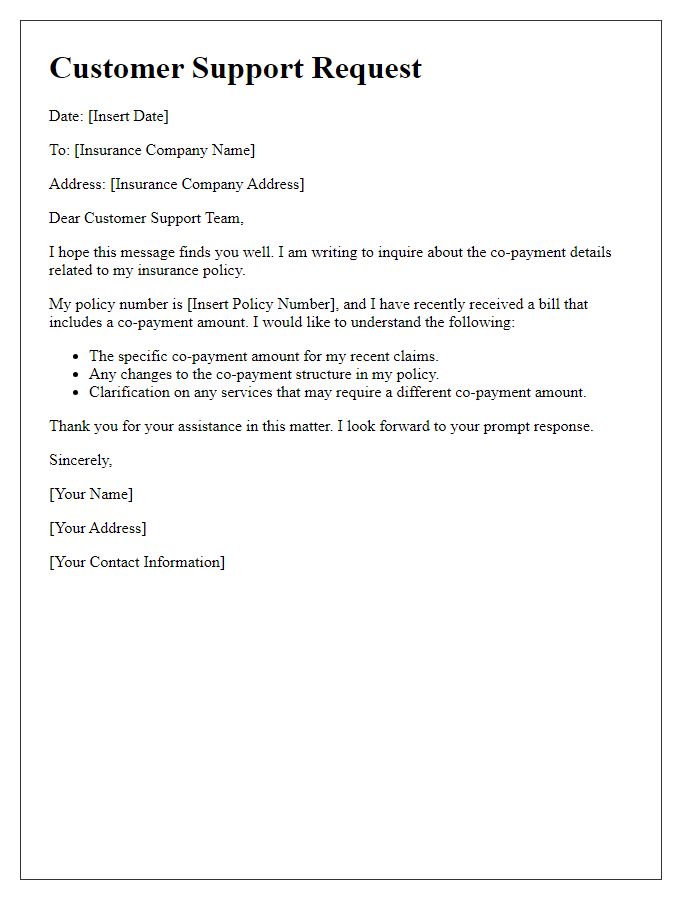

Contact Information for Inquiries

Co-payment structures in health insurance plans often vary based on multiple criteria, including the type of medical service received and the specific insurance provider. For instance, a routine doctor's visit might require a co-payment of $25, while specialist consultations may demand a larger fee, possibly $50 or more. Policyholders experiencing questions about their co-payment responsibilities should reach out to their insurance company's customer service department, typically found on the membership card. Contact information may include toll-free phone numbers, email addresses, or online chat options available 24/7 for immediate assistance. Clear understanding of co-payment requirements can prevent unexpected out-of-pocket expenses for policyholders.

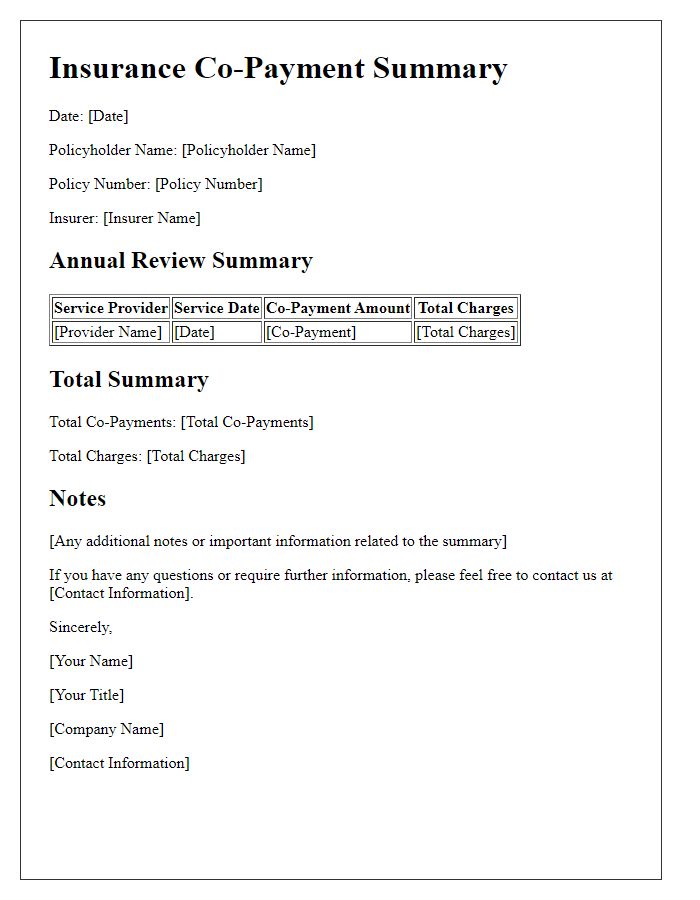

Letter Template For Insurance Co-Payment Explanation Samples

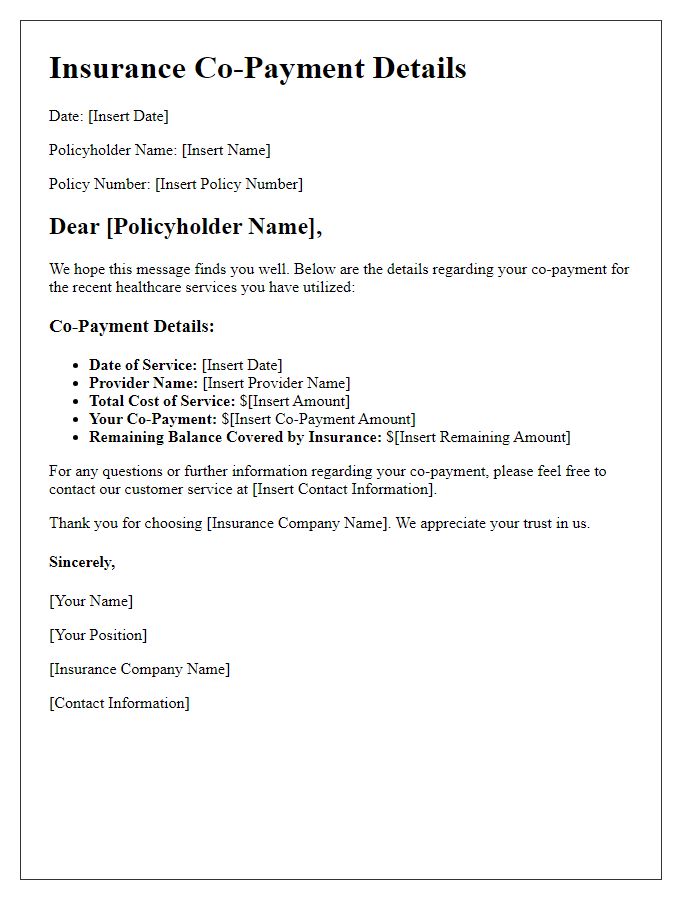

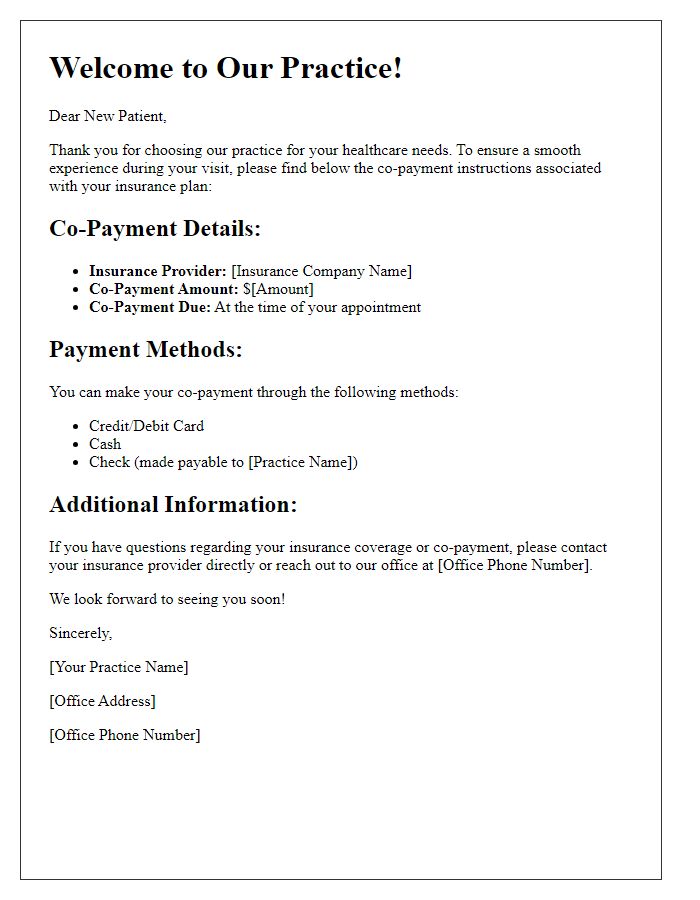

Letter template of insurance co-payment clarification for claims processing.

Letter template of insurance co-payment breakdown for specific treatments.

Letter template of insurance co-payment notification for upcoming services.

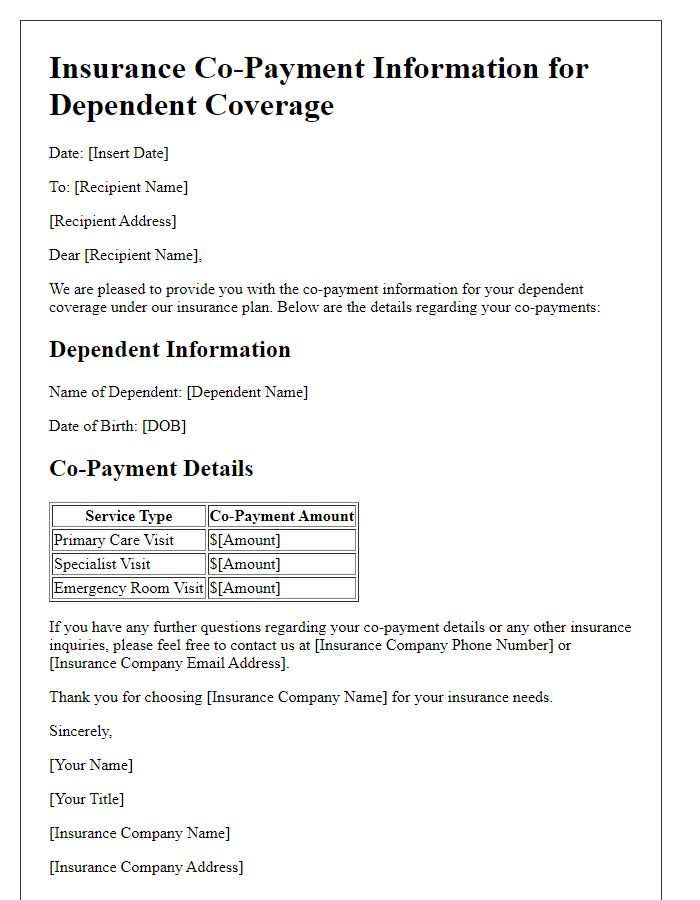

Letter template of insurance co-payment information for dependent coverage.

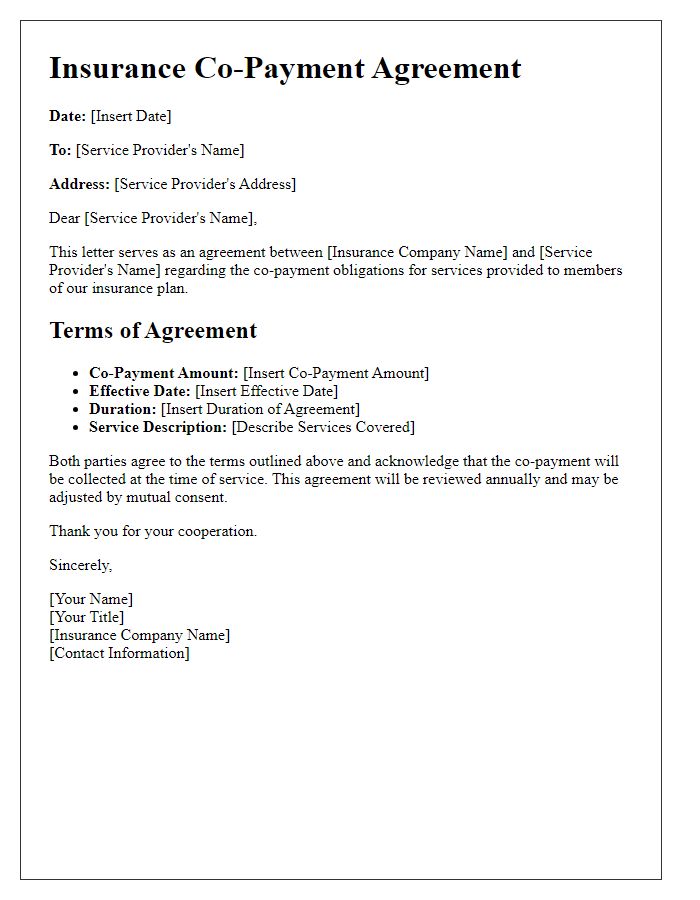

Letter template of insurance co-payment agreement for service providers.

Comments