Are you navigating the complex world of cargo insurance and need some clarity? Understanding your coverage is essential for safeguarding your shipments and ensuring peace of mind. In this article, we'll break down the key elements of cargo insurance, from policy specifics to verification processes, making it easier for you to digest. So, grab a cup of coffee and dive into our comprehensive guide to learning everything you need about verifying your cargo insurance coverage!

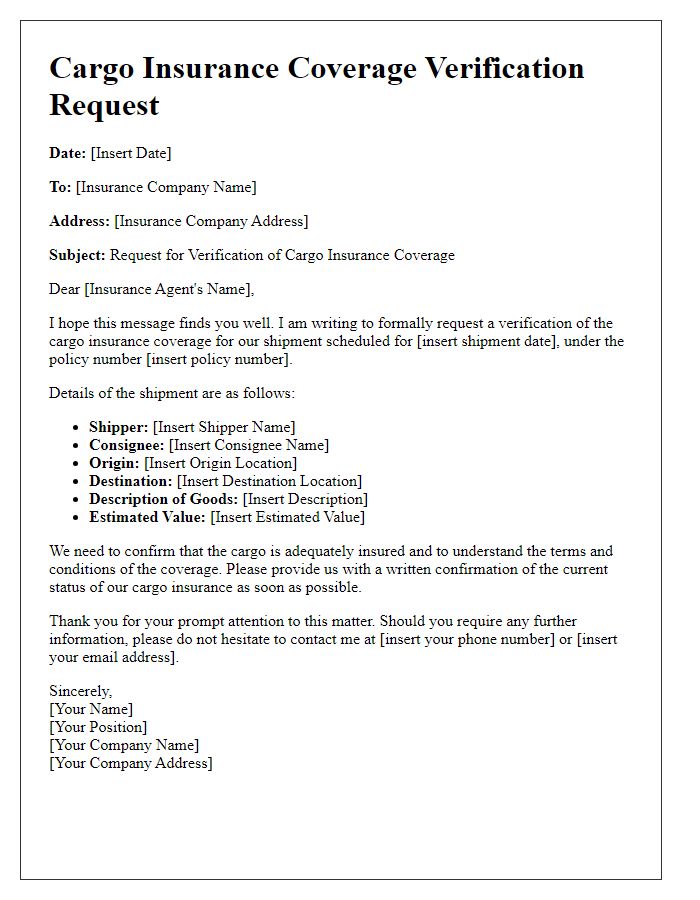

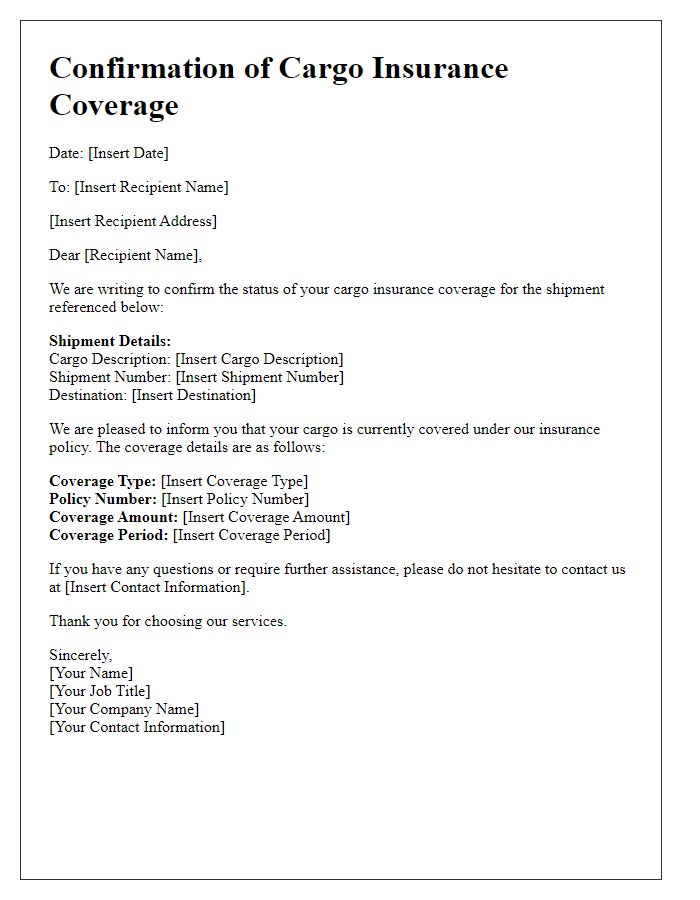

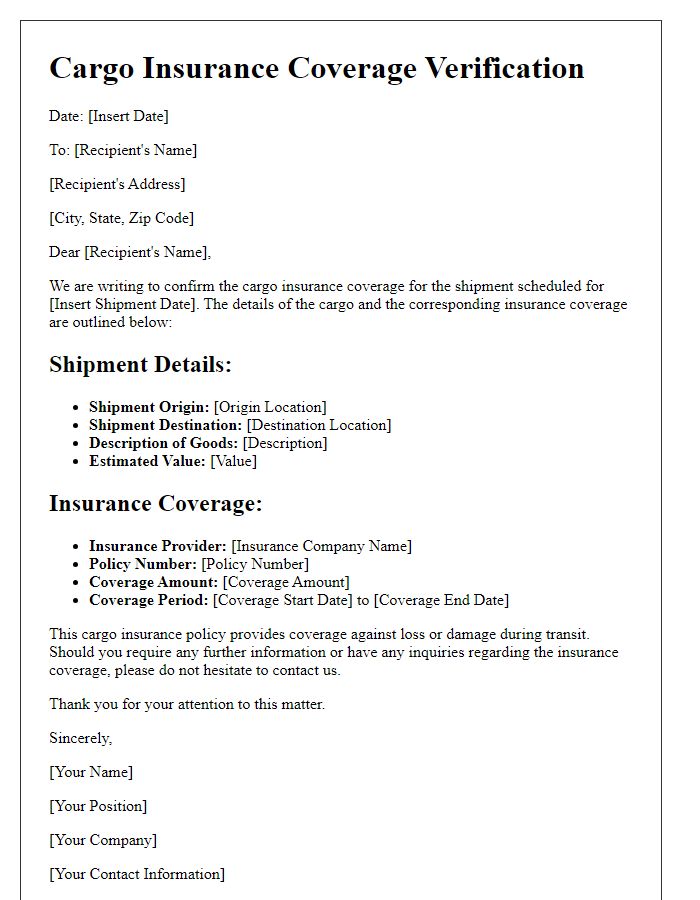

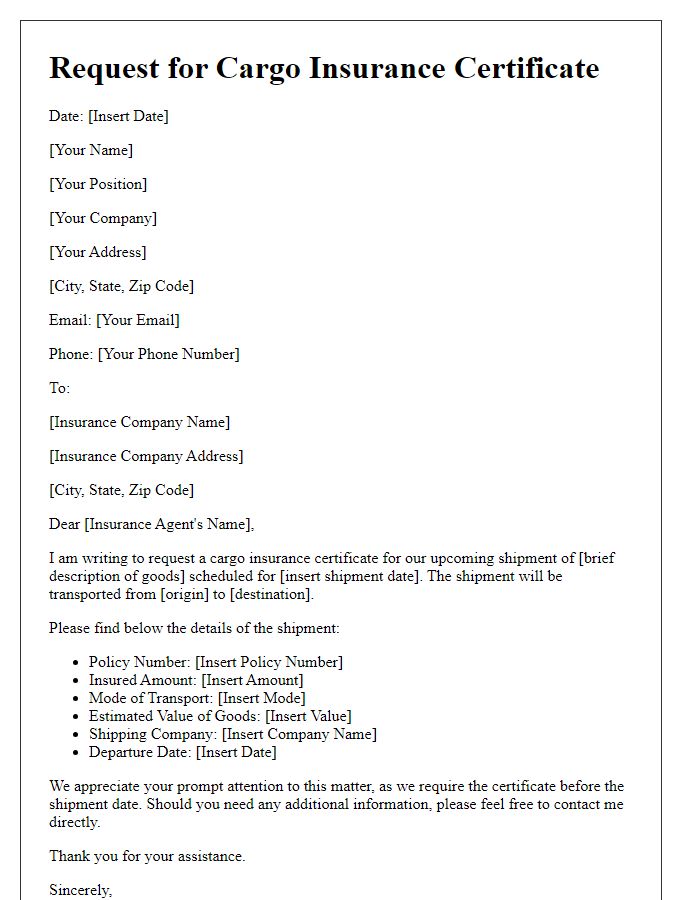

Policy Number and Insured Details

Cargo insurance verification ensures that goods transported by sea, air, or land are adequately protected against potential risks such as theft, damage, or loss during transit. A valid policy number serves as the unique identifier for the cargo insurance contract, detailing the specific coverage terms and conditions applicable to shipments. Insured details typically include the name of the insured party, such as a corporation or individual, along with their registered address, contact information, and descriptions of the insured goods, which could range from electronics to perishables. Insurance coverage limits, exclusions, and duration of coverage are critical elements that define the scope of protection during the transit process. Accurate verification of this information is essential for claims processing and ensuring peace of mind for businesses engaged in global trade.

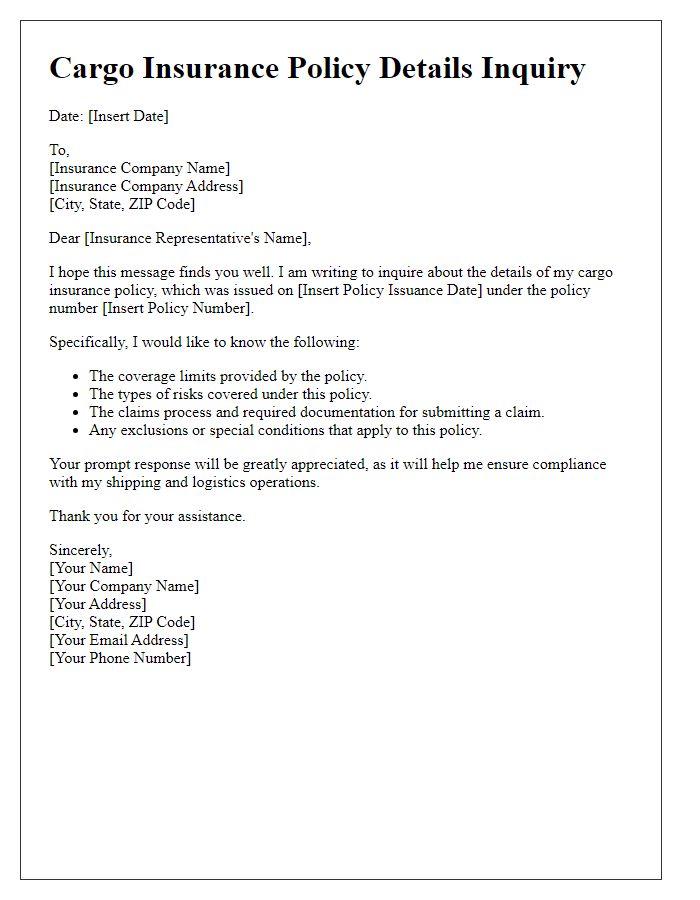

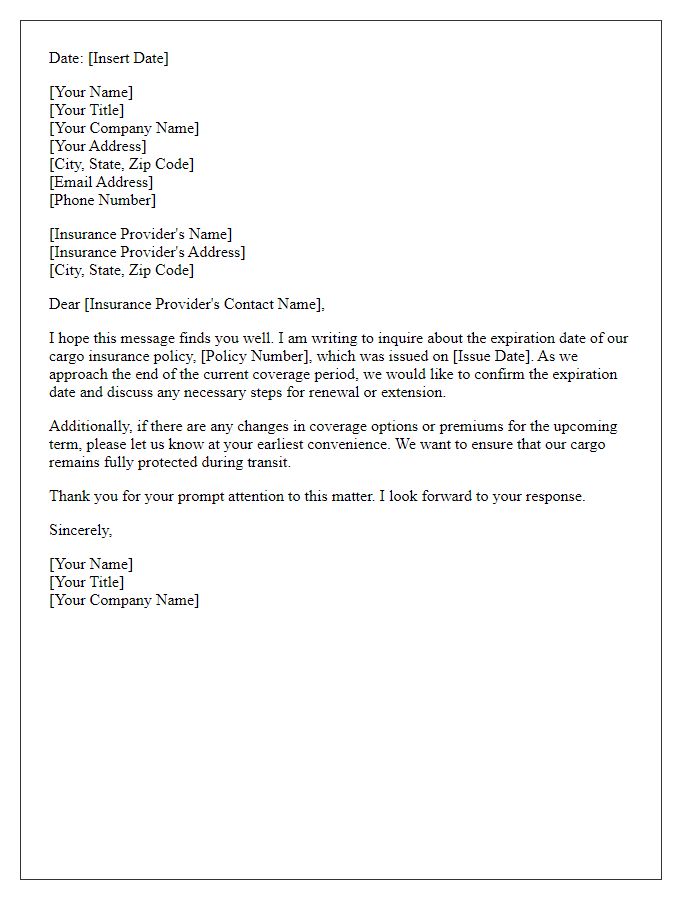

Coverage Scope and Limits

Cargo insurance coverage verification is essential for protecting shipments against financial losses during transportation. Policies can vary significantly, with typical coverage limits for marine cargo insurance ranging from $5,000 to several million dollars, depending on the nature and value of the goods. Many transport companies, including major players like Maersk and DHL, provide specific terms outlining the scope of coverage, which might include loss, theft, damage from natural disasters, and shipping mishaps. It is crucial to review any exclusions or specific conditions outlined in the policy, as factors such as improper packaging or pre-existing damages may disqualify claims. Verification processes should document all cargo details, such as the shipment destination, typically major ports like Los Angeles or Rotterdam, and the value of items, ensuring all parties understand their coverage limits before transporting goods.

Cargo Description and Transit Details

Cargo insurance verifies coverage details for transporting goods. Specific items such as electronics, textiles, or machinery may require unique policies tailored to their value and risk factors. Transit details include departure location, such as Charleston, South Carolina, estimated arrival at ports like Rotterdam, Netherlands, and transportation methods, whether by land, sea, or air. Key dates, such as shipment date (October 1, 2023) and delivery date (October 15, 2023), play a crucial role in dictating insurance terms. Valuation of the cargo, often expressed in monetary terms ($50,000 for high-value shipments), should align with both the warehouse storage and transportation environments, ensuring adequate protection throughout the journey.

Claims Process and Contact Information

Cargo insurance coverage is essential for protecting shipments during transit, typically handled by freight forwarders or shipping companies. Major insurers, such as AIG or Allianz, provide various policies covering loss or damage to goods, including theft, natural disasters, or accidents. The claims process involves notifying the insurer promptly, typically within 30 days of the incident, and providing necessary documentation such as the bill of lading, invoices, and photographs of damaged goods. Contact information for claims assistance can be found on the insurer's website, with dedicated claims departments available via phone or email for streamlined communication. Following these guidelines ensures a smoother claims experience and timely recovery of losses.

Insurer's Signature and Verification Date

Cargo insurance coverage verification ensures protection for shipments against potential loss or damage during transit. This verification process involves essential documents, including the insurance policy number and coverage limits, detailing the specific transit routes, such as ocean freight from ports like Long Beach to Shanghai, and the cargo types, such as electronics or perishables. Insurer's signature serves as the authoritative acknowledgment of policy validity, while the verification date, often noted in formats such as MM/DD/YYYY, confirms the timeframe of coverage active during shipping. Accurate verification minimizes financial risks for businesses relying on safe and secure transport of valuable goods.

Comments