Are you feeling overwhelmed about navigating the process of claim settlements? Whether it's an insurance claim or another type of reimbursement, understanding the ins and outs can be quite challenging. In this article, we'll break down the essential steps and offer tips for effectively communicating with your insurer or provider. So, if you're ready to take control of your claim process, let's dive in and learn more!

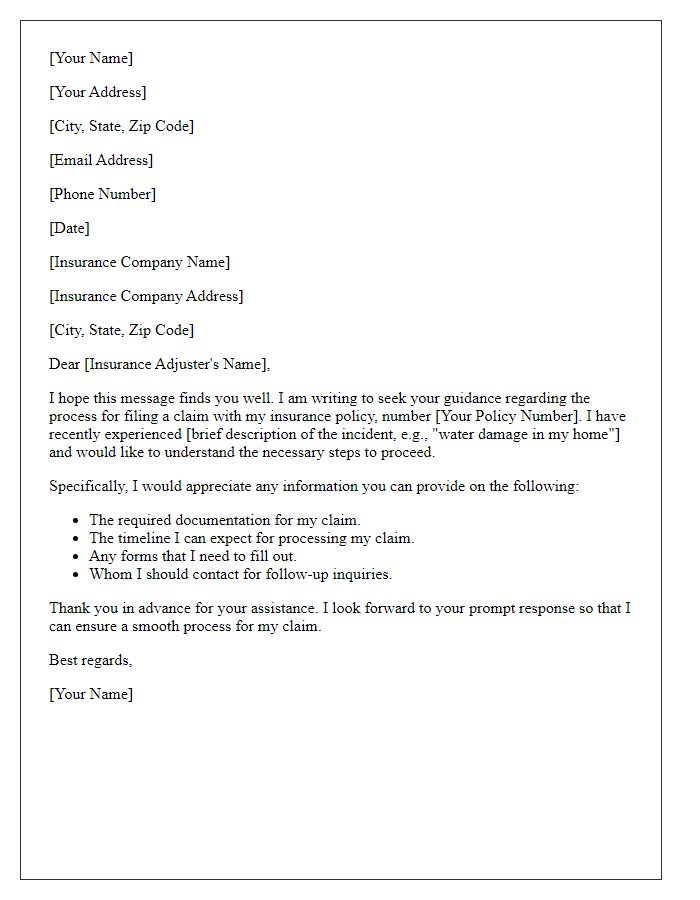

Clear subject line and introduction

Seeking advice on insurance claim settlement requires clarity and precision. The subject line should reflect the purpose, such as "Request for Guidance on Insurance Claim Settlement." In the introduction, briefly introduce the claim details, including the claim number (e.g., Claim #123456) and the date of occurrence (e.g., August 15, 2023). Explicitly state the nature of the claim, whether it pertains to property damage, medical expenses, or any other category relevant to the situation. A concise overview of the circumstances leading to the claim enhances understanding, ensuring the recipient can provide relevant advice and support.

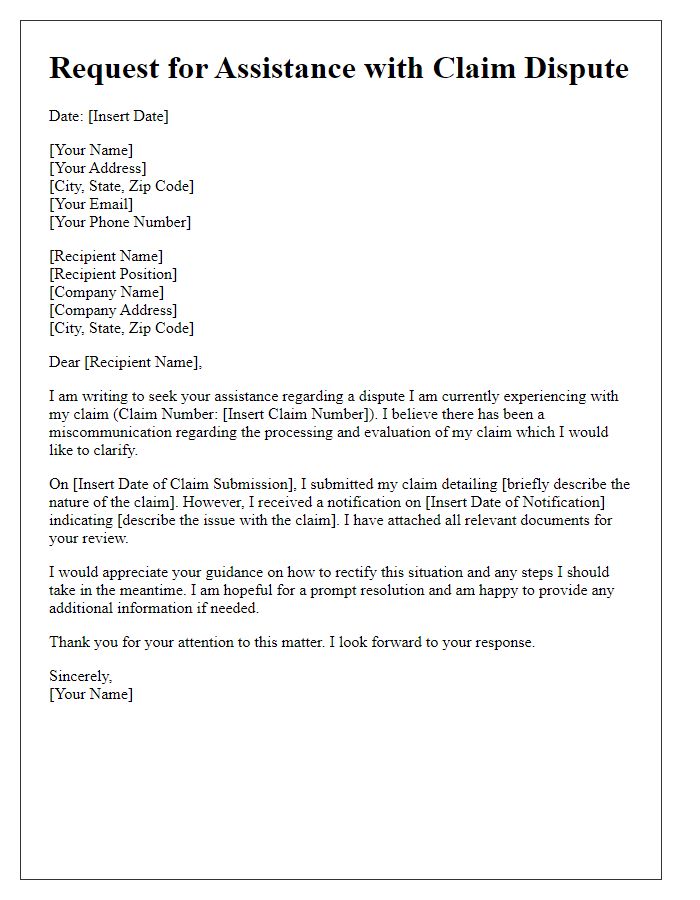

Detailed description of the claim issue

In October 2022, a fire incident at Pinewood Apartments, located in Atlanta, Georgia, caused extensive damage to Unit 304, resulting in a claim submission for fire and water damage. The claim, numbered A123456, details property loss estimated at $50,000, including structural damage and personal property destruction. The insurance provider, Beacon Insurance Company, initially acknowledged the claim on November 1, 2022, but subsequent communications indicated prolonged delays in the settlement process. Investigation reports highlighted issues regarding coverage limits and negligence determinations, leading to frustrations over the perceived lack of transparency. Numerous follow-up inquiries revealed inconsistencies in information provided by the claims adjuster, causing concerns over the clarity of policy terms and entitlements. Seeking expert advice on navigating this complex claim settlement process and ensuring fair compensation is crucial in addressing this challenging situation.

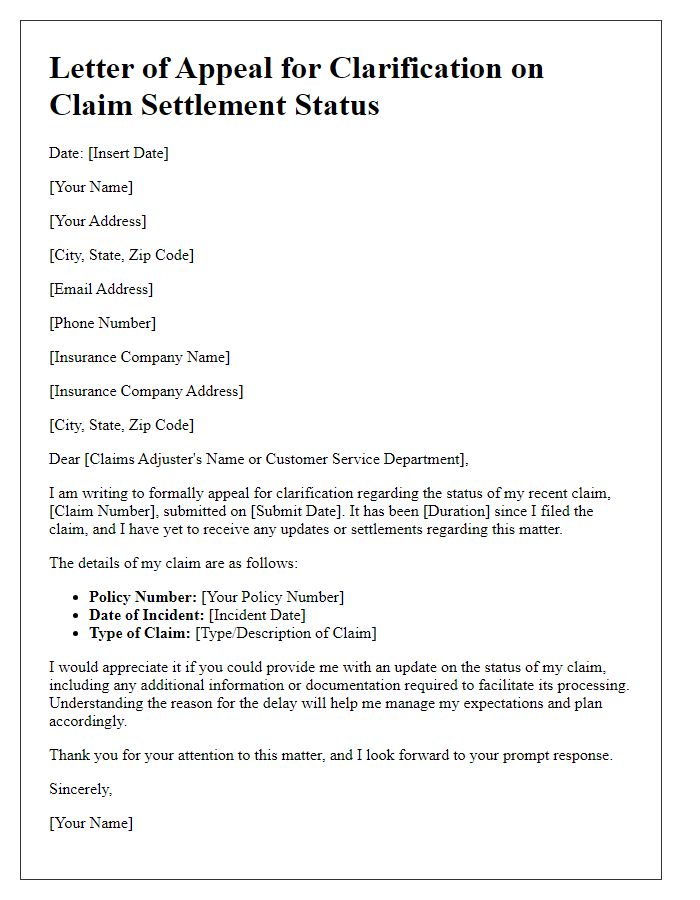

Documentation and evidence references

Seeking guidance on claim settlement requires thorough documentation and clear evidence references. Comprehensive documentation includes essential paperwork such as medical reports, repair estimates, and photographs of damages. Evidence should also encompass witness statements and any police reports filed during the incident, which establishes the context and validity of the claim. Each piece of evidence must be dated and relevant to the specifics of the claim, ensuring a solid foundation for negotiations. Accurate references to relevant laws or policies, such as insurance policy numbers or claims numbers, reinforce the claim's legitimacy and helps facilitate a smoother settlement process.

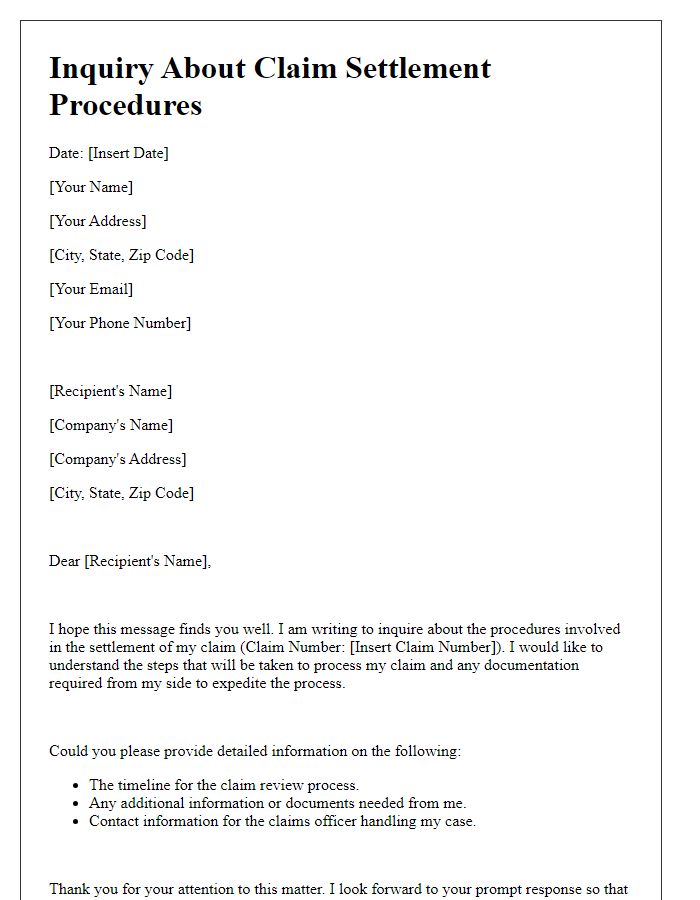

Specific questions or advice sought

When seeking advice on a claim settlement, provide essential details about the incident or event leading to the claim. Specify the insurance provider, policy number, and date of the incident (e.g., auto accident on May 15, 2023). Outline specific questions regarding claim status, timelines for resolution, or documentation needed for submission. Request guidance on best practices for communicating with the insurer and strategies for maximizing the settlement amount. Highlight any key deadlines or potential challenges faced during the claims process to ensure comprehensive support in the inquiry.

Polite and professional closing remarks

Seeking advice on claim settlement involves navigating a complex process that requires careful attention to detail. A well-structured approach is essential for achieving favorable outcomes. Important elements include the specific insurance policy in question, which may contain clauses related to coverage limits and exclusions, as well as pertinent deadlines, often set within 30 to 90 days after the event leading to the claim. Additionally, citing relevant laws, such as the Fair Claims Settlement Practices Regulations, can strengthen your position. Consulting with experienced professionals, like insurance adjusters or legal advisors, can provide valuable insights, ensuring that all necessary documentation, including proof of loss and supporting evidence, is thoroughly prepared for submission, thereby enhancing the likelihood of a successful resolution.

Comments