Hello there! If you're a student navigating the ins and outs of insurance, you're in the right place. Keeping your student insurance policy updated is crucial for ensuring you have the right coverage during your academic journey. In this article, we'll break down the steps you need to follow for a smooth policy update, so you can focus on your studies with peace of mind. Ready to dive in? Let's get started!

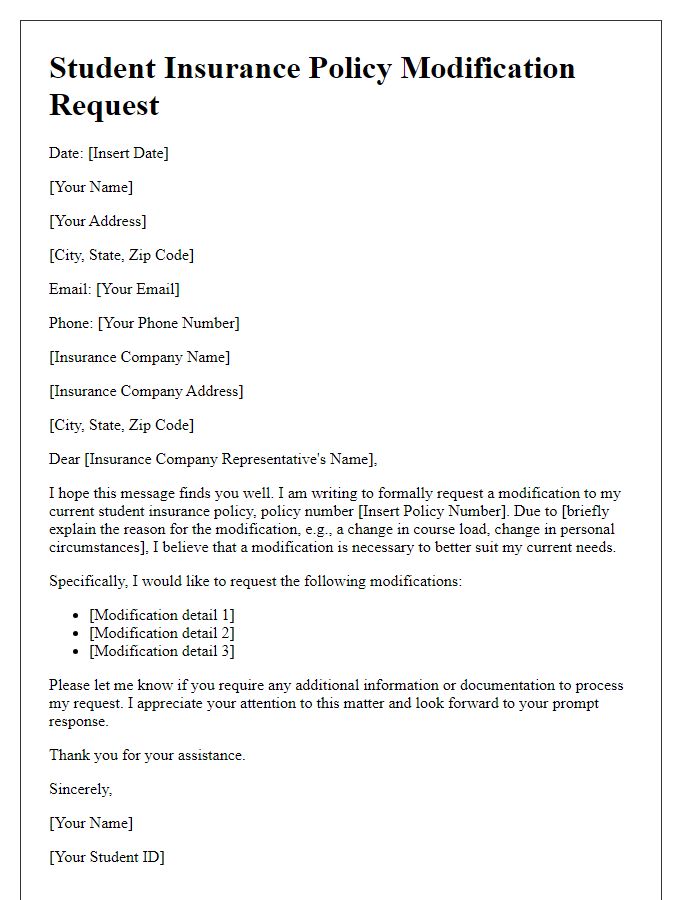

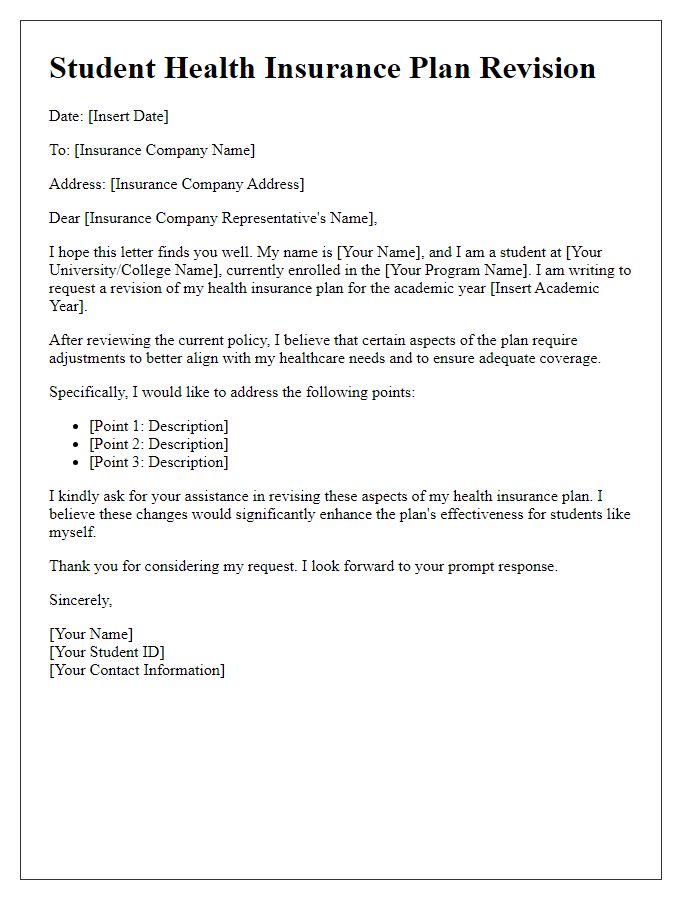

Policyholder's full name and contact information

The importance of maintaining an updated student insurance policy cannot be overemphasized as it ensures continuous coverage for medical needs. The policyholder, often the student, should provide full name details, including middle initial if applicable, to avoid discrepancies. Accurate contact information, such as permanent address, phone number (preferably mobile for quick communication), and email address, is crucial for receiving notifications regarding the policy or changes in coverage options. Timely updates to this information, especially during transitions between semesters or changes in residency, can prevent lapses in vital health insurance coverage essential for students.

Insurance policy number

Updating a student insurance policy requires careful attention to detail, particularly important information such as the insurance policy number. This unique identifier, often consisting of alphanumeric characters, allows for accurate tracking and management of the coverage provided. Insurance policy updates may be prompted by changes in personal information, such as a change of address, an adjustment in enrollment status (full-time to part-time), or the addition of new dependents. Institutions typically advise students to keep their insurance details current to avoid lapses in coverage, ensuring access to medical services at partnered healthcare facilities. Furthermore, policy updates may also reflect changes in premiums or coverage limits, necessitating clear communication from the insurance provider.

Details of requested updates (e.g., coverage adjustments)

Student insurance policies often require periodic updates to ensure that coverage matches current needs. For example, many universities, such as the University of California, Davis, provide comprehensive health insurance options tailored to students. Adjustments to coverage may include increases in limit amounts for medical expenses, which typically range from $50,000 to over $500,000, depending on the plan. In addition, optional coverage for dental and vision services can be requested. Events like studying abroad may necessitate modifications for international trips, requiring additional evacuation coverage and emergency medical expenses. Students should specify requested changes, ensuring that all pertinent information, including student ID numbers and dates of requested adjustments, is included for seamless processing.

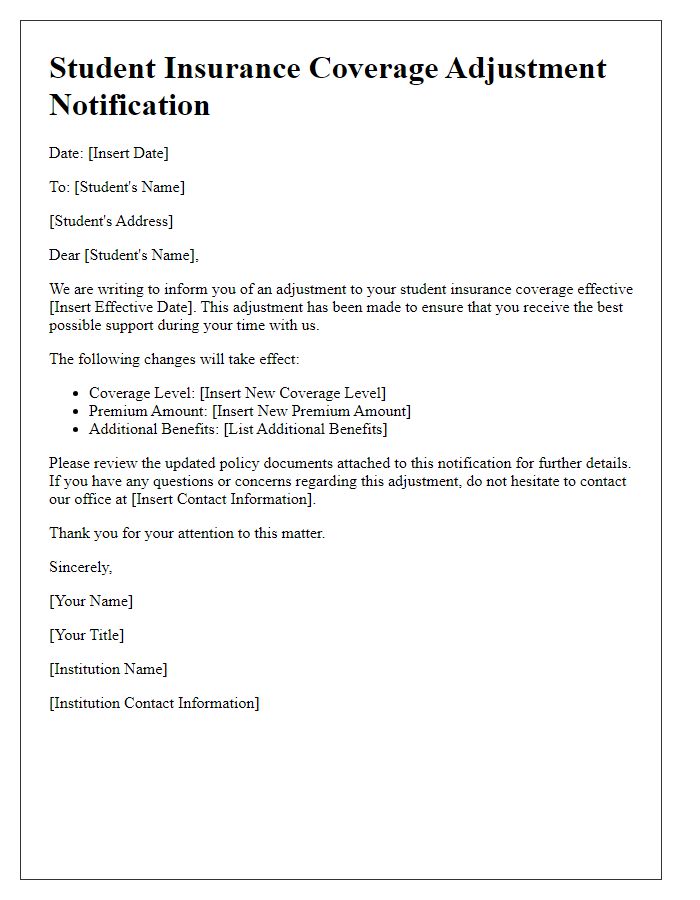

Effective date for changes

Insurance policies for students may require regular updates to ensure coverage aligns with their current needs. For example, if a student attending a university in California updates their address or changes their course of study, these changes can impact the insurance policy. Effective dates for these modifications typically begin upon the completion of the submission of required forms, which usually include personal information such as student ID numbers, policy numbers, and relevant documentation. It is essential that students monitor their policies regularly, accounting for factors like age, program enrollment, and any changes in health status to ensure optimal coverage while studying.

Reason for the update request

Students enrolled in higher education institutions often require insurance coverage to manage medical expenses. Changes in personal circumstances such as age milestones, academic program modifications, or travel plans might necessitate an update to the student insurance policy. For instance, a student moving from a dormitory in New York to an off-campus apartment may need alterations in coverage levels or geographical limitations. Additionally, participation in extracurricular activities like sports or internships can influence the type of coverage, as certain activities may pose higher risks. Updating the policy ensures comprehensive protection tailored to the student's current needs and lifestyle, which is crucial for their well-being and peace of mind.

Comments