Are you considering a thorough examination of your insurance policies? A well-crafted letter requesting an audit can pave the way for a clearer understanding of your coverage and potential savings. By taking the initiative to review your policies, you ensure that you're not only compliant but also receiving the best possible service from your insurer. If you're ready to learn how to draft the perfect request, keep reading for a comprehensive guide!

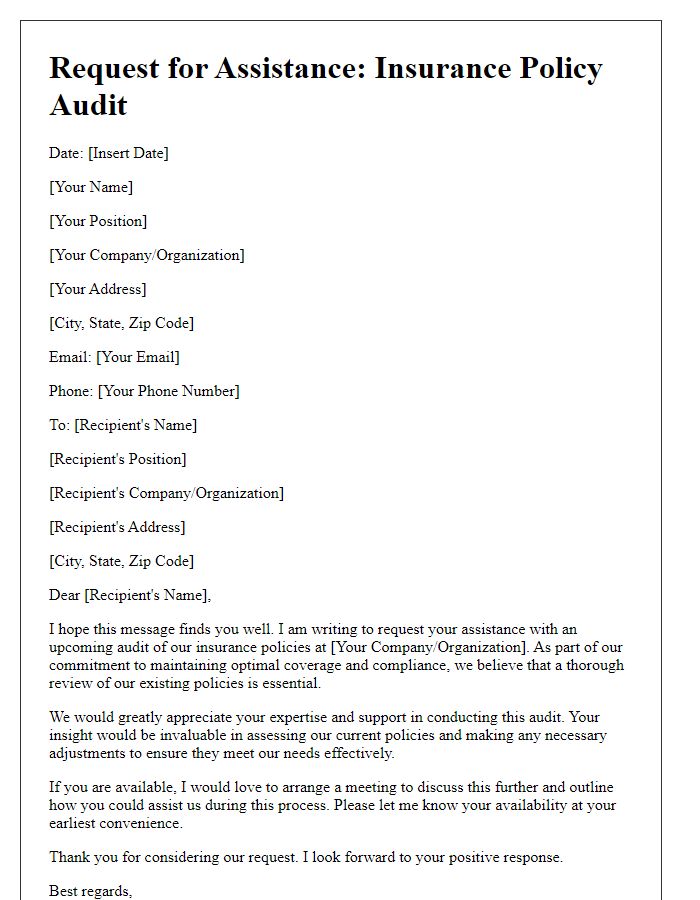

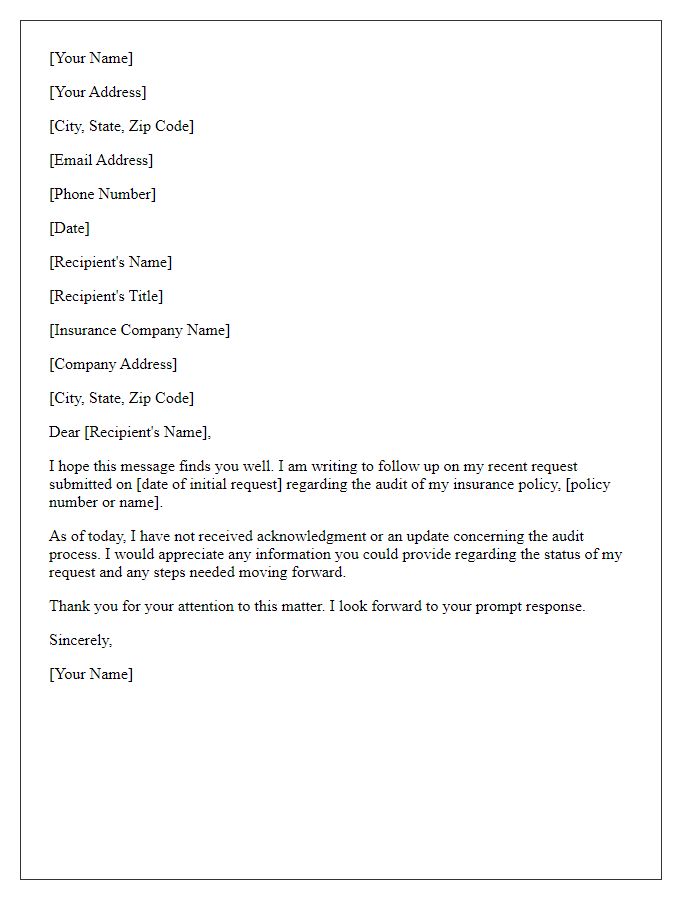

Clear subject line

Insurance policy audits are critical for assessing coverage adequacy and ensuring compliance with policy terms. A well-organized audit review can help identify potential gaps in coverage or overpayments in premium costs, which often arise from changes in risk profiles or business operations. A typical audit may involve detailed examinations of policy documents, claims history, and loss control measures, while evaluating factors such as the insured's business size, employee count, and property values. Engaging with an insurance auditor or company representative can facilitate a thorough understanding of the policy's provisions, ensuring that the necessary adjustments reflect the current risk exposure and provide optimal protection tailored to the insured's unique circumstances.

Concise introduction

A comprehensive insurance policy audit is essential for ensuring that coverage aligns with current needs and industry standards. Regular assessments help identify gaps, discrepancies, or overages in coverage that can impact financial protection. Engaging a qualified auditor guarantees an objective review of all terms, conditions, and exclusions within the policy, ultimately leading to potential cost savings and enhanced security for clients.

Specific policy details

In order to ensure compliance with policy standards and confirm coverage adequacy, an insurance policy audit is essential. Specific policy details for review include the policy number (e.g., 12345678), issued by XYZ Insurance Company, covering property located at 123 Main Street, Springfield. The current policy period runs from January 1, 2022, to December 31, 2022, with a total insured value of $500,000. Additional coverage details such as liability limits (e.g., $1 million), deductible amounts (e.g., $1,000), and any recent endorsements or changes should also be examined. Regular audits help in identifying discrepancies, ensuring that coverage aligns with current risks and legal requirements.

Reason for audit request

An insurance policy audit is often necessary to ensure compliance with the terms and conditions laid out by insured entities, such as businesses or individuals. Regular audits may reveal discrepancies in the reported premiums and actual business activities, particularly for liability insurance, which can lead to adjustments in coverage and premium costs. The audit request may stem from significant changes in business operations, such as expansion into new territories or changes in employee numbers, which can impact risk assessments. Additional factors, such as regulatory compliance and a desire to optimize insurance costs, can also drive the need for an audit to maintain accurate and effective policy management. Conducting this audit ensures that the insurance coverage remains adequate and relevant, reflecting any changes in circumstances that could affect the policyholder's risk profile.

Contact information

A comprehensive insurance policy audit helps in assessing coverage adequacy and identifying potential gaps in protection. It usually involves detailed examinations of policies related to auto, home, and health insurance. The contact information provided will include essential details such as the policyholder's name, address, phone number, and email. These details facilitate communication with the insurance company, ensuring the audit is conducted efficiently and effectively. Many insurers recommend having policy documents (like declarations pages, endorsements) ready for review during the audit process to pinpoint areas for improvement and cost savings.

Comments