Hey there! As we wrap up another year, it's the perfect time to reflect on our current policies and ensure they align with our evolving goals and needs. An annual policy review not only sharpens our focus but also helps us identify areas for improvement and growth. If you're interested in learning more about how to effectively conduct this review, why not dive into the details? Let's explore together how this process can enhance our organization's success!

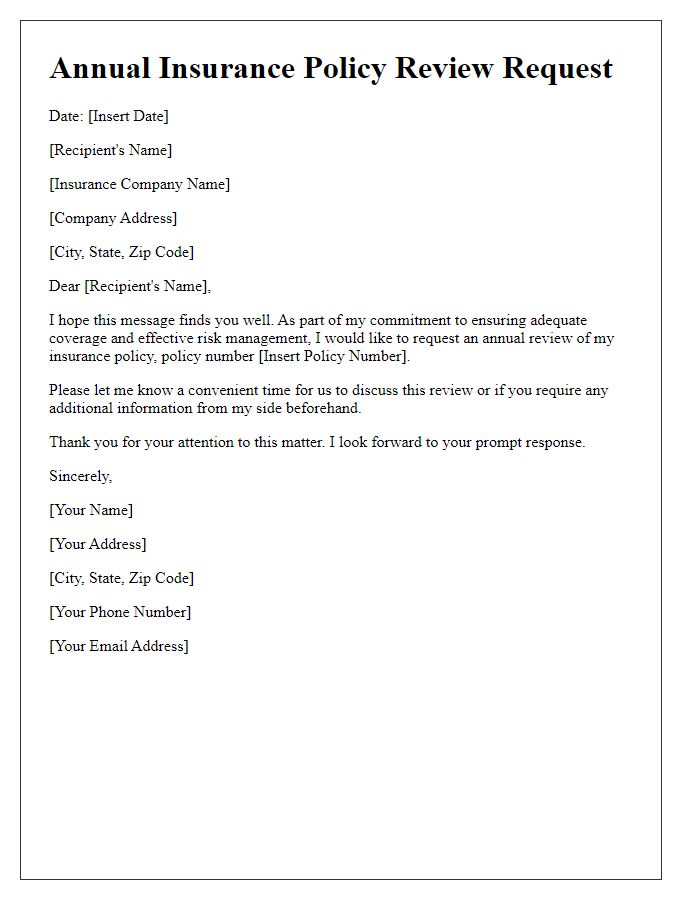

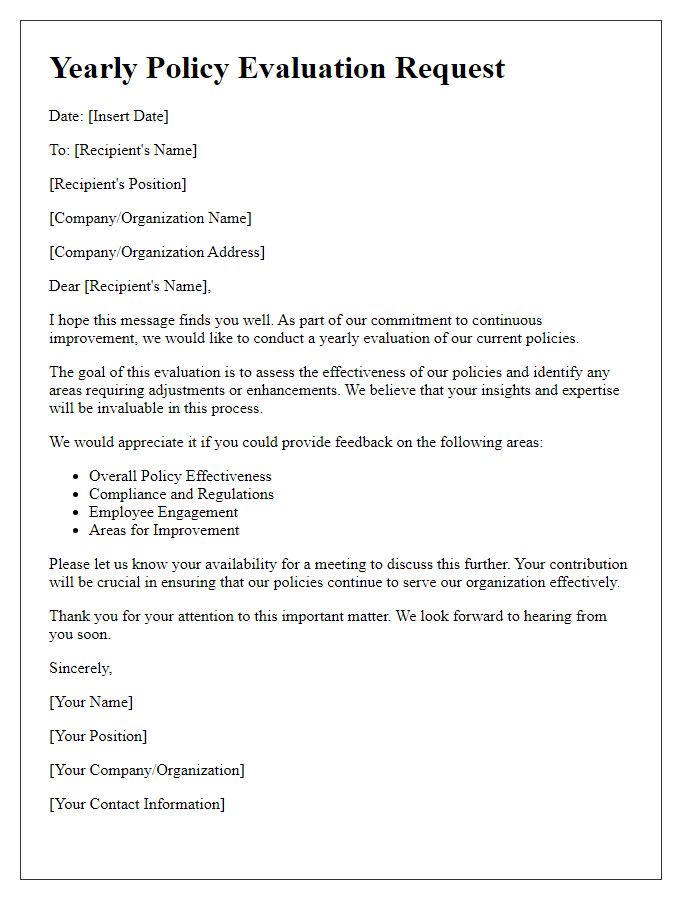

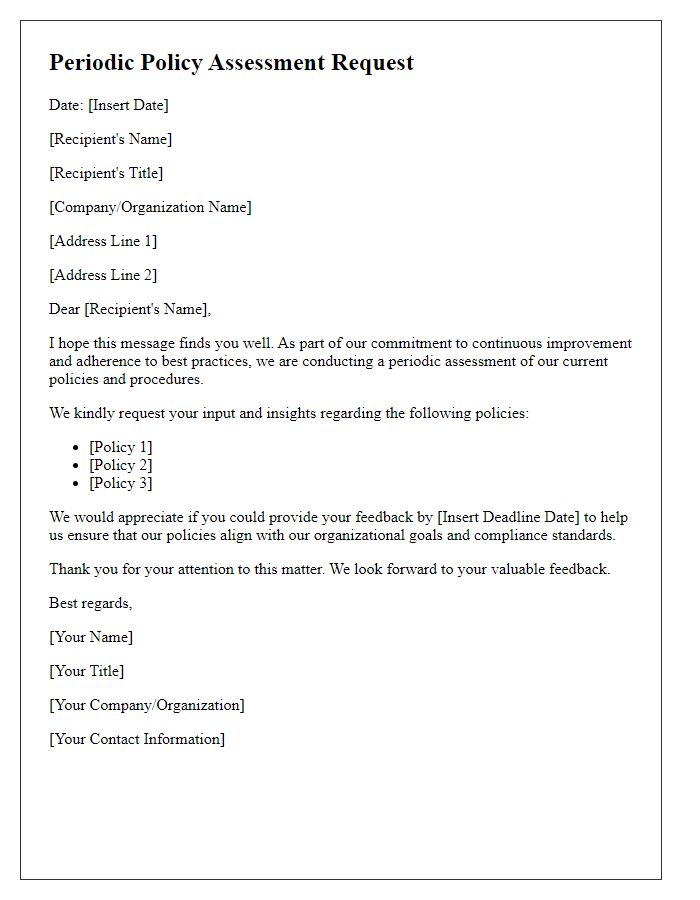

Clear subject line

Annual policy review requests ensure compliance with regulations and enhance organizational efficiency. A subject line such as "Request for Annual Policy Review" clearly communicates the purpose to recipients, prompting timely attention. Key policies may include workplace safety, data protection, and employee conduct, which require thorough examination annually. This review process engages stakeholders, incorporates feedback, and aligns the organization with changing legal requirements. Actions taken during the review can lead to updates in documentation, training programs, and risk management strategies, ensuring the organization remains proactive in maintaining a compliant and effective operational framework.

Personalized salutation

The annual policy review process involves an in-depth analysis of existing guidelines and regulations to ensure alignment with current organizational objectives and compliance with applicable laws. Conducted typically in October, this review examines various components such as risk management procedures, employee benefits packages, and, if applicable, environmental policies. Additionally, stakeholders including department heads, compliance officers, and legal advisors contribute their insights during this comprehensive evaluation. The outcomes of the review can influence future policy adjustments, budget allocations, and training programs. Engaging in a collaborative approach fosters transparency and promotes employee awareness of any necessary updates.

Purpose and context statement

The annual policy review process is crucial for ensuring that organizational guidelines remain relevant and effective. Timely evaluations can identify necessary updates or changes in response to evolving regulations, market conditions, and stakeholder needs. For instance, in a corporate environment, a review might assess compliance with new labor laws, while in a healthcare setting, it could address updates in patient privacy standards under HIPAA. Conducting comprehensive policy reviews annually enables organizations to uphold best practices and mitigate risks associated with outdated procedures. The engagement of all relevant departments, such as Human Resources, Legal, and Compliance, is essential in this context to gather diverse perspectives and ensure a thorough examination of existing policies. This collaborative approach promotes transparency and accountability, fostering a culture of continuous improvement within the organization.

Request for specific documents or information

Annual policy reviews are essential for ensuring compliance and alignment with current regulations. Organizations, such as corporations or non-profits, often require specific documents, including updated policy manuals, recent audit reports, and compliance checklists, to effectively assess their operational policies. The review process typically takes place annually, allowing stakeholders to evaluate key changes within the business environment, legal frameworks, and internal practices. Relevant dates, such as the fiscal year end or regulatory deadlines, play a critical role in scheduling these reviews. Gathering this information from department heads or compliance officers ensures a comprehensive evaluation, supporting informed decision-making and strategic planning moving forward.

Closing with call-to-action and contact information

During the annual policy review process, organizations often assess existing insurance agreements and risk management strategies, ensuring they meet current needs. Employees participate in discussions covering topics like coverage limits, exclusions, and compliance requirements. It is crucial to understand how policy changes can impact financial planning and risk exposure. Stakeholders should compile feedback from various departments to support a comprehensive review. Effective communication remains key to maintaining transparency throughout this process, allowing for informed decision-making and future readiness. For further assistance, please contact the Risk Management Team at riskteam@company.com or call (555) 123-4567.

Comments