Have you ever found yourself puzzled by the fine print of a policy? It's not uncommon to feel overwhelmed by the jargon and details that often come with important documents. Understanding the terms and conditions can significantly impact your decisions, which is why clarifying these aspects is essential. If you're interested in demystifying policy terms and gaining clarity, read on to explore our detailed guide!

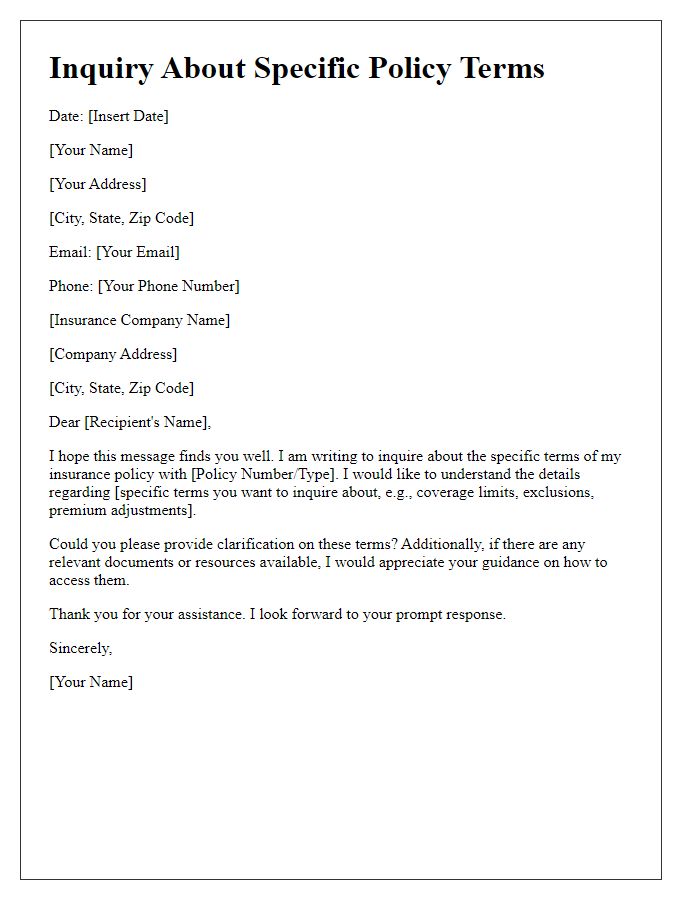

Clear subject line

Clear subject lines are essential for effective communication. A well-defined subject line conveys the main point of the message immediately, ensuring the recipient understands the context. For instance, "Clarification of Policy Terms Regarding Coverage Limitations" succinctly indicates the nature of the query. This approach significantly increases the likelihood of timely and accurate responses from stakeholders, enhancing overall efficiency in corporate communications. In corporate settings, specific terms like "deductibles," "exclusions," or "claims process" can be highlighted to help recipients locate important information quickly.

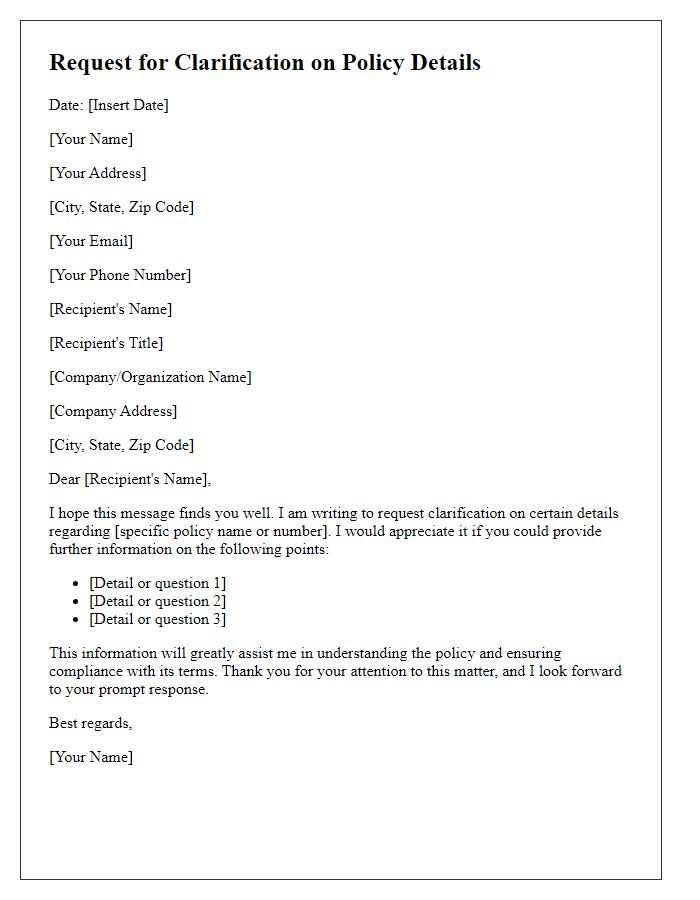

Recipient's contact details

Recipient's contact details, including name, physical address, and email, are essential for effective communication. Accurate name spelling ensures proper recognition, while the physical address allows for the timely delivery of documents or packages, particularly important in legal or business settings. An email address is critical for digital correspondence, especially for sending updates or requests regarding policy clarification. This information facilitates a streamlined interaction process, ensuring all necessary details are correctly addressed and exchanged.

Specific policy reference

Clarifying policy terms is crucial for understanding insurance agreements, such as the "Comprehensive Auto Insurance Policy." This specific policy provides coverage against various risks, including theft, vandalism, and natural disasters affecting vehicles. Policyholders should pay particular attention to terms like "deductible," the out-of-pocket expense before coverage kicks in, and "premium," which refers to the amount paid regularly to maintain coverage. Understanding these terms is vital for effective claims processing, with a focus on conditions such as "exclusions," instances where coverage will not apply, which can significantly impact financial reimbursement. Grasping these facets ensures comprehensive understanding and avoidance of potential disputes with the insurer.

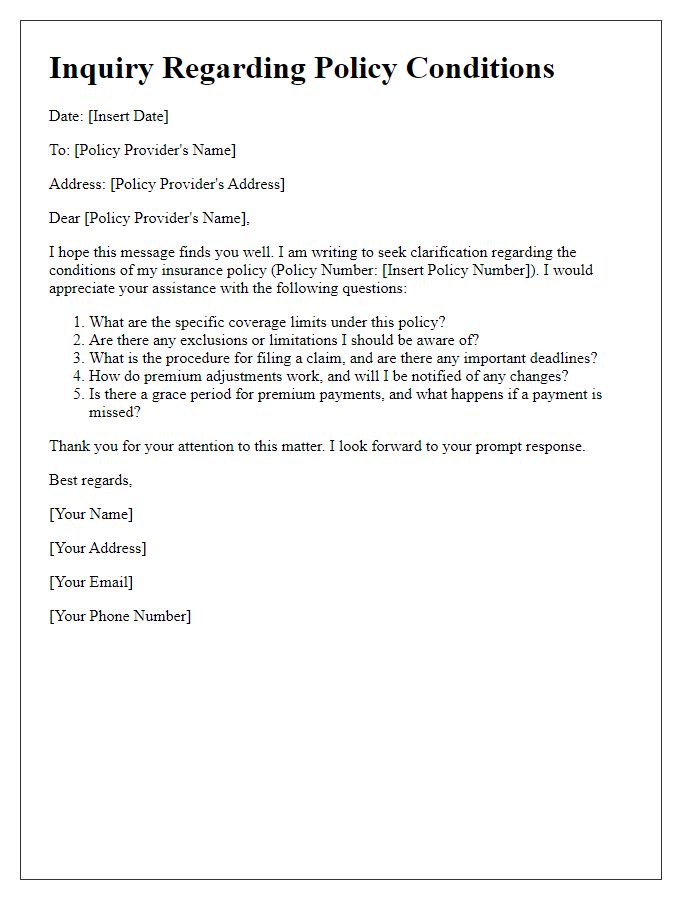

Structured explanation

In a corporate environment, policy terms often require clarification to ensure all employees understand their implications. For example, a non-disclosure agreement (NDA) protects sensitive company information, which includes proprietary technologies, trade secrets, and client data. An important point of clarity is the duration of confidentiality obligations, typically ranging from two to five years after employment ends. Furthermore, violations can lead to severe consequences, including legal action and financial penalties, which can reach up to $500,000 in damages. Another significant aspect is the definition of "sensitive information," which encompasses both written and electronic formats. Clearly outlining these terms fosters transparency and encourages adherence to company policies among staff.

Contact information for follow-up

Clear communication of policy terms is essential for both providers and clients. It's important to provide accurate contact information for follow-up inquiries regarding the policy details. Including relevant details such as the customer service department's phone number, usually formatted as (555) 123-4567, and the official email address, for example, support@insurancecompany.com, allows clients to reach out easily. Additionally, specifying business hours, often Monday through Friday from 9 AM to 5 PM local time, ensures timely responses. Including a direct link to the company's official website can offer clients access to FAQs and further resources, enhancing their understanding of the policies offered.

Comments