Hey there! We totally understand that sometimes life can throw unexpected challenges your way, leading to delays in premium payments. It's important to stay on top of these things to ensure your coverage remains uninterrupted. In this article, we'll provide a helpful template for notifying your insurance provider about any payment delays. So, stick around to learn more about how to effectively communicate this situation!

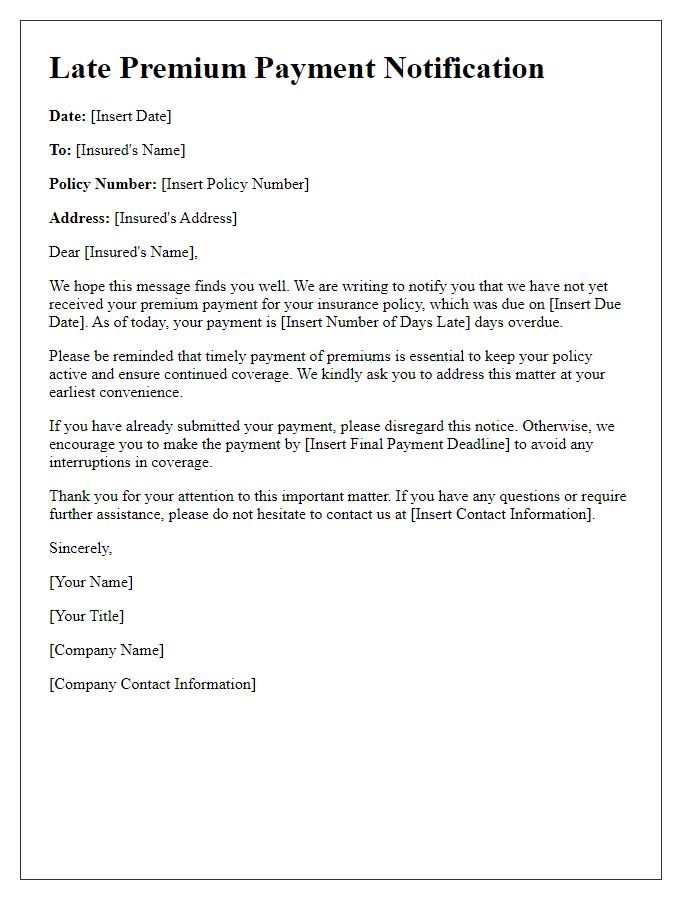

Clear subject line

Insurance premium payment delays can lead to potential policy lapses or coverage interruptions. Policyholders often receive notifications regarding overdue payments for their insurance, specifically health, auto, or home insurance policies. Failure to submit payments by the due date may result in late fees and increased premiums in future billing cycles. Insurers, such as State Farm or Allstate, typically send these notifications via email or postal mail, highlighting the importance of timely payments to maintain coverage. Communication may also include specific amounts owed, payment options, and deadlines to rectify the delay. Keeping track of payment schedules is crucial for policyholders to ensure continuous coverage and avoid unnecessary penalties.

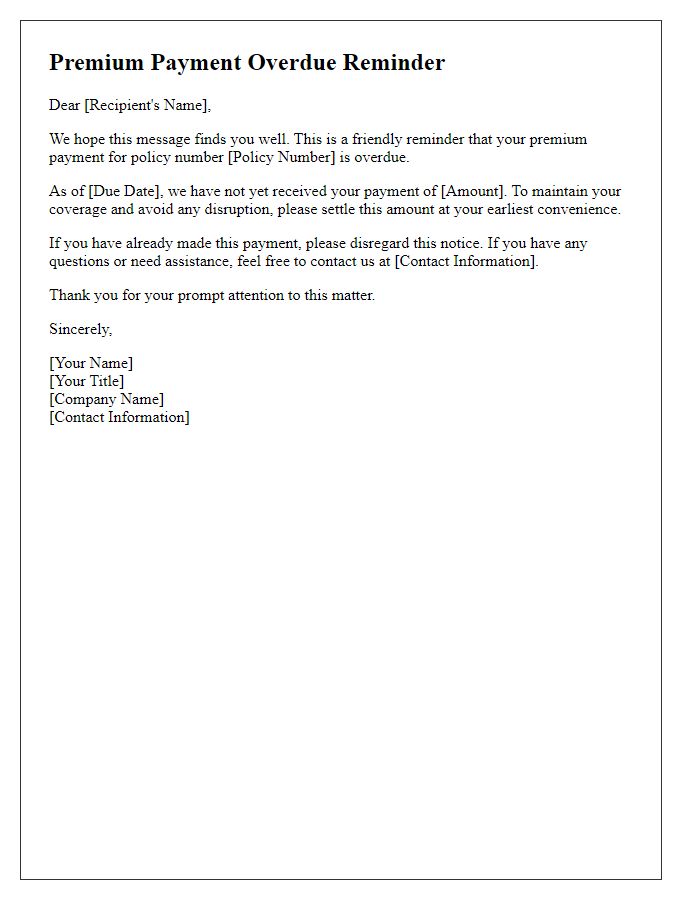

Polite greeting

A delay in premium payments can lead to significant consequences for an insurance policyholder. Policies, such as life insurance (with cover amounts often exceeding $100,000), or health insurance (covering medical expenses that can reach thousands), may lapse if payments are not received within a specified grace period, usually 30 days. Lapsed policies can result in loss of coverage, making beneficiaries financially vulnerable during critical times. In addition, reinstatement of coverage often requires payment of back premiums and possible penalties. Affected individuals may face increased premiums or denial of benefits upon reinstatement, emphasizing the importance of timely premium payments for maintaining financial protection.

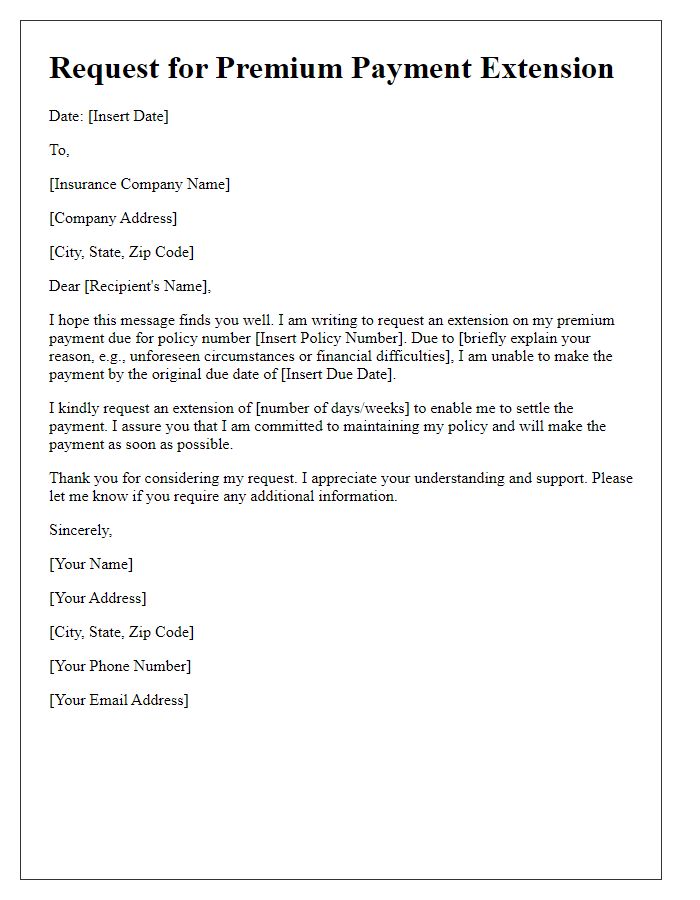

Explanation of delay

In recent weeks, many policyholders have experienced delays in processing premium payments, primarily due to increased demand on administrative systems. This surge has been particularly evident since the implementation of new compliance regulations in January 2023, which required additional documentation and verification steps for each payment. Furthermore, technical issues related to the online payment portal have also contributed to the delays, with some users reporting difficulties accessing their accounts during peak hours. As a result, customers may notice discrepancies in their payment schedules or temporary interruptions in their coverage. The company is actively addressing these issues to ensure timely processing and restore service quality.

Assurance of payment

Increased premiums for life insurance policies, such as whole life or term life, often necessitate timely payments to maintain coverage. Policyholders experiencing financial difficulties may encounter delays in premium payments, leading to potential lapses in coverage. Insurers typically send notifications to inform clients about the payment delay and emphasize the importance of rectifying the situation. Ensuring awareness of grace periods, which can extend up to 30 days, allows policyholders to avoid immediate coverage loss. Insurance agents encourage timely action to restore premium payments, helping to safeguard financial protection for families and beneficiaries in the event of unforeseen circumstances.

Contact information for further queries

Delays in premium payments can lead to complications in insurance policies, particularly in life insurance plans like Whole Life or Term Life. Customers, typically in the United States, must adhere to payment deadlines, often set annually or monthly, to maintain policy benefits. Contact information, including customer service phone numbers (usually listed as 1-800-XXX-XXXX) and email addresses (e.g., support@insurancecompany.com), becomes crucial for addressing any payment issues or clarifications. Agents or customer service representatives can help navigate these concerns, ensuring that clients understand potential penalties, grace periods (often 30 days), and coverage lapses, reinforcing the importance of timely premium payments.

Comments