As your policy anniversary approaches, we want to take a moment to express our appreciation for choosing us as your trusted partner. This is a great opportunity to review your coverage and ensure it still meets your needs as your life evolves. We believe that staying informed about your policy benefits can provide you with peace of mind and confidence in your protection. So, keep reading to discover how you can maximize your policy advantages and what to expect in the coming year!

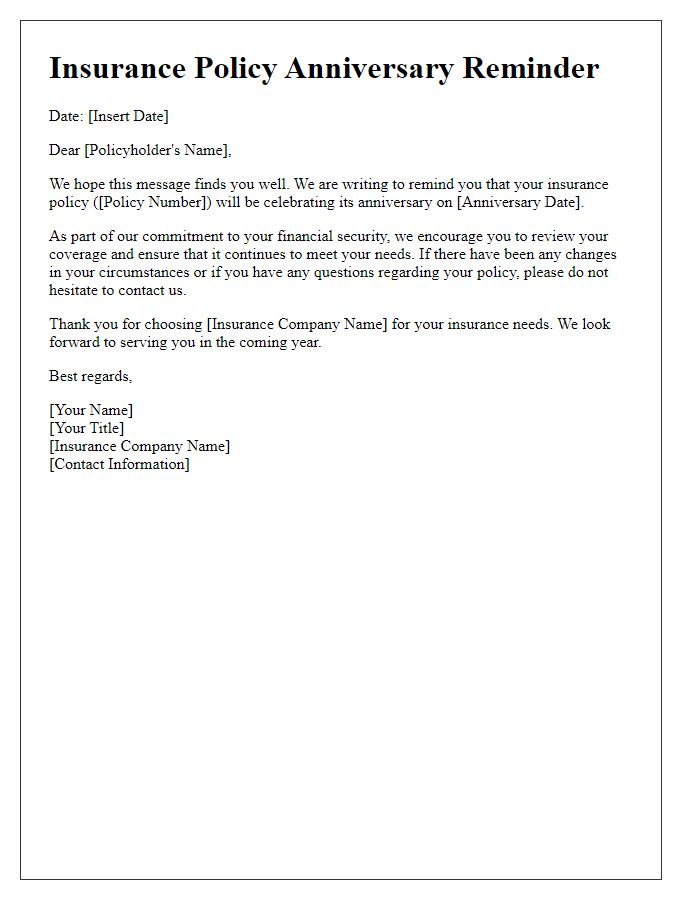

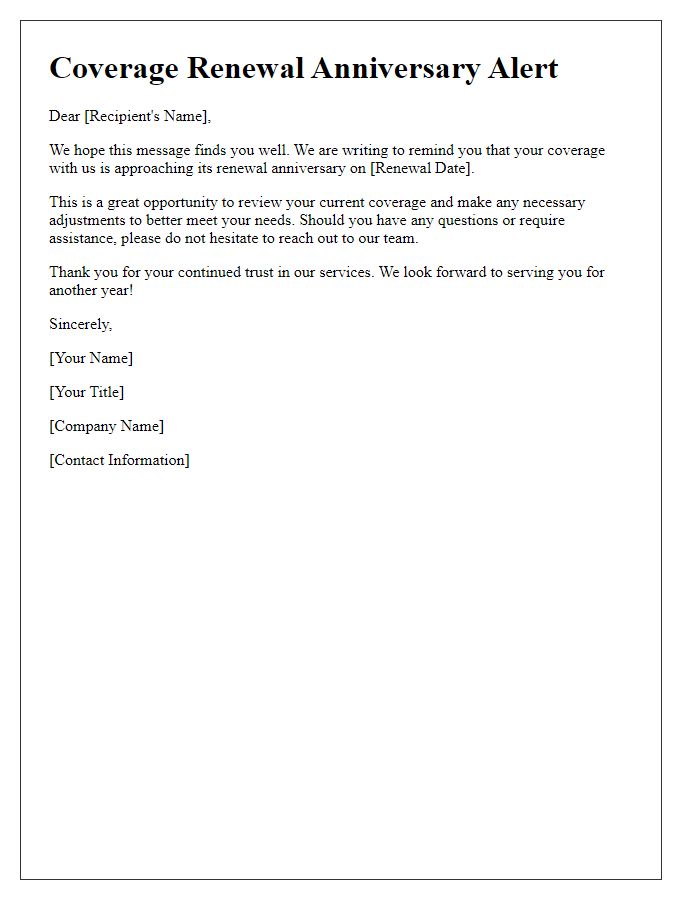

Subject Line & Header

Insurance policy anniversaries present an important opportunity for renewal and assessment of coverage. Policyholders should receive timely notifications regarding their policy milestones for effective planning and decision-making. Well-structured email notifications can enhance client engagement and satisfaction while providing essential details such as the policy number, renewal date, and any applicable premium adjustments. Including succinct summaries of coverage benefits and a reminder for potential policy upgrades ensures clients are informed and can make proactive improvements. Engaging subject lines, such as "Your Policy Anniversary is Here: Review Your Coverage," establish urgency and draw attention, encouraging prompt response. Note: Elements like policy number, renewal date, and premium adjustments are crucial for clarity and relevance in client communication.

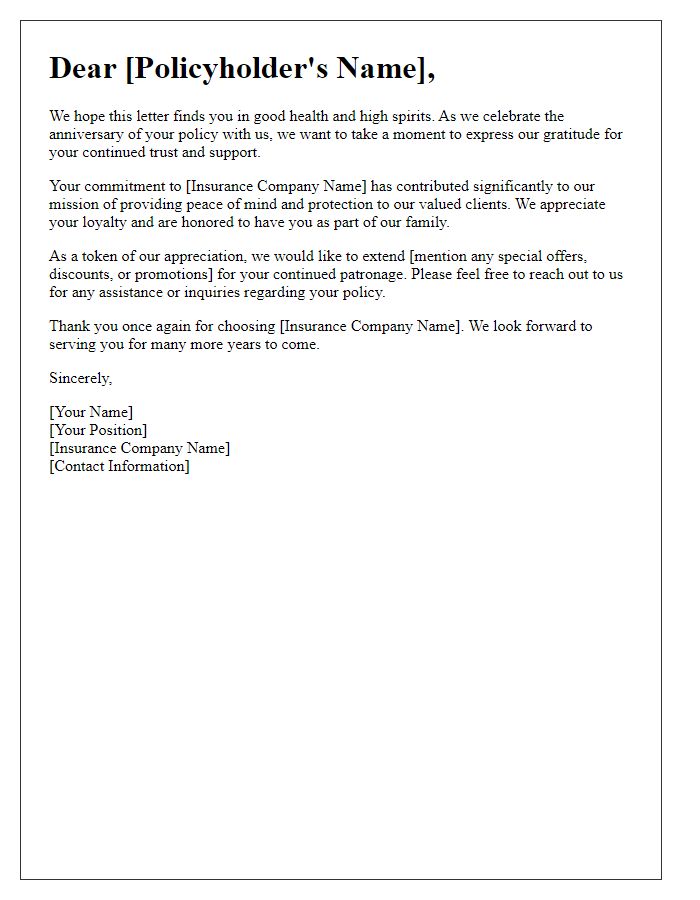

Personalized Greeting

The anniversary of a policy is an important milestone for our valued clients, often marked by a renewed commitment to safeguarding their assets. In this notification, we celebrate the one-year mark of your insurance policy, highlighting key coverages such as property damage, liability limits, and premium adjustments. As we reflect on the past year, changes in your personal circumstances or evolving needs may warrant adjustments to coverage limits or additional riders. We also encourage you to review the policy details, ensuring understanding of exclusions and benefits, reinforcing the importance of maintaining adequate protection.

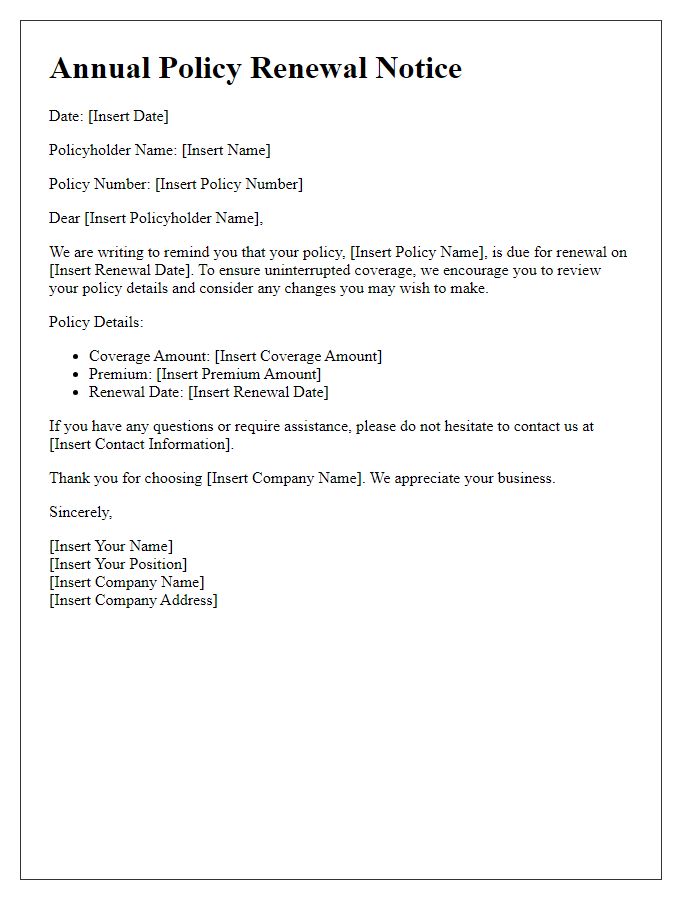

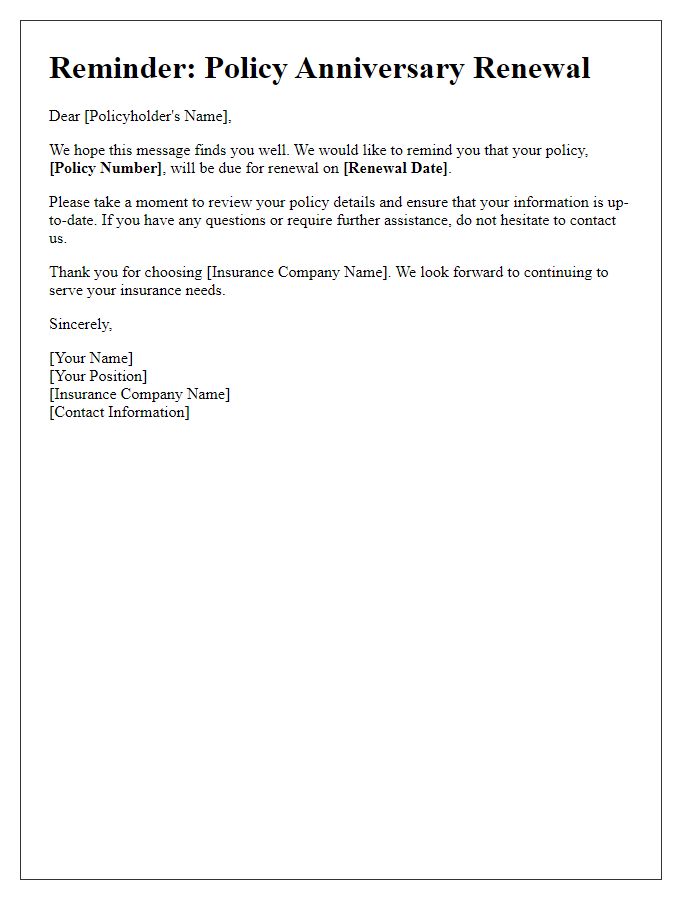

Policy Details Overview

Policy anniversary notifications serve as crucial reminders for policyholders, emphasizing important details of their insurance agreements. These notifications typically include essential information such as the policy number (a unique identifier for the coverage), the coverage type (like life, health, or auto insurance), and the effective date (the date the policy originally began). Additionally, premium amounts due (the monthly or yearly payment required to maintain coverage) highlight financial obligations, while the renewal terms outline conditions for continuing the policy. Contact information for customer service representatives ensures policyholders can seek assistance for questions or concerns. An overview of any upcoming changes to coverage, benefits, or premiums provides critical insights, enhancing overall awareness and satisfaction with the insurance service.

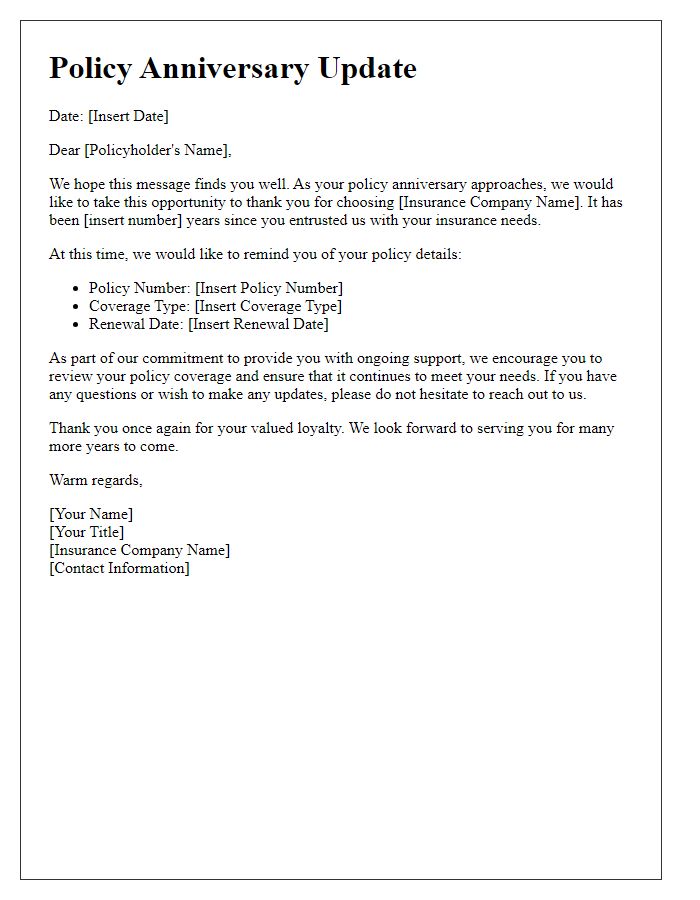

Benefits & Features Highlight

Policy anniversary notifications serve as essential reminders for policyholders, providing valuable information about their insurance coverage's benefits and features. Each anniversary marks a significant milestone in a policyholder's journey with the insurance provider, often prompting a review of the terms and conditions. Key highlights may include coverage limits, premium adjustments, and any changes in benefits that occurred over the past year. For example, a life insurance policy may detail increased cash value accumulation or additional riders that enhance security, while a health insurance plan might emphasize preventive care advantages or wellness benefits. Such notifications also encourage policyholders to assess their evolving needs, promoting proactive engagement with their insurance to ensure optimal protection and utilization, ultimately fostering a stronger relationship with the insurance company.

Call to Action & Contact Information

Policy anniversary notifications serve as essential reminders for policyholders, highlighting important updates regarding their insurance coverage or benefits. Timely notifications can include specific dates, such as the annual policy renewal date, along with key details about premium adjustments or changes in policy terms. Engaging clients effectively often involves a clear call to action, encouraging them to review their current plan or consider additional coverage options tailored to their needs. Furthermore, providing easily accessible contact information for customer support, such as phone numbers (generally including toll-free options), email addresses, and office hours, ensures that policyholders can reach out for assistance without any inconvenience, fostering a trust-based relationship between the insurer and the insured.

Comments