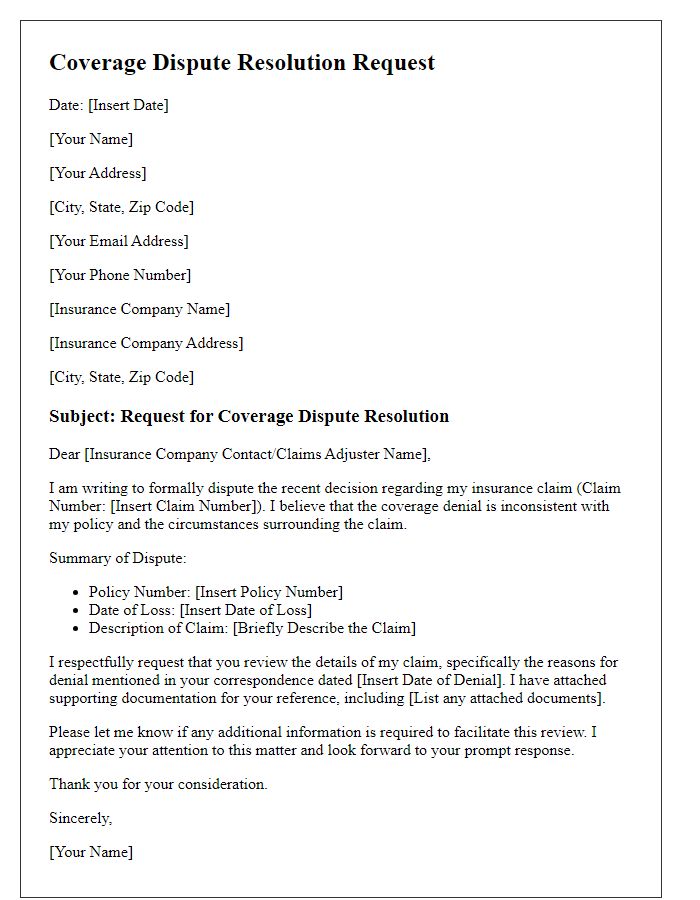

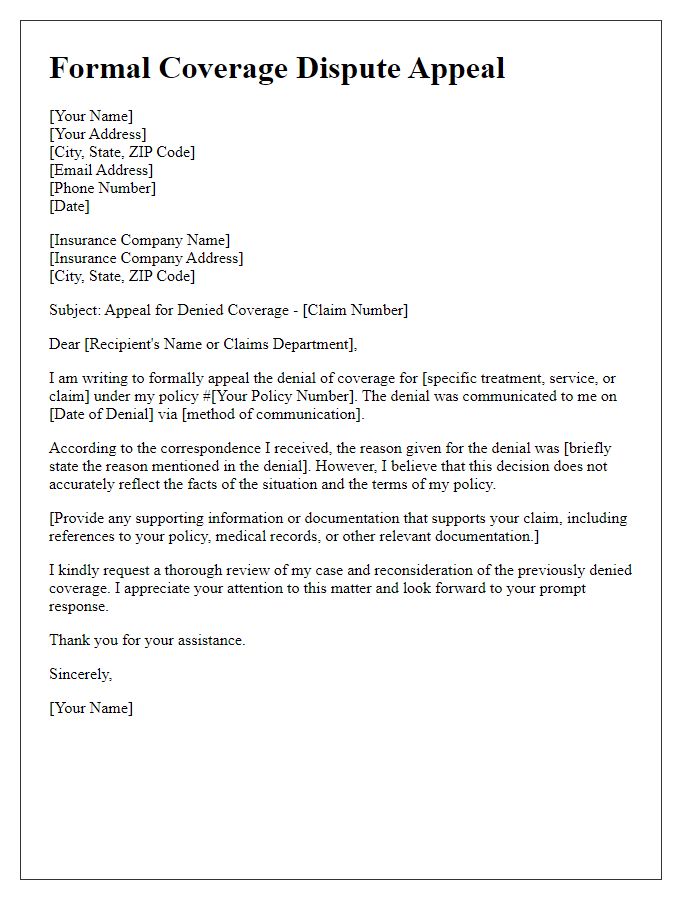

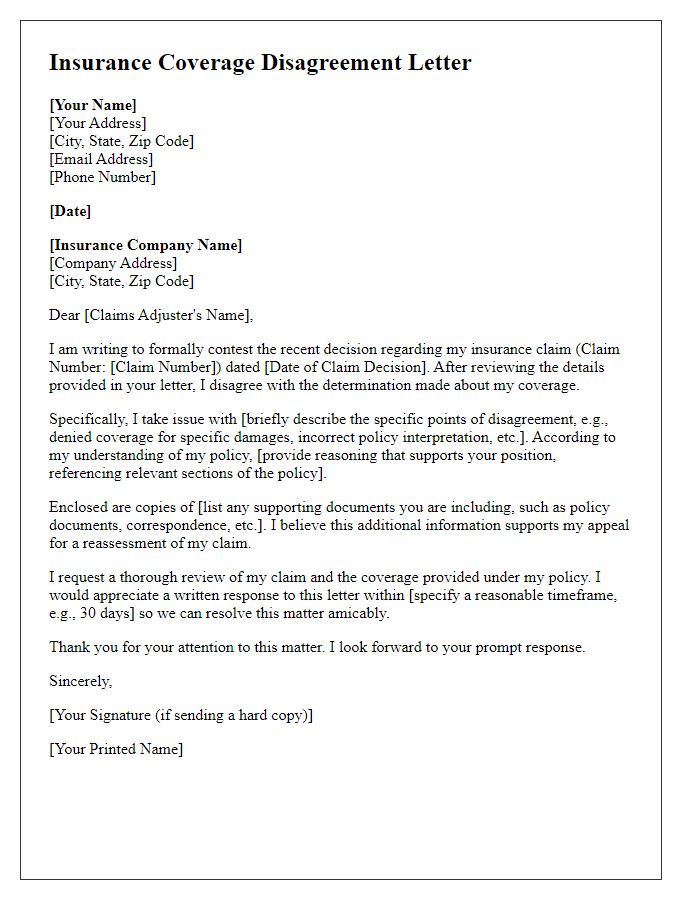

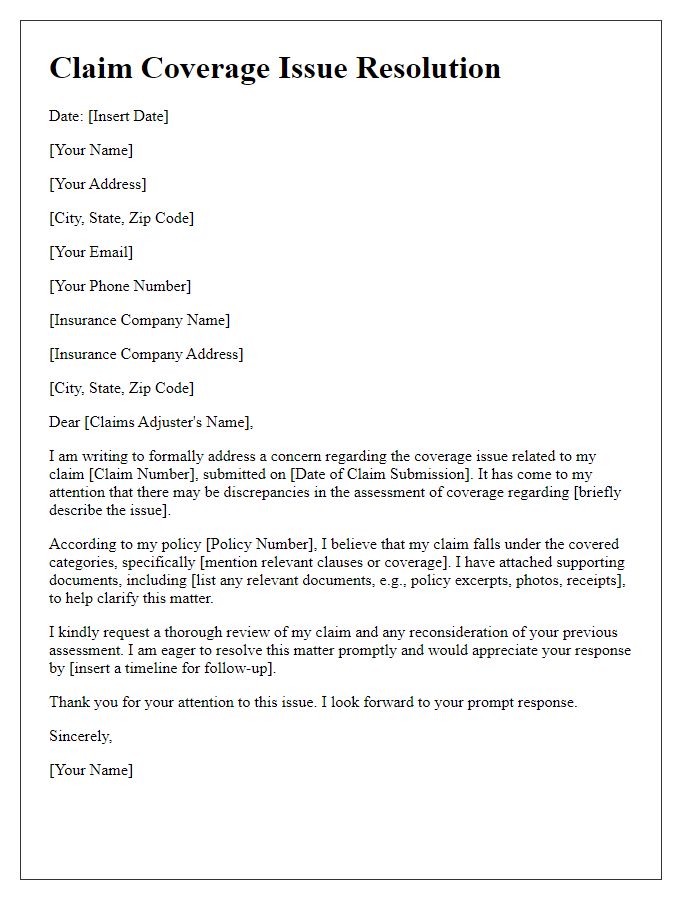

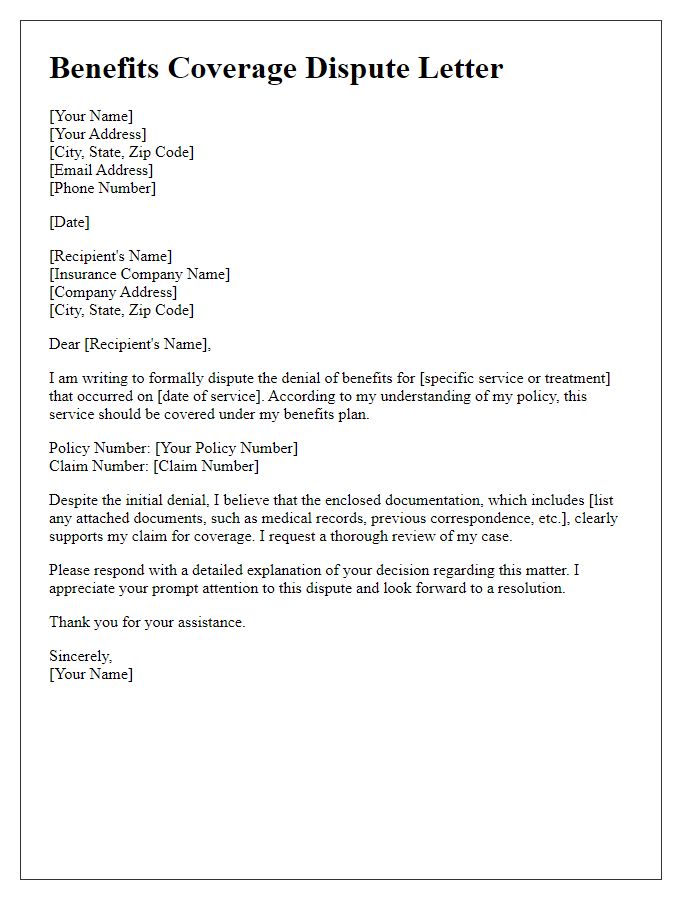

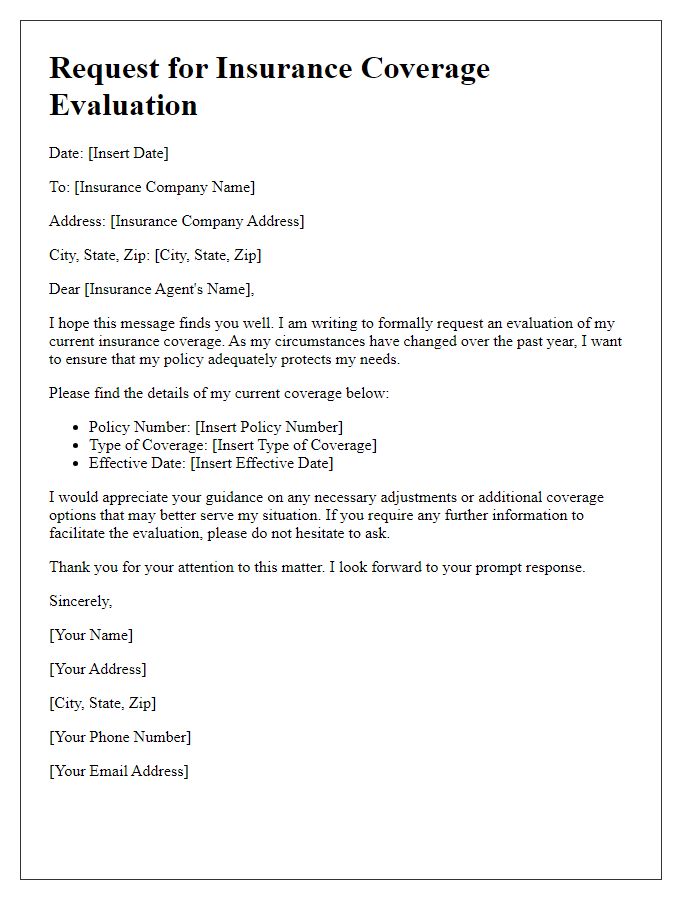

Navigating the complexities of coverage disputes can be challenging, but having a well-crafted letter template can make the process smoother. Whether you're dealing with an insurance company or seeking resolution on a coverage issue, it's essential to communicate effectively to express your concerns clearly. In this article, we'll provide you with a practical template that outlines the key elements necessary for addressing your coverage dispute. So, let's dive in and get you equipped with all the tools you need to resolve your situation effectively!

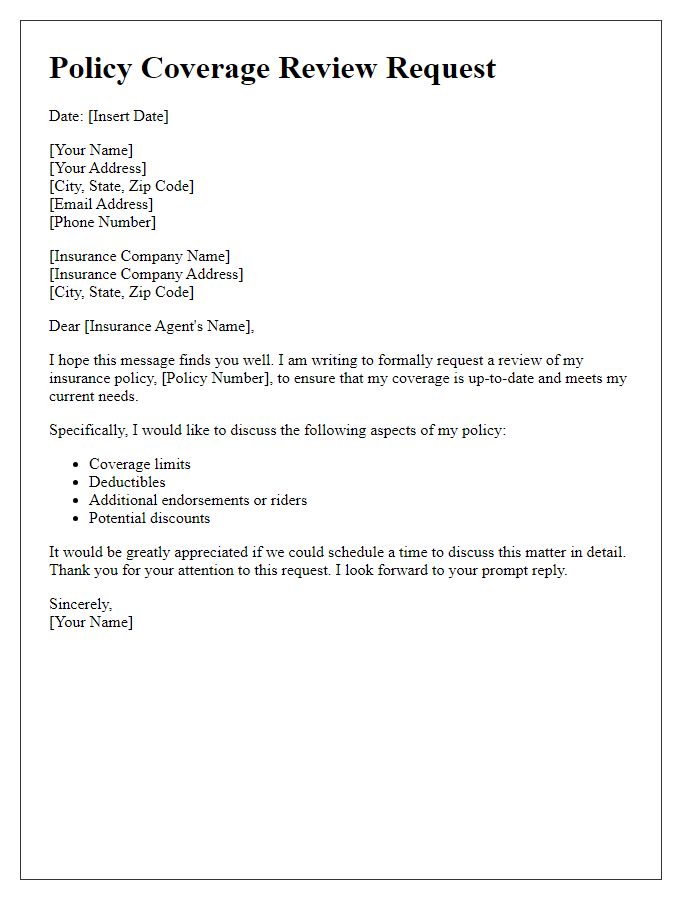

Clear Identification of Policy Details

In the context of a coverage dispute resolution, clear identification of policy details is crucial for effective communication between the insured party and the insurance provider. Essential elements include the policy number, typically a unique identifier assigned to each insurance contract, the insured party's name, and the specific coverage type such as homeowner's insurance or auto insurance. Effective identification of event dates, such as the date of loss or claim submission, is also necessary. Furthermore, referencing pertinent documents, such as declarations pages or endorsements, ensures all parties are aligned on the terms and conditions. This level of specificity aids in streamlining discussions, promoting clarity, and ultimately facilitating a resolution.

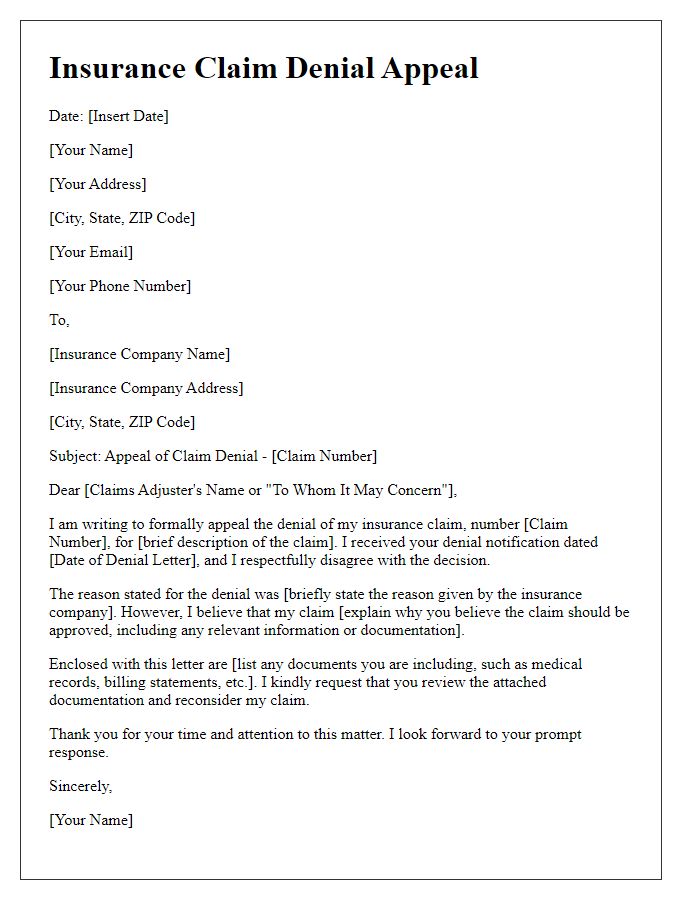

Concise Explanation of Dispute

Coverage disputes often arise from conflicting interpretations of policy language in insurance agreements. For instance, a homeowner's insurance claim may be denied due to the insurer's assertion that the type of water damage sustained falls under "flooding," which is not covered. Conversely, the homeowner may argue that the damage results from a burst pipe, qualifying for coverage under the 'sudden and accidental' clause. Documentation such as photographs, repair estimates, and correspondence with the insurance adjuster can support the homeowner's position. Timely resolution is essential to avoid prolonged financial strain and dissatisfaction with the claims process. Notably, state regulations may also impact the handling of such disputes, requiring specific timelines and actions by insurance companies to resolve claims fairly.

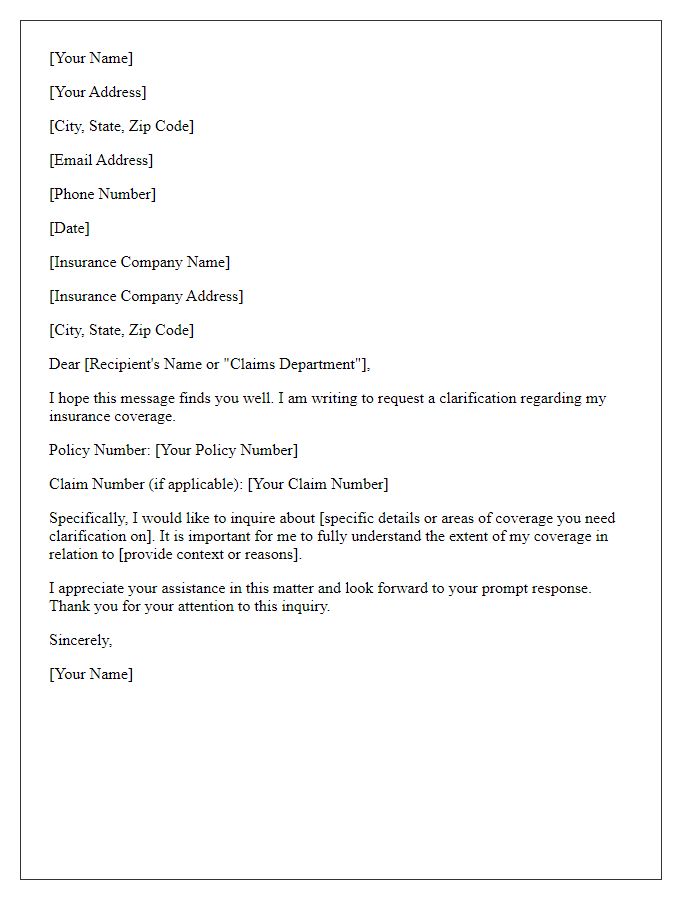

Reference to Relevant Policy Sections

In a coverage dispute resolution context, understanding relevant policy sections is essential for accurate communication of claims and entitlements. Policy documents like Homeowners Insurance typically delineate coverage limits, exclusions, and conditions under sections titled "Coverage A" (Dwelling), "Coverage B" (Other Structures), and "Coverage C" (Personal Property). Clauses regarding "Exclusions" outline scenarios not covered, such as natural disasters or wear-and-tear, which can significantly impact the resolution process. Additionally, reference to "Conditions" provides insight into the responsibilities of the insured, including timely filing of claims and cooperation during investigations. Understanding these policy sections is crucial to craft a compelling argument, ensuring compliance while advocating effectively for one's rights under the insurance contract.

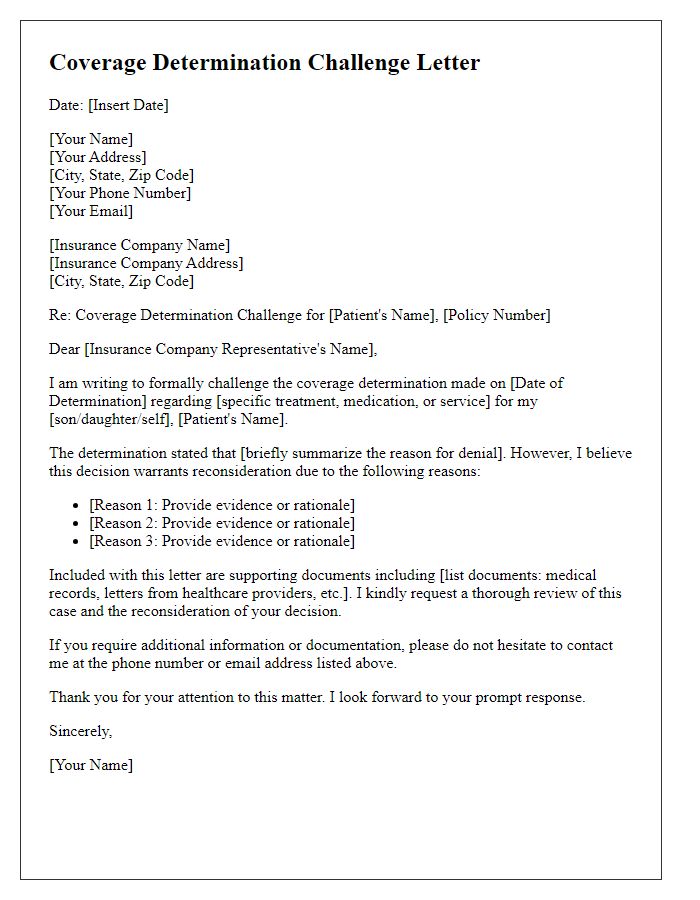

Evidence Supporting Claim

A coverage dispute resolution can hinge on the evidence presented to support a claim, including documents such as policy statements, claim forms, and medical records. These documents must detail interactions with service providers from facilities like hospitals (operating under regulations such as HIPAA) and insurers, showcasing instances of policy adherence and claims processing. Timely submissions within designated time frames (often 30 days from the event) are crucial in establishing credibility. Exhibits like photographs, expert testimonies, or incident reports, particularly in personal injury or property damage cases, can fortify an argument. Moreover, correspondence from insurance adjusters or denial letters may highlight inconsistencies in claims handling. Retaining original documents is essential for reference during mediation or arbitration processes.

Proposed Resolution or Action Steps

Proposed resolutions for coverage disputes often involve clear action steps aimed at reaching an agreement. Document submission should include relevant policy details, claim numbers, and specific dates. In the case of insurance, policyholders may need to provide additional supporting documents such as medical records or receipts. Timely communication through formal letters or emails should be established with the claim adjuster or dispute resolution department. Follow-up calls can clarify any ambiguities and ensure all parties understand the next steps. Mediation processes may also be considered, engaging neutral third-party professionals to facilitate dialogue and potential settlements. Establishing deadlines for responses from both sides can expedite resolution and reduce protracted negotiations.

Comments