Are you looking to cancel a policy but don't know where to start? Writing a clear and concise letter is key to ensuring your request is processed smoothly. In this article, we'll guide you through crafting a cancellation letter that covers all the necessary details while maintaining a professional tone. Ready to take the next step? Let's dive in!

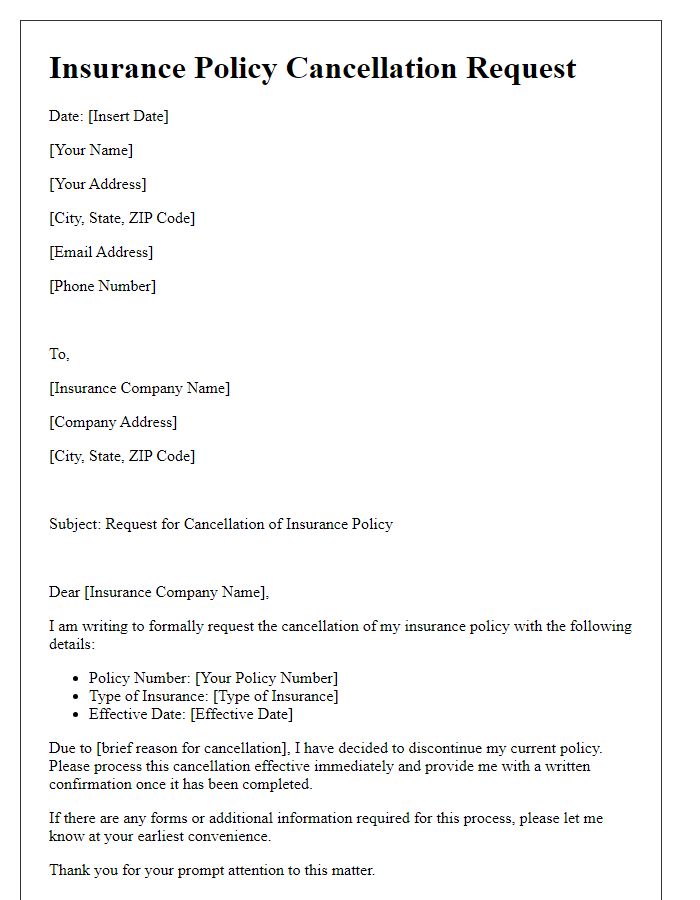

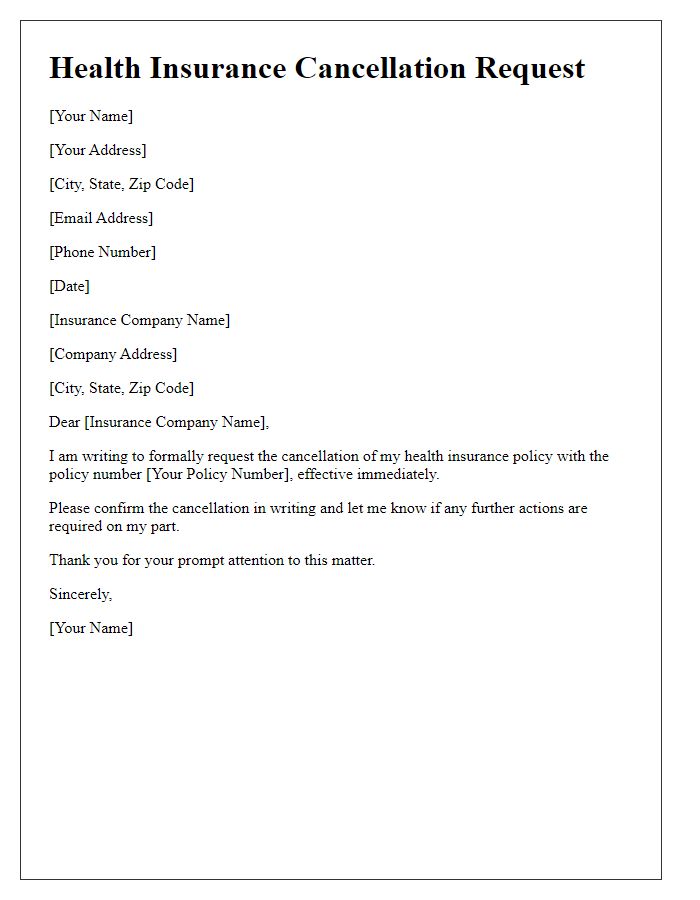

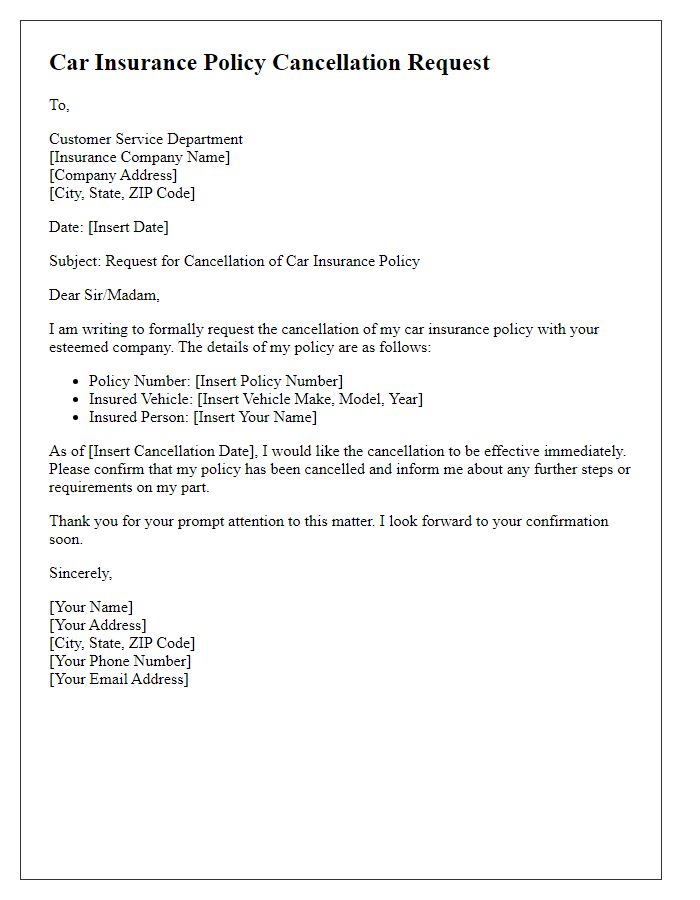

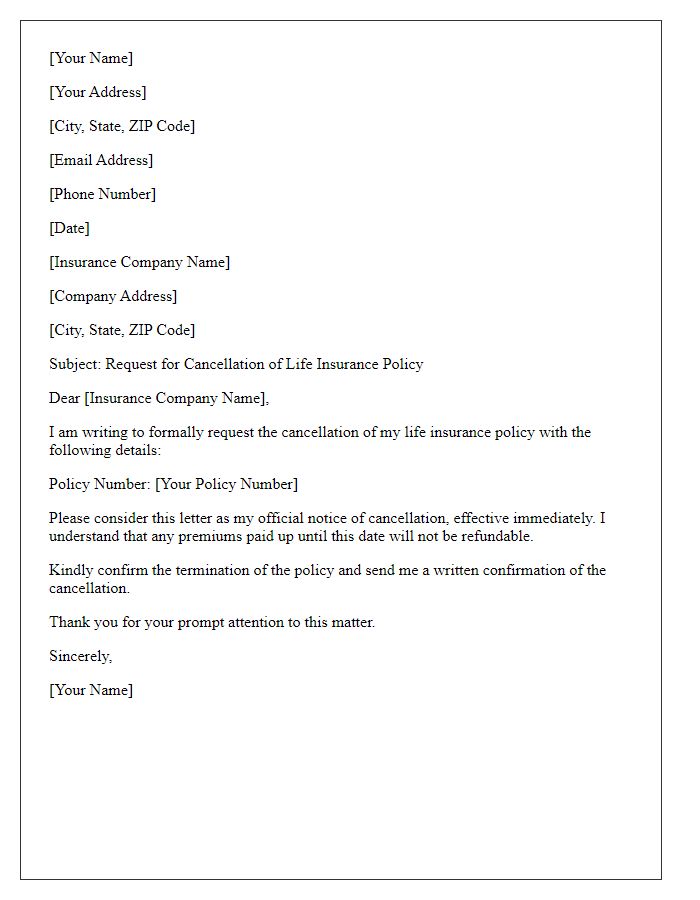

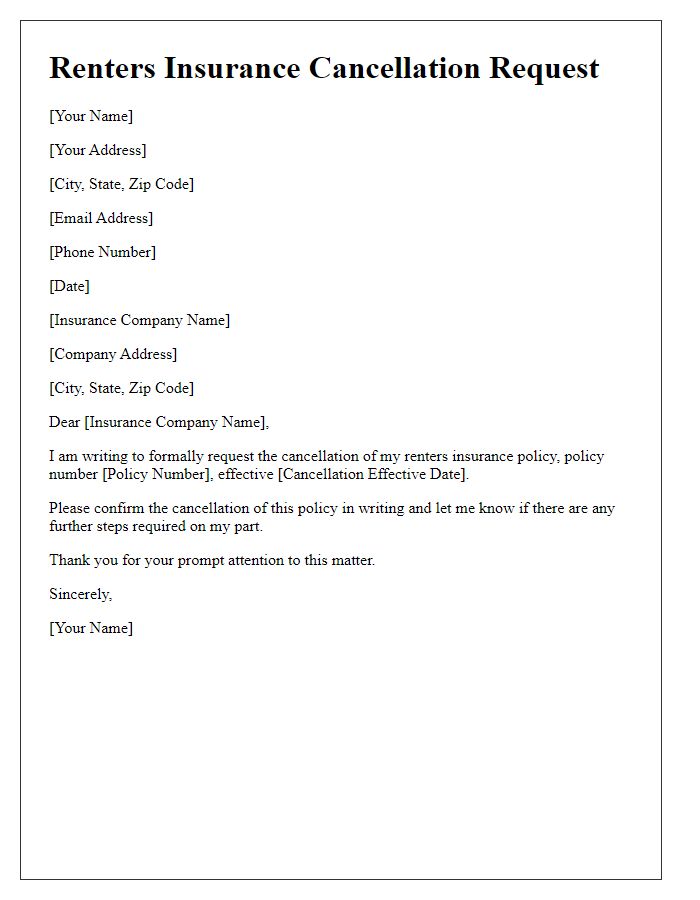

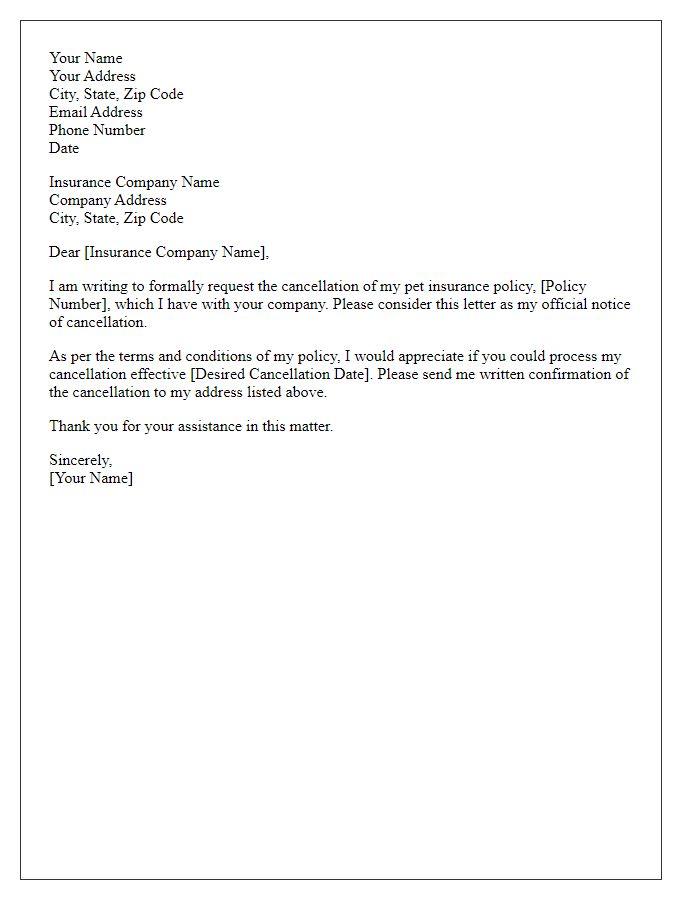

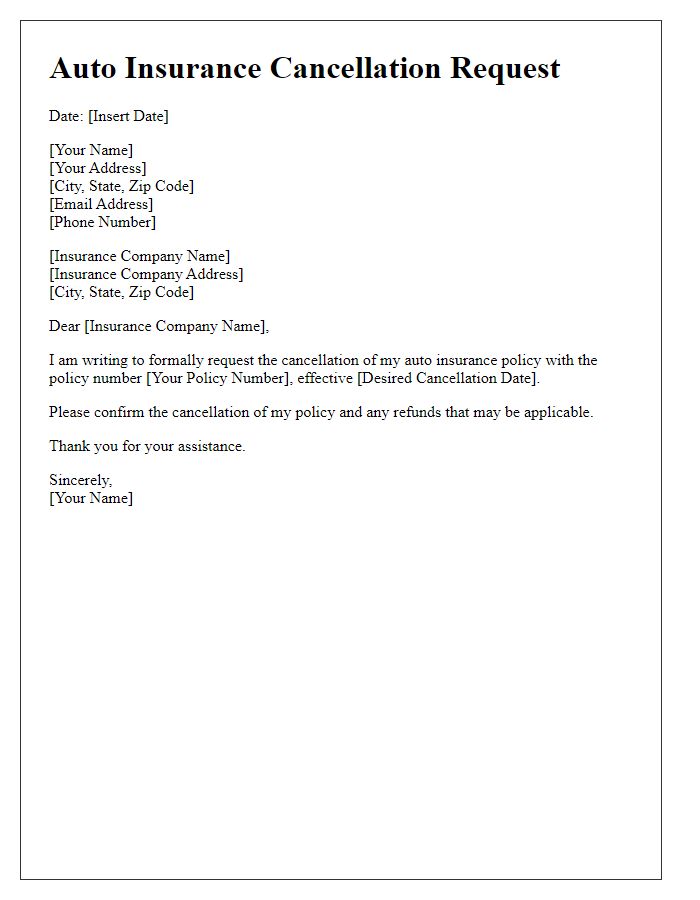

Personal Information

Submitting a request for policy cancellation necessitates the provision of explicit personal information to ensure proper identification and processing by the insurance provider. Key details should include the policyholder's full name (as registered on the policy document), policy number (a unique identifier assigned to the insurance contract), date of birth (for verification purposes), and contact information (including both phone number and email address). Additionally, it is often required to mention the effective date of cancellation, which signifies when the coverage will officially cease, as well as a brief explanation of the reason for cancellation to facilitate internal processing. Thoroughly providing this information enables a smooth and efficient cancellation process while maintaining clear communication with the insurance company.

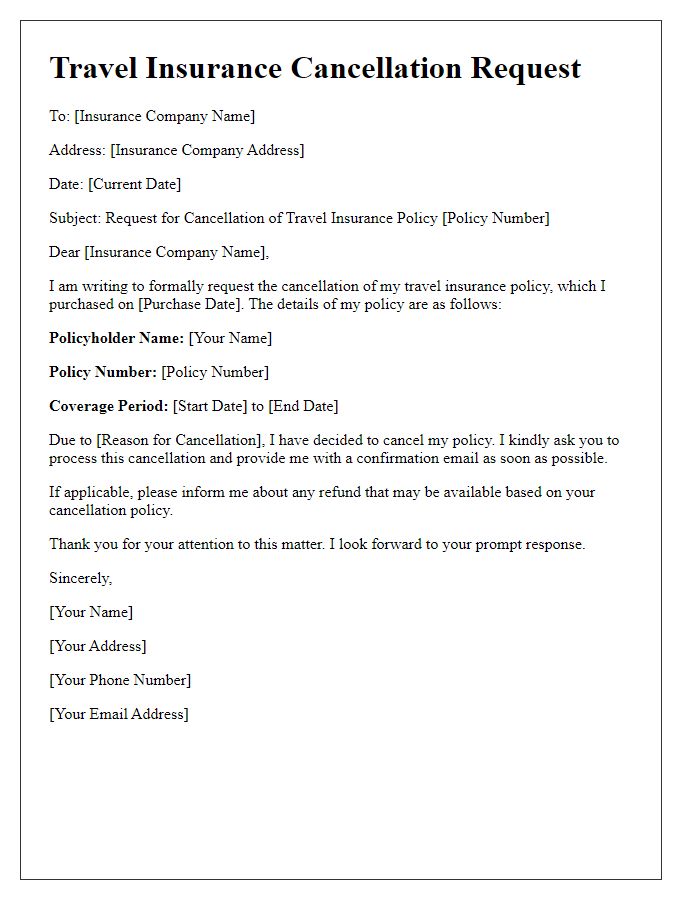

Policy Details

A policy cancellation request requires specific information for processing. The policyholder must include crucial details such as the policy number, which uniquely identifies the insurance contract, effective dates indicating the coverage period, and the policyholder's name for accurate identification. Including a detailed reason for the cancellation, whether due to financial constraints, policy dissatisfaction, or switching providers, can expedite the review process. Furthermore, contact information such as a phone number and email should be provided to facilitate communication regarding any necessary follow-up actions or confirmations.

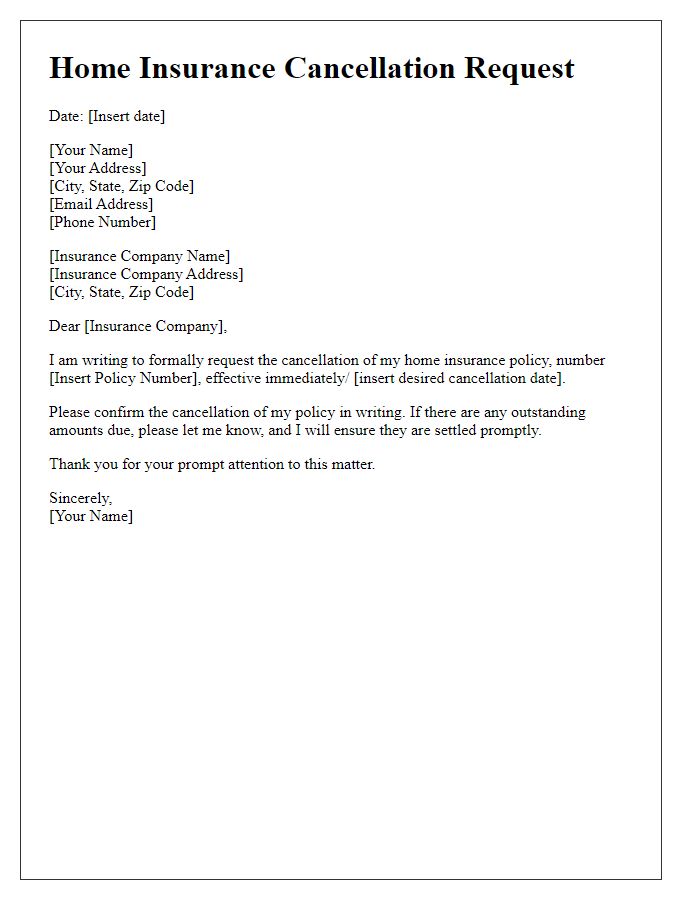

Cancellation Request Statement

Policy cancellation requests require precise documentation to ensure clarity and compliance. A standard cancellation request must include policy details such as policy number, the insured individual's name, and the effective cancellation date. It's crucial to mention the reason for cancellation, whether due to financial constraints, dissatisfaction with services, or switching to another provider. Ensuring the request aligns with the insurer's guidelines, including proper submission methods--like mailing to specific departments or via secure online portals--will facilitate a smoother process. Recording the cancellation confirmation receipt is essential for future reference.

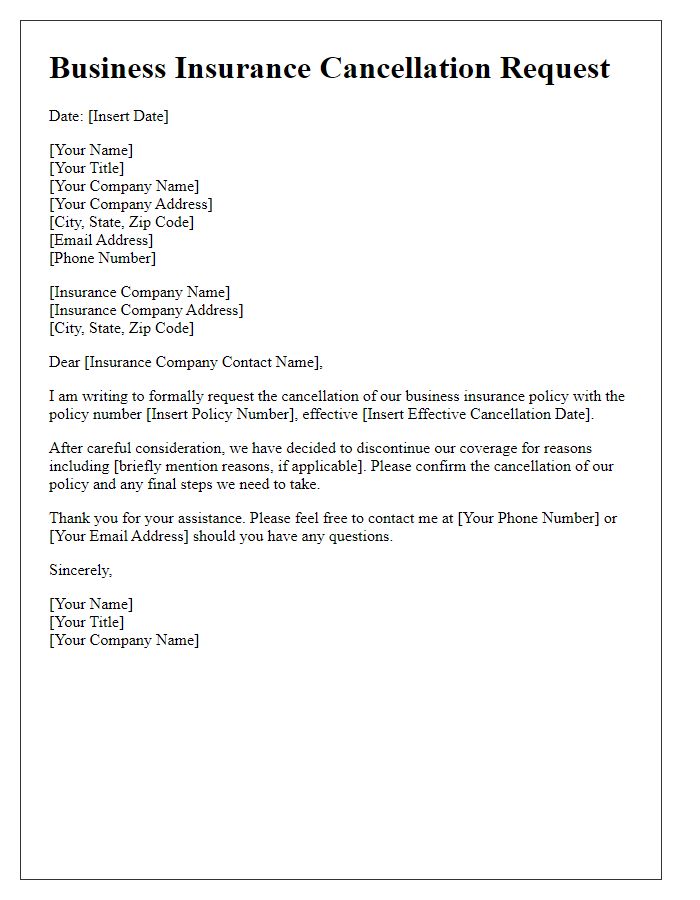

Reason for Cancellation

Policy cancellation requests often stem from various reasons including financial constraints, changes in personal circumstances, or dissatisfaction with the coverage provided. Individuals may cite reasons such as a change in employment status leading to reduced income, relocation to a different area resulting in unnecessary coverage, or experiences with customer service that failed to meet expectations. It's crucial to include specific details related to the insurance policy, like policy number, type of coverage (such as auto, home, or health insurance), and the effective date of cancellation to facilitate a smooth request process.

Contact Information for Confirmation

Policy cancellations often require essential contact information for verification purposes. Insurers typically request the policyholder's full name, policy number, and associated contact details such as phone number and email address. Providing accurate information ensures swift processing of cancellation requests. The contact information allows representatives to confirm identity and expedite communication regarding the status of the cancellation. Ensuring clarity in the shared details can minimize potential delays and misunderstandings during the cancellation process.

Comments