Are you looking to save money on your insurance premiums? A multi-policy discount could be just what you need! By bundling different insurance policies together, you can enjoy significant savings while simplifying your finances. Want to learn more about how to apply for a multi-policy discount? Keep reading!

Policy Details and Numbers

A multi-policy discount application can significantly reduce insurance costs for individuals or families holding multiple policies, such as auto, home, and life insurance. Policyholders typically provide essential information including policy numbers (unique identifiers for each insurance agreement), effective dates (indicating when coverage begins), and premiums (the fee charged for coverage). Insurance companies often require documentation proving the existence of these policies, enhancing eligibility for discounts. The discount percentage may vary based on the number of policies combined, potentially reaching up to 25% savings depending on the insurer's guidelines. Clear communication of these details ensures a smoother application process and helps expedite approval for reduced rates.

Customer Information and Contact

Customers seeking multi-policy discounts can benefit significantly from consolidating their insurance coverages with a single provider. This strategy often leads to substantial savings on premiums, promoting financial efficiency. Prospective applicants typically need to provide detailed customer information, including full name, address, and date of birth. Contact details must also be submitted, including email address and phone number, ensuring seamless communication with the insurance company for updates and policy management. Additional factors such as the number of policies desired, types of coverage (e.g., home, auto, life), and existing policies with other providers enhance the potential for discounts, supporting the customer's financial needs.

Eligible Policies and Coverage Types

Multi-policy discounts provide significant savings for customers managing various insurance types like auto, home, and life. Insurance providers often offer discounts ranging from 5% to 25%, depending on the number of policies and total premiums. Eligible policies can include homeowners insurance, renters insurance, auto insurance, and life insurance, among others. For instance, a customer may bundle a homeowner's policy with an auto policy, resulting in an average savings of up to 15% annually. The coverage types can vary in range and limits, ensuring that consumers not only receive discounts but also maintain sufficient protection across all their assets. Insurers typically require that all policies remain active and in good standing to qualify for the multiclass discount. Understanding these elements could lead to substantial financial benefits while enhancing overall insurance protection.

Discount Percentages and Savings

Multi-policy discounts provide significant savings for individuals and families purchasing various insurance types, including auto, home, and life insurance. These discounts can range from 5% to 25%, depending on the insurer and the number of policies bundled together. For instance, customers who combine auto insurance with homeowner's insurance might receive a 10% discount on their premiums, translating to savings of up to $500 annually. State Farm, Allstate, and Progressive are notable providers that offer multi-policy discounts. Additionally, some companies implement tiered discount structures, rewarding customers even further for adding additional policies, thereby incentivizing comprehensive coverage across multiple aspects of life.

Application Submission and Deadline

Submitting a multi-policy discount application requires attention to deadlines and specific requirements outlined by the insurance provider, such as State Farm or Allstate. Typically, these applications need to be submitted within a specific window, often 30 days from policy initiation or renewal dates. Documents required may include current policy details, proof of eligible additional policies, and compliance with payment schedules. Failure to meet these deadlines can result in ineligibility for discounts, potentially costing consumers an average of 10 to 20 percent in savings on their premiums. Therefore, timely assembly and submission of necessary information is crucial for maximizing benefits.

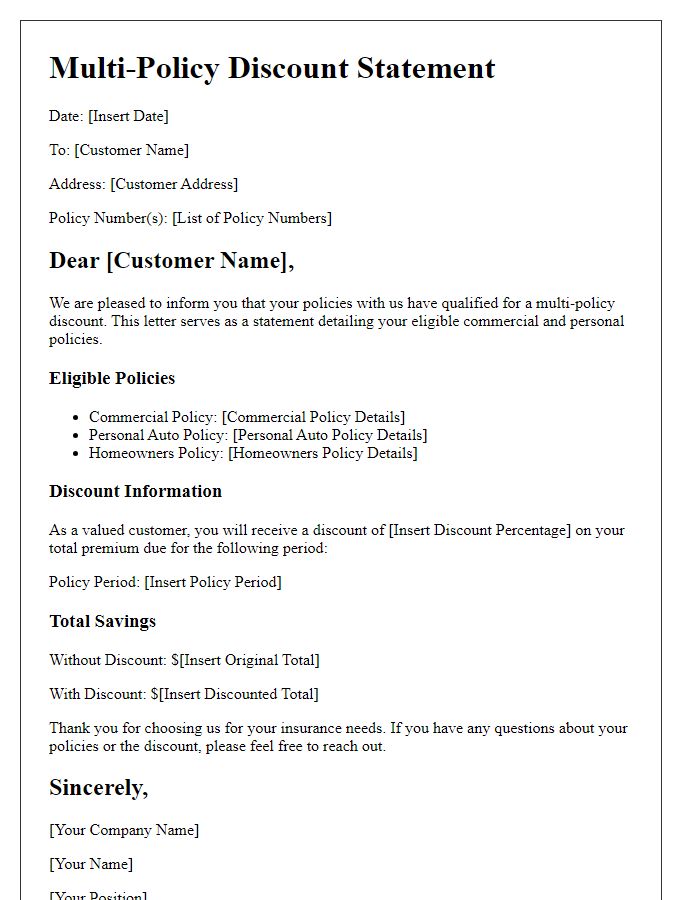

Letter Template For Multi-Policy Discount Application Samples

Letter template of multi-policy discount request for homeowners and auto insurance.

Letter template of multi-policy discount inquiry for health and auto coverage.

Letter template of multi-policy discount application for life and property insurance.

Letter template of multi-policy discount petition for business and personal insurance.

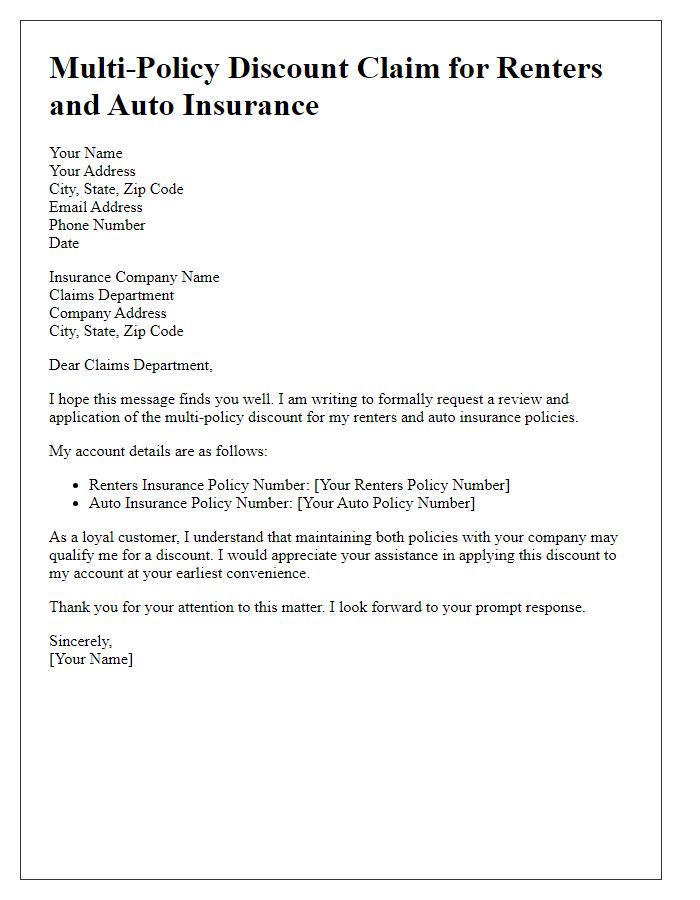

Letter template of multi-policy discount claim for renters and auto insurance.

Letter template of multi-policy discount appeal for condo and travel insurance.

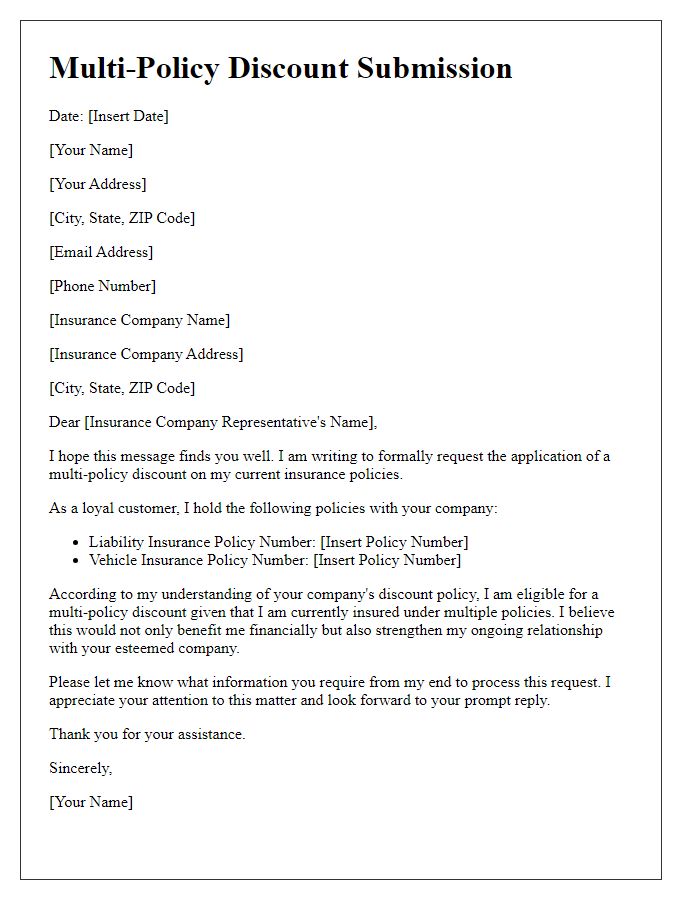

Letter template of multi-policy discount submission for liability and vehicle insurance.

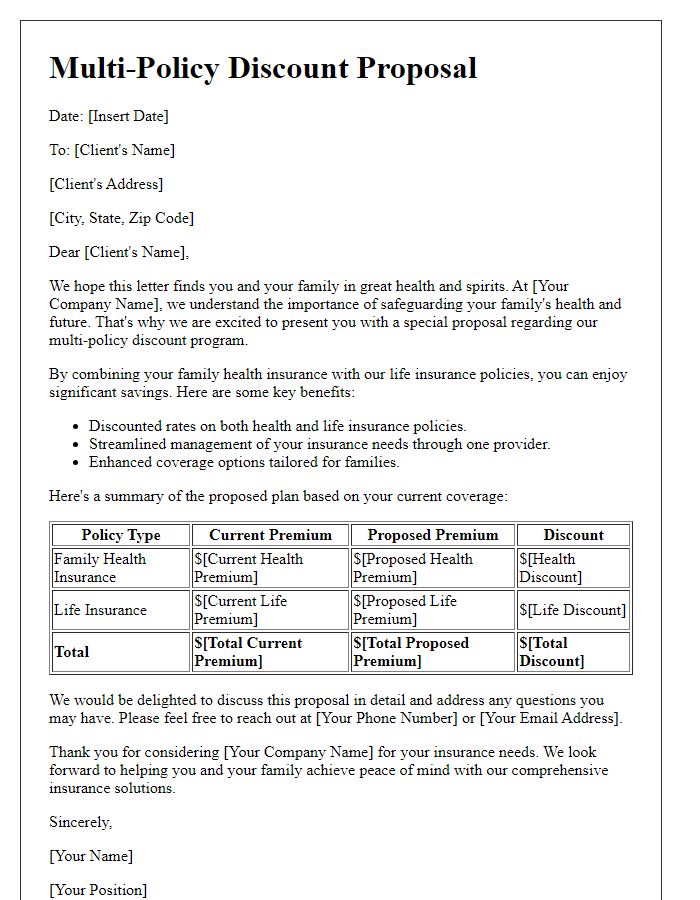

Letter template of multi-policy discount proposal for family health and life insurance.

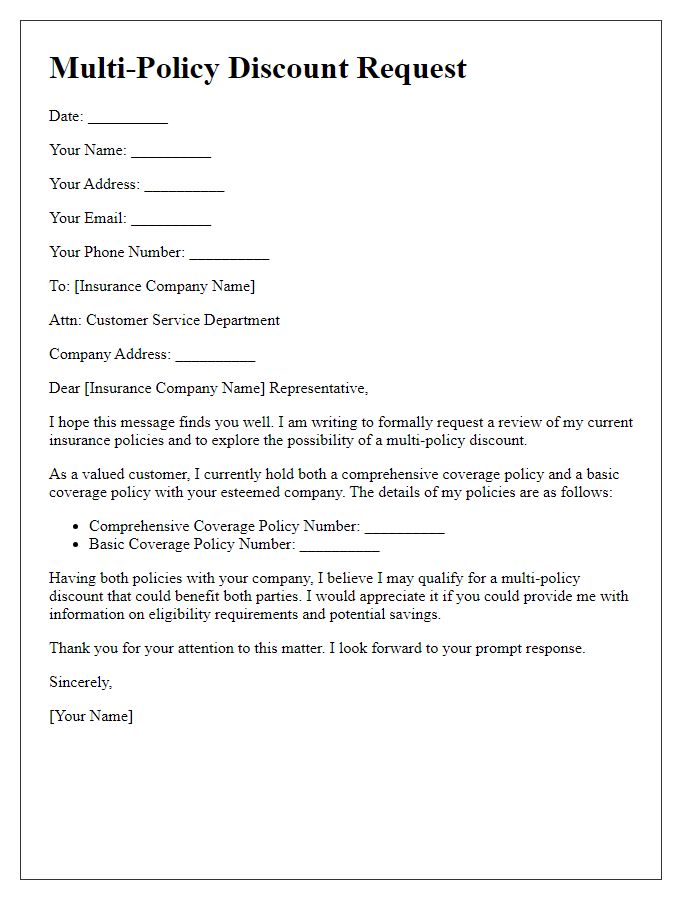

Letter template of multi-policy discount request for comprehensive and basic coverage.

Comments