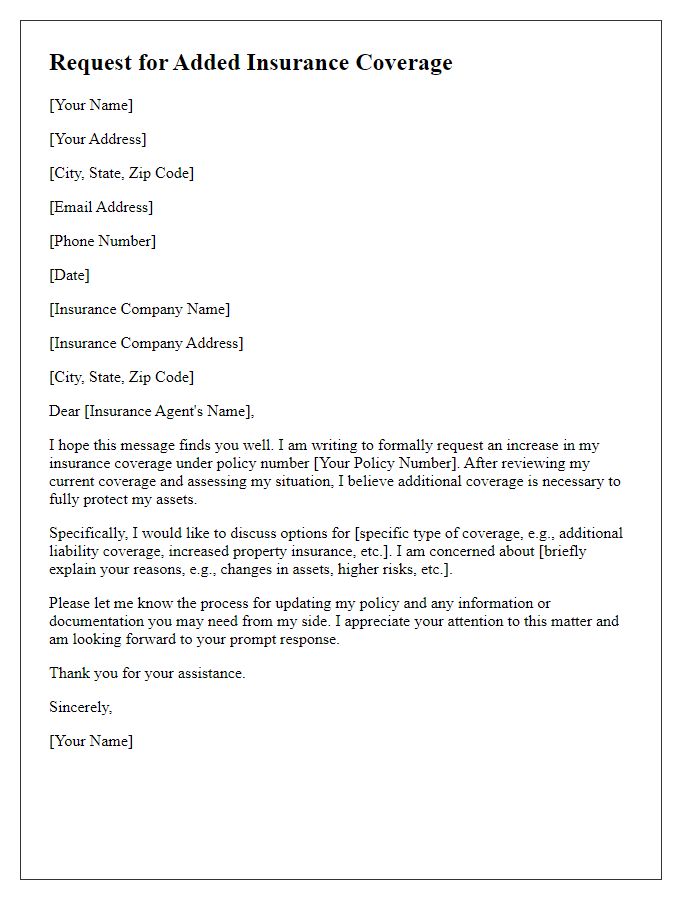

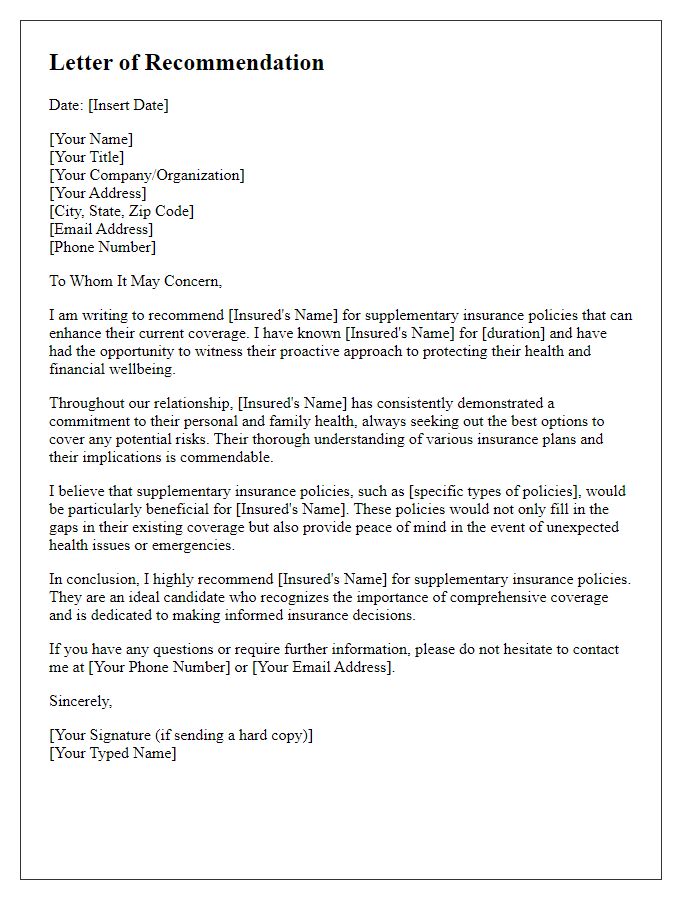

Are you feeling a bit uneasy about your current insurance coverage? You're definitely not alone! Many people are realizing the importance of additional insurance protection to safeguard their assets and provide peace of mind. If you're curious about how to effectively request extra coverage, keep reading for a practical letter template that can help you get started!

Introduction and Purpose

Seeking additional insurance protection is essential for safeguarding assets and mitigating risks. Increased coverage can support individuals and businesses facing evolving threats, such as natural disasters, cyberattacks, or liability claims. By addressing concerns regarding current policy limitations, individuals can secure peace of mind. Crafting a formal request allows for clear communication with the insurance provider, emphasizing the need for enhanced coverage options tailored to specific circumstances. Understanding policy nuances and potential gaps often drives this request, reflecting a proactive approach to financial security.

Specific Coverage Details

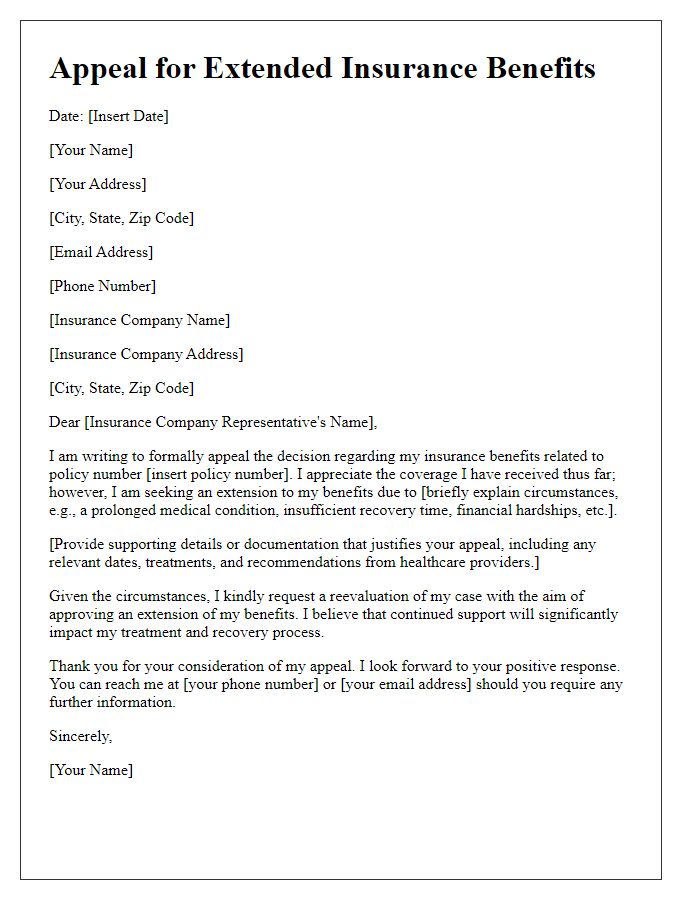

Requesting additional insurance protection involves understanding specific coverage details that cater to unique circumstances. Homeowners insurance (such as HO-3 policies) may not cover certain natural disasters like floods or earthquakes, requiring additional endorsements or separate policies. For instance, adding a flood insurance policy through the National Flood Insurance Program can mitigate risks in flood-prone areas, especially in regions like New Orleans (known for hurricanes) or San Francisco (prone to earthquakes). Similarly, personal property coverage may need to be expanded to include high-value items, such as jewelry exceeding $1,000, through scheduled personal property endorsements. Business owners should consider general liability coverage to protect against lawsuits, particularly in industries such as hospitality (restaurants and hotels), where liability claims can be substantial. Understanding the limits and exclusions of current coverage is essential for comprehensive protection against potential risks.

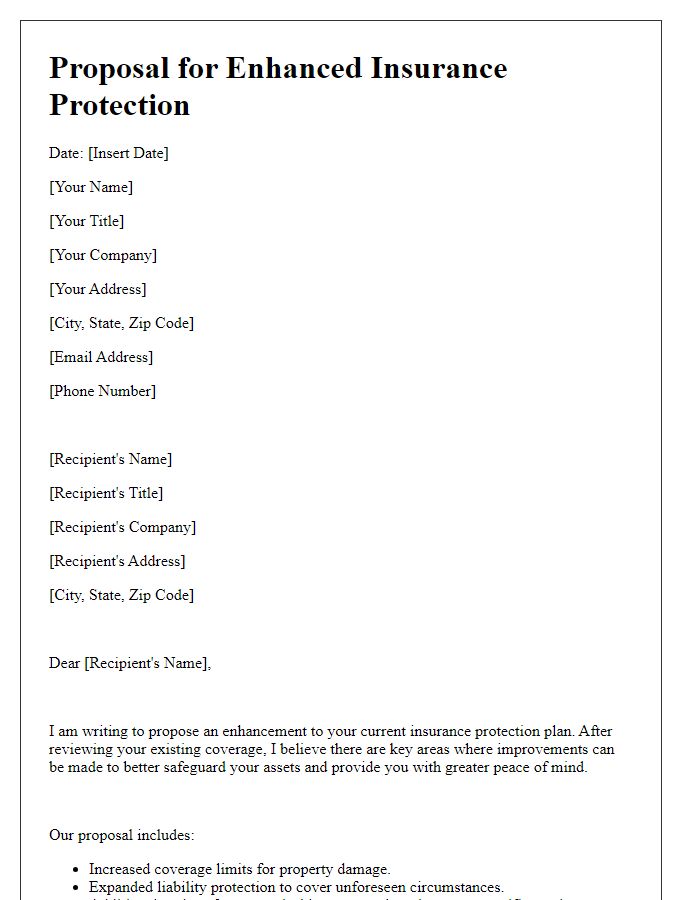

Justification and Risk Assessment

Requesting additional insurance protection is crucial for businesses operating in industries prone to various risks such as natural disasters, liability claims, or cyberattacks. A thorough risk assessment identifies potential vulnerabilities within operational areas, such as asset loss from fire, theft, or operational downtime due to equipment failure. For instance, in high-value environments like manufacturing facilities (averaging $1 million in equipment costs), the financial impact of an unanticipated event can be significant. Justification for enhanced coverage includes the need to protect assets valued at this level, ensuring business continuity and safeguarding against legal claims that can reach millions in damages. Additionally, considering statistical data indicating a 30% increase in cyber threats affecting small to medium enterprises (SMEs), it becomes evident that augmenting insurance provisions is imperative for maintaining overall business resilience.

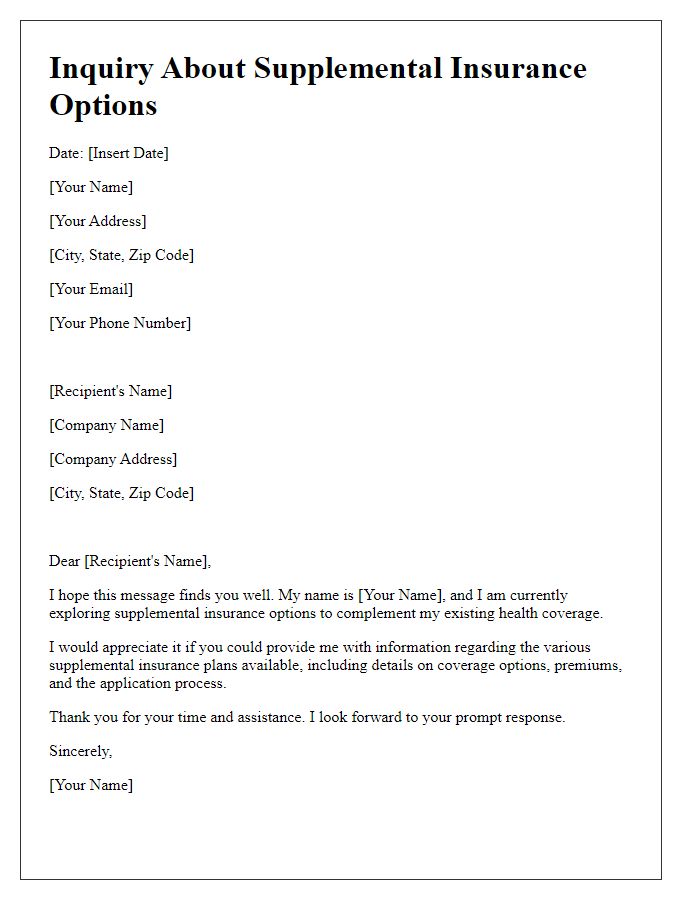

Policy and Premium Adjustments

Insurance policies often require adjustments to ensure adequate coverage for valuable assets. Many individuals seek additional protection through endorsements or riders attached to existing policies, enhancing their coverage for specific needs such as high-value items or unique circumstances. Premium adjustments will occur based on the new terms of coverage, influencing ongoing monthly or annual payments. Consultation with insurance providers is critical, ensuring clarity on policy details, modification timelines, and potential impacts on future claims. Keeping abreast of changing needs in coverage helps maintain financial security and peace of mind.

Contact Information and Response Timeline

Requesting additional insurance protection is essential for ensuring comprehensive coverage for assets. Insurance policies often have limits that may not adequately safeguard high-value items, such as luxury vehicles or expensive jewelry, against unforeseen events. Specific details, like the vehicle's make, model, and market value or the appraised value of jewelry pieces, are crucial when submitting a request. Clear communication with the insurance provider, ideally through email or a formal letter, should include a reasonable response timeline, generally between 14 to 30 days, to allow adequate processing time for the request. Providing all necessary information enhances the chances of receiving the desired coverage efficiently.

Comments