Are you feeling overwhelmed by unexpected insurance charges? You're not alone, as many people find themselves facing billing disputes that can cause stress and confusion. In this article, we'll guide you through the process of addressing overcharges with your insurance provider, ensuring you know your rights and how to effectively communicate your concerns. So, grab a cup of coffee, settle in, and let's explore your options to resolve this issue together!

Policy information

Overcharging by insurance companies can lead to confusion concerning policy details and payments. Policyholders often experience discrepancies in premium charges, sometimes resulting in amounts that exceed the established rates listed in the insurance policy documents. For example, a typical homeowner's insurance policy might have a premium of $1,200 annually; however, customers may find charges rising unexpectedly to $1,500 or more. Accurate documentation of the original policy number, coverage limits, and billing cycle is crucial, as errors can arise from human oversight or system malfunctions. The state insurance regulatory agencies (like the California Department of Insurance) provide oversight to ensure fairness in billing practices, and policyholders have the right to dispute excessive charges through formal channels provided by their insurance provider.

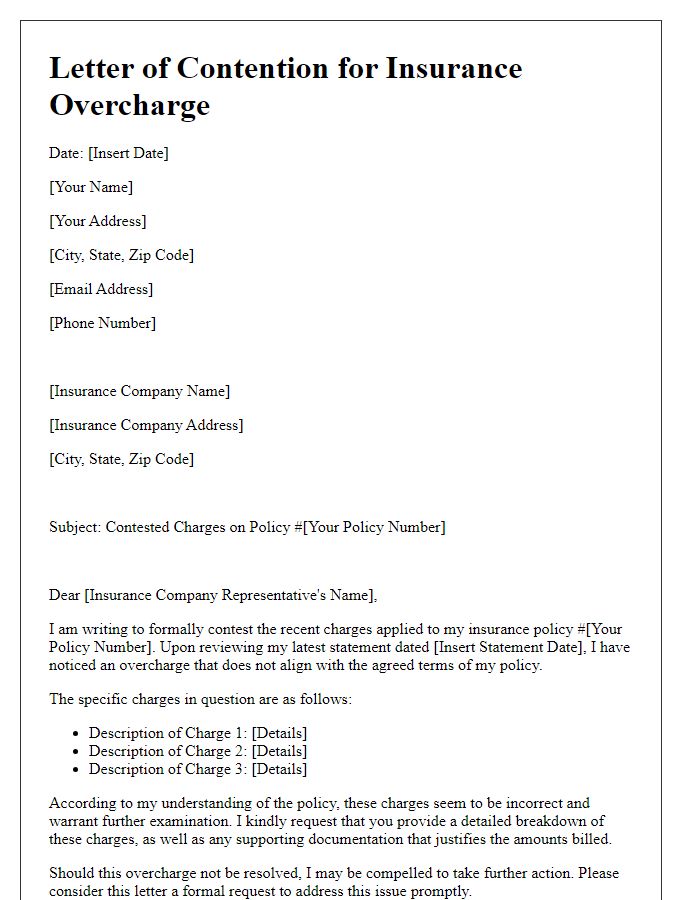

Detailed overcharge description

Excessive billing inaccuracies in insurance premiums can significantly impact household budgets. For instance, an auto insurance policy, typically averaging around $150 monthly, might reflect an unexplained increase of $75, leading to a total monthly cost of $225. This discrepancy often originates from erroneous claims on driving records or miscalculated risk factors. Notably, geographical factors like residing in a high-risk area, such as Los Angeles, California, could inflate rates. The impact of unresolved billing disputes can extend beyond financial stress, affecting overall customer satisfaction and trust in insurance providers. Addressing these grievances often requires thorough reviews of documents, communication with customer service representatives, and careful attention to policy terms and conditions.

Supporting documentation

Insurance overcharge disputes often require detailed supporting documentation to facilitate a resolution. Key documents include billing statements, policy agreements, and correspondence with the insurance company. Billing statements should highlight specific charges and dates of service, enabling a clear comparison with agreed-upon policy terms. Policy agreements outline coverage and premium stipulations that verify discrepancies. Correspondence, such as emails or letters to customer service, serves to document attempts made to address the issue. Additional evidence could include documented conversations with agents and any relevant state insurance regulations that provide context for the dispute. Collectively, this documentation creates a comprehensive case for challenging unjustified overcharges effectively.

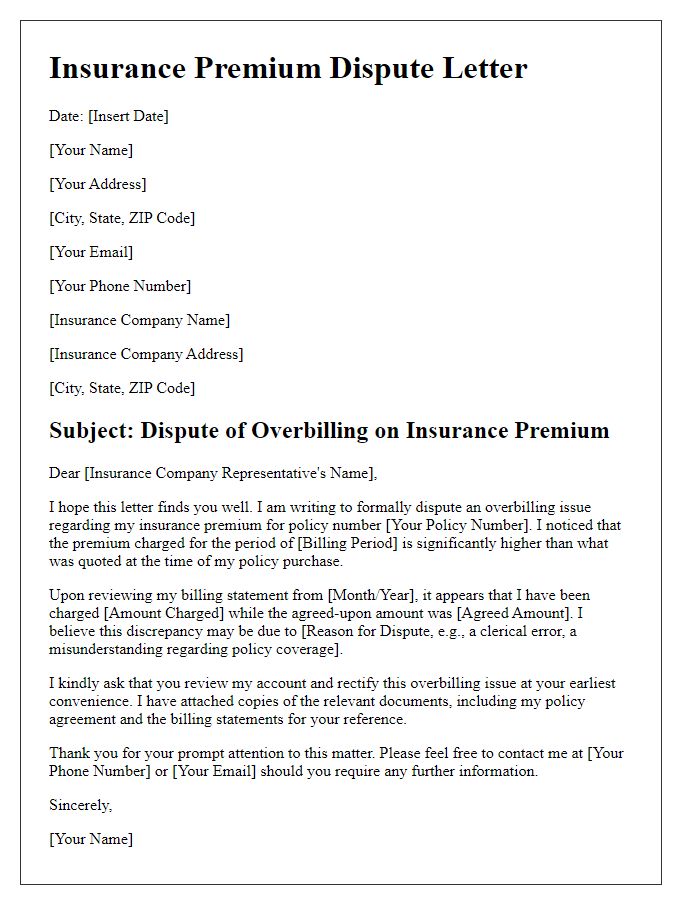

Request for resolution

In a recent insurance policy review, discrepancies were identified regarding overcharges related to premiums, notably in automobile coverage with a standard liability limit of $100,000 personal injury protection. The monthly premium projections presented initially were approximately $250, yet the actual billed amount escalated to $350 within three billing cycles. Documentation, including policy declarations from January 2023 and payment records, highlights the inconsistencies. Immediate action is required to rectify this issue, ensuring that the customer is only charged according to the agreed terms and any overpayments are refunded. Clear communication with the insurance provider, ABC Insurance, located in Springfield, is critical to achieving a timely resolution.

Contact information

For individuals facing an insurance overcharge dispute, it is critical to utilize clear and detailed contact information to facilitate efficient communication and resolution. Primary contacts include the insurance provider's customer service department, typically reachable via a dedicated phone number (often found on the insurance policy document) and an email address (usually listed on the company's official website). It is advisable to reference specific policy identifiers, such as the policy number, which is essential for locating account details. Additionally, include your full name, address, and any previous correspondence related to the dispute to ensure a prompt response. Providing this comprehensive information helps streamline the dispute process and clarifies the nature of the overcharge in question.

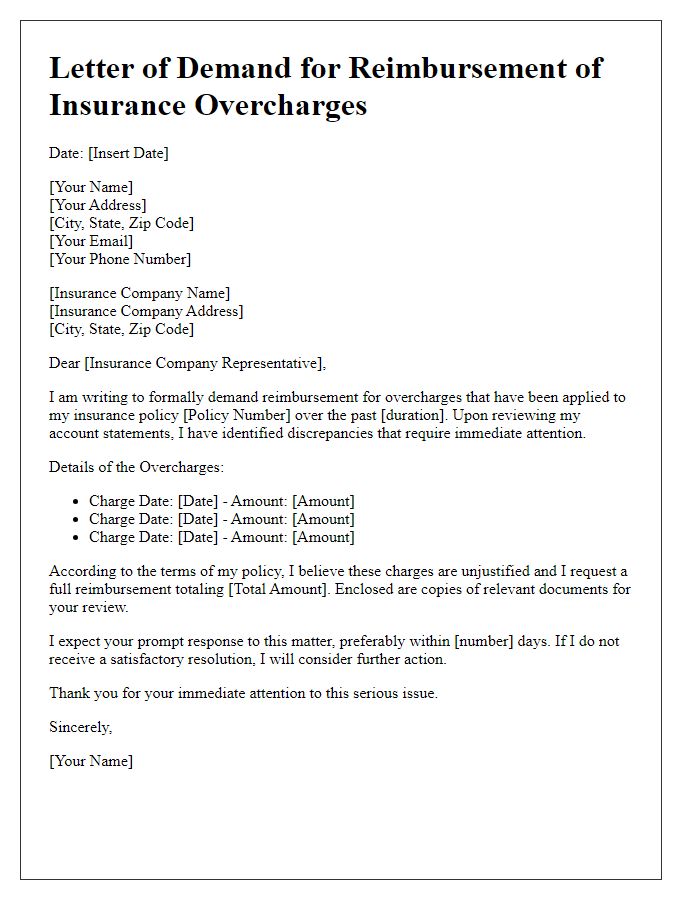

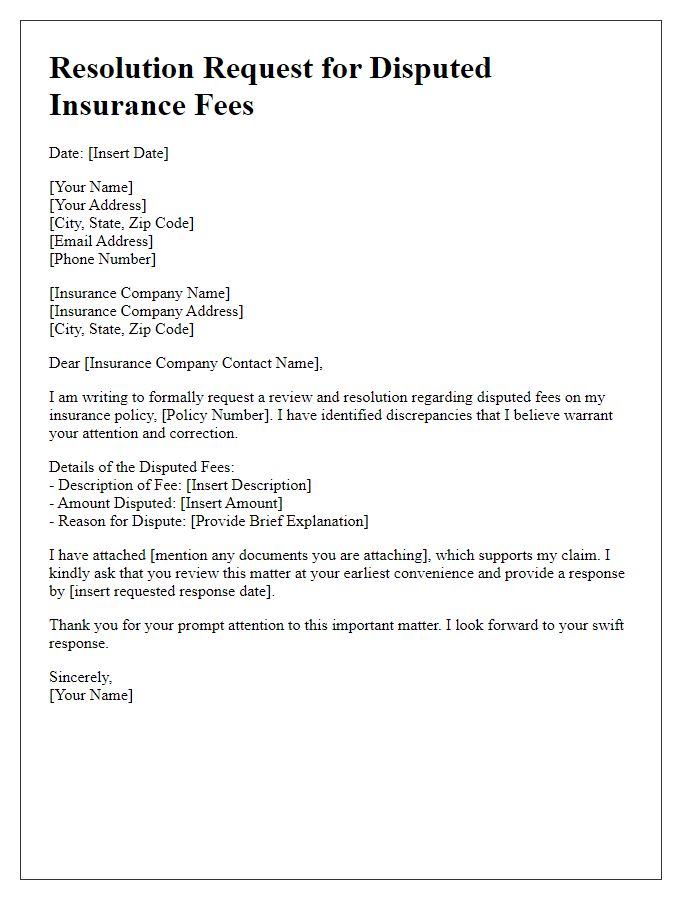

Letter Template For Insurance Overcharge Dispute Samples

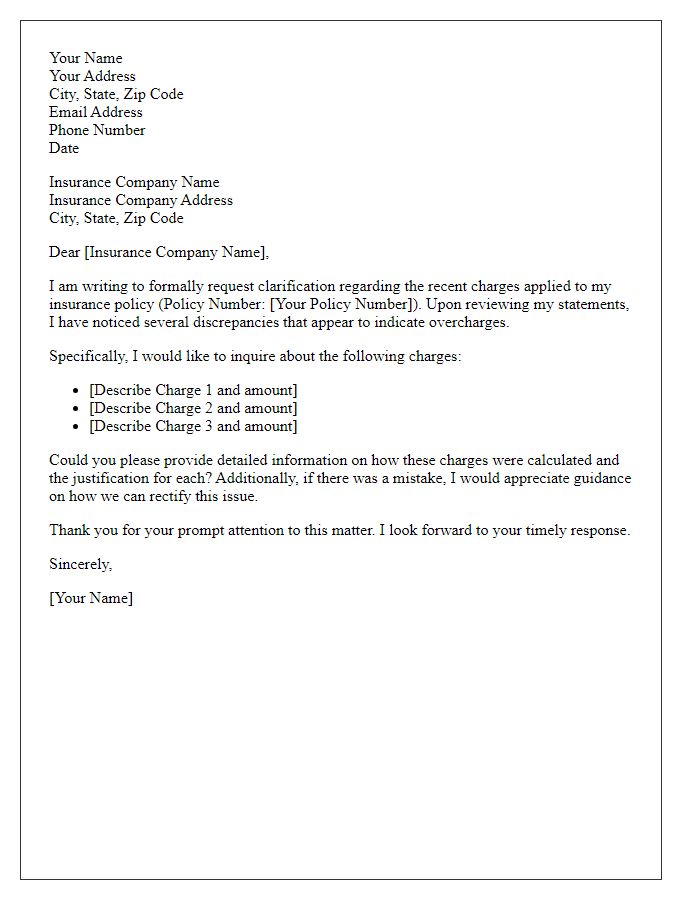

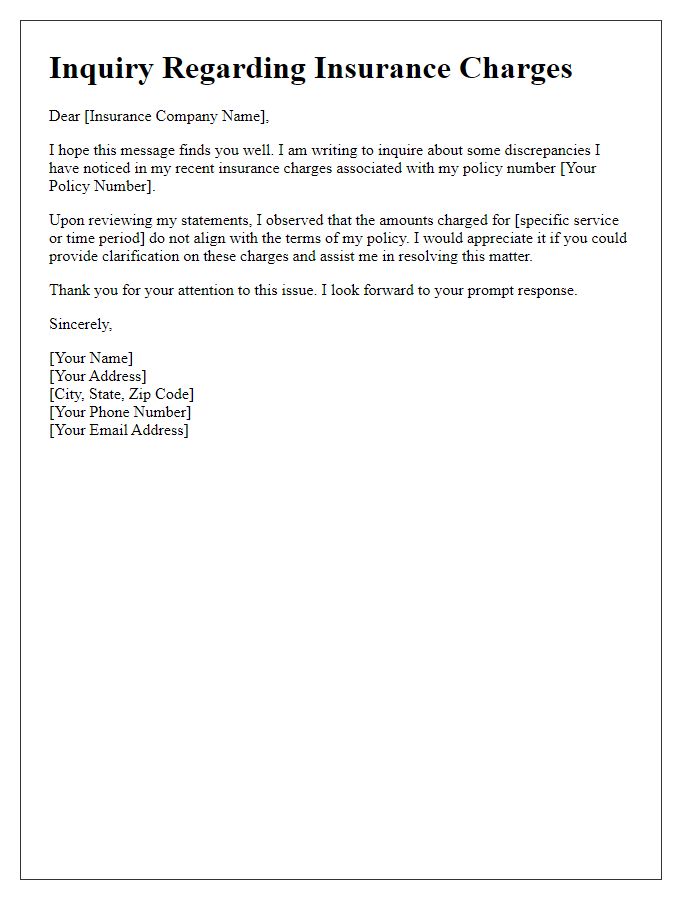

Letter template of clarification request regarding insurance overcharges

Comments