Are you feeling frustrated over an incorrect claim processing issue? You're not alone! Many individuals find themselves navigating the complex world of claim submissions and often encounter unexpected hiccups along the way. In this article, we'll explore how to effectively address these discrepancies and ensure your concerns are resolvedâso keep reading for practical tips and insights!

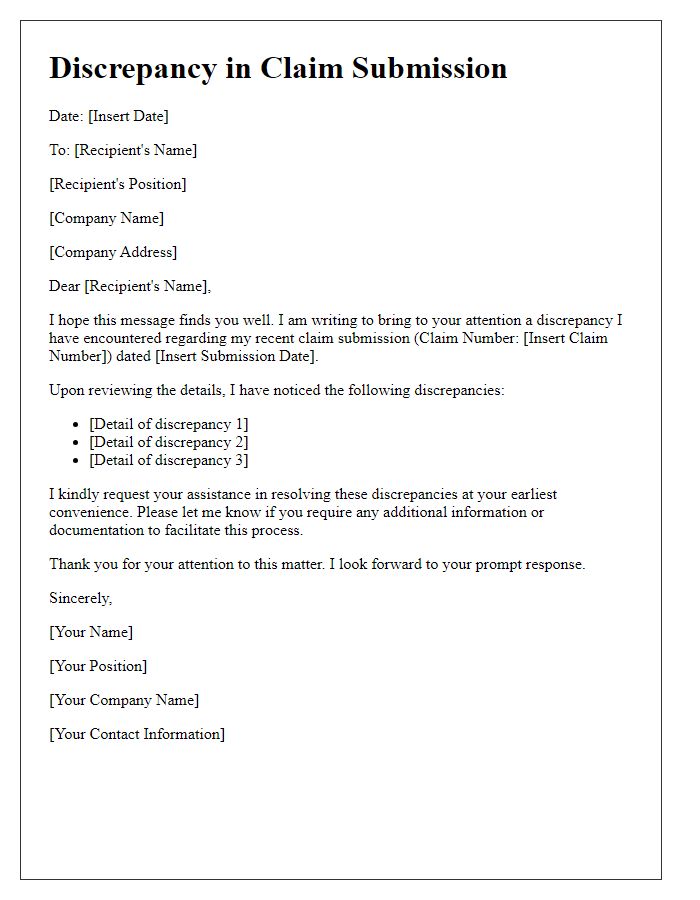

Accuracy and Error Analysis

Inaccurate claim processing can lead to significant financial discrepancies in insurance firms, particularly within the healthcare sector. Common errors may include incorrect coding of medical procedures according to the Current Procedural Terminology (CPT) codes, which are essential for proper billing. For instance, an incorrect code might result in a claim rejection, causing delays in reimbursement that can extend up to several months. Additionally, automatic algorithmic processing errors may arise in claims management systems, increasing the likelihood of oversight in data entry. Regular audits and accuracy assessments are crucial, as studies indicate that up to 20% of medical claims contain errors, emphasizing the need for meticulous error analysis to ensure operational efficiency and accuracy in claims settlements.

Audience-Specific Language

Incorrect claim processing can lead to significant delays in patient reimbursements in healthcare organizations. Instances of denials often stem from coding errors or missing documentation during submission. For example, the error rate for Medicare claims can exceed 10%, impacting financial flow in facilities like general hospitals or outpatient clinics. Additionally, the appeal process can extend up to 30 days, exacerbating cash flow issues. Efficient tracking of claims through management software can mitigate these errors and enhance communication with insurance providers, ensuring timely resolutions and maintaining patient satisfaction.

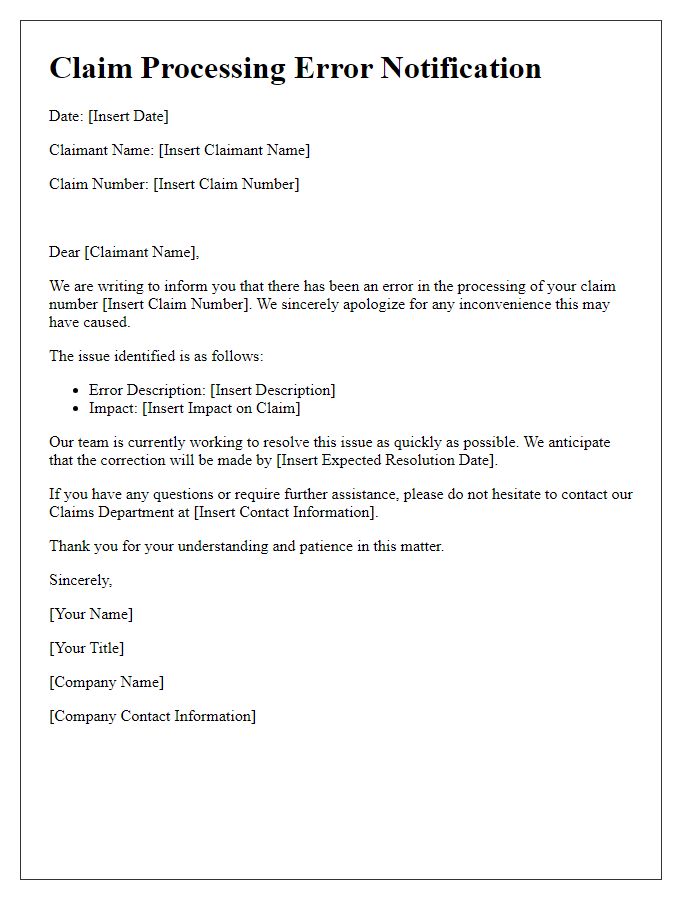

Clear and Concise Communication

The incorrect claims processing alert usually pertains to discrepancies in submitted insurance claims, often resulting from data entry errors or missing documentation. In the context of health insurance, these issues may involve patient identification numbers, incorrect procedure codes, or mismatches in billing information. For example, an insurance claim for a surgical procedure should accurately reflect the specific CPT (Current Procedural Terminology) code associated with the service, while also ensuring that the associated patient ID aligns with the insurer's records. To rectify such processing errors efficiently, clear communication with the billing department must occur, detailing the specific nature of the discrepancy and providing supporting documents such as the original claim form, any relevant correspondence, and updated patient records that substantiate the claim.

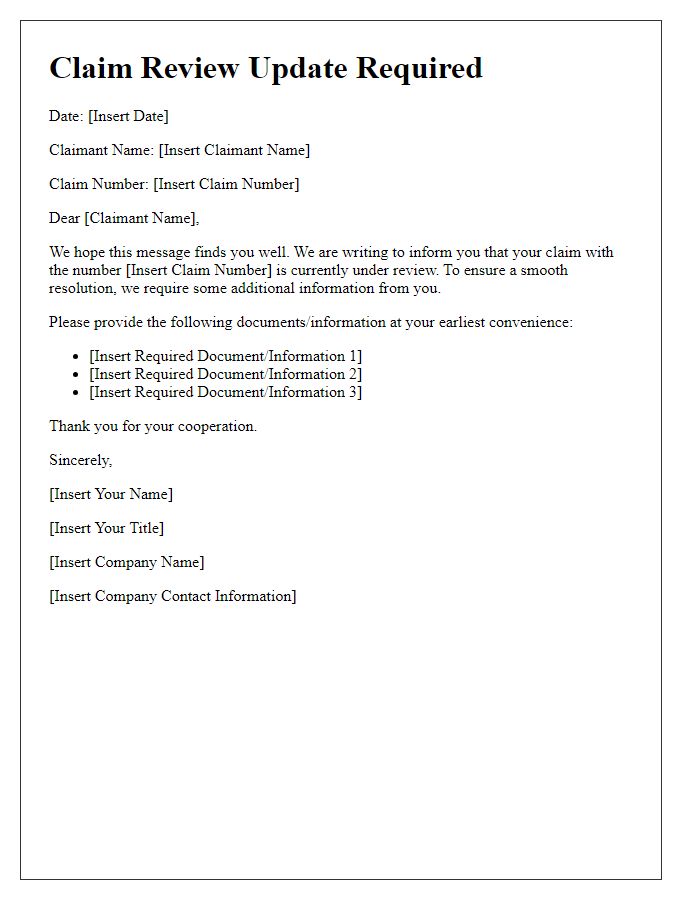

Compliance and Legal Considerations

Incorrect claim processing can lead to significant compliance and legal ramifications for organizations. Regulations, such as the Health Insurance Portability and Accountability Act (HIPAA), set by the U.S. Department of Health and Human Services, dictate strict guidelines regarding the processing of health-related claims. These guidelines require accurate information submission to prevent breaches of patient confidentiality and identity theft. Furthermore, the False Claims Act exposes organizations to substantial penalties, including fines ranging from $5,500 to $11,000 per false claim, along with treble damages. Inadequate handling of claims may also invite audits from regulatory bodies, causing reputational damage and financial loss. Ensuring compliance through thorough review and correction of claims is essential to maintain legal standing and operational integrity in the healthcare and insurance industries.

Tone and Professionalism

A notification regarding incorrect claim processing may cause significant delays in reimbursement for healthcare expenses, particularly for claims submitted under the Affordable Care Act provisions. Insurance companies, like Blue Cross Blue Shield, typically require accurate documentation, including patient IDs and detailed billing codes, to process claims efficiently. Delays due to errors can lead to frustration for patients and providers alike. Swift resolution is crucial to ensure compliance with regulatory deadlines, which may vary by state, such as within the California or New York jurisdictions. Regular training for claims processors on coding guidelines and documentation requirements is essential to minimize mistakes and enhance the professionalism of the claims handling process.

Comments