Are you looking to stay informed about your insurance coverage? Understanding policies and potential recalls can be quite the task, but it's crucial for your financial security and peace of mind. In this article, we'll break down everything you need to know about policy recall notifications and how they can impact you and your coverage. So, let's dive in and explore this important topic together!

Policyholder Information

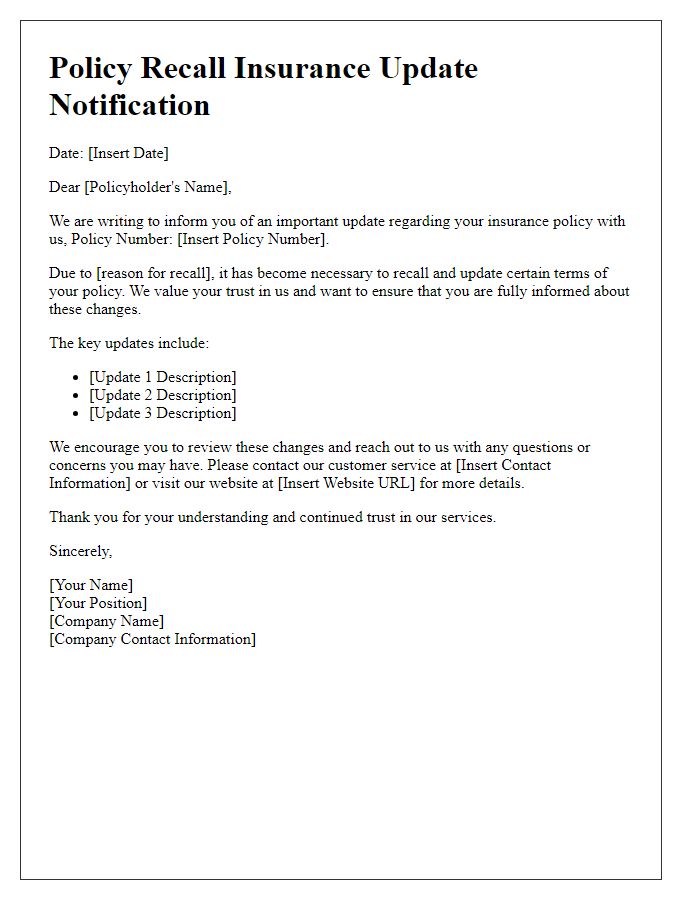

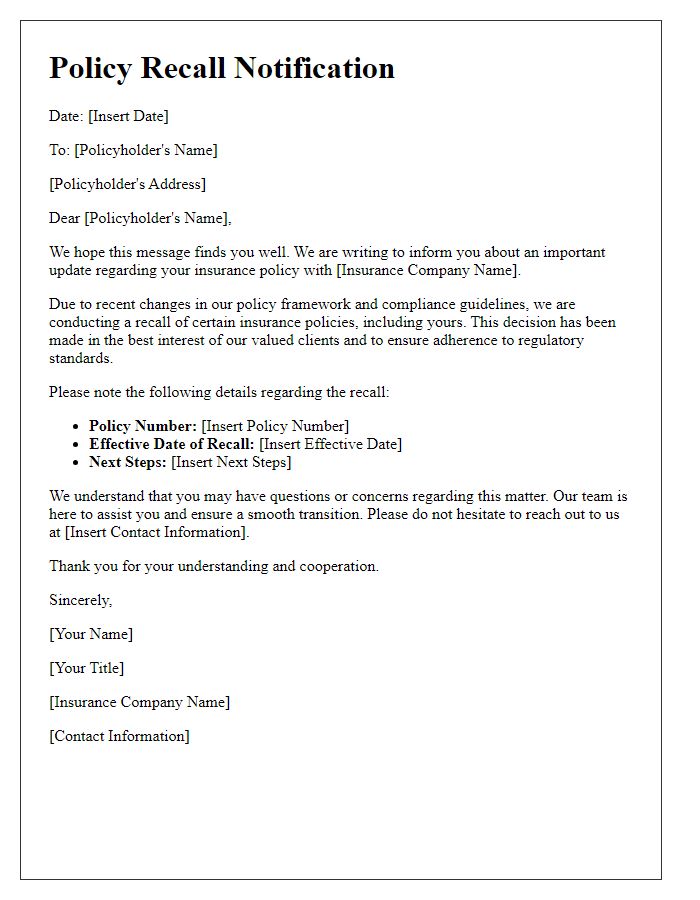

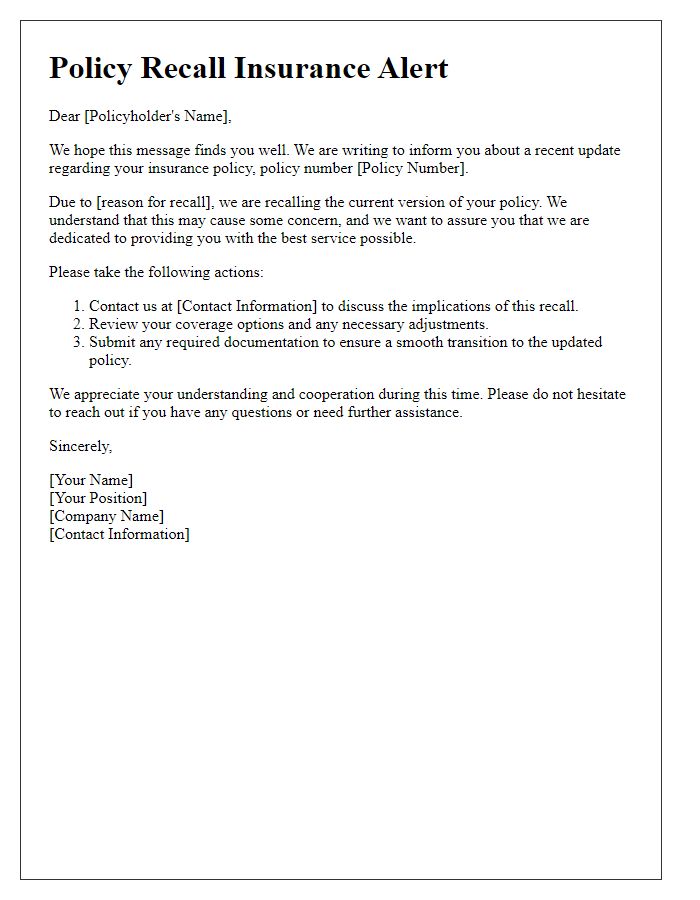

Policyholder information is essential for effective communication regarding insurance matters. This includes the policyholder's full name (often required for identification), policy number (unique identifier associated with the specific insurance agreement), contact information (such as phone numbers and email addresses for updates or inquiries), and the insured address (which helps in verifying the location of coverage). It is crucial to ensure all details are accurate and up-to-date to avoid complications during communications or claims processes. Additional notes may include policy expiration dates and any relevant amendments to the terms of coverage.

Description of Changed Terms

Policy recall insurance notifications require clear and concise communication regarding the altered terms, ensuring policyholders understand potential impacts. Policy number XX1234-567, associated with XYZ Insurance Company, now reflects amendments affecting coverage limits and exclusions. The liability limit, previously set at $2 million, has been adjusted to $1.5 million, while specific circumstances under which coverage applies have been narrowed. Notably, coverage for product recalls due to alleged contamination incidents will only be offered if confirmed by FDA guidelines. Policyholders must review these changes carefully to assess ongoing coverage sufficiency. Notifications regarding specific processing periods for claims submission have also been revised, now indicating a 30-day notice requirement post-recall announcement, versus the previous 15-day window.

Effective Date of Changes

A policy recall insurance notification is essential for informing policyholders about impactful changes to their coverage. Effective dates can significantly affect the scope of protection. For instance, a modification in coverage terms may alter the extent of liability in specific situations, such as product defects. The notification should clearly state the effective date when the new terms will apply, ensuring policyholders understand when they need to review their coverage. Additionally, contact information for customer service should be provided to address any questions arising from the changes, ensuring transparency and support for all clients affected by the policy adjustments.

Contact Information for Queries

Policy recall notifications necessitate clarity and accessibility for policyholders. Include essential contact information such as a dedicated customer service hotline, typically available from 9 AM to 5 PM, Monday through Friday, ensuring prompt assistance. Provide an email address featuring a domain associated with the insurance provider, facilitating efficient communication for inquiries regarding policy adjustments or claims related to the recall. Additionally, mention a physical address for correspondence, especially for policy documents or written notices, located in a known city (like New York) or state, ensuring customers have clear routing. Clear and concise instructions enhance customer satisfaction during the recall process.

Instructions for Next Steps

Policy recall notifications often arise when unforeseen issues with coverage require urgent attention from policyholders. In such cases, it is crucial to inform policyholders about the next steps they must take promptly. Policyholders should review their current insurance agreement, specifically checking for any amendments highlighted in the notification. This can involve contacting their insurance provider, such as Allstate or Progressive, to discuss potential changes or updates to their coverage. Additionally, they may need to submit necessary documentation or evidence, such as proof of previous claims or renewal applications, to streamline the process. Moreover, policyholders should be aware of deadlines for responding to the recall, typically set between 30 to 60 days, ensuring they maintain continuous coverage. In case of confusion, consulting legal counsel or a licensed insurance agent can provide clarity on rights and options available.

Comments