Submitting a motorcycle insurance claim can often feel overwhelming, but it doesn't have to be! In this article, we'll break down the process into simple steps, making it easy for you to navigate your way through the necessary paperwork and requirements. You'll find valuable tips on how to document your incident and communicate with your insurance provider effectively. So, if you're ready to tackle that claim with confidence, keep reading to discover all the essential details you need!

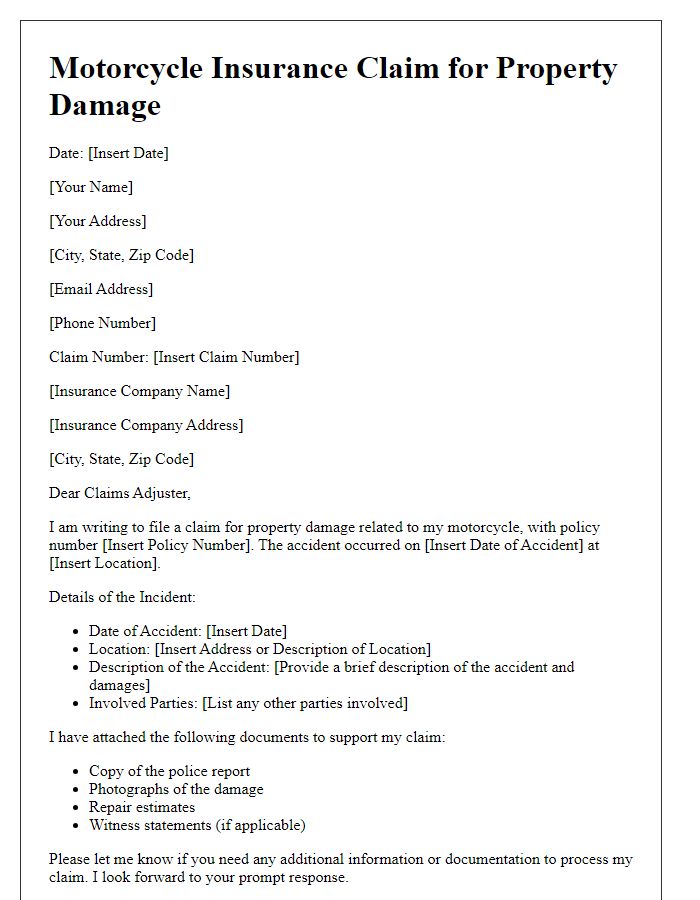

Policyholder Information

Motorcycle insurance claims require precise documentation to ensure a smooth process. Policyholder information includes essential details such as full name, policy number, contact information including phone number and email address, and mailing address. Additional aspects may include the make and model of the motorcycle, year of manufacture, Vehicle Identification Number (VIN), and any prior claims history. Accurate and comprehensive submission aids insurance adjusters in processing claims efficiently, reducing delays in reimbursement or repair approval. Maintaining clear records of communication and documentation is vital for possible disputes or follow-up inquiries.

Incident Details

A motorcycle insurance claim submission requires specific incident details for accurate processing. The exact date and time of the incident, such as March 15, 2023, at 3:30 PM, must be recorded. Clear location information, including the intersection of Main Street and 5th Avenue in Springfield, is essential. A precise description of events leading to the incident, like losing control while navigating a sharp turn due to wet road conditions, should be included. Mentioning all parties involved, including other vehicles, pedestrians, or property, is crucial, along with relevant details like license plate numbers or contact information. Documenting any injuries sustained or damages incurred, such as a fractured wrist or a dented fuel tank, can support the claim further. Photographs or incident reports from local authorities, assuming an accident report number is available, will strengthen the submission's credibility.

Damage Description

A motorcycle accident on Highway 101 in California involving a 2021 Yamaha YZF-R3 resulted in significant damage to the bike's fairings and exhaust system. The front left fairing sustained extensive scratches and cracks, estimating repair costs of approximately $1,200. The exhaust pipe showed noticeable dents and discoloration, which may require replacement, projected at $800. Additionally, the rear fender was bent out of shape from contact with the vehicle's rear, contributing to an estimated $300 repair expense. Overall, the value of the damages totals around $2,300, necessitating immediate attention for safe operation and aesthetic restoration.

Supporting Documentation

Supporting documentation for motorcycle insurance claims typically includes essential elements such as the motorcycle's registration certificate, coverage details under the insurance policy, and a valid driver's license, specifically for motorcycle operation. Photographic evidence documenting the accident scene can provide critical insights, illustrating damage to the motorcycle and any other involved vehicles. Police incident reports (filed within 24 hours of the accident) serve as authoritative accounts, detailing the circumstances. Witness statements (signed and dated, if available) may enhance the claim by corroborating the event. Estimates for repairs from licensed mechanics can substantiate the claim's financial aspect, alongside any medical records if injuries occurred, reflecting treatment received post-incident. Lastly, a detailed personal account of the accident, including time, date, and location, will further support the claim submission process.

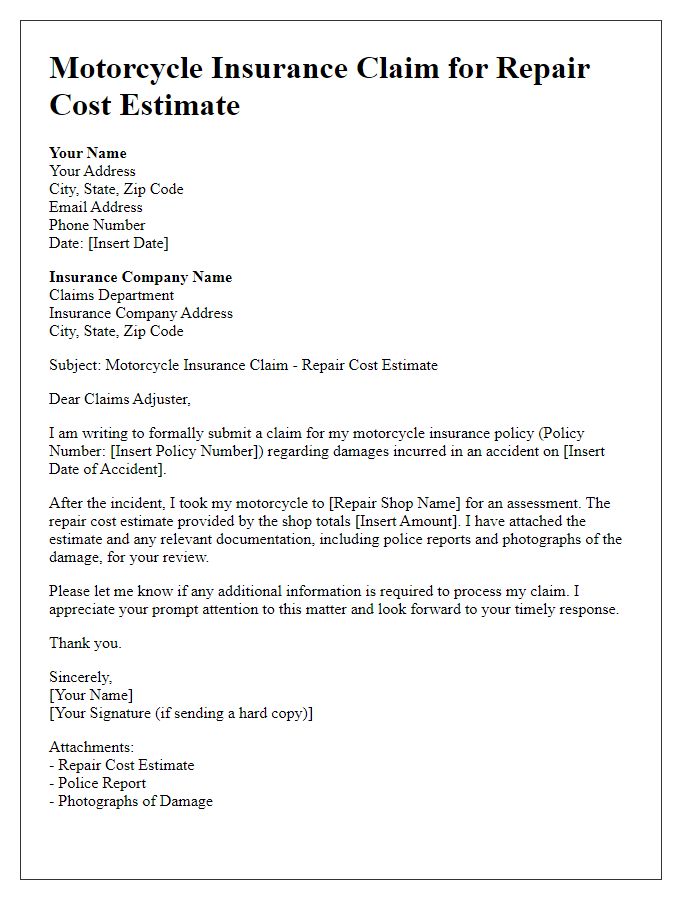

Contact Information

Motorcycle insurance claims require precise information to facilitate processing. Include your full name, as it appears on the insurance policy, and your policy number (typically a unique identifier assigned by the insurance provider). Provide a valid phone number (preferably a mobile number for quick communication) and an email address (ensure this is monitored regularly). Additionally, state your complete mailing address, including street address, city, state, and ZIP code, as correspondence may be sent via postal service. It's essential to include the date of the incident (for timely processing) and any reference numbers related to earlier communications with the insurance company.

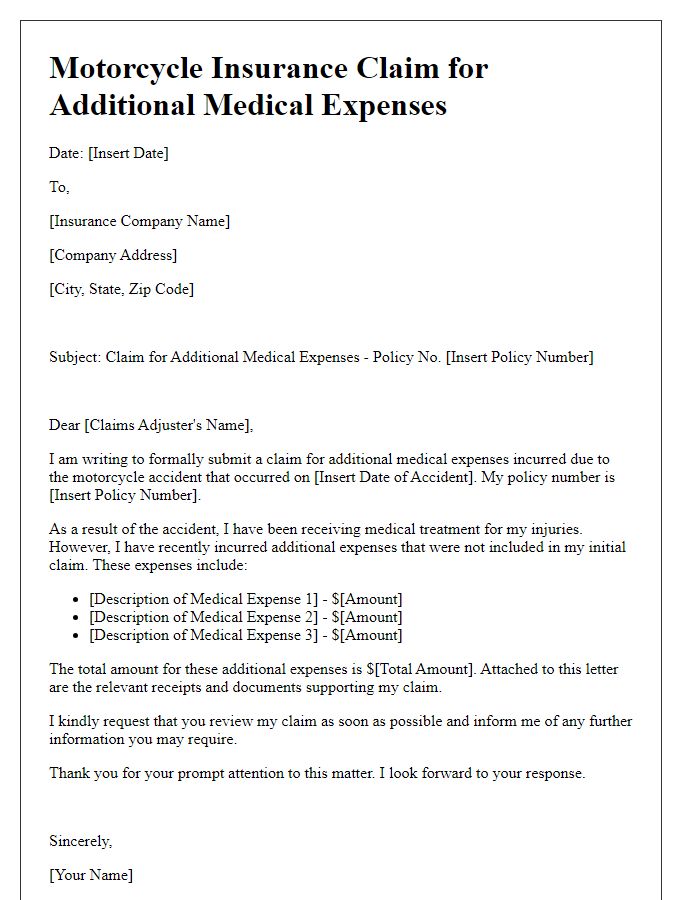

Letter Template For Motorcycle Insurance Claim Submission Samples

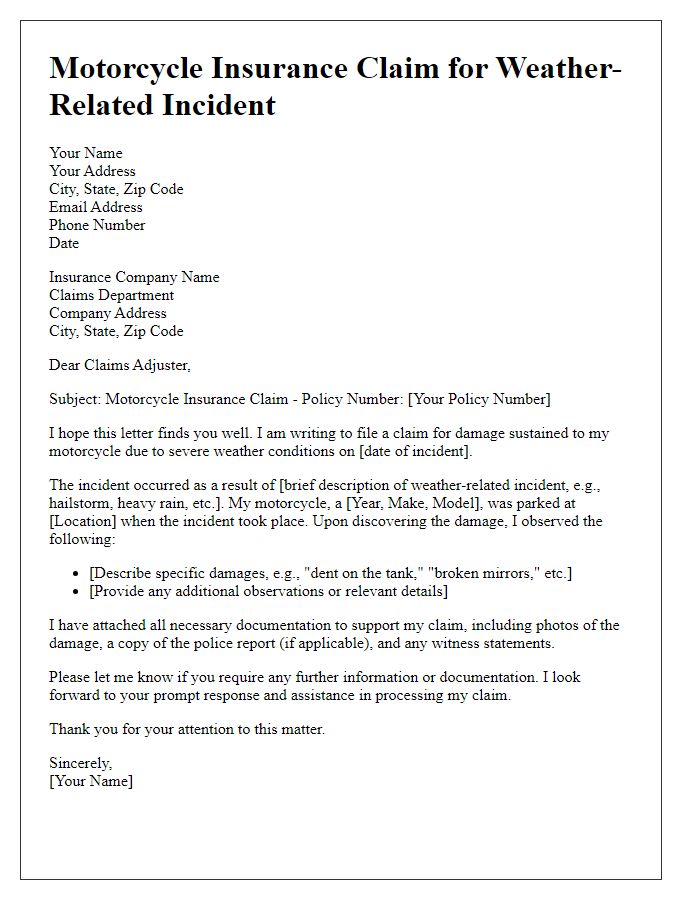

Letter template of motorcycle insurance claim for weather-related incidents.

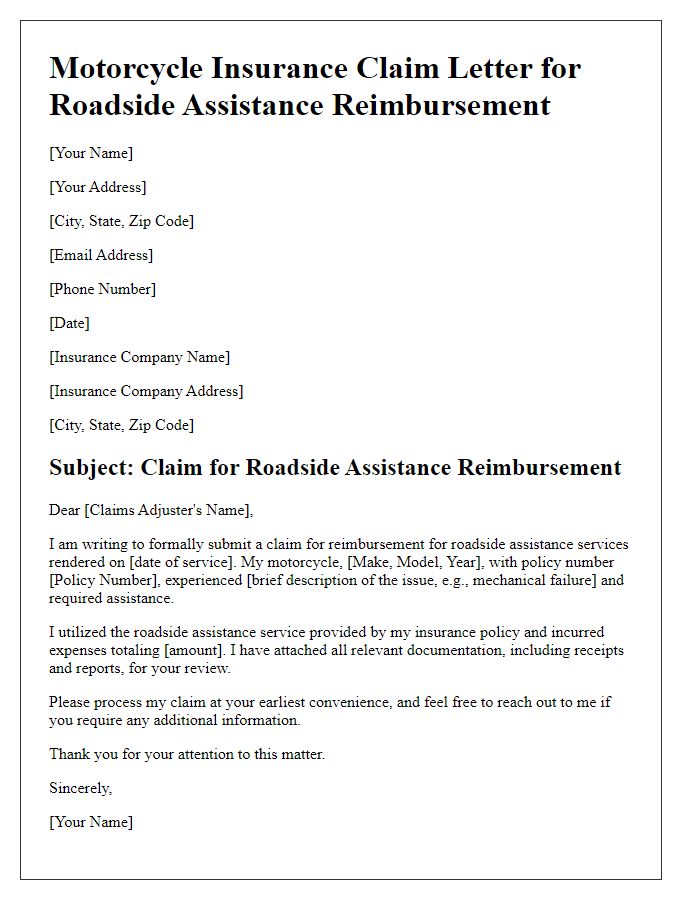

Letter template of motorcycle insurance claim for roadside assistance reimbursement.

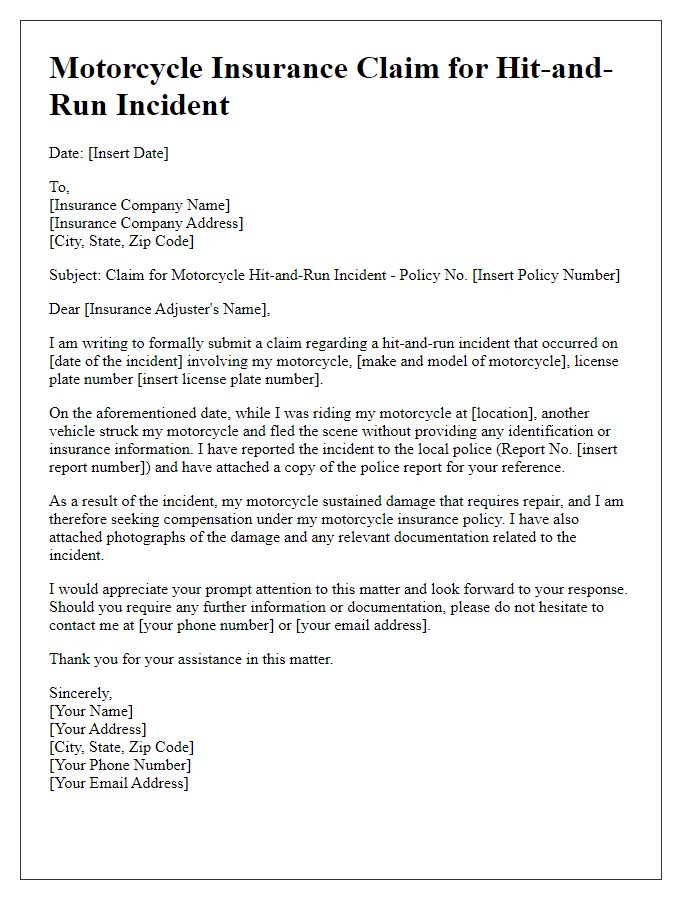

Letter template of motorcycle insurance claim for hit-and-run incidents.

Comments