Changing the beneficiary on your life insurance policy is an important step in ensuring your loved ones are taken care of in the event of the unexpected. It might seem like a daunting task, but it's actually quite straightforward and can reflect your current wishes and situation. Understanding the implications and processes involved can make a significant difference in securing your family's future. Ready to learn more about how to navigate this process? Let's dive in!

Policyholder's full name

Changing the beneficiary on a life insurance policy is an important legal action that can impact the distribution of benefits after the policyholder's passing. When updating information, the policyholder's full name (including middle name) should be accurately provided for identification purposes. Details such as policy number, date of birth, and current address also warrant inclusion to prevent any discrepancies. Depending on the life insurance company, additional requirements may include signatures or notarization to validate the request. Any changes to the beneficiary designation must comply with state regulations to ensure enforceability.

Policy number

Changing the beneficiary on a life insurance policy can ensure that the desired individuals receive the benefits upon the policyholder's passing. For instance, a policy number, such as 123456789, is a unique identifier for a specific life insurance contract with a provider. The policyholder may need to submit a formal request, often in writing, detailing their intention to change beneficiaries. This document must include key information such as old beneficiaries, new beneficiaries, and their respective contact information. Additionally, the insurance company may require the policyholder's signature and date to authenticate the request, ensuring the change is processed efficiently. Different insurance providers may have specific forms or online systems for beneficiary changes, emphasizing the importance of confirming the proper procedure with the insurance company involved.

Current beneficiary details

The current beneficiary for the life insurance policy, held with XYZ Insurance Company, is designated as Jane Doe (relation: spouse), residing at 123 Maple Street, Springfield, IL 62704. The policy number is ABC123456. The current beneficiary has been in place since the policy's inception date on January 1, 2020. This designation ensures that in the event of the policyholder's passing, Jane Doe would receive the specified death benefit amounting to $500,000. It's essential to keep beneficiary information up-to-date to reflect any personal or financial changes that may occur over time.

New beneficiary details

Life insurance policies are crucial financial instruments that provide peace of mind and security for families. Updating beneficiary details ensures that policy proceeds reach the intended individuals. When changing beneficiaries, it's essential to include specific information such as the full name, relationship to the insured, birthdate, and contact information of the new beneficiary. Additionally, proper identification documents may be required, depending on the insurance provider's policies. Timely updates are essential, particularly after significant life events such as marriage, divorce, or the birth of a child, to avoid unnecessary complications in claim processes. Always review policy provisions to understand any potential tax implications or limitations on beneficiary changes.

Signature and date

Life insurance policies often require a formal request for a beneficiary change. When submitting such a request, the policyholder must provide essential details, including policy number, current beneficiary, new beneficiary name, relationship to the policyholder, and contact information. Additionally, the request typically necessitates the policyholder's signature and date to validate the change, ensuring it is officially documented by the insurance company. It's important to keep a copy of the request for personal records to confirm the change in the future. Always consult specific insurance provider guidelines for any additional information required.

Letter Template For Life Insurance Beneficiary Change Samples

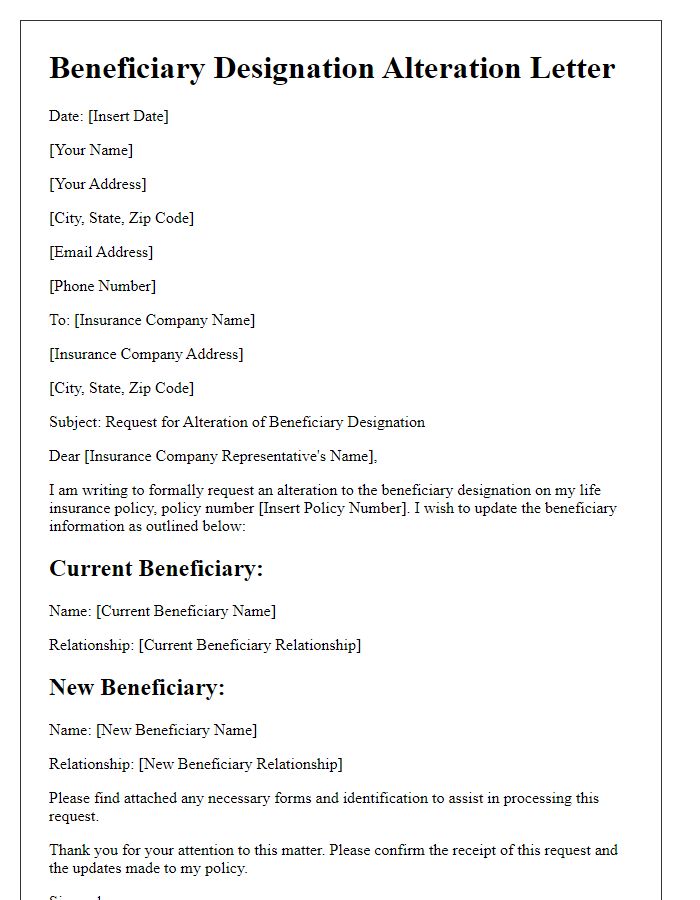

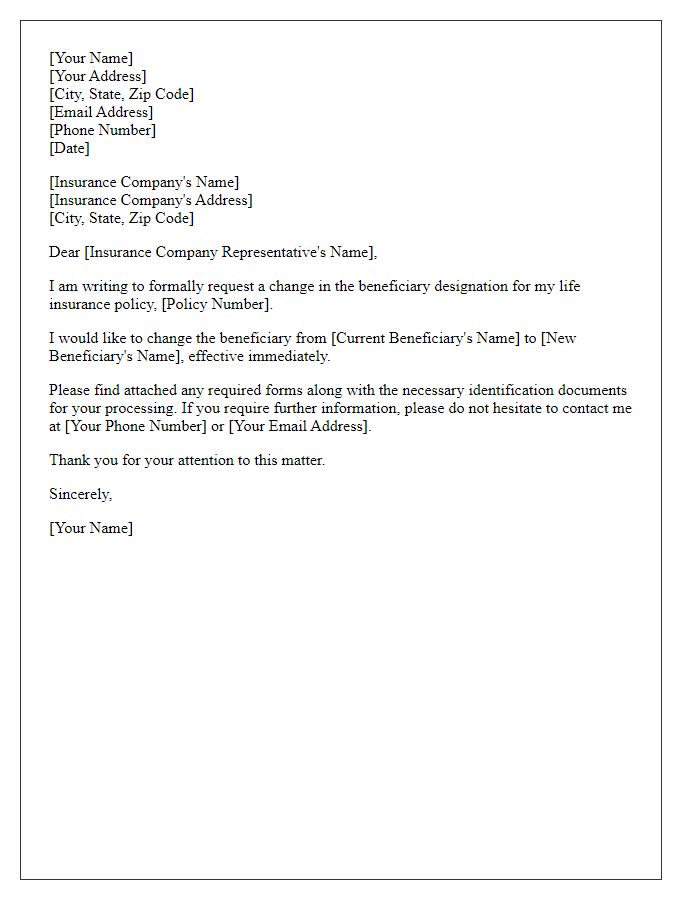

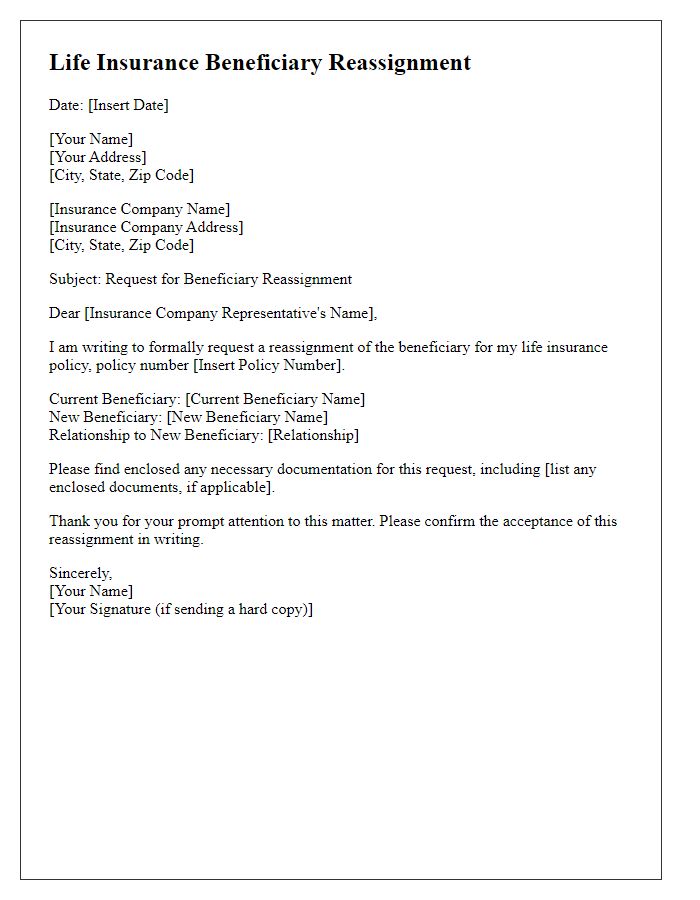

Letter template of beneficiary designation alteration for life insurance.

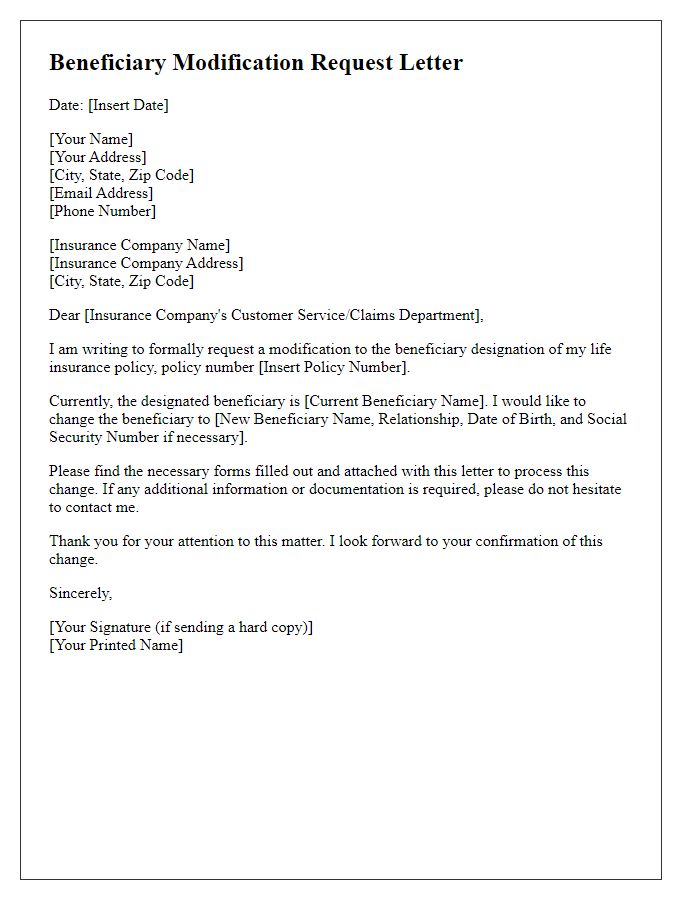

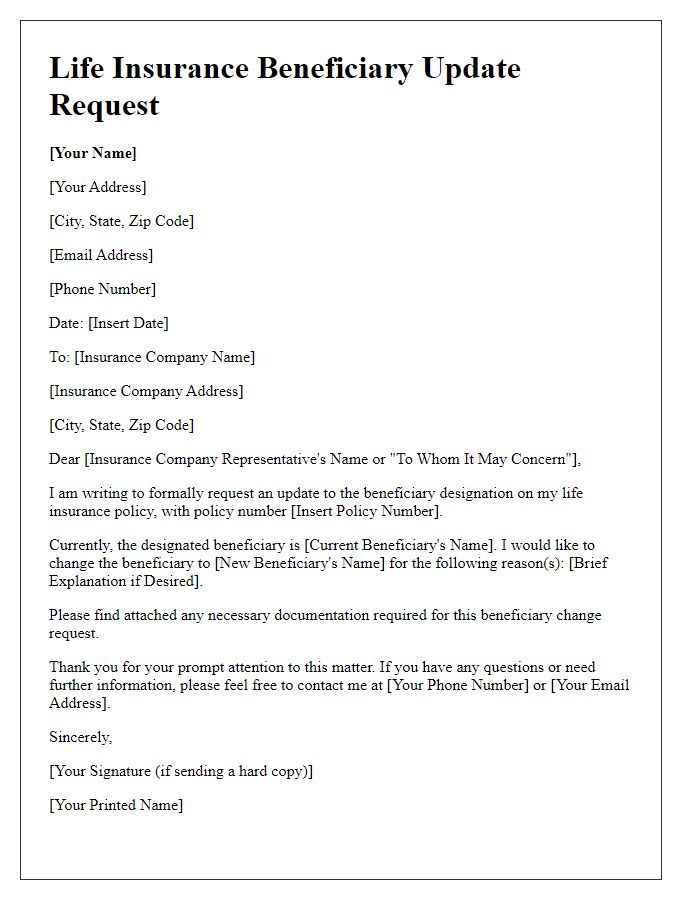

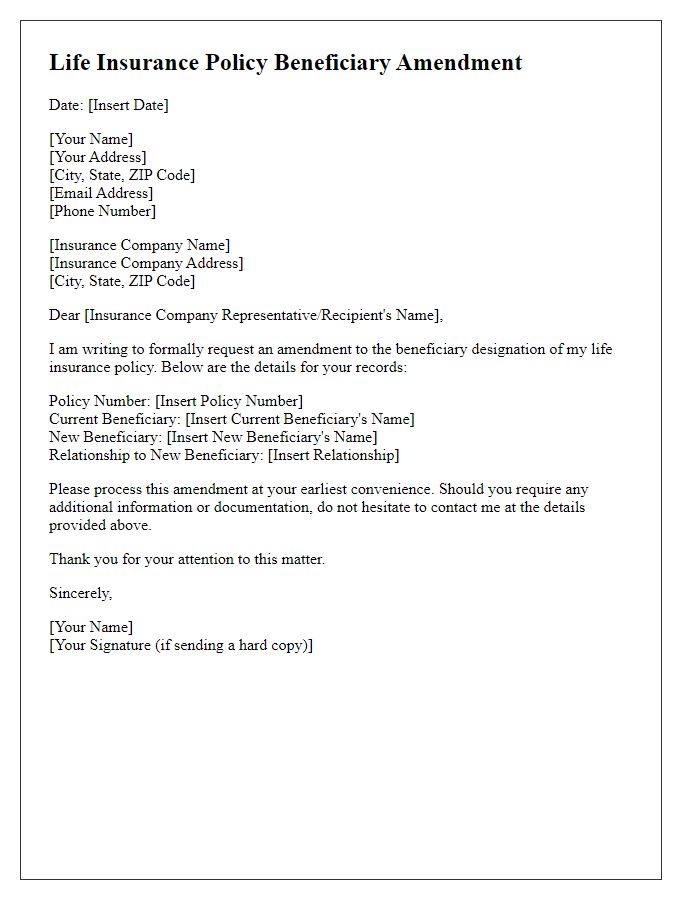

Letter template of requested beneficiary modification for life insurance.

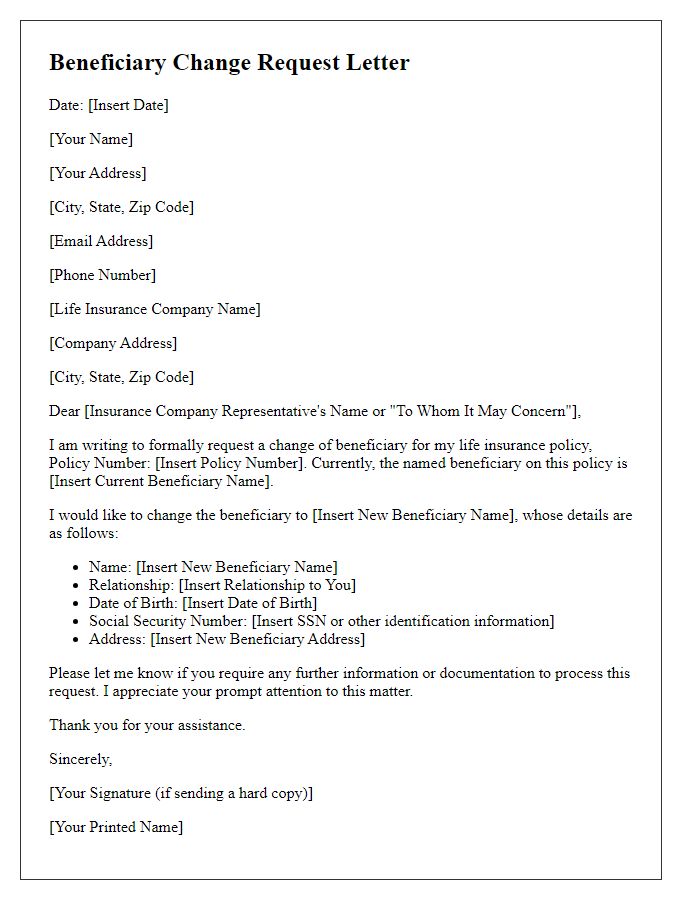

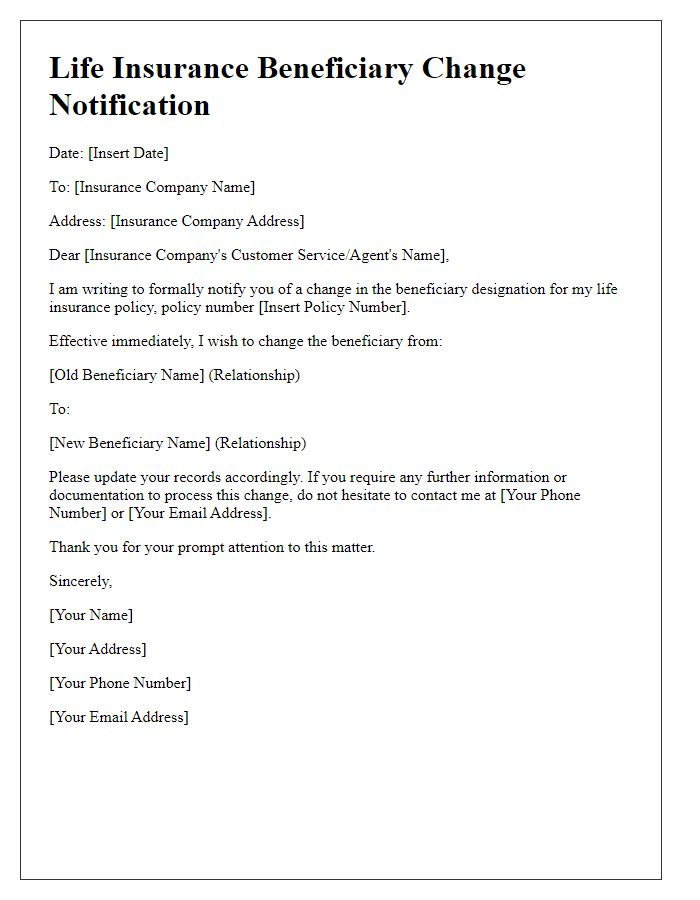

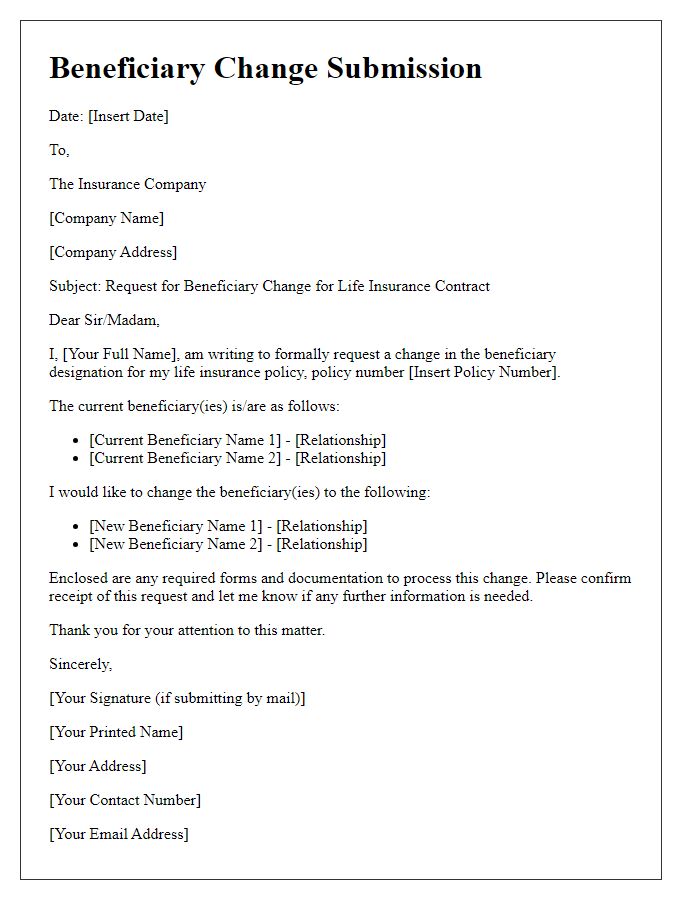

Letter template of authorized request for beneficiary change in life insurance.

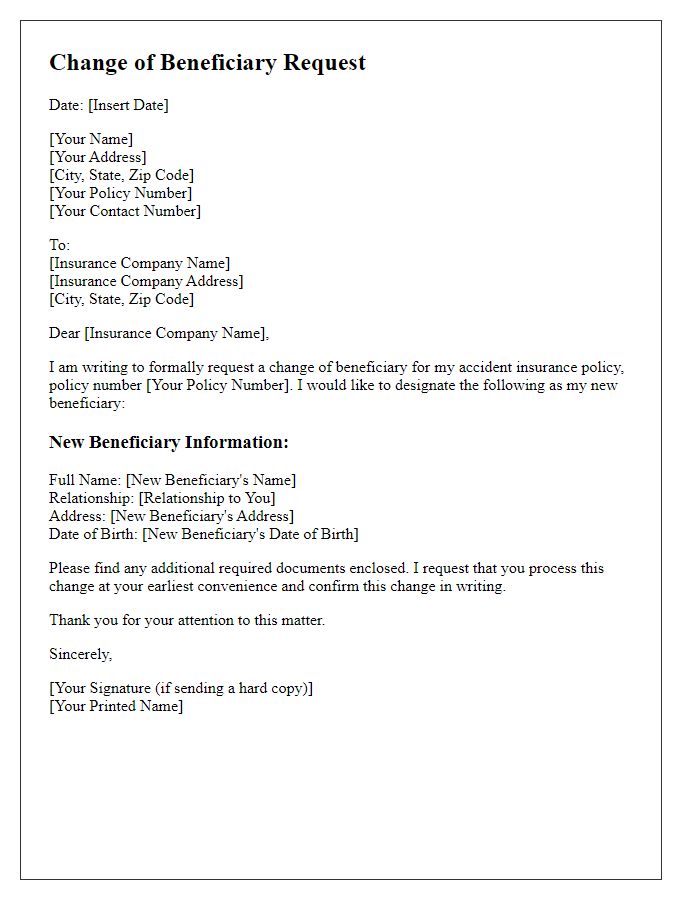

Letter template of official communication for changing life insurance beneficiary.

Comments