Are you facing an insurance coverage dispute and feeling overwhelmed by the process? You're not alone; many individuals find themselves at a crossroads when navigating the complex world of insurance claims. Understanding the nuances of your policy and knowing how to effectively communicate your position can make all the difference in resolving your issue. Join us as we explore invaluable tips and a practical letter template that can help you advocate for your rights and get the coverage you deserve!

Policy details: policy number, coverage period

A significant insurance coverage dispute often arises from misunderstandings regarding specific policy details, including policy number and coverage period. For instance, a policy number--typically a unique identifier assigned by the insurance company--serves as a reference for tracking claims and coverage. The coverage period, usually defined in the policy documents, indicates the timeframe during which the insured events are protected, such as from January 1, 2020, to December 31, 2020. Discrepancies in these details can lead to denial of claims, prompting the policyholder to seek resolution through formal channels, such as insurance regulatory authorities or legal intervention, to ensure their rights are upheld.

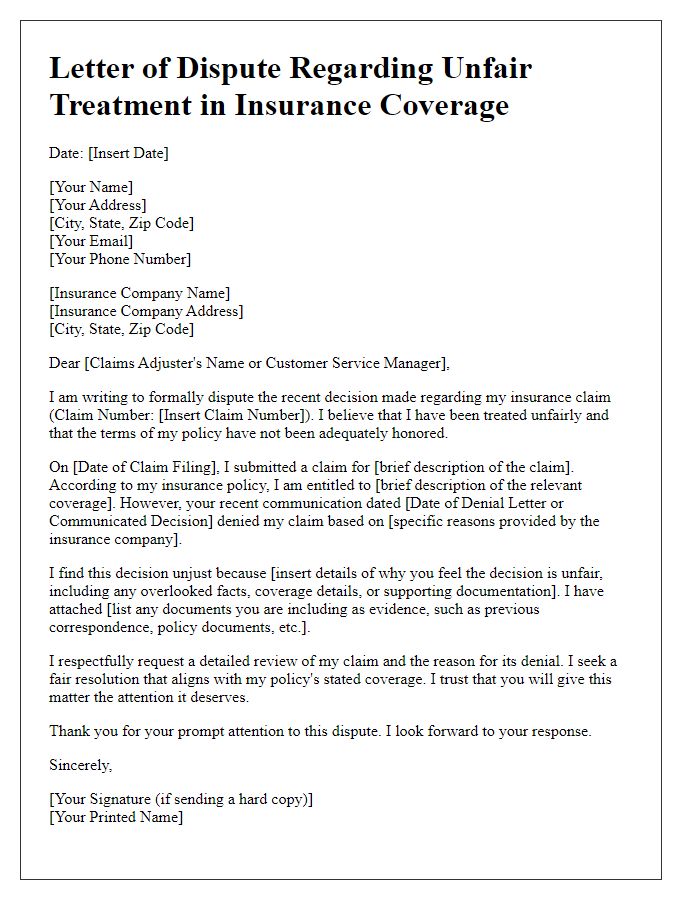

Clear statement of dispute: identify specific issue

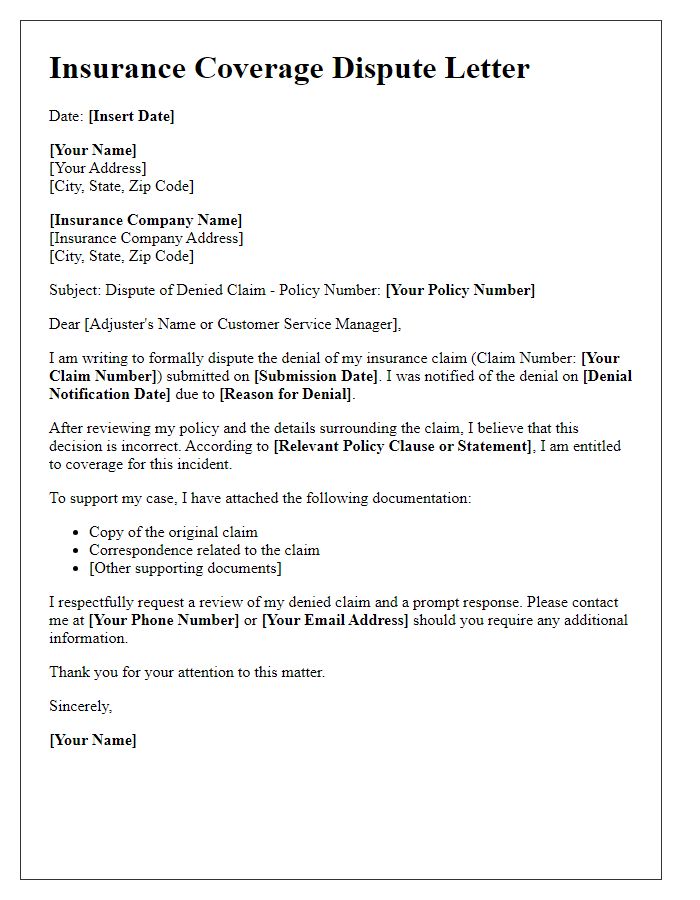

Insurance coverage disputes often arise when policyholders feel that their claims have been unfairly denied or undervalued. A clear statement of dispute includes specific issues, such as the denial of a claim for property damage with the claim number 4578ZB, related to a fire incident on July 15, 2023, at 123 Elm Street, Springfield. The policyholder asserts that the insurer, ABC Insurance Company, failed to honor the terms outlined in the homeowner's insurance policy, which specifies coverage for fire-related damages. Key aspects include discrepancies in the interpretation of "covered perils" and the insufficient assessment of the damages estimated at $50,000 by independent appraisers. The policyholder requests a review of the decision based on the documentation provided and adherence to the agreed coverage terms.

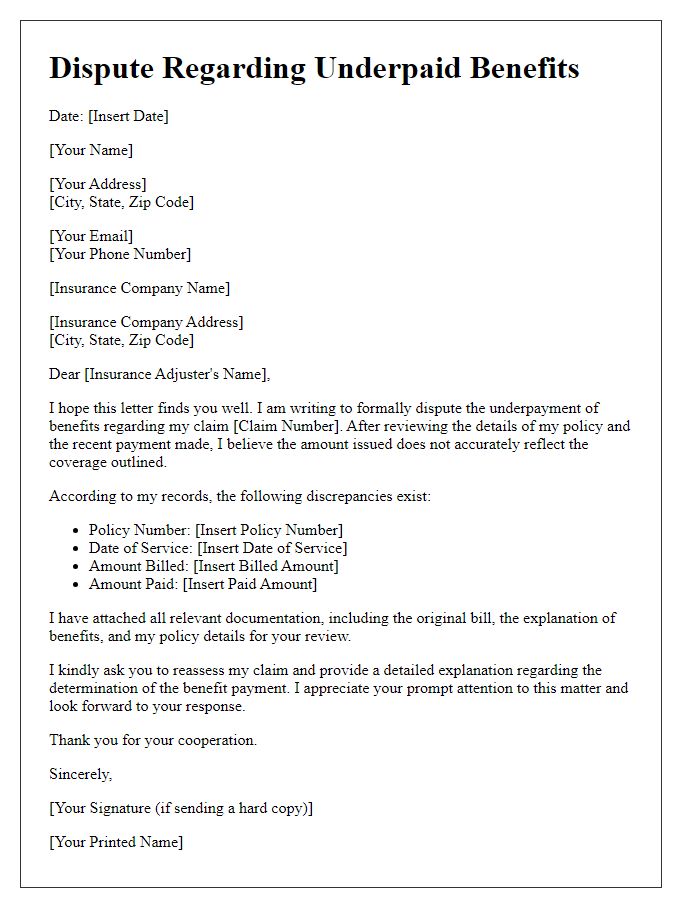

Supporting documentation: medical records, bills

Insurance coverage disputes often arise from discrepancies between policy terms and healthcare expenses incurred by policyholders. Supporting documentation, including detailed medical records from healthcare providers and itemized bills reflecting services rendered, plays a crucial role in clarifying these disputes. Medical records typically encompass diagnosis codes, treatment plans, and provider notes, while bills outline specific charges for consultations, procedures, and medications. Accurate documentation, such as date-stamped records or receipts, is essential for substantiating claims and ensuring fair assessment by insurance companies. These elements provide evidence that can resolve misunderstandings and reinforce the validity of the coverage sought.

Desired resolution: specify coverage or reimbursement

An insurance coverage dispute often arises when policyholders question the extent of their insurance benefits in a specific situation. Detailed documentation is crucial, including policy numbers, dates of incidents, and specific claims submitted. For instance, in an automobile insurance scenario, a claimant may seek reimbursement for repair costs incurred after an accident involving a third party. The claimant should reference the specific policy clauses that delineate coverage types, such as collision or comprehensive coverage, to establish the basis for reimbursement. Personal injury claims may require pertinent medical records and associated costs substantiated by bills and payment receipts. Each aspect of the case must be meticulously outlined to ensure clarity and facilitate a resolution from the insurance provider.

Contact information: phone, email, address

Disputes regarding insurance coverage can involve numerous intricate details that require thorough documentation and clear communication. The policyholder's contact information, which includes phone numbers for immediate communication (typically area code followed by seven digits), email addresses formatted as [username]@[domain].com, and physical addresses consisting of street numbers, street names, city names, state abbreviations, and ZIP codes, forms the essential framework for effective correspondence. Clarity on the nature of the dispute--whether it's related to claim denial, coverage limitations, or premium fluctuations--must be articulated. Additionally, references to the specific policy number, dates of incidents, and estimated costs of claims can prove invaluable. Record-keeping should include copies of previous communications (letters, emails) with the insurance company, supporting documents (receipts, photographs, witness statements), and any relevant laws or regulations governing the insurance contract.

Letter Template For Insurance Coverage Dispute Samples

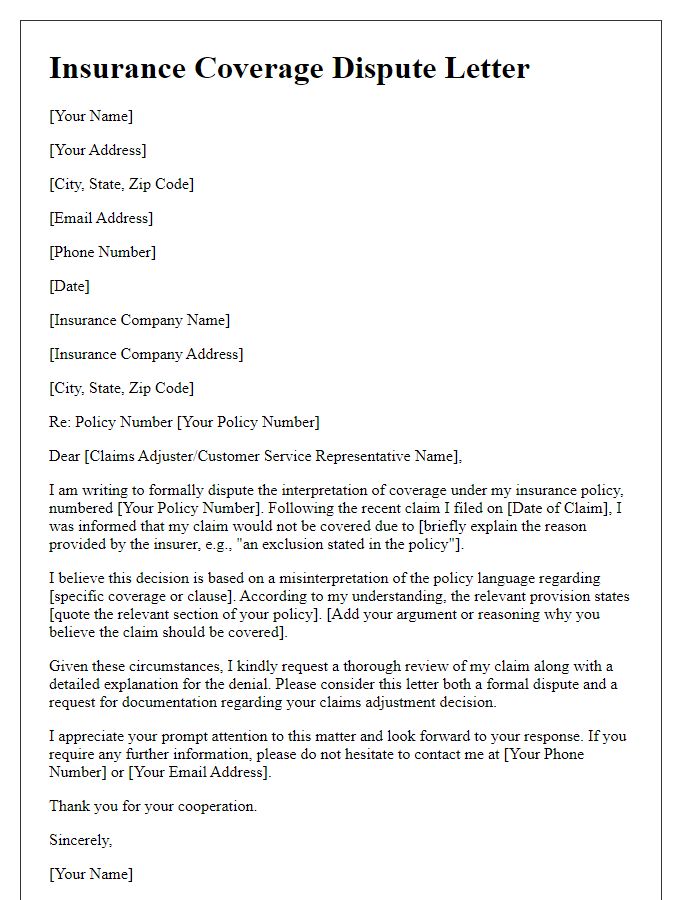

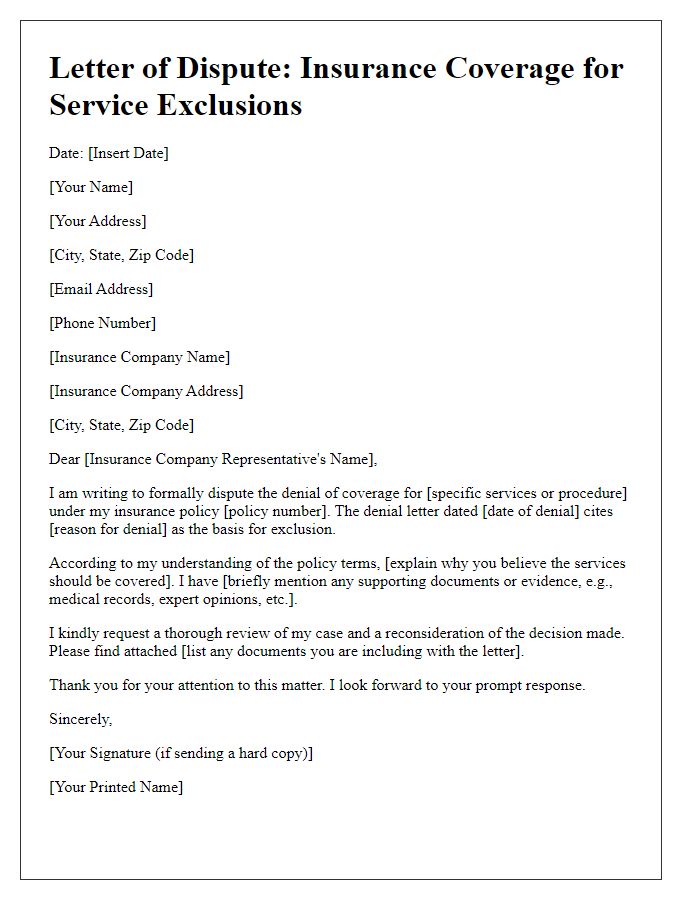

Letter template of insurance coverage dispute over policy interpretation.

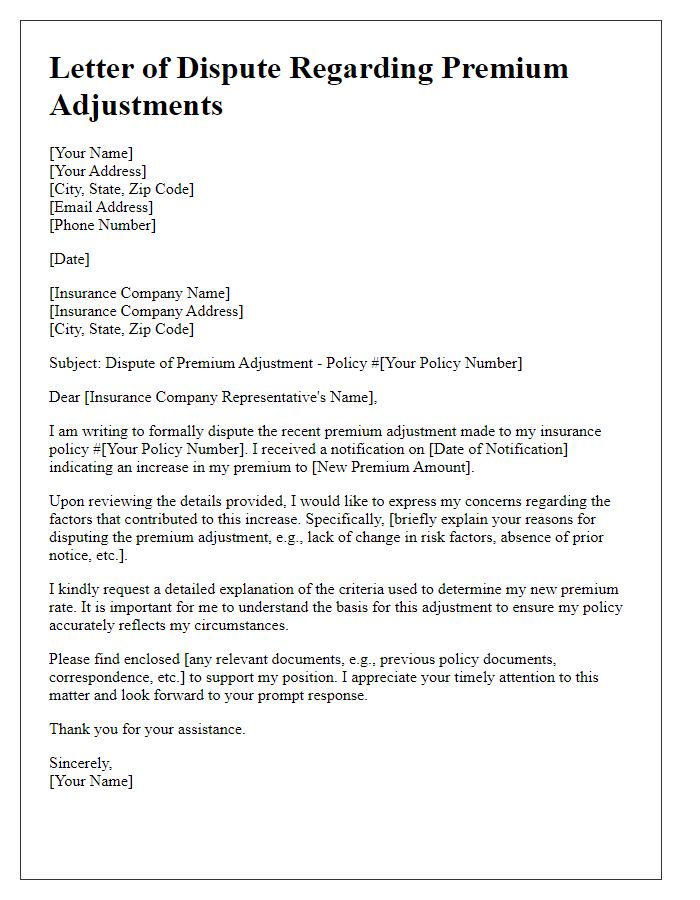

Letter template of insurance coverage dispute concerning premium adjustments.

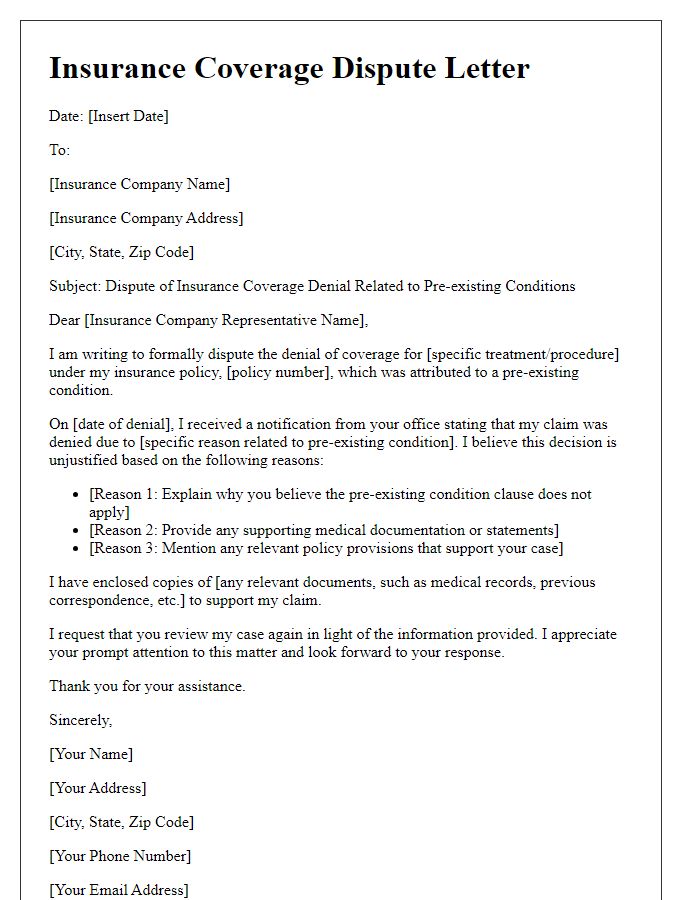

Letter template of insurance coverage dispute related to pre-existing conditions.

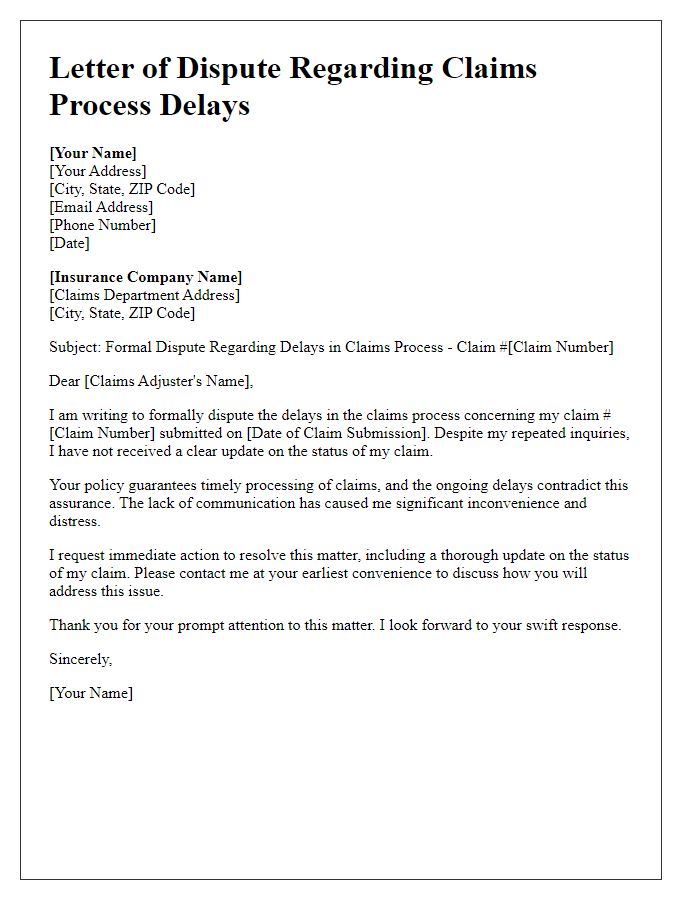

Letter template of insurance coverage dispute involving claims process delays.

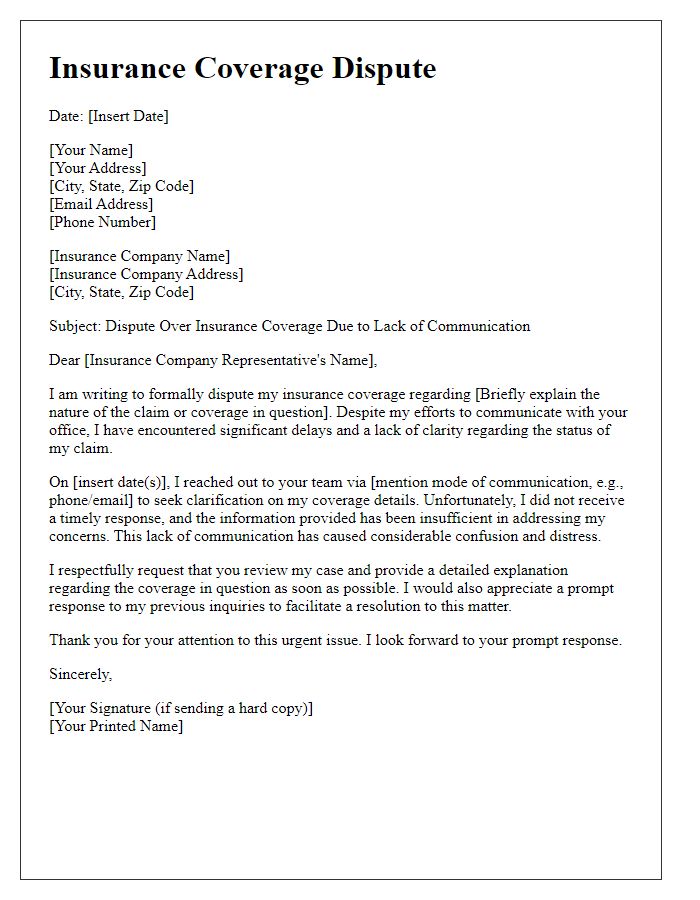

Letter template of insurance coverage dispute for lack of communication.

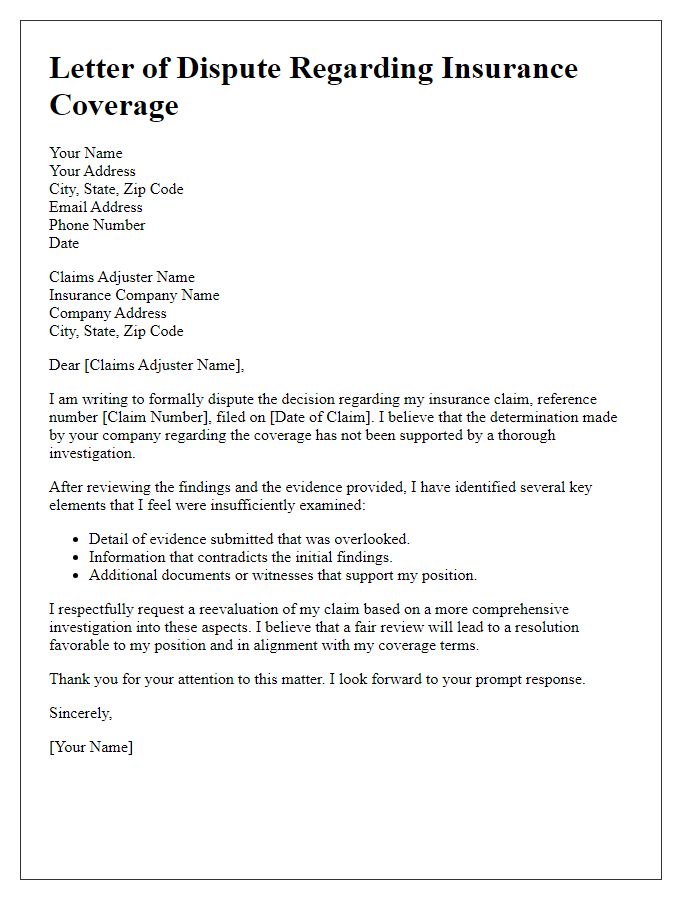

Letter template of insurance coverage dispute addressing insufficient investigation.

Comments