Are you looking to share your thoughts on the insurance services provided by your head office? Writing a letter can be a powerful way to express your feedback and suggestions. Whether you're praising their customer support or highlighting areas for improvement, your insights can make a difference. So, grab your pen and learn how to craft the perfect letter to convey your message effectively!

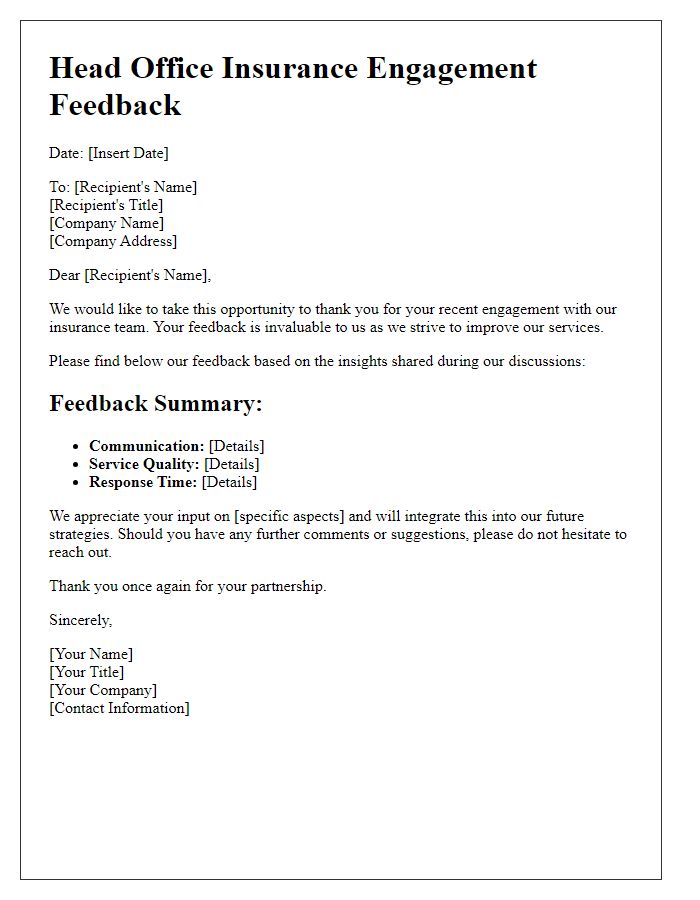

Clear subject line

The feedback regarding the head office insurance experience highlights several crucial aspects such as policy coverage, claim processing efficiency, and customer service interactions. Policy coverage details include essential components like liability protection, property damage, and employee benefits, which are vital for maintaining operational continuity. Claim processing efficiency, particularly the turnaround time of approximately 30 days for most claims, significantly impacts financial stability and employee satisfaction. Additionally, customer service interactions reflect the professionalism and responsiveness of representatives, with response times averaging under 24 hours for inquiries. Overall, these elements contribute to the overall perception of the insurance provider's reliability and effectiveness in addressing the needs of the head office.

Professional greeting

In the bustling city of New York, the headquarters of leading insurance companies often receive valuable feedback that shapes their policies. Instances of positive client experiences, such as timely claims processing or exceptional customer service, frequently highlight the importance of maintaining trust. For example, during the recent claims handling process, a case involving a $50,000 property damage claim was resolved in under three days, showcasing efficiency. Additionally, customer satisfaction surveys reveal that over 85% of clients feel confident in their coverage, underscoring the significance of clear communication. This information is crucial for enhancing service delivery in the insurance sector.

Specific feedback details

Head office insurance policies often require comprehensive evaluations to ensure effectiveness and customer satisfaction. Recent claims processing timelines, averaging over 30 days, have drawn concerns from policyholders. Additionally, the communication clarity regarding policy terms and exclusions has been cited as confusing by approximately 45% of surveyed clients. The accessibility of customer support, currently limited to business hours, has decreased satisfaction ratings by 15% in recent polls. Moreover, the online portal functionality presents challenges, with reported downtime of over 20% during peak hours, frustrating users trying to file claims or update information. Addressing these feedback points can enhance client experience and improve overall trust in head office insurance services.

Relevant policy information

Insurance policies play a crucial role in providing financial protection against potential risks. Each policy, such as property insurance or general liability insurance, outlines specific coverage details, including limits, exclusions, and premium costs. Notable policy details may involve critical information like policy numbers (unique identifiers for each coverage type), effective dates (starting point of coverage), and renewal terms (conditions under which a policy is renewed). Clear communication of these elements is essential for both the insurer and the insured to ensure mutual understanding and proper coverage throughout events like natural disasters or accidents. Additionally, regular reviews and updates to policy information can help adapt to changing circumstances, enhancing overall risk management strategies.

Contact information for follow-up

Feedback from clients regarding insurance policies can significantly influence product improvement strategies. Constructive feedback often highlights areas needing attention, such as policy clarity, customer service response times, and claim processing efficiency. Gathering contact information, including email addresses and phone numbers, allows the head office (such as a regional office located in Chicago) to engage in meaningful follow-up discussions. This can foster a stronger relationship with clients while addressing specific concerns, contributing to higher satisfaction levels with the insurance services provided. The data collected can also assist in tailoring future offerings to better meet client expectations and enhance overall service delivery.

Comments