Welcome to our guide on navigating the often intricate process of an insurance fraud investigation follow-up. Whether you've recently filed a claim or are facing scrutiny regarding an existing one, understanding your rights and the procedures involved can make a significant difference. Our aim is to simplify this often daunting process and equip you with the necessary knowledge to respond effectively. So, let's dive deeper into the steps you need to take to ensure your voice is heard, and feel free to read more for comprehensive tips and insights!

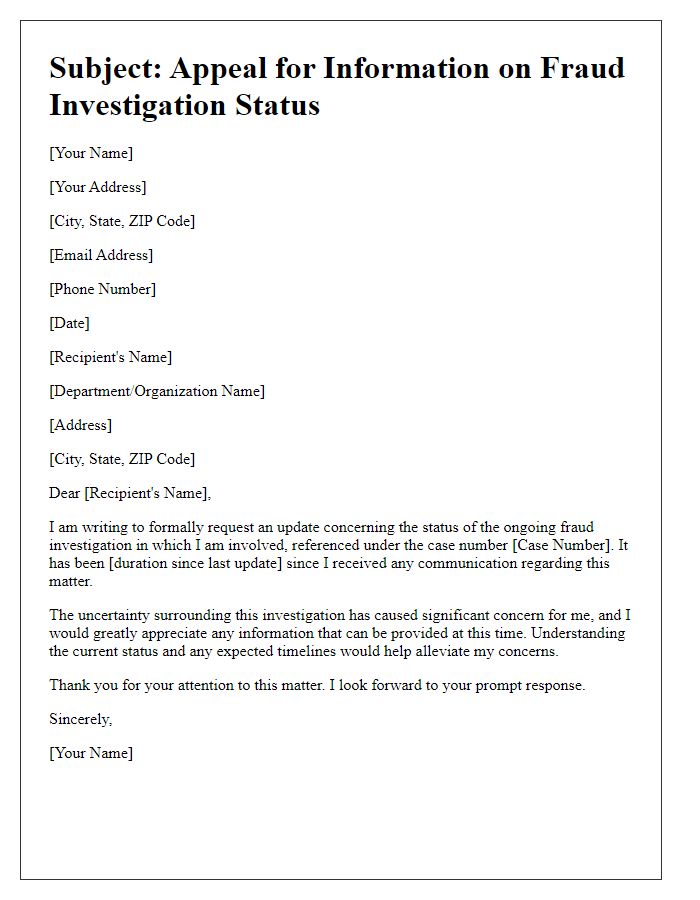

Subject line clarity

Clarity in subject lines is crucial for effective communication during insurance fraud investigations. A well-defined subject line, such as "Follow-Up on Claim No. 125678: Ongoing Fraud Investigation," immediately informs the recipient of the email's purpose. Including specific details like the claim number ensures that the issue is easily identifiable and trackable, facilitating quicker responses and efficient resolution processes. Clear language highlights urgency and maintains professional standards, encouraging prompt attention from the relevant parties involved in the investigation, such as claims adjusters and investigators.

Professional and formal tone

Insurance fraud investigations may reveal crucial information impacting claim decisions, necessitating detailed follow-ups. Investigators review documentation meticulously, including incident reports, photographs, and witness statements. Comprehensive examining of financial records, such as bank statements and transaction histories, can uncover inconsistencies. Interviews conducted with claimants, medical professionals, and repair services are essential for gathering additional insights. Furthermore, utilizing technology such as forensic analysis assists in validating evidence provided. Timely communication regarding investigation progress assures claimants of transparency and reinforces trust in the insurance process. Maintaining confidentiality is vital throughout the investigation to protect sensitive information and uphold legal standards.

Detailed investigation summary

Insurance fraud investigations often require comprehensive summaries detailing findings and methodologies. The investigation may involve examining claim submissions from 2022, particularly incidents related to property damage. A review of the claimant's history may reveal discrepancies, such as inconsistent statements regarding the timeline of events. Surveillance footage from local businesses could show the claimant's location during the reported incident, contrary to their account. Additionally, expert testimony from forensic analysts may highlight evidence of pre-existing damage to the property in question. Financial records may also indicate unusual transactions or patterns that suggest collusion with others. Thorough documentation and adherence to regulatory standards are essential for addressing potential fraud effectively.

Request for additional information or action

Insurance fraud investigations often require thorough follow-ups to obtain necessary information. A detailed request for additional documentation may include specific items related to the incident date (e.g., January 15, 2023), claim number (e.g., 123456789), and involved parties. Information may pertain to witnesses, police reports from the local precinct (e.g., Westside Police Department), photographs of the incident scene, or medical records from healthcare providers (e.g., City Hospital). Collecting this information is crucial for a comprehensive assessment of fraud allegations, ensuring all interactions accurately reflect the case's integrity. Timeliness in response is critical to expedite the investigation process and uphold the standards of the insurance claim.

Contact information for further communication

In the context of an insurance fraud investigation, contact information serves as a critical component for facilitating ongoing communication between involved parties. The primary contact person can be the senior investigator assigned to the case, providing their direct phone number, email address, and office location, typically situated within the corporate headquarters of the insurance company. Additionally, alternate contacts may include claims adjusters or legal representatives, ensuring a comprehensive network for inquiry. Each contact's availability may be crucial, with many investigators operating during standard business hours, while others might offer extended availability depending on the case's urgency, fostering efficient collaboration in gathering evidence and coordinating interviews.

Comments