Are you navigating the often-overwhelming landscape of group insurance eligibility? Understanding the ins and outs can be complex, but it's crucial for making informed decisions about your coverage options. In this article, we'll break down the essential steps for verifying your eligibility, ensuring you have all the information you need at your fingertips. Stick around to learn more about the process and how to streamline your approach!

Accurate personal and group information.

For group insurance eligibility verification, accurate personal and group information is essential. Policyholders must provide essential details such as full name, date of birth, and social security number for individuals enrolled in plans. Group information includes the policy number, employer name, and group ID associated with the insurance coverage. Ensuring this data is correct facilitates a smoother verification process, prevents delays, and ensures that benefits are accurately applied. Inaccuracies can lead to complications with claims processing, affecting access to healthcare services and financial protection for members.

Policy number and coverage details.

Group insurance eligibility verification involves confirming participant status under specific policy conditions. The policy number (e.g., G123456789) provides a unique identifier for tracking and managing the coverage plan offered by the insurer, such as Blue Cross Blue Shield. Coverage details include pertinent information such as effective dates (e.g., January 1, 2023), types of coverage (medical, dental, vision), and limits on benefits (e.g., annual deductible of $1,000). Eligibility requirements may stipulate factors like employment status (full-time vs. part-time), waiting periods (90 days), and dependents' definitions (spouse, children under 26). Therefore, verifying eligibility ensures that members receive the appropriate benefits and abide by the policy guidelines.

Contact information for the insurance provider.

For group insurance eligibility verification, it is essential to obtain accurate contact information for the insurance provider. Typically, this includes the provider's full name, such as XYZ Insurance Company, along with the contact phone number, which may be a toll-free line like 1-800-555-0199, and a dedicated email address, such as support@xyzinsurance.com. Additionally, physical address details, such as 123 Benefits Blvd, Suite 100, Anytown, State, ZIP Code, should be recorded for any written correspondence. Important also to note is the customer service hours, generally listed as Monday to Friday, 9 AM to 5 PM, to ensure timely responses regarding eligibility verification.

Verification request purpose and details.

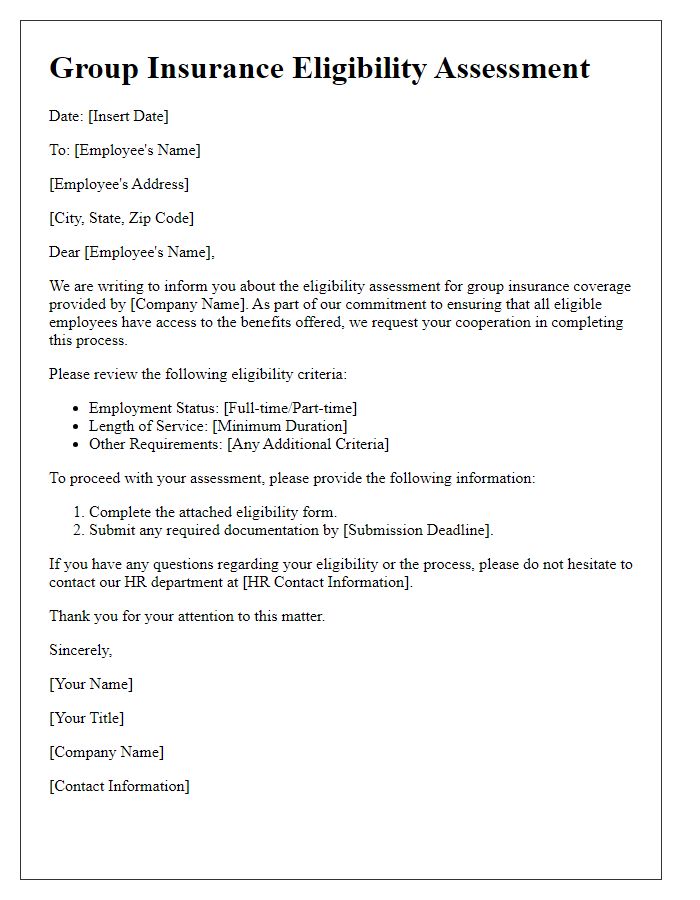

A group insurance eligibility verification request is essential for confirming the coverage status of members within a specific organization, such as businesses or unions. The primary purpose of this verification is to ensure that all eligible participants, typically employees or members, are enrolled in the appropriate insurance plans and can access necessary benefits. This process often involves reviewing details such as policy numbers, participant names, dates of birth, and employment status for accuracy. In some cases, the verification may require submission to insurance providers like Blue Cross Blue Shield or Aetna, ensuring compliance with federal regulations like ERISA (Employee Retirement Income Security Act). Timely and accurate verification is crucial for preventing gaps in coverage and ensuring that all claims can be processed smoothly.

Authorized signatures and consent statements.

Group insurance eligibility verification requires authorized signatures and consent statements to ensure compliance with policy regulations. The verification process involves gathering essential information from all members of the group, typically comprised of employees within a company or organization, regarding their personal details, employment status, and dependent information. This documentation often includes signatures from authorized representatives, such as HR managers or benefits coordinators, who affirm that the information provided is accurate and complete. Additionally, consent statements must be obtained, allowing the insurance provider to process the submitted data and verify eligibility for coverage under specific group plans, like health, dental, or life insurance, in accordance with the guidelines established by the Department of Labor or other regulatory bodies. Accurate record-keeping of these signed documents is crucial to maintaining compliance and facilitating smooth claim processes.

Letter Template For Group Insurance Eligibility Verification Samples

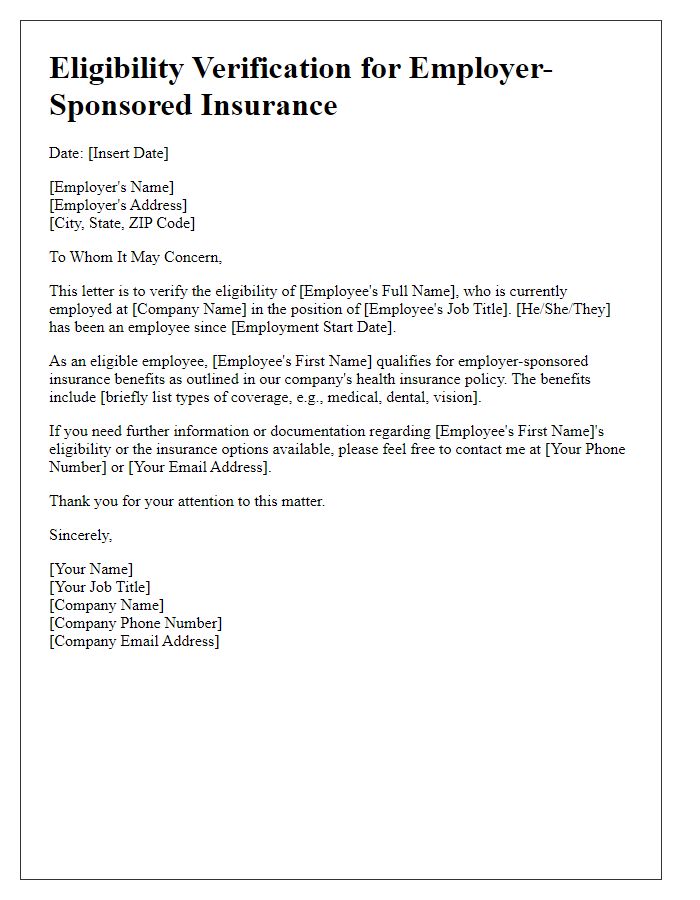

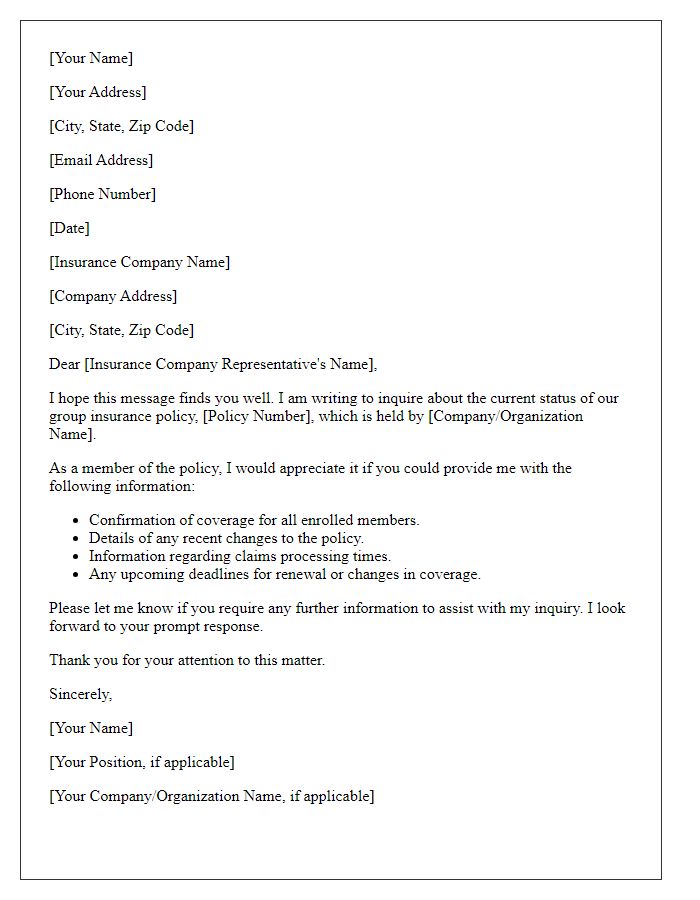

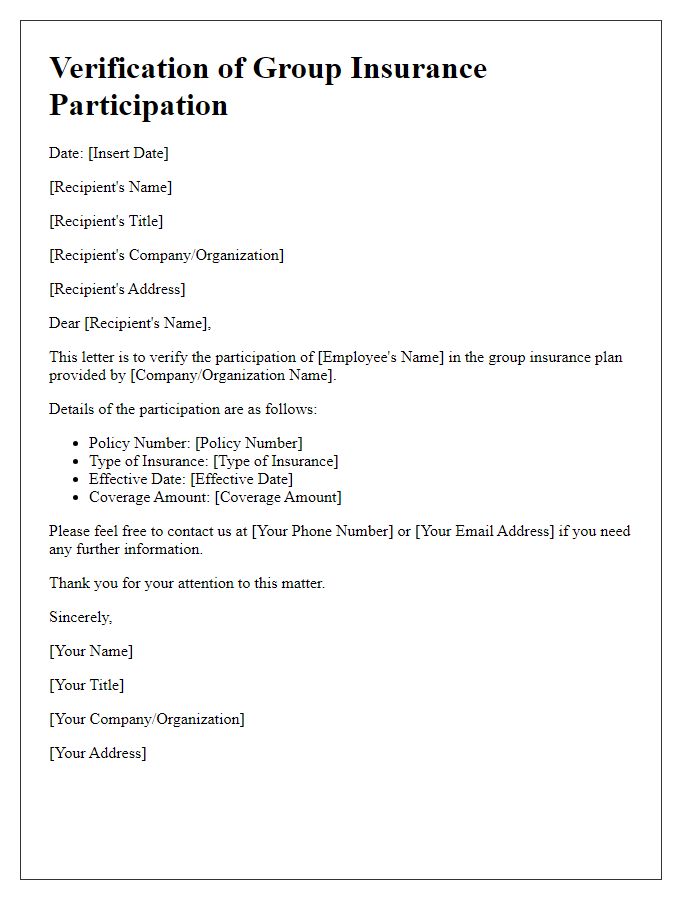

Letter template of eligibility verification for employer-sponsored insurance

Comments