Are you facing challenges with your medical insurance? It can be frustrating when claims are denied or when you feel your needs aren't being met. In this article, we'll explore the essential steps to effectively lodge a grievance with your insurance provider, ensuring your voice is heard. Stick around to learn how to navigate the process and advocate for your rights!

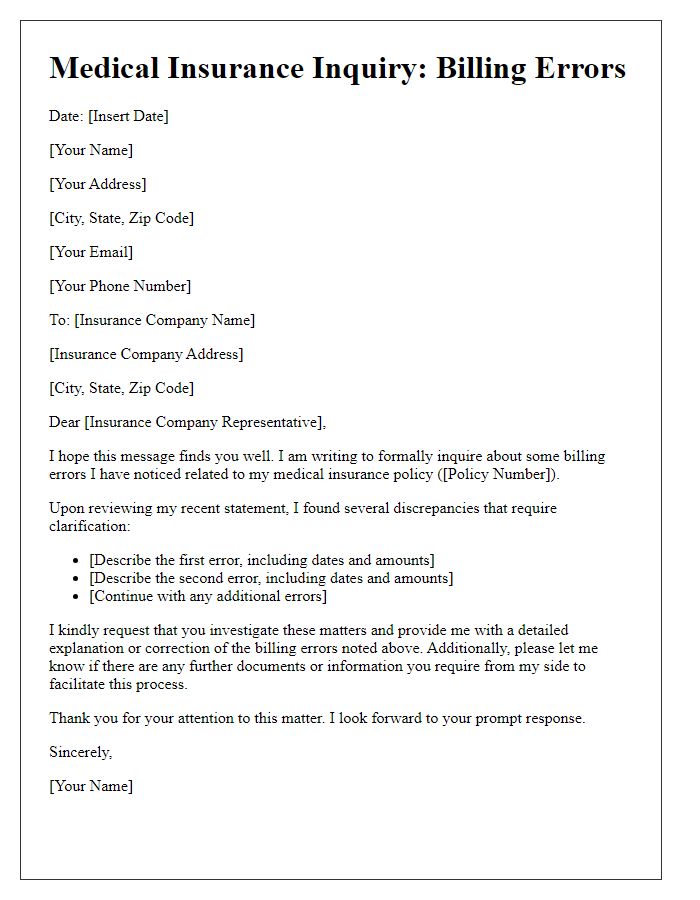

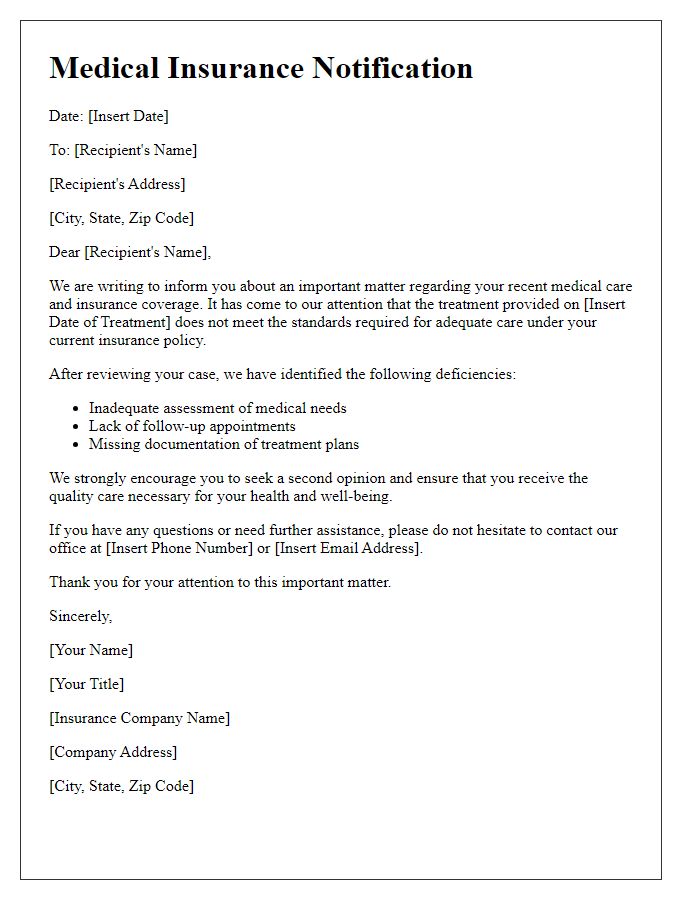

Clear Subject Line

A clear subject line for a medical insurance grievance can greatly impact the effectiveness of your communication. For example, using "Grievance Regarding Denial of Coverage for [Specific Treatment or Procedure] - Policy Number [Your Policy Number]" immediately informs the reader about the nature of the complaint and provides essential identification information. Including specific details like the type of treatment (e.g., MRI, surgery) and your policy number ensures that the grievance can be promptly addressed by the appropriate department within the insurance company, optimizing the chances of a swift resolution.

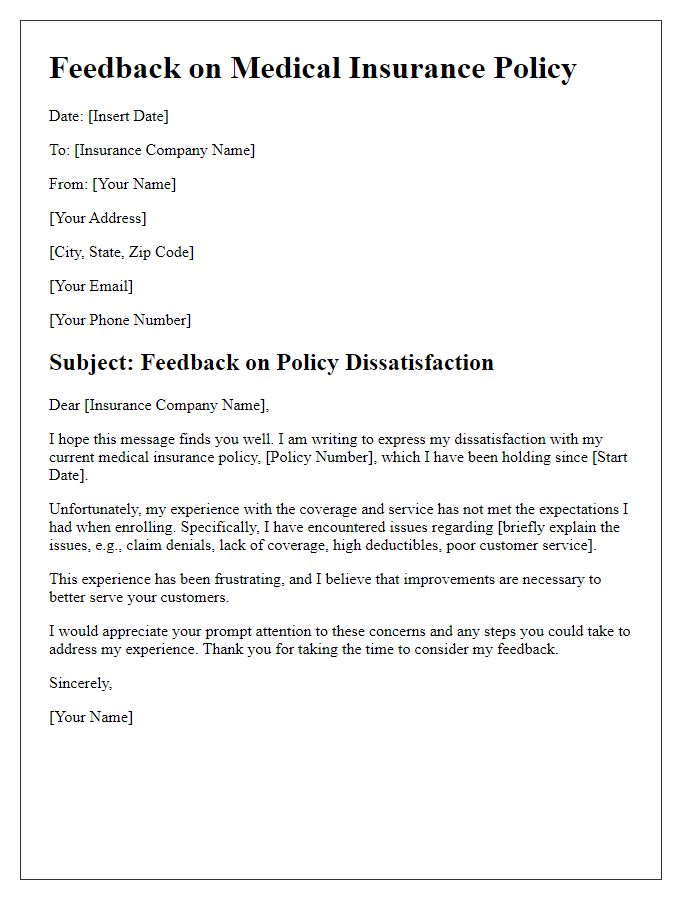

Policy Information

Medical insurance policies can vary widely, encompassing specific terms and conditions that govern coverage. The policy number identifies the unique contract between the insurer and policyholder, while the subscriber's details, including name and contact information, help facilitate communication regarding grievances. Dates of service, particularly when treatments or procedures were rendered, can influence the claims process. Additionally, understanding the types of coverage--such as in-network versus out-of-network providers--affects the resolution of disputes. This information plays a crucial role in addressing grievances, allowing the insurance provider to quickly assess claims related to eligibility, coverage limits, and potential oversights in the claims processing.

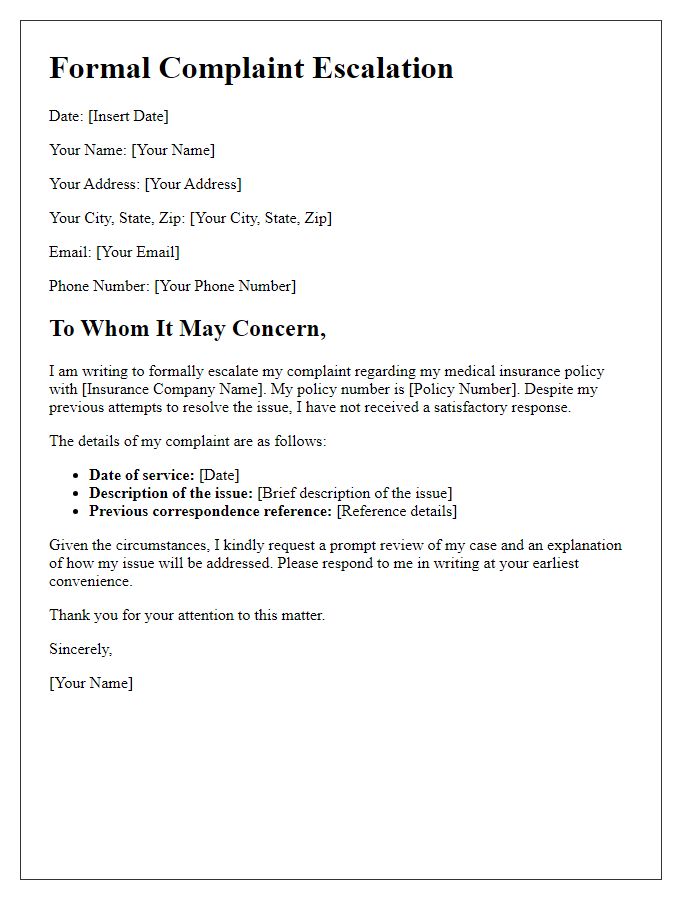

Detailed Description of Grievance

A medical insurance grievance often arises when policyholders face issues regarding claim denials or inadequate coverage. One common scenario occurs when a patient, like John Smith, submits a claim for a necessary MRI scan (costing approximately $1,500) prescribed by Dr. Emily Davis to diagnose a potentially serious condition. Despite the claim meeting all required criteria, the insurance company, HealthSecure, denies payment, citing a lack of medical necessity. This denial occurs despite the fact that Dr. Davis provided detailed documentation and recommendations indicating the scan was crucial for proper diagnosis. The delay in accessing necessary medical care not only impacts the patient's health but also increases out-of-pocket expenses. Furthermore, prolonged denial processes lead to significant stress for patients navigating their treatment plans and financial burdens. The entire experience underscores the importance of clear communication and cooperation between healthcare providers, insurance companies, and patients.

Supporting Documentation

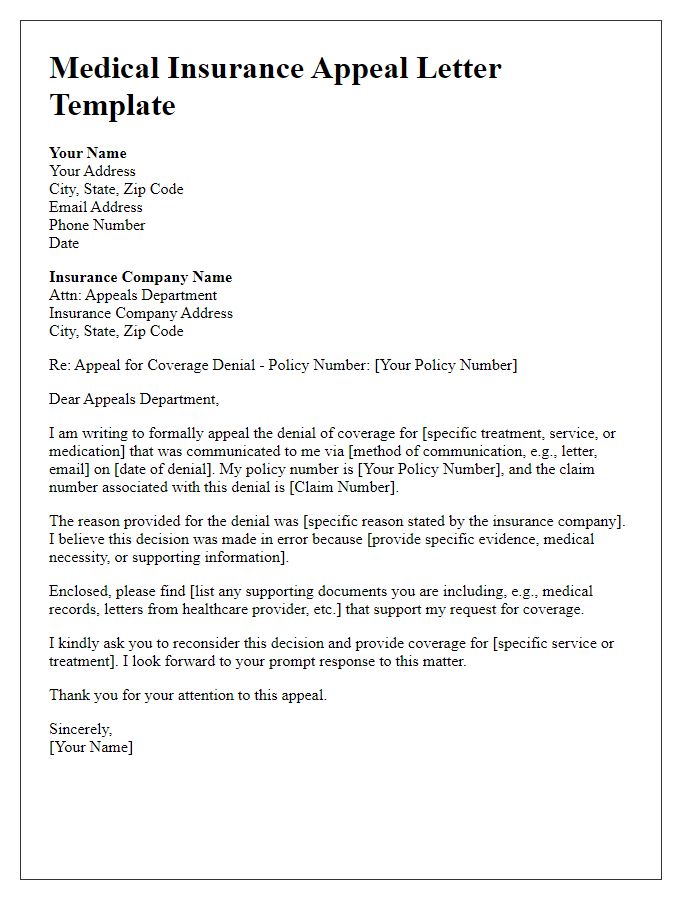

Supporting documentation for a medical insurance grievance often includes multiple key elements that bolster the case for review or appeal. First, a detailed summary of the incident or event leading to the grievance should be included, citing specific dates (such as the date of service), the nature of the medical treatment or procedure (for example, a surgical operation), and the healthcare provider's name (like a specific hospital or specialist). Important insurance information should be clearly outlined, such as the policy number (identified in the documentation), coverage details (highlighting relevant exclusions or limitations), and correspondence history (including denial letters and dates received). Additionally, it's crucial to attach any relevant medical records (such as test results or physician notes) that reinforce the necessity of care, along with any bills or statements (itemized invoices) that illustrate out-of-pocket costs incurred. Organized and comprehensive documentation can significantly impact the resolution of the grievance process.

Specific Resolution Request

Insurance grievances must be evaluated to ensure compliance with coverage policies. A denial of services (often due to pre-existing conditions) can lead to significant financial burden for patients. Timely resolution typically mandates submission within a specified timeframe, often 30 days from the denial notice. Specific requests for coverage reinstatement or medication approval must reference policy numbers and effective dates. Proper documentation, including reference to relevant state regulations (such as the Affordable Care Act) and professional medical opinions, strengthens the case for reconsideration. Ascertain that all correspondence is directed to the appropriate department, often the Appeals or Grievance Unit, within the insurance provider.

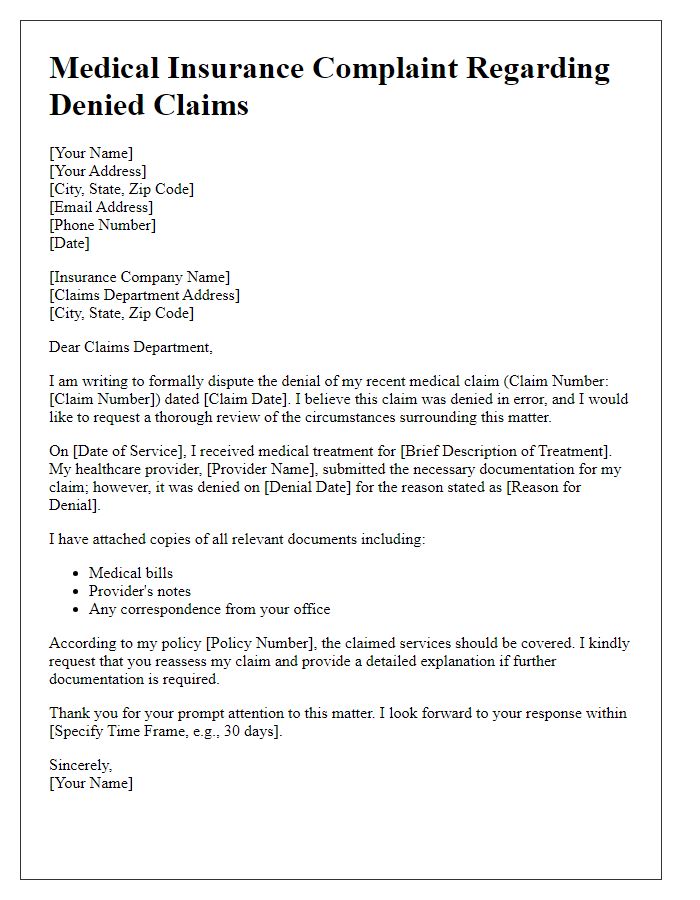

Letter Template For Medical Insurance Grievance Samples

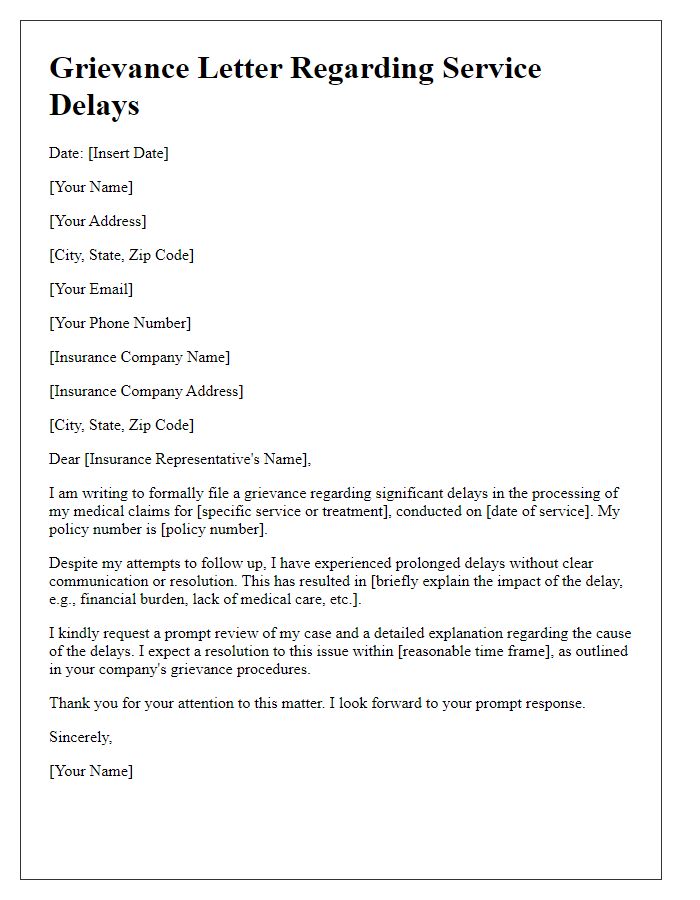

Letter template of medical insurance grievance addressing service delays

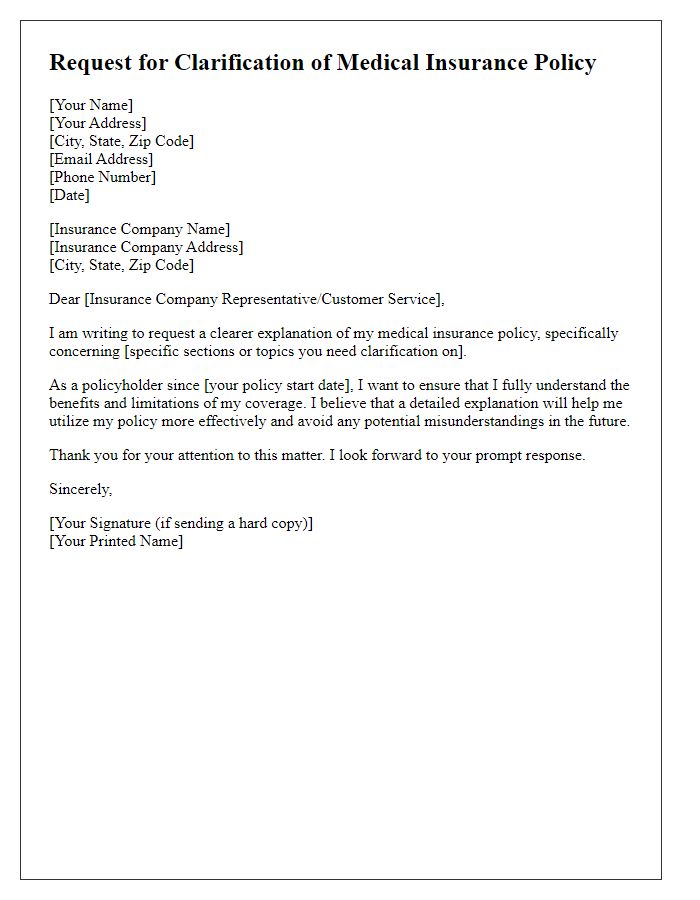

Letter template of medical insurance request for clearer policy explanation

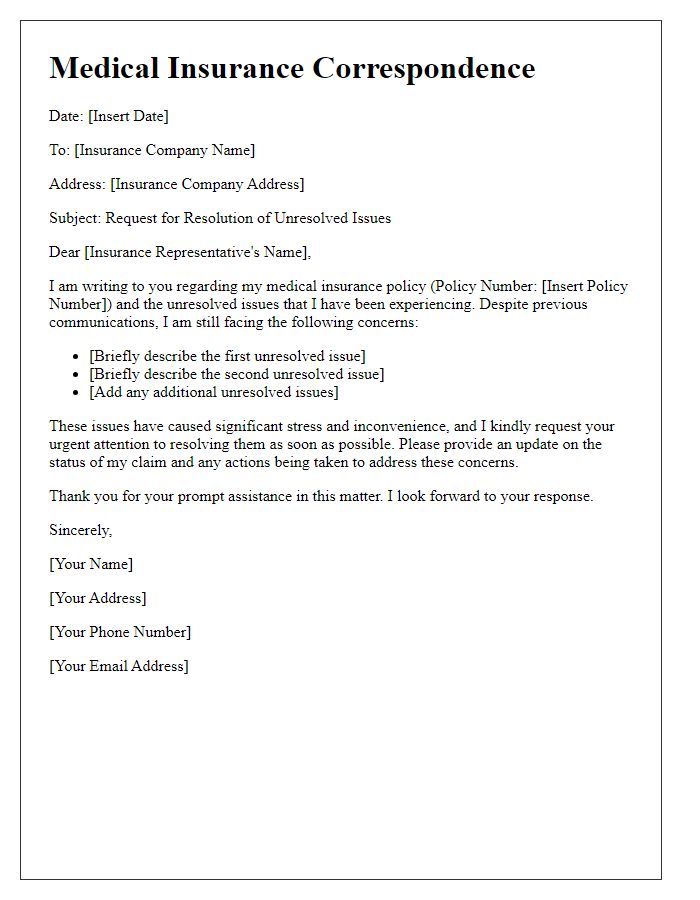

Letter template of medical insurance correspondence for unresolved issues

Comments