Are you looking to navigate the world of health savings accounts (HSAs) and insurance? Understanding how to request information or services related to your HSA can be straightforward, but it's essential to approach it with the right knowledge and template. In this article, we'll guide you through a sample letter that covers all the necessary details to make your request effective and professional. So, let's dive in and explore how to craft the perfect request for your health savings account!

Formal Salutation

A Health Savings Account (HSA) allows individuals to save for medical expenses with tax advantages. Contributions to an HSA can be made annually, with current limits set at $3,850 for individuals and $7,750 for families as of 2023. Eligibility requires enrollment in a high-deductible health plan (HDHP) that has a minimum deductible of $1,500 for individual coverage and $3,000 for families. Funds in the HSA can be used to cover a variety of qualified medical expenses, including copays, prescriptions, and dental services, making it a valuable financial tool for managing healthcare costs. Balances rollover annually and can accumulate tax-free, increasing savings over time.

Clear Subject Line

A health savings account (HSA) can significantly enhance financial flexibility for medical expenses. Individuals can contribute pre-tax income, which reduces taxable income while also promoting savings for future health-related costs. Healthcare providers, especially those offering services in outpatient clinics, often require insurance verification for HSA use during appointments. The IRS allows tax-deductible contributions up to $3,850 for individuals and $7,750 for families in 2023. Additionally, unused funds can roll over annually, making HSAs an attractive option for long-term savings. Participating in an HSA can empower individuals to take control of their healthcare financing while maximizing tax benefits.

Policyholder Information

Health savings accounts (HSAs) offer tax advantages for medical expenses. Individuals must meet eligibility criteria, including enrollment in a qualified high-deductible health plan (HDHP) defined by the IRS. Policyholder information should include full name, Social Security number, and mailing address for precise identification. It is essential to include the insurance policy number to link the HSA with the appropriate health insurance plan. Clear documentation, such as proof of enrollment in an HDHP and past contributions, is vital to validate the request. Processing times may vary depending on the insurance provider, typically ranging from a few days to a couple of weeks. Accurate submission ensures quicker access to funds for qualified medical expenses.

Specific Request Details

Health Savings Accounts (HSAs) offer individuals tax-advantaged benefits for medical expenses. A comprehensive insurance request should detail specific information about the HSA, such as account numbers and associated financial institutions. The letter should include the type of healthcare services required, providing clear descriptions of the medical conditions or treatments involved. Relevant documentation from healthcare providers, including invoices or receipts, may be attached to substantiate the request. State regulations and eligibility criteria for HSAs, such as minimum contribution limits and qualifying high-deductible health plans, should be referenced to ensure compliance. Proper personal information, such as names, addresses, Social Security numbers, and contact numbers, is essential for processing the request efficiently.

Contact Information for Follow-up

Health Savings Account (HSA) requests require detailed communication for efficient processing. Essential contact information includes full name, address, and phone number (preferably mobile for real-time updates). An email address serves as an alternative communication method to receive confirmation or additional requests. Inputting accurate Social Security numbers assures secure identity verification. For follow-up assistance, specifying preferred contact times enhances the communication experience, enabling swift resolution of any inquiries regarding the HSA insurance claim process.

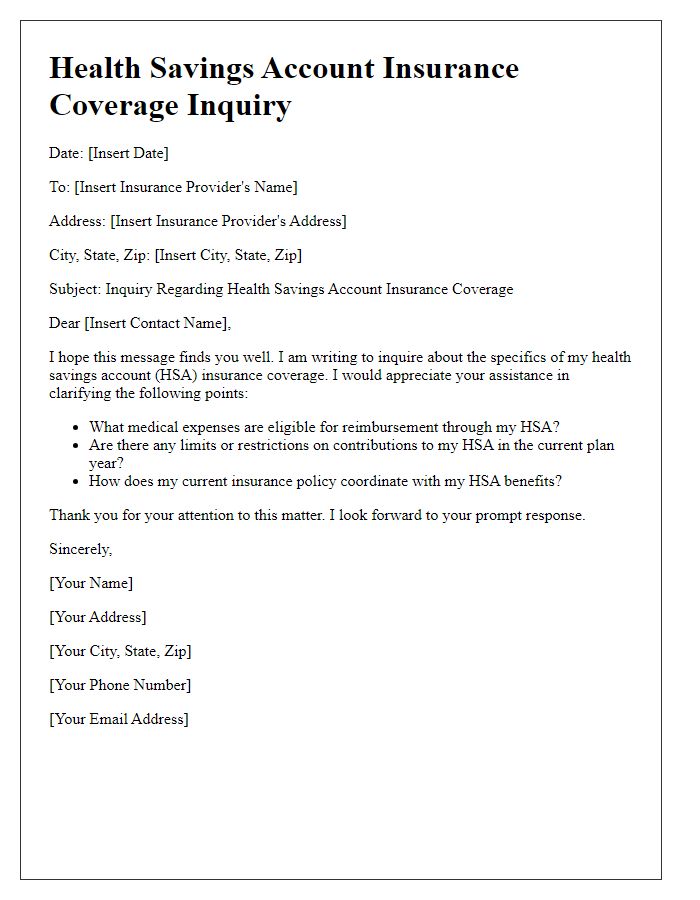

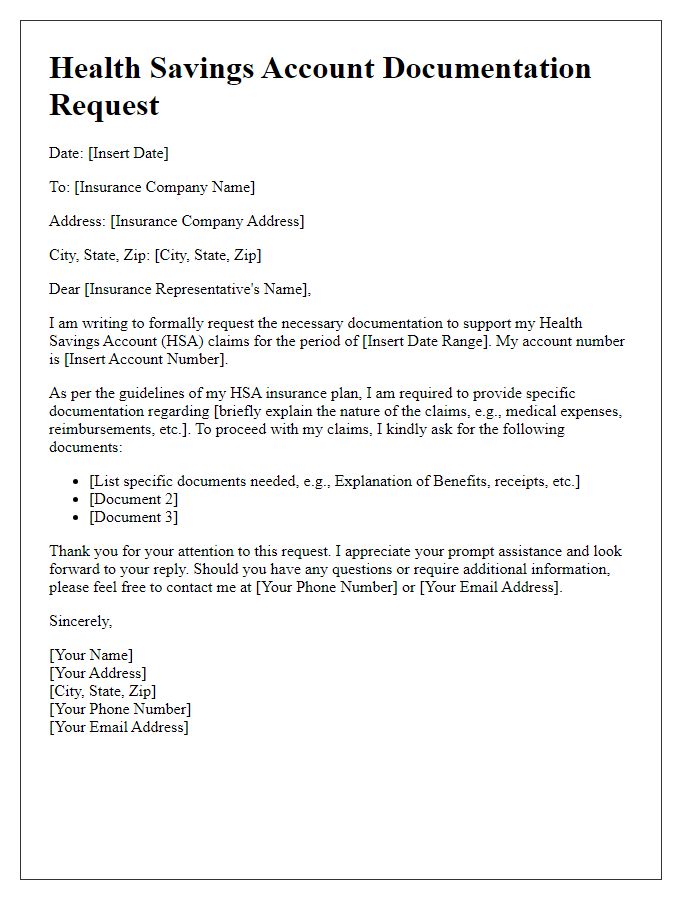

Letter Template For Health Savings Account Insurance Request Samples

Letter template of health savings account insurance benefits clarification

Letter template of health savings account insurance policy change request

Letter template of health savings account insurance contribution request

Letter template of health savings account insurance claims process request

Comments