Are you looking to draft a concise insurance notification letter? Crafting the right message can make all the difference when it comes to communicating important details to your insurance provider. In this article, we'll guide you through the essential components of an effective letter template that simplifies the process. So, if you're ready to learn how to create a clear and professional notification letter, keep reading!

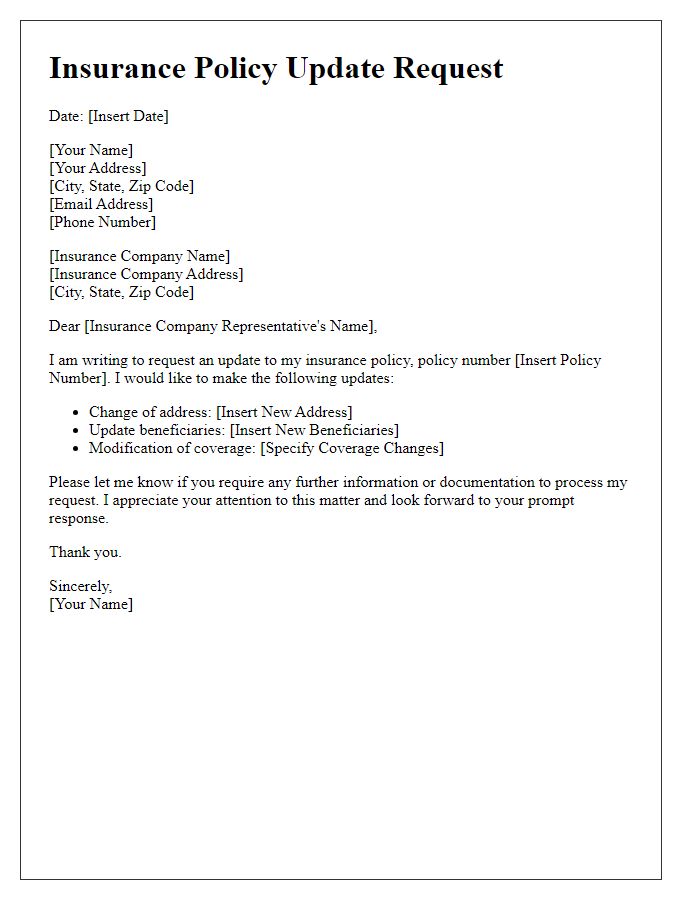

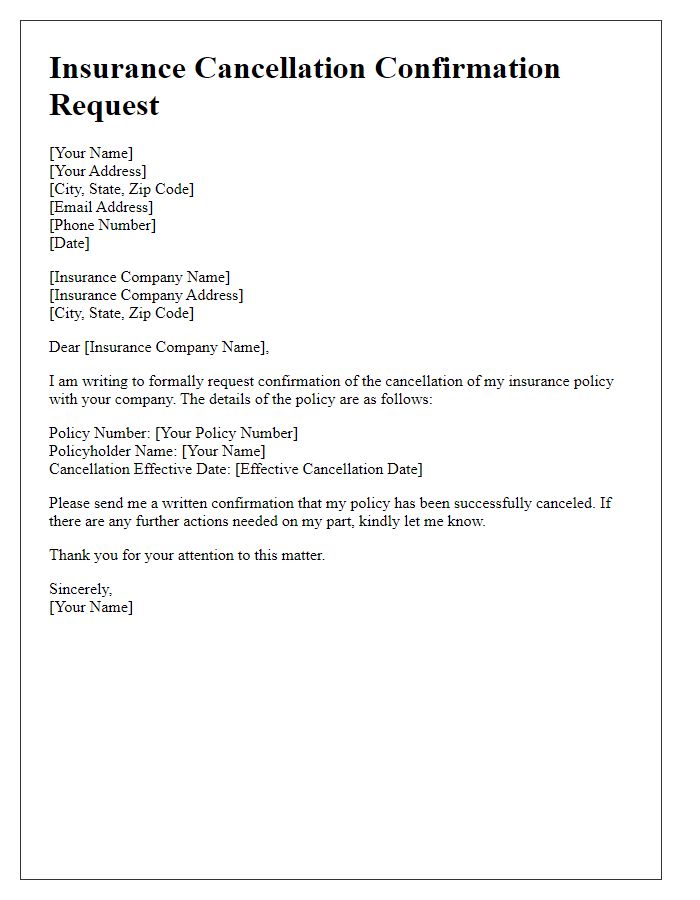

Insurance policy details

Important insurance notifications can affect policyholders' understanding of their coverage. Typically, an insurance policy (a contract between the insurer and the insured) outlines key details like premium amounts, coverage limits, deductibles, and exclusions. For context, a typical homeowner's insurance policy may cover damages to property (such as damage from fire or water) and personal liability, often up to $300,000. It is essential for policyholders to have access to their policy documents and any amendments to understand their rights and responsibilities fully. Contacting the insurance provider directly is recommended to request these documents for clarity on coverage details, deadlines, and claims procedures.

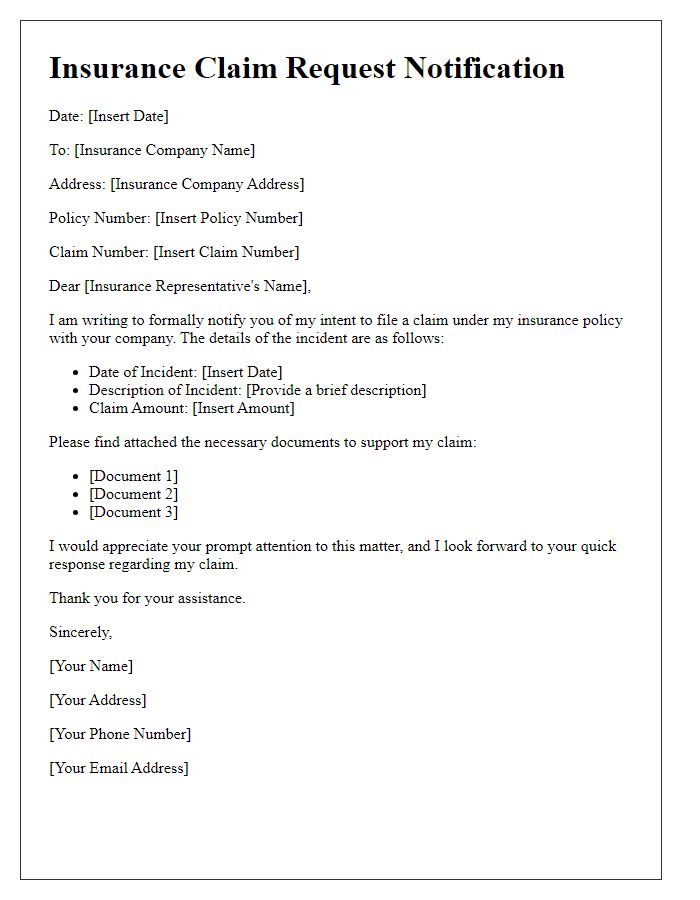

Claims process information

An insurance notification request for claims process information should evoke a clear understanding of the necessary steps. The claims process often initiates with the filing of a claim form, which typically requires detailed information about the incident, including date (for example, March 15, 2023) and location (such as a specific city or property address). The claims adjuster, often assigned within days, will assess the situation, requiring documentation like photographs or police reports. Essential deadlines such as the standard 30-day period for filing this claim should be highlighted. The insurer's customer service line, a crucial resource, can assist with inquiries, offering clarity regarding policy specifics (such as claim limits and deductibles). Understanding these elements streamlines the process, ensuring comprehensive and timely claims management.

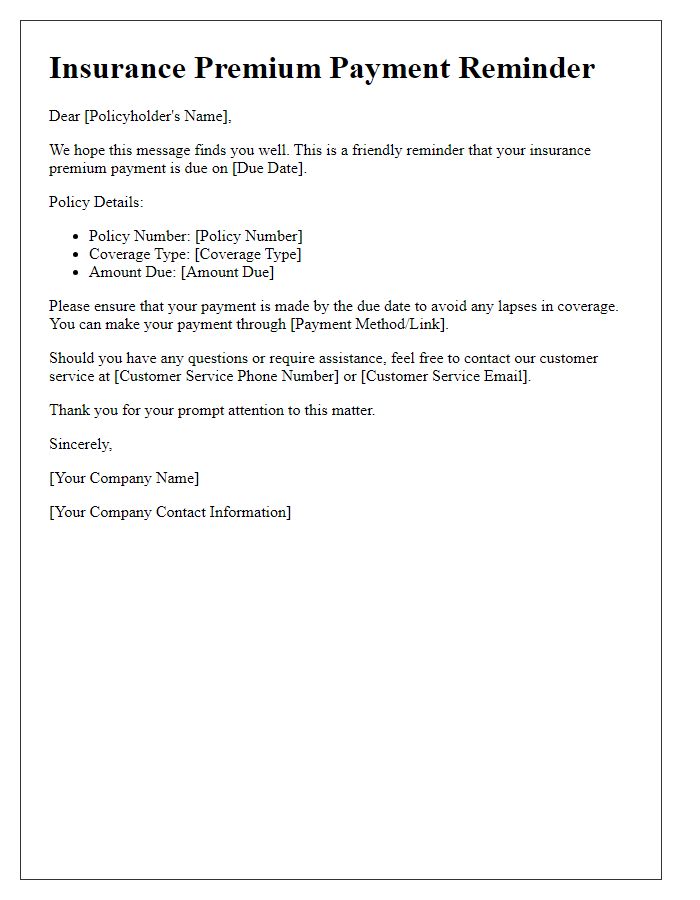

Contact details of recipient

In the bustling realm of financial communications, the necessity for precise contact details for recipients within insurance notification letters remains paramount for effective correspondence. Essential information includes the recipient's full name, typically including middle initials or suffixes, along with a complete street address--number, street name, city, state, and postal code (ZIP code). Additionally, the recipient's phone number serves to facilitate prompt communication, and an email address offers alternative digital contact. Abiding by privacy standards and regulations safeguards the security of this personal information, while ensuring seamless delivery and clarity in the context of communication with insurance companies like State Farm, Allstate, or Geico, which often handle a myriad of client inquiries and notification requirements.

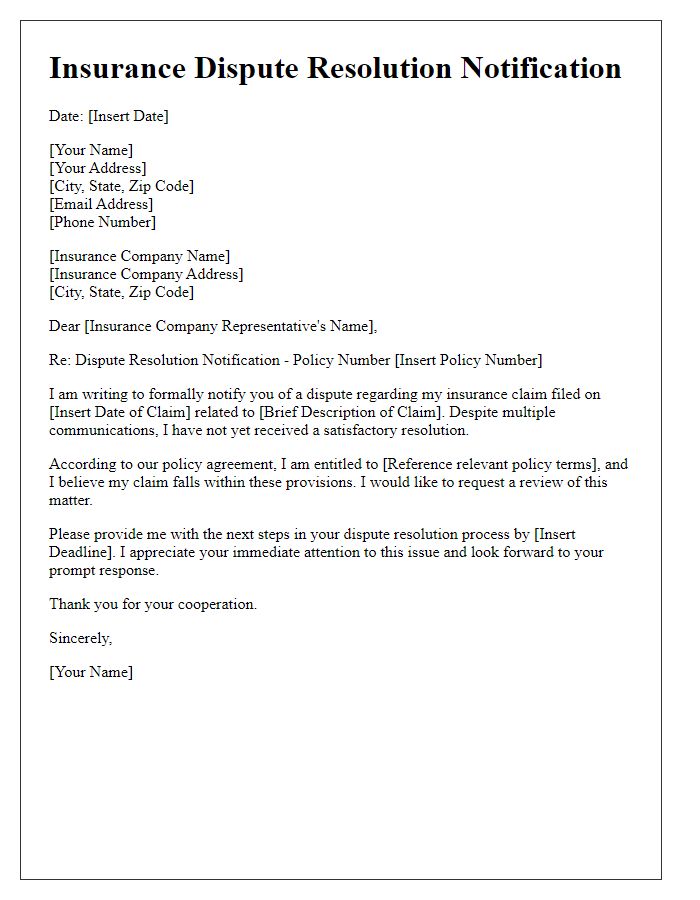

Reason for notification

Insurance notifications serve multiple purposes, including updates on policy changes, claims status, or reminders for renewals. Each notification typically highlights essential details such as the policy number, decision status, and any necessary actions required from the insured party. Notifications can arise from significant events, for instance, accidents requiring claims processing, or policy adjustments based on risk assessments. Clear communication ensures the insured understand their coverage, deadlines, and any implications for future policies. Additionally, timely notifications can prevent lapses in coverage that may lead to financial setbacks during unexpected events.

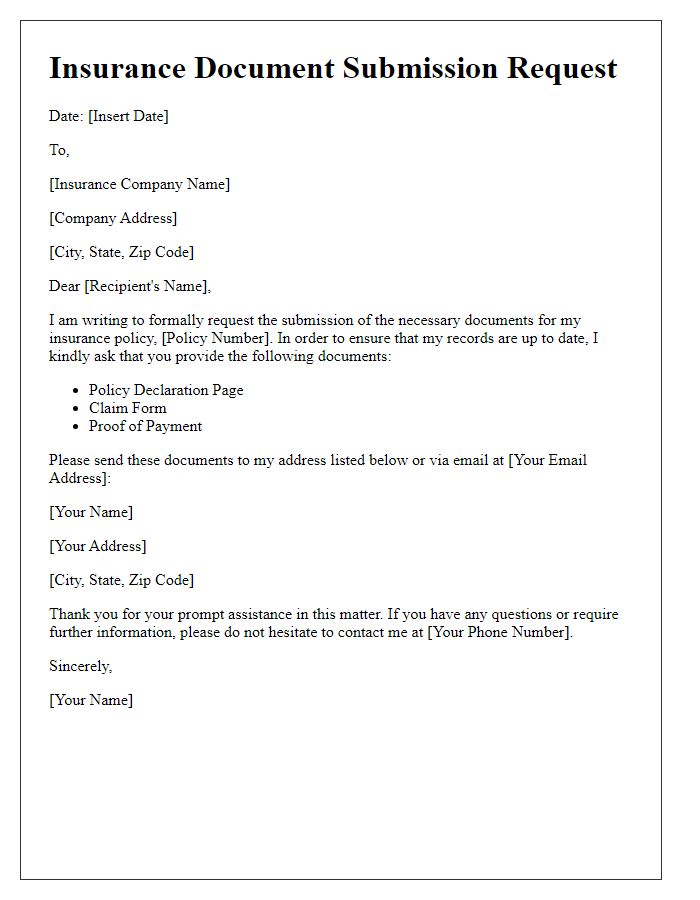

Required documentation

Insurance notification requires specific documentation to process claims efficiently. These documents typically include a filled-out claim form (detailing the incident and coverage), proof of loss or damage (photographs, police reports, damage estimates), identity verification (government-issued ID, social security number), and any relevant policy documents (policy number, coverage details). Additionally, receipts for expenses incurred related to the claim (repair costs, medical bills) can expedite processing. Failing to provide comprehensive documentation may delay the approval of claims, impacting financial recovery during the claim process.

Comments