Are you feeling a bit overwhelmed by the complexities of annuity insurance payments? You're not alone, as many individuals find themselves navigating the nuances of payment adjustments and the impact they can have on their financial planning. Fortunately, understanding the process can help ease your concerns and empower you to make informed decisions. Ready to dive deeper and explore how you can efficiently manage your annuity insurance payment adjustments?

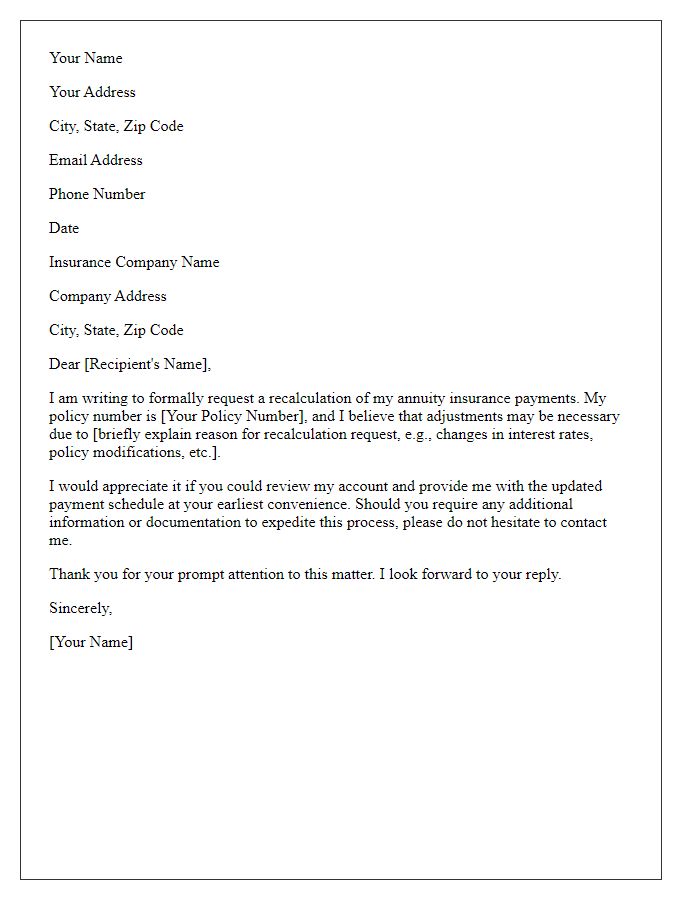

Policyholder Details

Annuity insurance payment adjustments often require detailed information about the policyholder's circumstances and needs. Policyholders, typically individuals or entities who have purchased this financial product, should provide their full name, policy number, and contact information such as address and email. In many cases, policyholders may also include additional details about their financial situation, changes in income, or specific reasons for requesting an adjustment to ensure that the insurance company reviews their request accurately. This communication should outline the desired changes, specify any relevant terms from the original policy, and indicate the expected impact on future payments. Providing complete and accurate information facilitates a smoother adjustment process while maintaining compliance with policy guidelines.

Annuity Contract Information

Annuity insurance payment adjustments often involve specific contract details, such as the contract number and the policyholder's name. The adjustment process can impact monthly payments, potentially changing from fixed amounts to variable payments based on market performance. For example, an annuity contract tied to an index (such as the S&P 500) may fluctuate, reflecting the financial market's trends. Factors influencing adjustments include interest rates set by the Federal Reserve, the lifespan of the annuitant, and accumulated funds within the contract. Understanding the implications of these adjustments can help policyholders make informed financial decisions regarding their retirement income strategy.

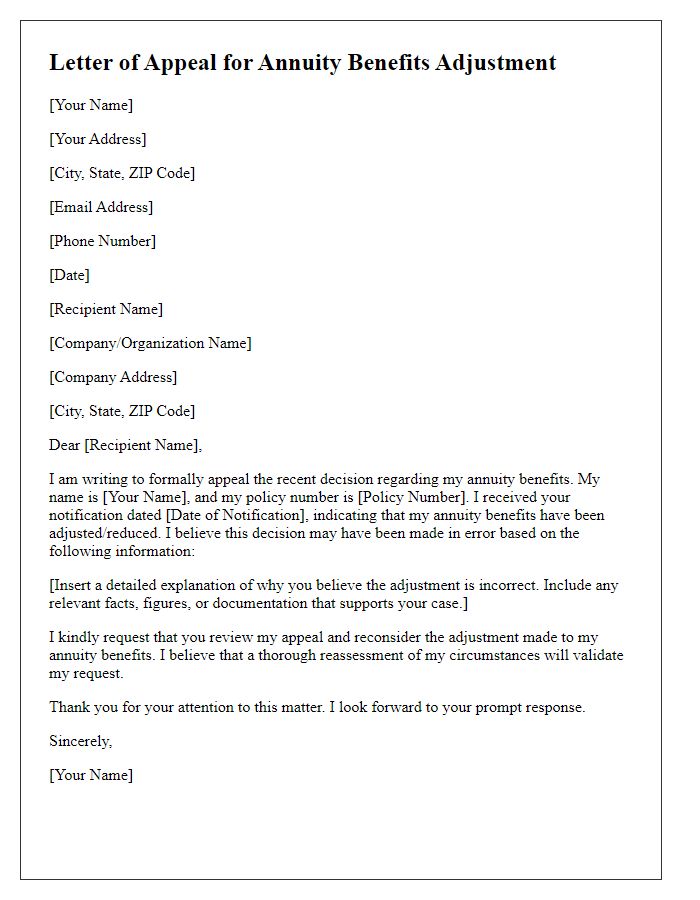

Reason for Payment Adjustment

An annuity insurance payment adjustment may arise due to various factors, such as changes in policyholder circumstances, regulatory updates, or shifts in market interest rates. For instance, if an individual, aged 65, experiences an unexpected health decline, this can necessitate a reassessment of their payment structure to ensure adequate financial support. Additionally, regulatory changes in 2023 may require adjustments to comply with newly established guidelines set forth by the National Association of Insurance Commissioners (NAIC). Market fluctuations, particularly the increase in 10-year Treasury yields to 3.5% in 2023, can also impact annuity payouts, prompting insurance companies to adjust payment amounts accordingly to reflect the current economic environment. Such adjustments aim to maintain the policy's sustainability and ensure the policyholder receives fair compensation throughout their retirement years.

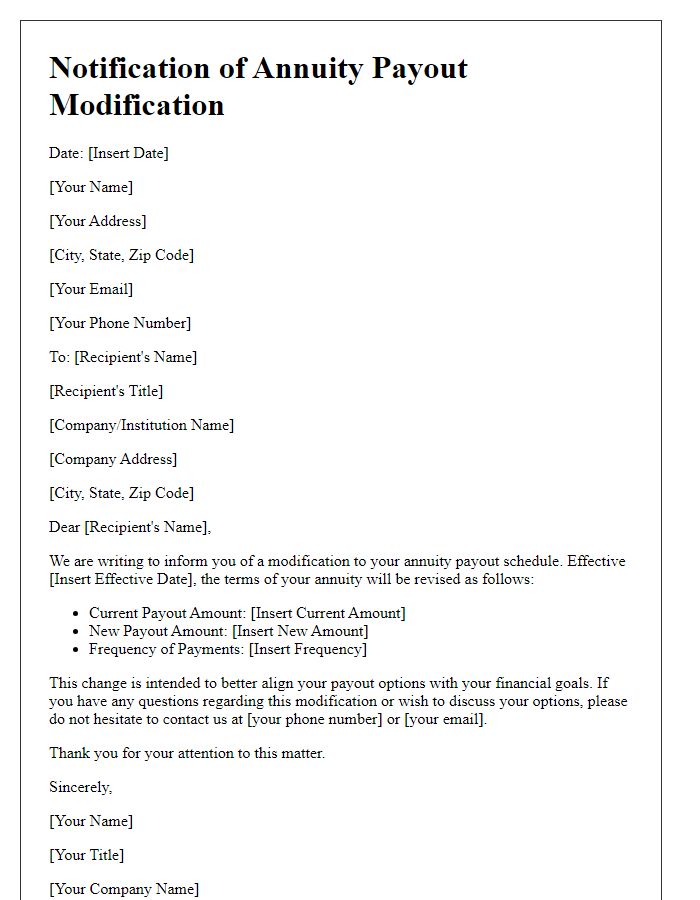

New Payment Schedule

Annuity insurance payment adjustments can significantly impact financial planning for policyholders. A new payment schedule may occur due to factors like changes in interest rates, policyholder's age, or additional benefits requested. For example, at age 65, a retiree may seek adjustments to ensure monthly disbursements align with living expenses. Policyholders typically receive notifications detailing changes, including effective dates and revised payment amounts. Accurate recalibration of payment schedules ensures that funds cater to long-term financial security while adhering to the terms outlined in the original annuity contract.

Contact Information for Queries

Annuity insurance payment adjustments can significantly impact policyholders' financial planning. Policyholders receiving insufficient monthly payments may contact customer service departments of insurance companies, such as MetLife or Prudential, to clarify issues. Each insurance provider typically provides dedicated contact numbers, often found on official websites or policy documents, ensuring quick access to assistance. Additionally, email support options may be available for non-urgent inquiries, often requiring a response time of 24 to 48 hours. When reaching out, it's advisable to have policy numbers and personal identification ready to streamline the process, enhancing efficiency in resolving payment discrepancies.

Comments