Are you feeling overwhelmed by the process of filing an insurance claim for your property? Navigating the intricacies of insurance terminology and documentation can be a daunting task, especially when you're trying to recover from unexpected damages. In this article, we'll break down the essential steps to take when inquiring about your property insurance claim, ensuring you have the right information at your fingertips. So, let's dive into the world of property insurance claims and get you on the road to recovery!

Claim Reference Number

The process of filing a property insurance claim involves detailing incidents that resulted in loss or damage, requiring extensive documentation for efficient processing. For instance, the Claim Reference Number serves as a unique identifier within insurance companies like State Farm or Allstate, facilitating tracking and communication. A comprehensive inquiry should include the specific date of the incident, locations such as residential addresses or commercial properties, descriptions of the damages incurred, and estimates from certified repair professionals. It is vital to ensure that all relevant policy details are documented, including coverage limits, endorsements, and any previous claims, to streamline the investigation and resolution process.

Insured Property Details

Insured properties, such as residential homes or commercial buildings, require precise documentation to facilitate insurance claims effectively. Essential details include the property address (including zip code for localization), type of property (single-family home, multi-unit dwelling, or office space), and policy number (to identify coverage specifics). It is important to note the date of the loss or damage event, along with descriptions of affected areas (such as roof, walls, or interior systems). Additional information may involve the estimated cost of repairs (supported by contractor quotes) and any previous claims filed (to assess history). This thorough compilation ensures accurate processing of inquiries and claims.

Date of Incident

The date of the incident serves as a crucial reference point in property insurance claims, often affecting claim timelines and assessments. For example, incidents occurring on significant dates, such as January 1st, may be processed differently due to high claim volumes during the New Year holiday. Additionally, the specific day can influence the available documentation, such as police reports or eyewitness accounts, especially in instances of theft or natural disasters like hurricanes. The date must be accurately documented in correspondence with the insurance company to ensure a smooth claims process and prevent potential disputes or delays in receiving compensation.

Description of Damage

Water damage in residential properties can result from various sources such as leaky roofs, burst pipes, or flooding incidents. In instances where water infiltrates interior spaces, it can compromise the structural integrity of materials such as drywall and flooring, leading to mold growth within 24 to 48 hours. Homeowners should note that insurance claims related to water damage may vary depending on policy specifics, including coverage limits and exclusions. Documentation is essential, including photographs of affected areas, estimates for repairs, and any correspondence with contractors. In severe cases, such as a complete loss of valuables or extensive wall damage requiring major repairs, timely filing of claims is crucial to avoid complications in securing compensation. Additionally, identifying the source of the water damage is important for claims processes, to ascertain if the incident is covered under the policy.

Supporting Documentation

In property insurance claims, supporting documentation plays a crucial role in validating losses and expediting the claim process. Essential items include photographs of the damage, showcasing the extent of destruction or loss, and repair estimates from certified contractors, providing accurate cost assessments. Detailed inventories of damaged items, with purchase receipts, help establish the value of lost possessions. Additionally, police reports (if applicable), accident reports, or fire department statements enhance the credibility of the claim. Policy documentation, including the declaration page and coverage limits, outlines the terms and conditions of the insurance, ensuring all claim details align with the policy. Accurate and organized submission of these documents fosters a smoother review process by insurance adjusters and promotes timely resolution.

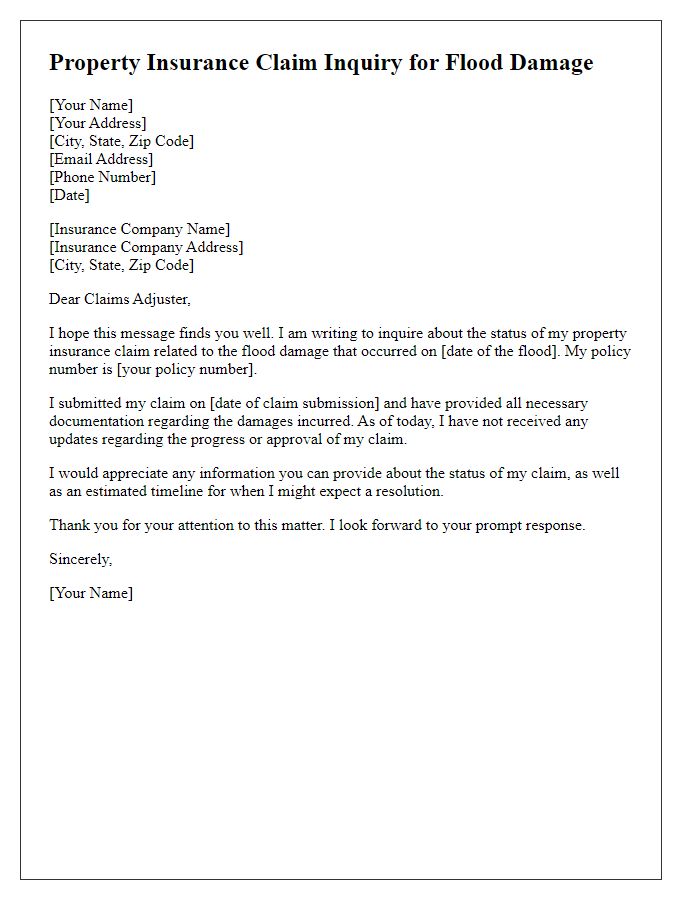

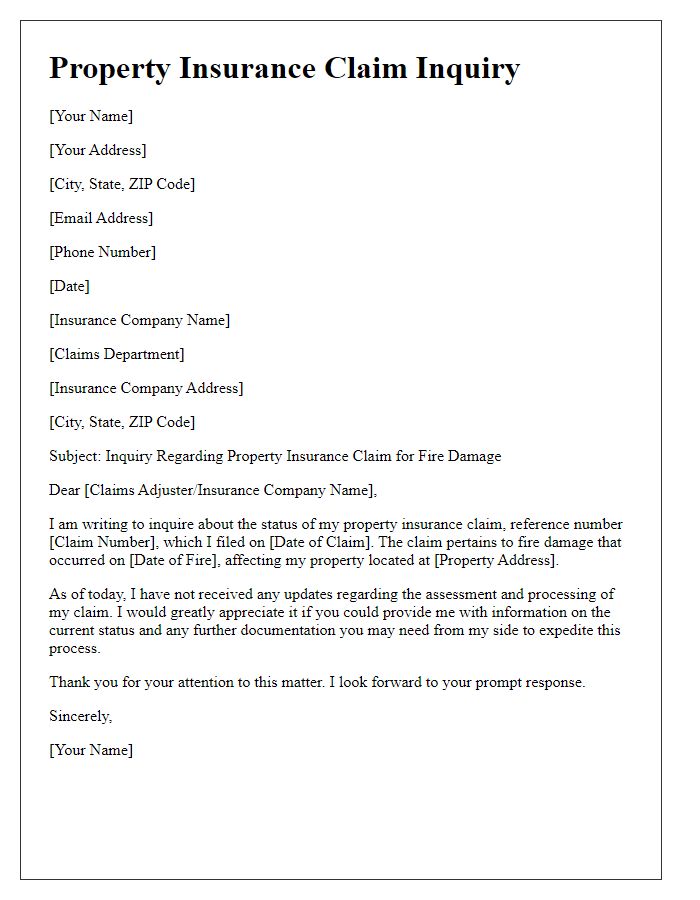

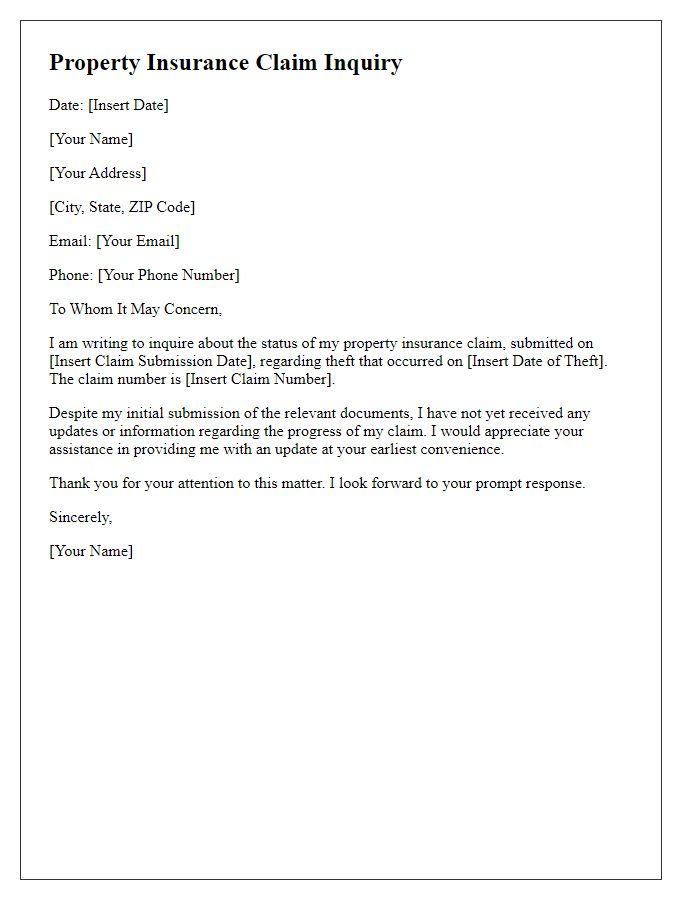

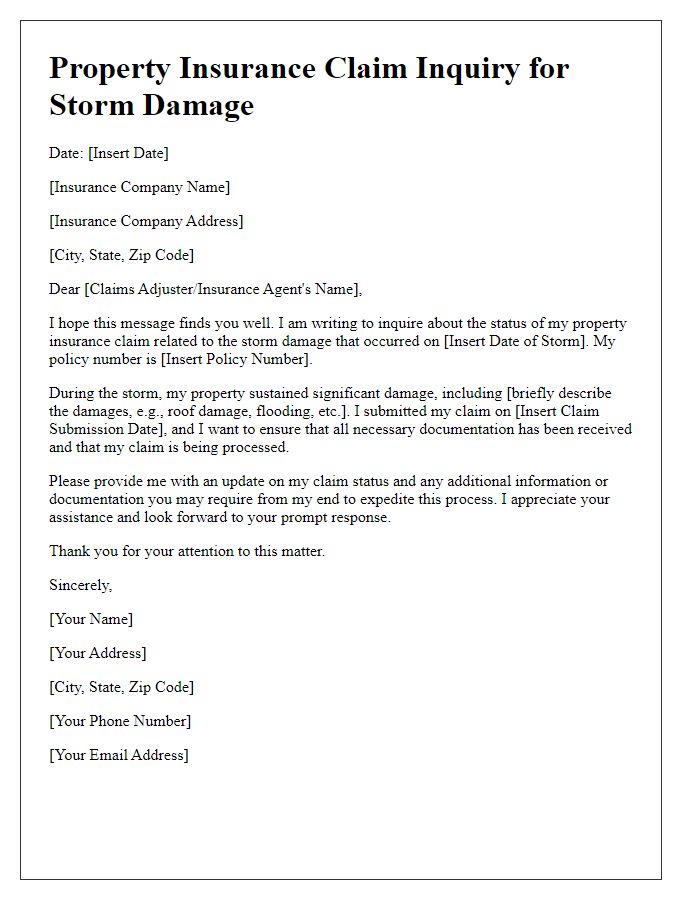

Letter Template For Property Insurance Claim Inquiry Samples

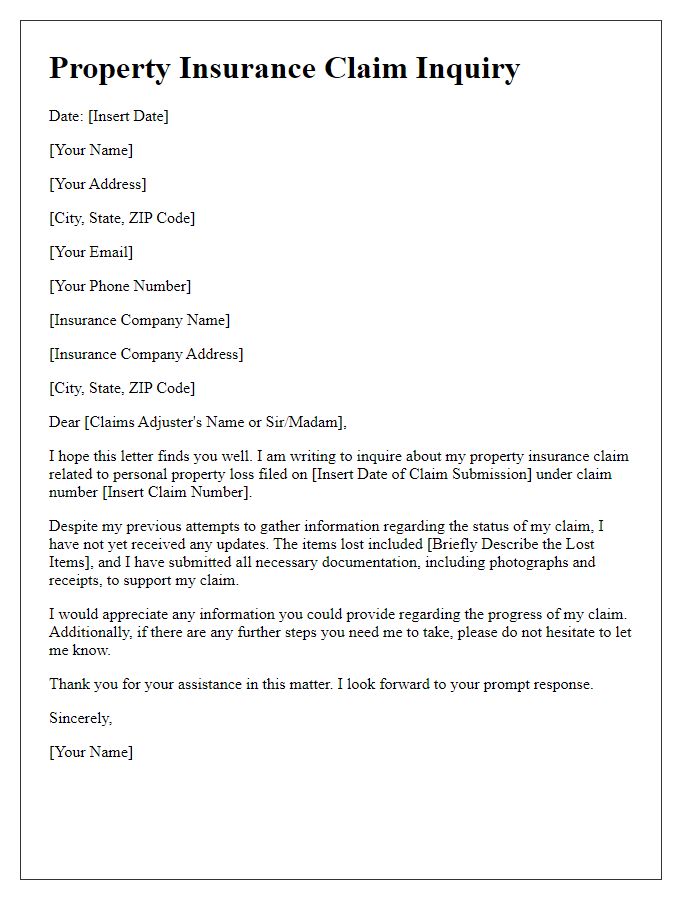

Letter template of property insurance claim inquiry for personal property loss.

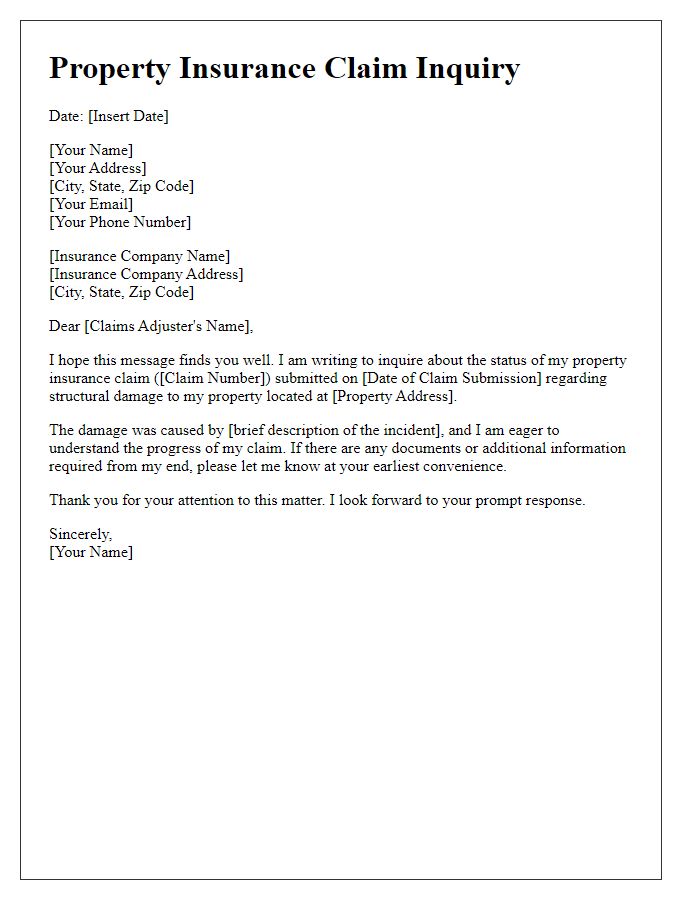

Letter template of property insurance claim inquiry for structural damage.

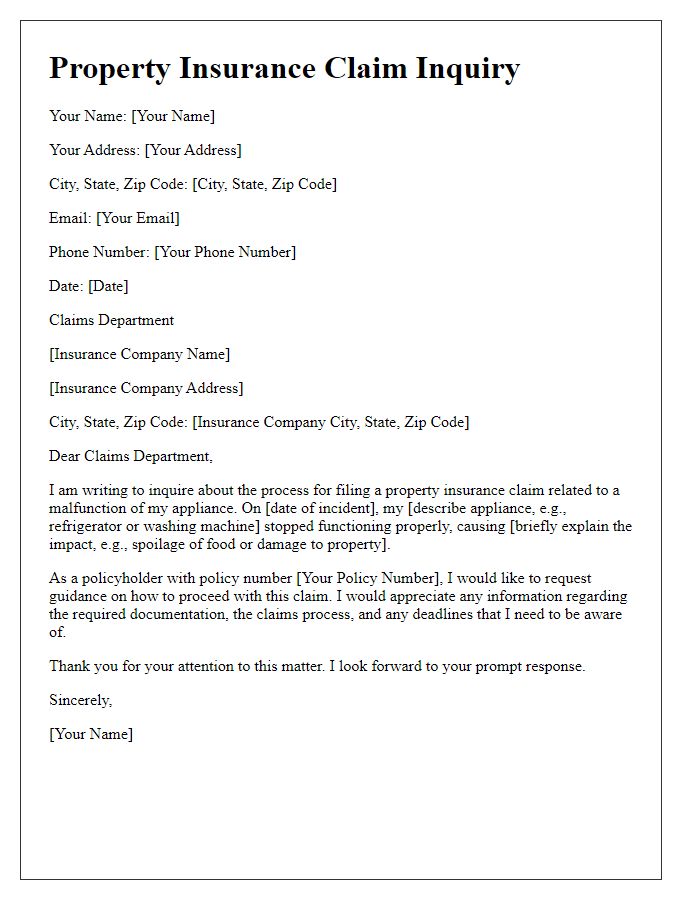

Letter template of property insurance claim inquiry for appliance malfunction.

Comments