In today's fast-paced world, telemedicine has emerged as a game-changer in healthcare, providing convenient access to medical services from the comfort of our homes. As we navigate the evolving landscape of healthcare, understanding telemedicine insurance coverage is more crucial than ever. This article explores the importance of extending insurance coverage for telemedicine, highlighting its benefits for both patients and healthcare providers. Join us as we delve deeper into the topic and discover how these changes can impact your health journey.

Policyholder Information

Telemedicine has increasingly become a vital component of healthcare, especially during events like the COVID-19 pandemic. Insurance policies, such as those from major providers like Blue Cross and Blue Shield, increasingly include telehealth provisions for policyholders. Relevant statistics illustrate that telemedicine visits surged by over 154% in 2020 compared to the previous year. This increase emphasizes the need for comprehensive coverage extension for virtual consultations, ensuring accessibility for chronic conditions management and preventive care. Notable states like California and New York have mandated such extensions, influencing policy adjustments. Moreover, regulatory changes support insurance reimbursements for telemedicine services, reinforcing the importance of clearly defined policyholder information to facilitate coverage implementation.

Current Coverage Details

Insurance plans that include telemedicine services often stipulate specific conditions for coverage, with updates frequently occurring. Current coverage typically encompasses primary care consultations, such as through doctors, nurse practitioners, or specialists, like endocrinologists. Many providers, including UnitedHealthcare and Aetna, have embraced virtual visits, with options available seven days a week, often without co-pays for both in-network and out-of-network providers. Covered services may include mental health consultations, chronic disease management sessions, and urgent care visits, with different plans capping coverage at a certain number of telemedicine encounters. Some states, such as California and New York, mandate insurance companies to offer telehealth coverage equally to in-person visits, aiming for increased access to healthcare.

Request for Extension

Telemedicine services have seen a significant rise in utilization, particularly during the COVID-19 pandemic. Many insurance companies, including Blue Cross Blue Shield and UnitedHealthcare, have implemented temporary coverage policies for virtual consultations and remote patient monitoring. Coverage for telehealth visits can vary; some plans offer full parity with in-person visits while others cap reimbursement rates. Key data indicate that telemedicine use increased by over 150% between March 2020 and December 2020. As healthcare providers, such as hospitals like Mayo Clinic and Cleveland Clinic, adapt to include remote services, a request for extension on telemedicine insurance coverage becomes crucial, particularly in ensuring continuity of care for patients with chronic conditions requiring ongoing evaluation.

Justification for Extension

Telemedicine has emerged as a pivotal healthcare solution, significantly expanding access to medical consultations, particularly in rural areas and underserved communities. Since the onset of the COVID-19 pandemic in early 2020, health insurance providers, including major companies like Blue Cross Blue Shield and UnitedHealthcare, began offering expanded coverage for telehealth services to facilitate remote patient care. Several studies, including a 2021 report by the American Medical Association, indicate a remarkable 154% increase in telehealth visits during the pandemic, demonstrating its crucial role in maintaining patient care continuity. An extension of telemedicine coverage is essential to sustain access to essential health services, particularly for individuals with chronic conditions, who often require regular monitoring and consultation. Furthermore, legislation like the Telehealth Services Expansion Act underscores the need for ongoing support in telehealth access, ensuring that patients can continue to receive timely care without geographical constraints or additional financial burdens.

Contact Information for Follow-up

Telemedicine insurance coverage extension is essential for patients seeking remote healthcare services. Many insurance providers are evaluating policy modifications in response to the COVID-19 pandemic, enabling broader access to virtual consultations with healthcare professionals. Contact information for follow-up on coverage details should include the insurance company's dedicated helpline number, typically found on the back of the insurance card. Additionally, policyholders should check their online account portal, where updates may be posted. It is vital to have direct email addresses for specific customer service representatives to expedite communication. State insurance department websites often provide assistance for further inquiries, along with contact details for filing complaints if coverage disputes arise.

Letter Template For Telemedicine Insurance Coverage Extension Samples

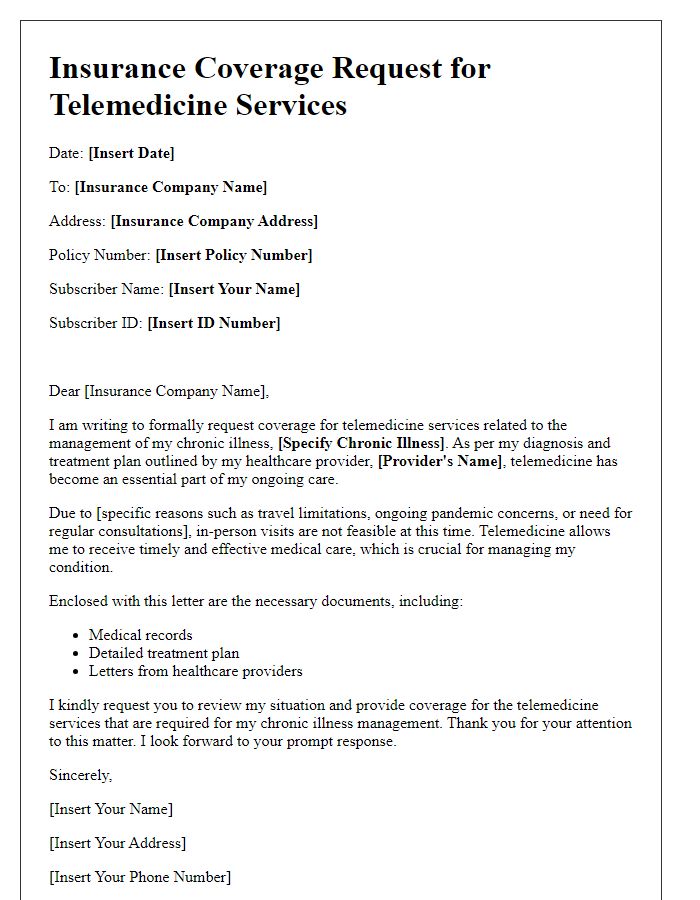

Letter template of telemedicine insurance coverage request for chronic illness management.

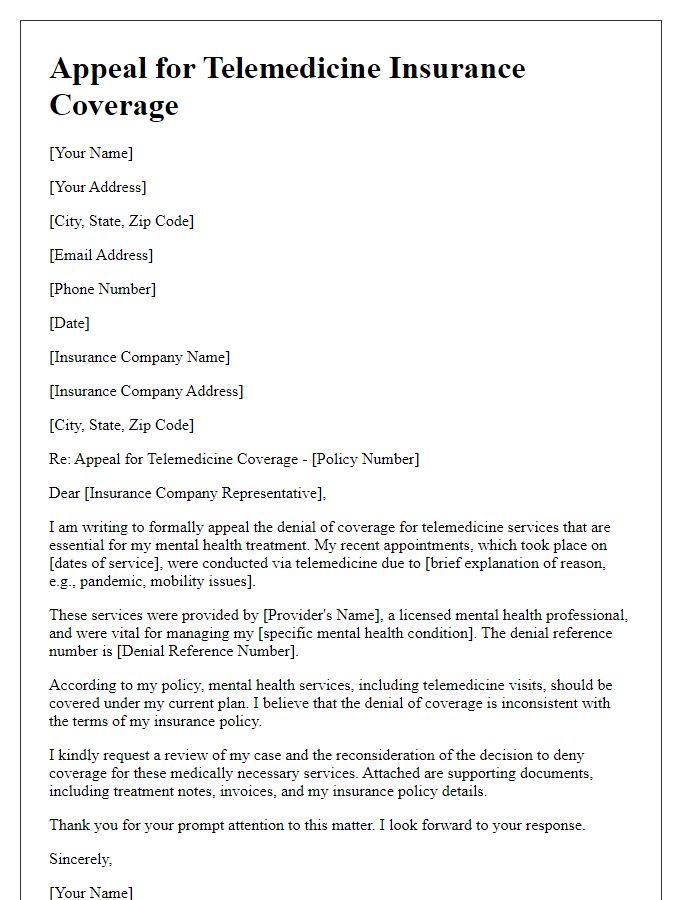

Letter template of telemedicine insurance coverage appeal for mental health services.

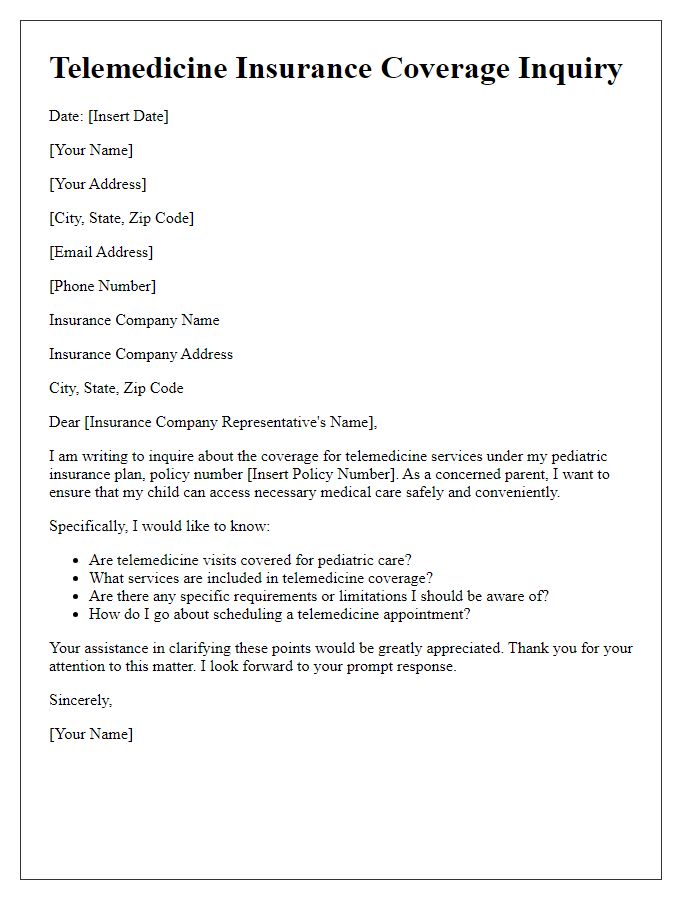

Letter template of telemedicine insurance coverage inquiry for pediatric care.

Letter template of telemedicine insurance coverage application for preventive care visits.

Letter template of telemedicine insurance coverage adjustment request for follow-up consultations.

Letter template of telemedicine insurance coverage clarification for specialist referrals.

Letter template of telemedicine insurance coverage support for remote monitoring programs.

Letter template of telemedicine insurance coverage confirmation request for new clients.

Letter template of telemedicine insurance coverage extension for out-of-state services.

Comments