In the world of business, unexpected disruptions can have serious financial implications, making it crucial to have a robust business interruption insurance policy in place. Whether it's due to natural disasters, fire, or unforeseen circumstances, knowing how to effectively communicate your claim can significantly impact the recovery process. In this article, we'll guide you through essential elements to include in your business interruption insurance claim letter, ensuring you present a comprehensive case to your insurer. Curious to learn more about crafting a compelling claim? Let's dive in!

Clear Policy Details

A business interruption insurance claim requires precise and comprehensive documentation to facilitate processing. The policy details must include the policy number (a unique identifier issued by the insurance company), effective dates (the duration of coverage typically noted on the policy document), and the specific coverage included (such as loss of income, extra expenses, and civil authority coverage). Further, indicating any endorsements or riders attached to the policy, which may alter the standard conditions, is crucial. Including the contact information of the assigned claims adjuster, along with procedures outlined for filing claims, can enhance clarity. Accurate representation of insured property (the physical assets covered under the policy, such as buildings, inventory, and equipment) is vital, as is noting the cause of business interruption (such as natural disasters or pandemics, which might lead to loss). Additionally, documenting the financial metrics (such as average monthly income, specific loss calculations, and any additional expenses incurred due to the interruption) is essential to validate the claim amount.

Incident Description

A significant water damage event occurred on March 15, 2023, at the main office located in downtown Chicago, Illinois, impacting operations severely. A broken pipeline within the building led to extensive flooding, affecting approximately 3,000 square feet of office space, including critical areas such as the IT department and customer service center. The resulting damage necessitated immediate evacuation and closure, resulting in a loss of revenue estimated at $250,000 over three weeks. Furthermore, essential operational equipment, including computers and telecommunication systems, suffered damage exceeding $75,000, leading to substantial delays in service delivery and client support. Emergency restoration efforts commenced on March 16, 2023, with full operational capacity not expected to resume until April 5, 2023.

Financial Impact Analysis

Business interruption insurance claims require detailed financial impact analysis to assess loss due to operational downtime. For instance, a restaurant (such as a local diner) experiencing a fire incident may find daily revenues dipping from $2,000 to zero, resulting in a potential loss of $60,000 over a 30-day closure period. Fixed costs, including rent ($3,000 monthly), utilities ($500 monthly), and staff salaries ($15,000 for the month), contribute to financial strain during this interruption. Market research indicates surrounding establishments (like competitors within a 3-mile radius) may suffer similar downturns, leading to an increased probability of a saturated market upon reopening. Documenting these figures is crucial to establish the economic impact and support settlement discussions with insurance providers.

Supporting Documentation

Business interruption insurance claims require comprehensive supporting documentation to ensure a successful application. Essential documents include the business's financial records, such as profit and loss statements for the past 12 months, providing clear evidence of revenue loss during the interruption period. Additional requirements may encompass copies of the insurance policy (e.g., policy number and coverage details), detailing terms and conditions, along with a formal notice of loss submitted to the insurance provider, typically within 30 days of the event. Detailed summaries documenting the nature of the interruption (such as a natural disaster like Hurricane Ida in 2021 or government-mandated shutdowns due to a pandemic) will support the claim. Further, correspondence related to recovery efforts, including repair estimates from contractors, may be included to highlight mitigation measures taken to restore business operations. Collectively, these documents strengthen the foundation for the claim evaluation process.

Contact Information

Business interruption insurance claims require specific contact information to facilitate the processing of the claim efficiently. Company name (e.g., ABC Manufacturing Inc.) must be clearly stated alongside the primary contact person (e.g., John Doe, Claims Manager). It is crucial to include the official business address (such as 123 Industry Lane, Cityville, State, ZIP) to identify the location affected by the interruption. Additionally, provide a phone number (e.g., +1-234-567-8901) for immediate communication and a professional email address (e.g., johndoe@abcmanufacturing.com) for documentation purposes. This information enables insurance providers to reach the claimant promptly and gather necessary details regarding the business's operational disruptions.

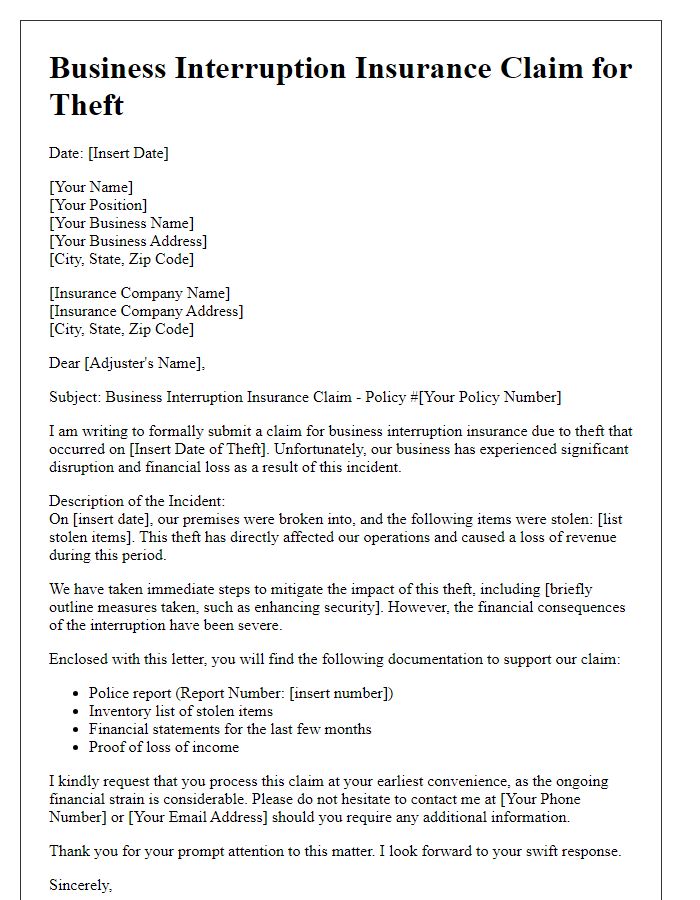

Letter Template For Business Interruption Insurance Claim Samples

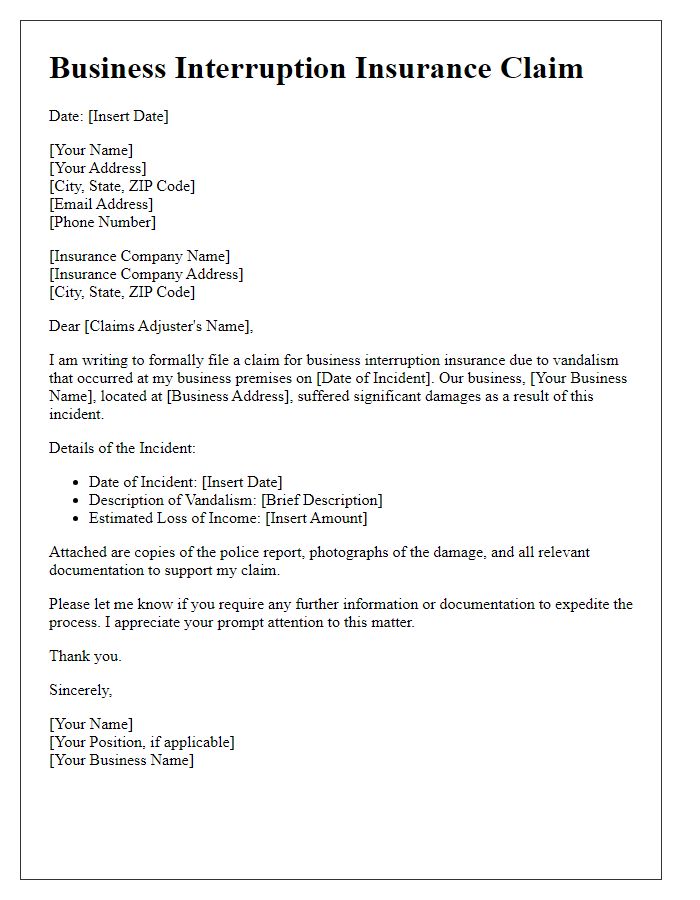

Letter template of business interruption insurance claim for property damage.

Letter template of business interruption insurance claim for natural disasters.

Letter template of business interruption insurance claim for equipment failure.

Letter template of business interruption insurance claim for supply chain disruptions.

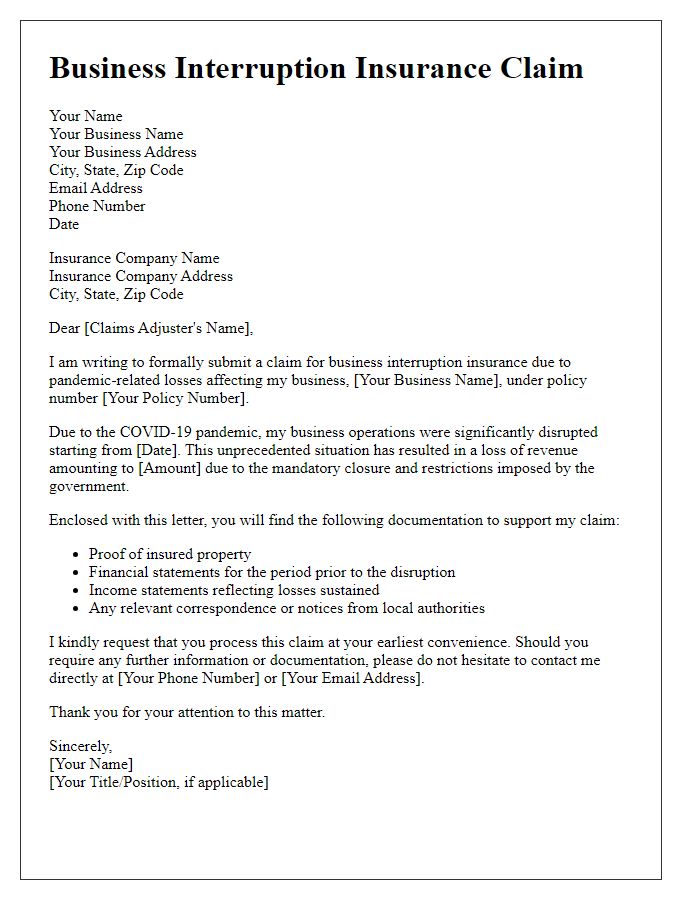

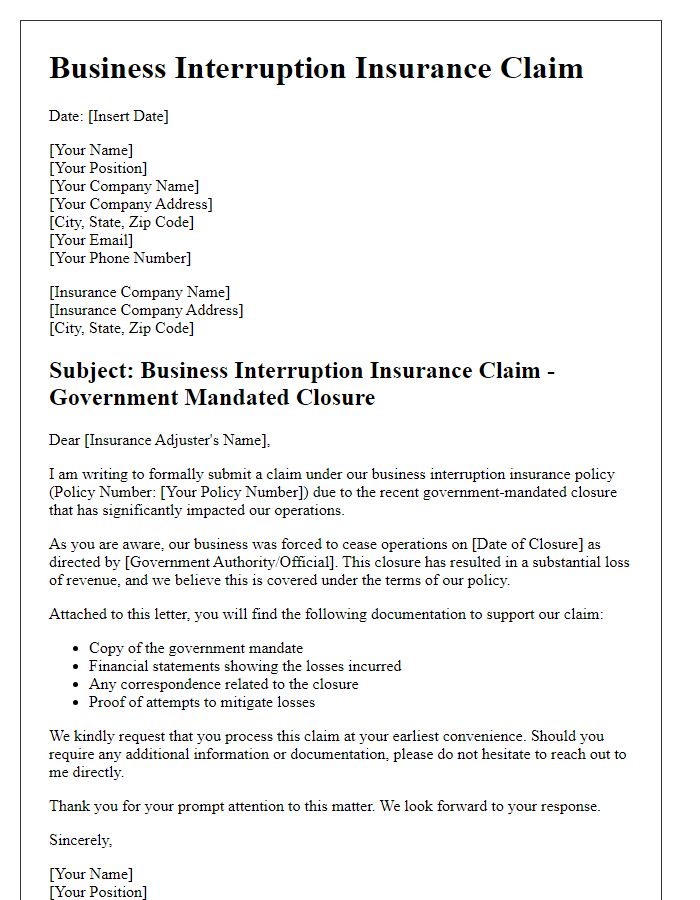

Letter template of business interruption insurance claim for pandemic-related losses.

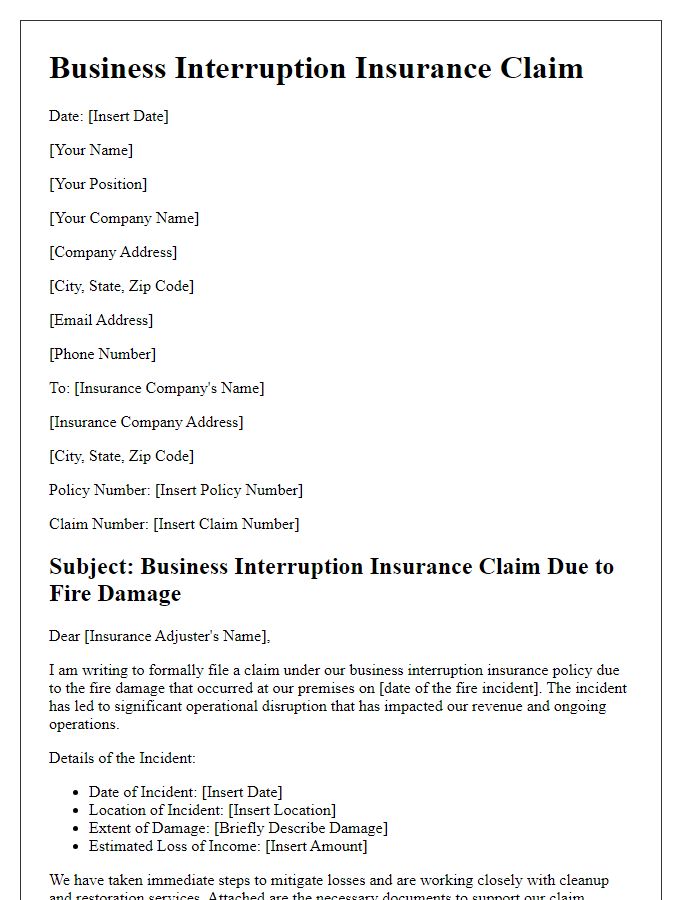

Letter template of business interruption insurance claim for fire damage.

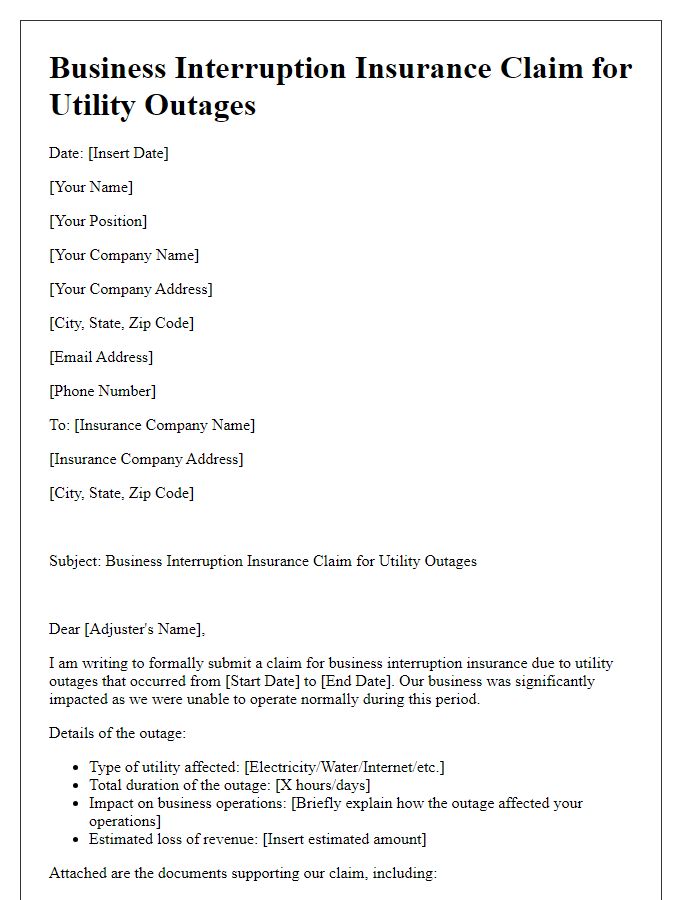

Letter template of business interruption insurance claim for utility outages.

Comments