Are you feeling overwhelmed by the process of filing an extended warranty insurance claim? You're not aloneâmany find it confusing and time-consuming. In this article, we'll break down the essential steps to help you navigate your claim smoothly and efficiently. So, grab a cup of coffee and let's dive into everything you need to know!

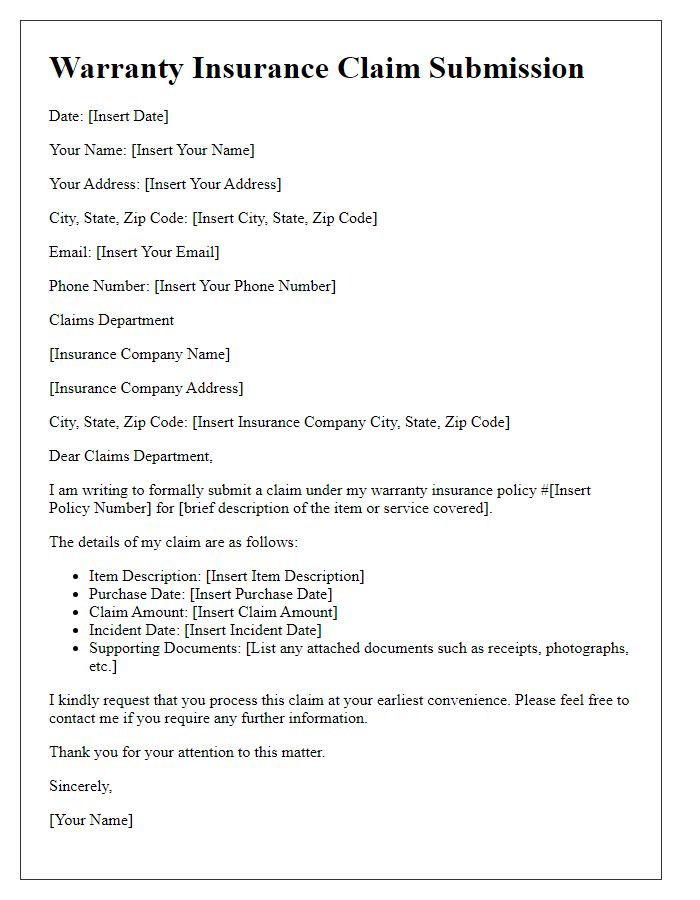

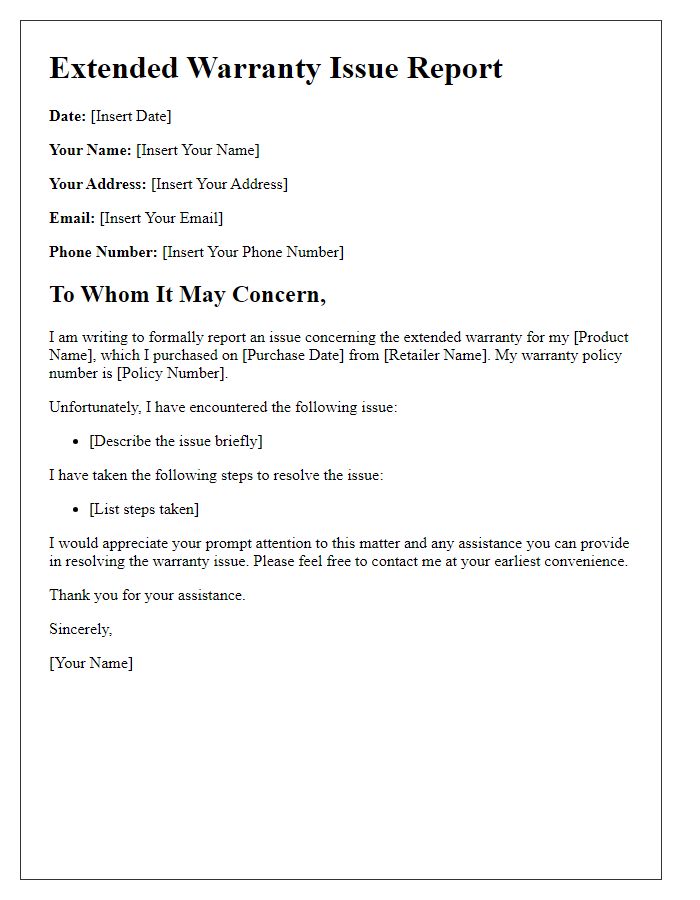

Policy details and personal information

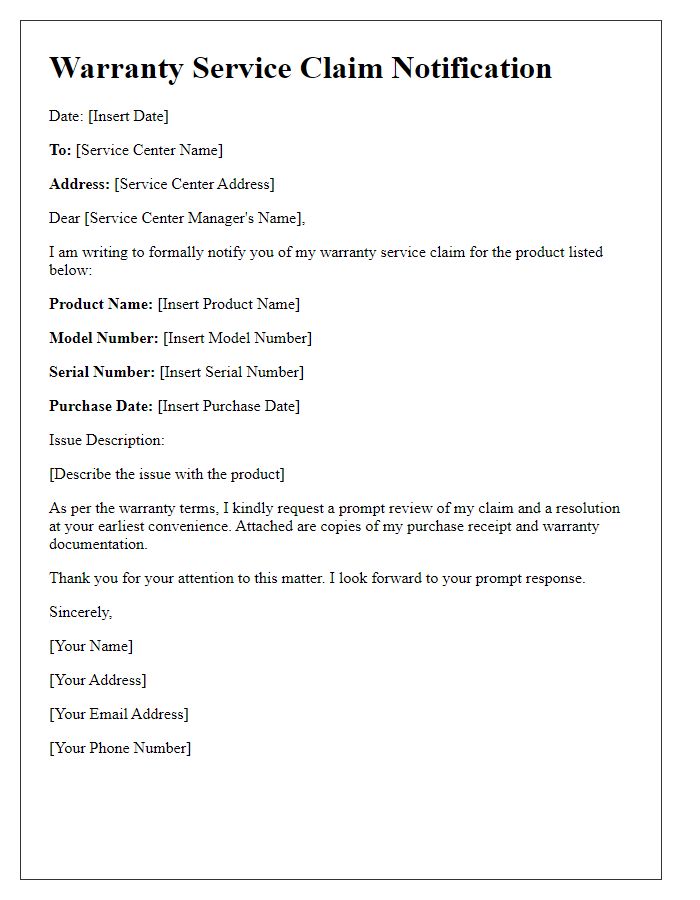

Extended warranty insurance claims require precise documentation to ensure a seamless process. Essential details include policy number, typically formatted as a string of alphanumeric characters relevant to the insurance provider, and the claimant's full name as listed on the policy. Include contact information such as telephone number and email address for communication purposes. Additionally, the description of the insured item, including model number and purchase date, is crucial for the claim. Provide information about the specific issue or defect, referencing warranty terms to substantiate eligibility for the claim. Time sensitivity matters; adhering to deadlines outlined in policy agreements can significantly impact outcome.

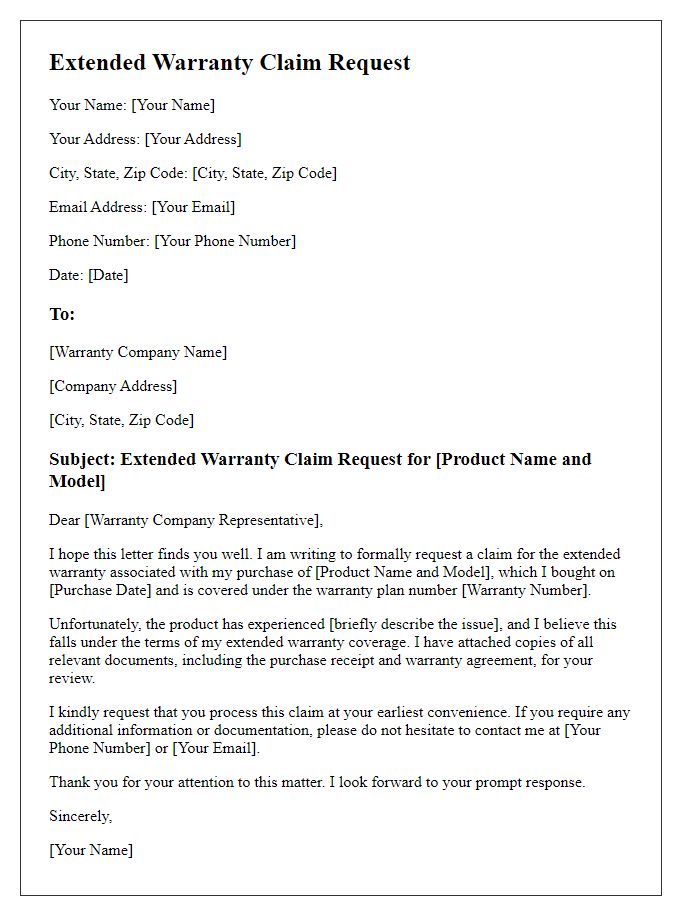

Description of the issue or defect

A malfunctioning dishwasher can lead to inefficient cleaning cycles and water leakage, affecting both performance and household convenience. Common issues include faulty drain pumps (which can lead to standing water), malfunctioning heating elements (causing poor drying), and broken door seals (resulting in leaks). The appliance may also exhibit error codes such as E1 or E2, indicating specific electrical or mechanical failures. These problems can significantly disrupt daily routines, particularly in households heavily reliant on this essential kitchen equipment. Regular maintenance and timely repair under a warranty can prevent escalation of damage and ensure optimal operation of the appliance.

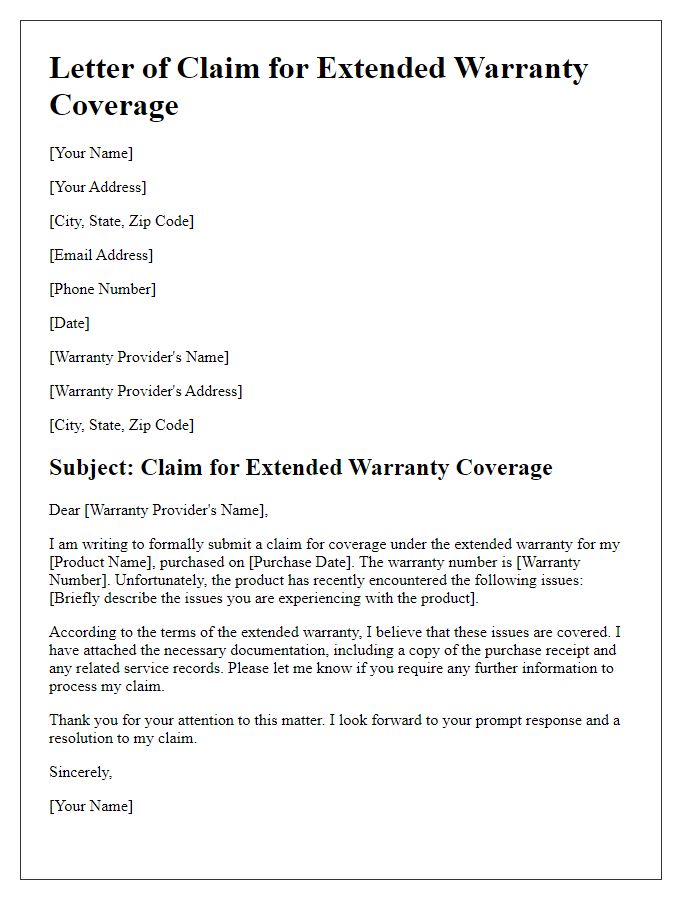

Documentation and evidence (receipts, photos, etc.)

When submitting a claim for an extended warranty insurance policy, it is essential to compile comprehensive documentation and evidence that supports your case. Key elements to include are detailed receipts that outline the original purchase, including the date and point of sale, which is often critical for verifying warranty terms. Photographic evidence depicting the product's condition and any defects needs to be clear and well-lit, capturing specific issues while also showcasing the product's serial number or model information. Additionally, include any prior correspondence with customer service representatives or technicians that may illustrate efforts to resolve the issue before filing your claim. Ideally, all documents should be organized chronologically to ensure clarity and ease in processing your insurance claim.

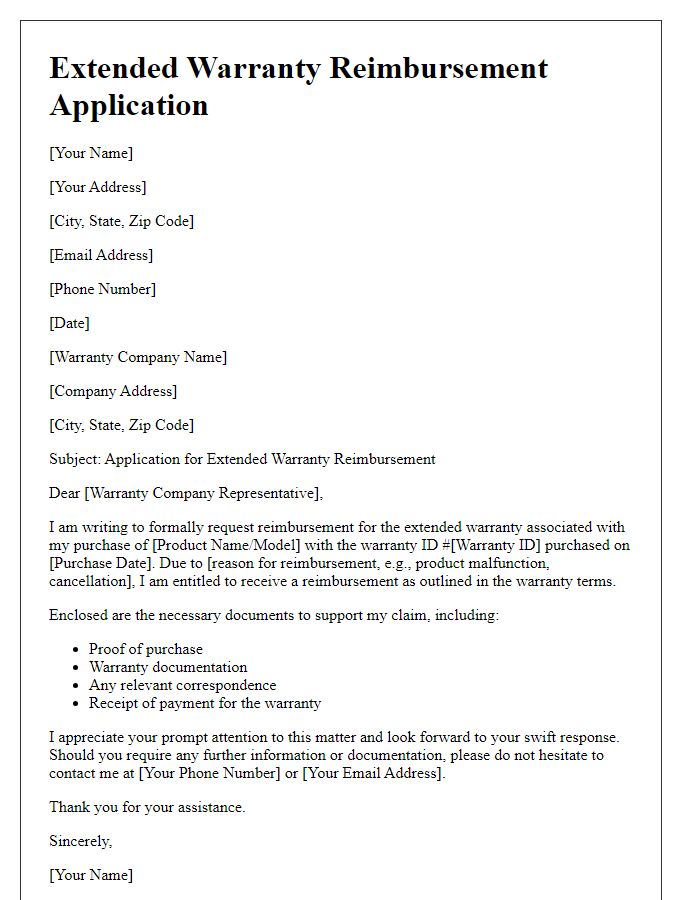

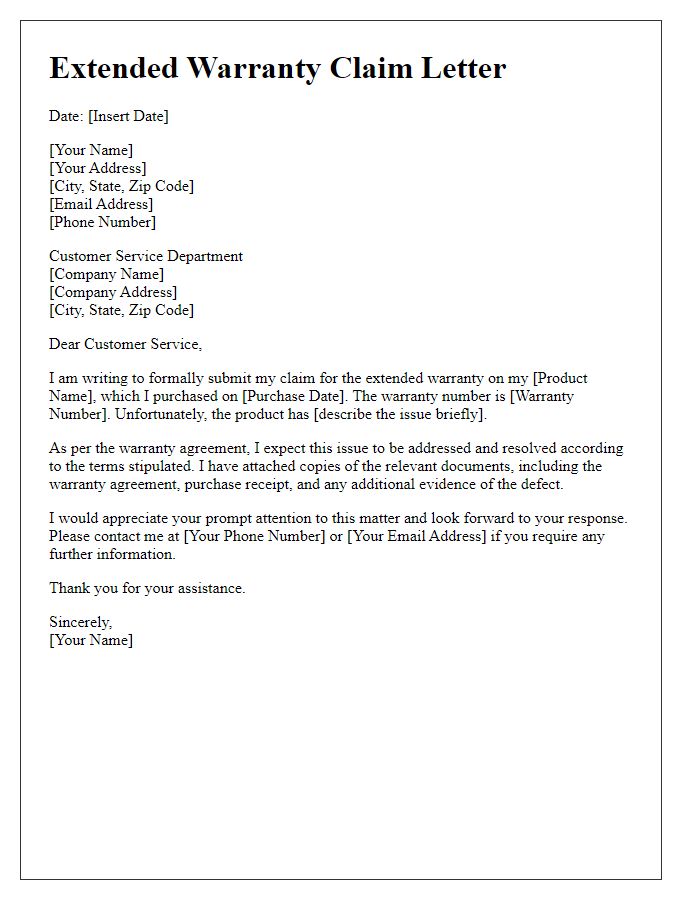

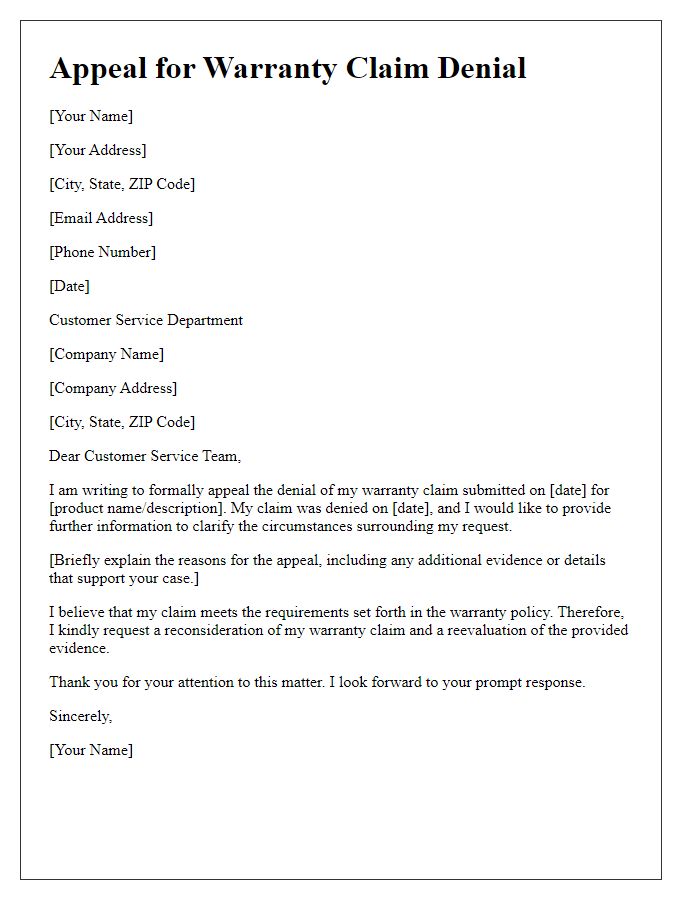

Request for specific action or resolution

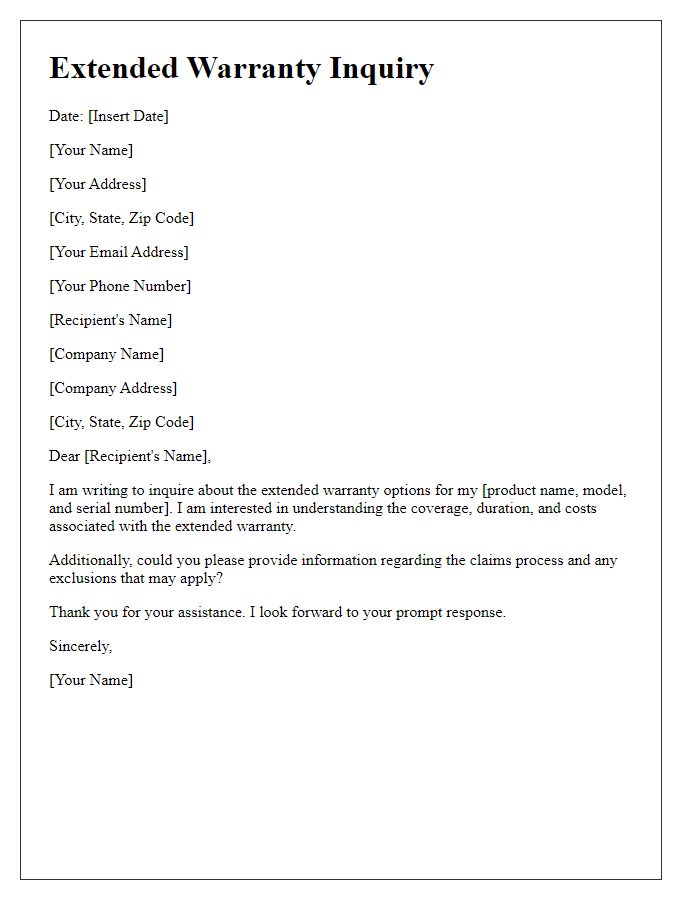

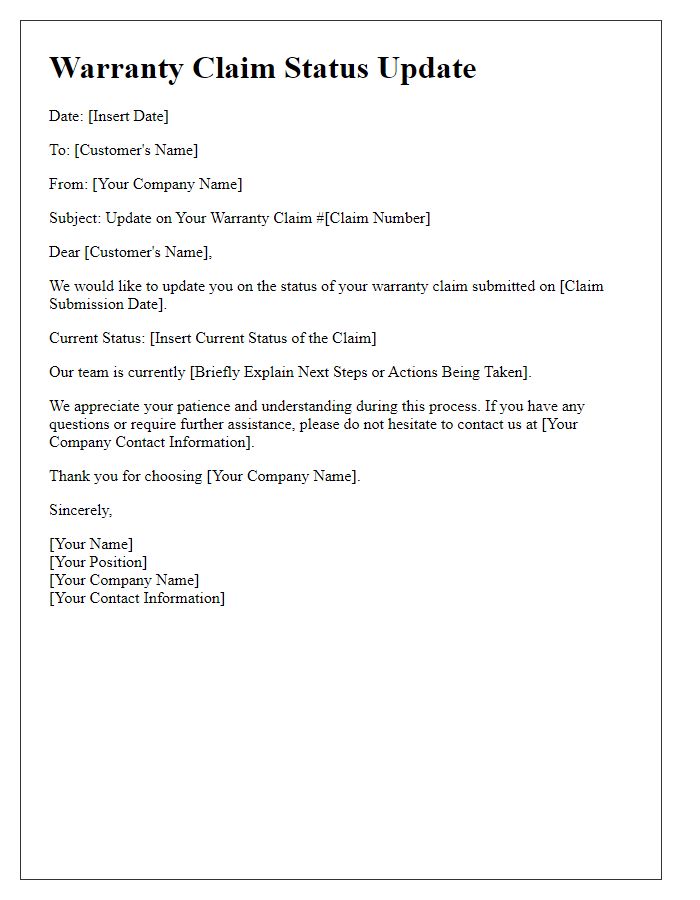

Inadequate communication regarding extended warranty insurance claims can lead to dissatisfaction among customers. Claims submitted for vehicle breakdowns, such as those under the Extended Vehicle Protection Plan, often experience delayed responses, resulting in frustration. Clear guidelines stating processing times, typically up to 30 days, can alleviate concerns, while specific resolution pathways must be accurately documented. Essential contact information for claims assistance, including customer service hotlines and email addresses, ensures that customers can pursue resolutions effectively. Additionally, maintaining thorough documentation of all interactions related to claims, such as dates, representatives spoken with, and claim numbers, is crucial for a streamlined resolution process.

Contact information and preferred communication method

Extended warranty insurance claims require clear communication to ensure efficient processing. Contact information, including first name, last name, phone number, and email address, must be accurately provided. Preferred communication method, whether through telephone, email, or traditional mail, should be specified for updates regarding the claim. Also, reference any policy numbers associated with the warranty to facilitate a smooth claims process. Timely responses from the insurance provider improve customer satisfaction and expedite resolution.

Comments