Updating your policyholder information can often feel like a daunting task, but it doesn't have to be! Whether you've moved to a new address, changed your contact details, or simply want to ensure that everything is up to date, we've got you covered. It's essential to keep your information current to receive timely communications and avoid any potential hiccups in your coverage. So, if you're ready to learn how to easily update your details, stick around to explore our comprehensive guide!

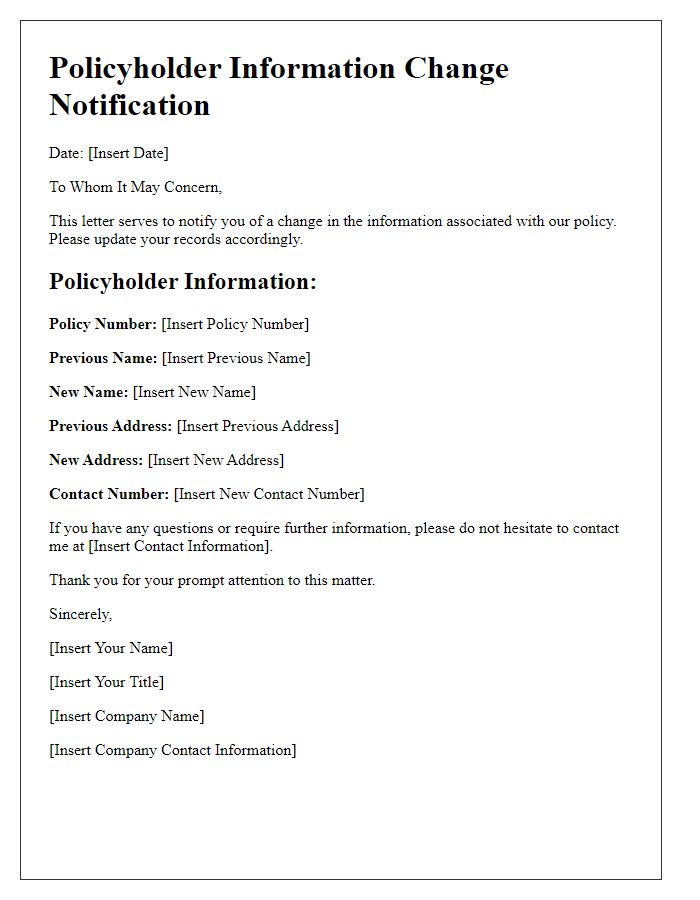

Personalization and Addressing the Policyholder

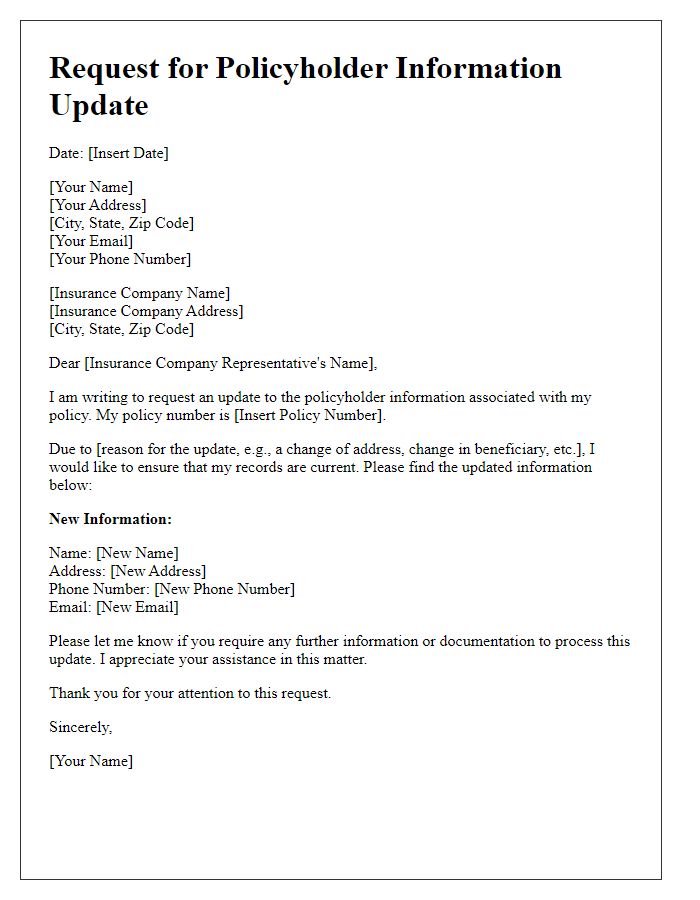

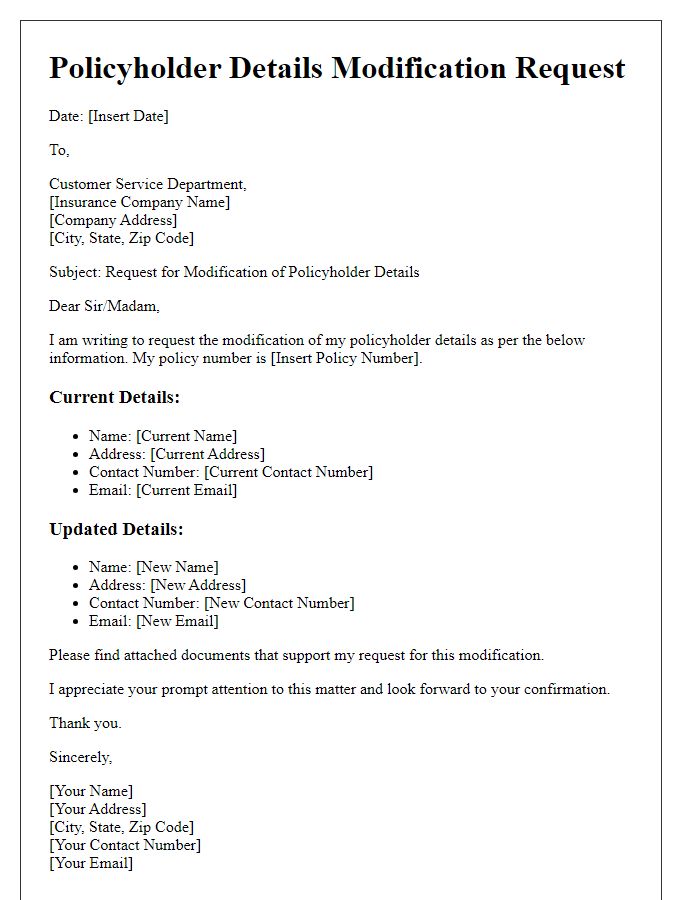

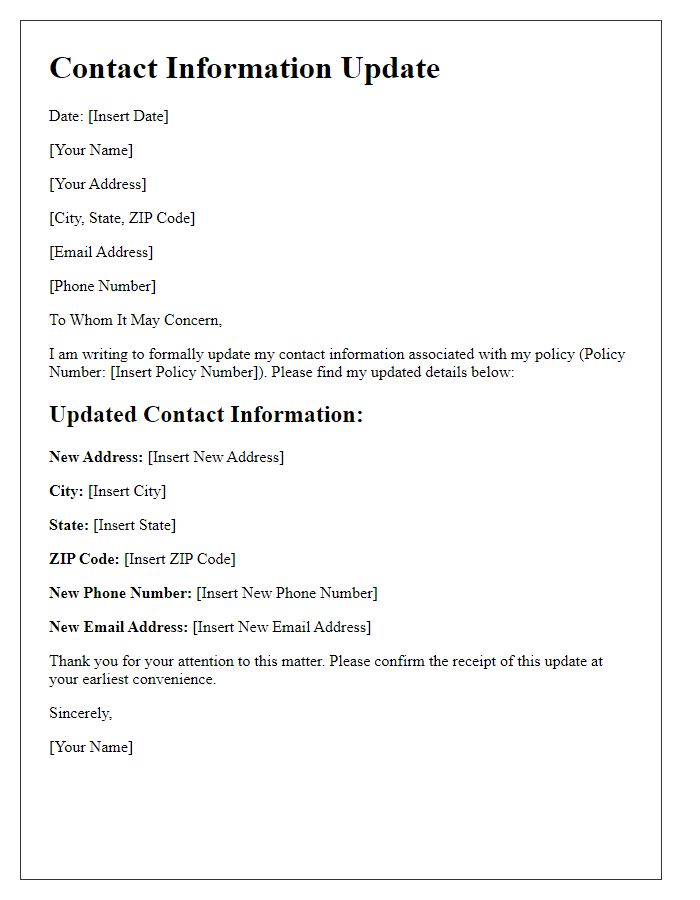

Policyholder information updates are essential for ensuring accurate communication between insurance providers and clients. A personalized greeting is crucial, with the policyholder's full name (first and last) prominently displayed, fostering a sense of individual attention. Addressing the policyholder with their preferred title (Mr., Ms., Dr., etc.) further promotes a respectful tone. The letter should include a concise statement regarding the purpose of the correspondence, such as updating contact information, beneficiary details, or coverage preferences. Additionally, the policy number, unique to each policyholder, should be included for reference, along with a detailed list of the specific changes requested. Clear instructions for updating information, possibly including a dedicated phone number or email address, will facilitate the process. Lastly, a warm closing to encourage further communication, coupled with a signature from a relevant representative (such as a customer service manager), will enhance the letter's overall effectiveness.

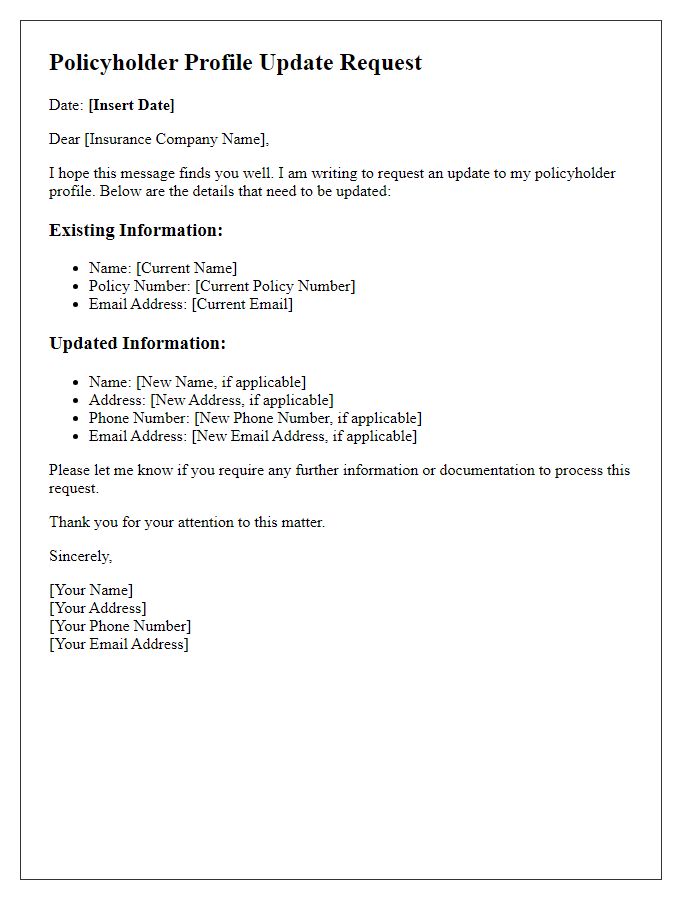

Clear Explanation of Update Purpose

Updating policyholder information enhances communication between the insurance provider and customers. Accurate data ensures timely notifications regarding policy changes or claims processes. For instance, an updated address allows the insurer to send important documents and renewal reminders directly to the policyholder's residence. Additionally, maintaining current phone numbers enables prompt delivery of claims assistance in emergencies. This attention to detail supports customer satisfaction and strengthens the overall relationship between the insurer and the insured. Regular updates, ideally reviewed annually or upon any significant life change, foster transparency and trust in the insurance process.

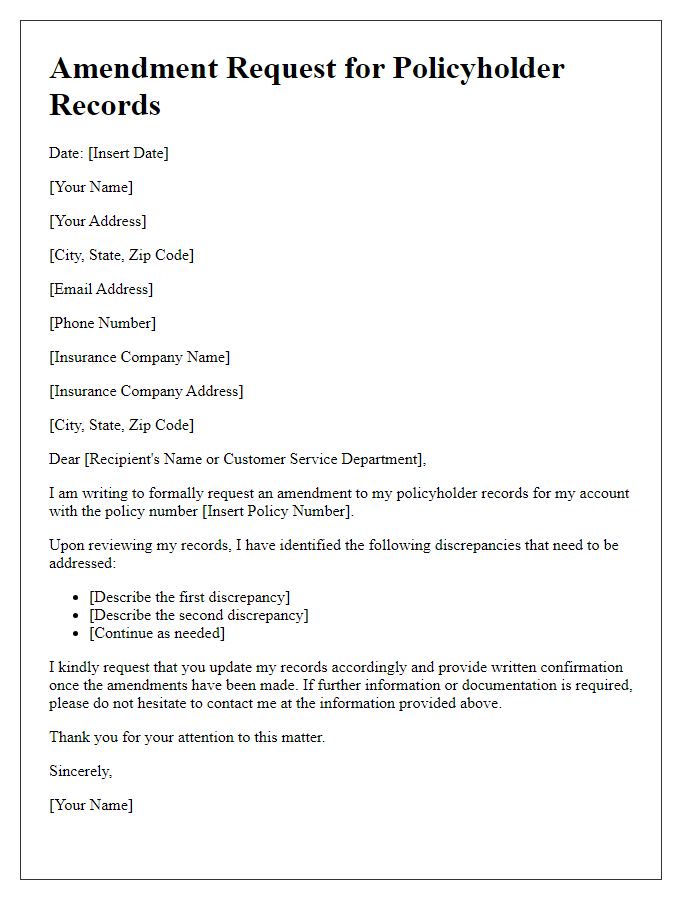

List of Required Information and Documents

Updating policyholder information ensures accurate records and effective communication for insurance providers. Required information typically includes the policyholder's full name, residential address including the postal code, phone number, and email address. Additional documentation may consist of a government-issued ID to verify identity, proof of residence such as utility bills or lease agreements, and any legal documents such as marriage certificates for name changes. Furthermore, any changes in beneficiary designations must be accompanied by relevant forms or declarations to maintain compliance with the insurance policy stipulations. Keeping this information current protects both the policyholder and the insurance company from potential discrepancies.

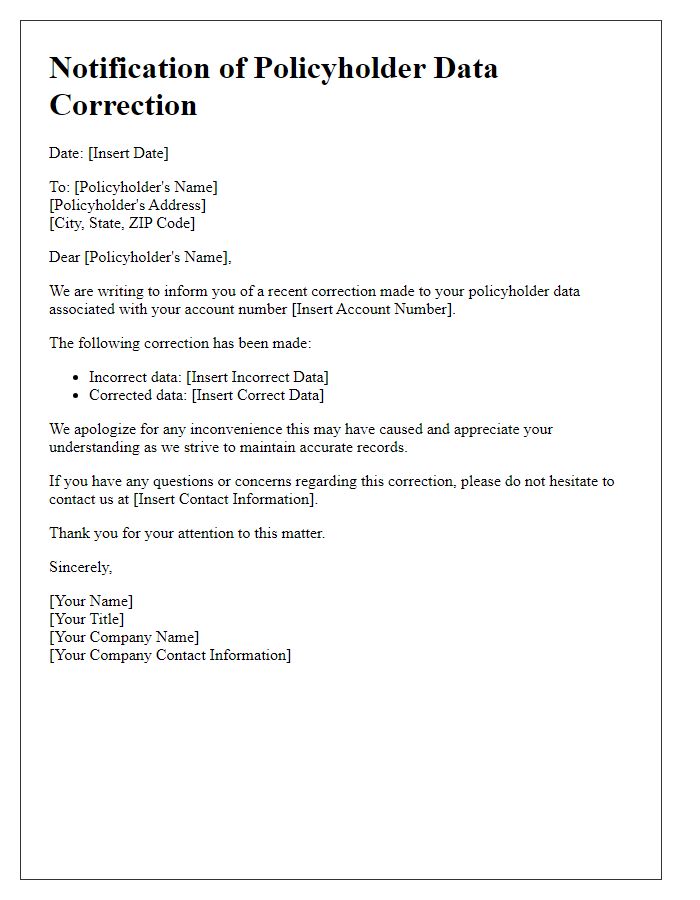

Deadline or Timeframe for Submission

Updating policyholder information is crucial for maintaining accurate records and ensuring effective communication regarding insurance policies. Typically, insurance companies set deadlines (ranging from 30 to 60 days) for policyholders to submit any updates. Important information may include changes in personal details such as address, phone number, or beneficiary information. Timely submission of this data (preferably via online portals or designated forms) assists in avoiding potential coverage issues. Policyholders should always be aware of their insurance provider's specific timeframe to ensure uninterrupted service and accessibility to benefits during claims processing.

Contact Information for Assistance and Queries

Updating policyholder information is essential for accurate communication regarding insurance coverage. Policyholders, such as individuals having plans with major insurance companies like State Farm or Allstate, must provide current contact details. Incorrect information can lead to missed notifications about policy changes, premium payments, and claims processing. Typically, a dedicated customer service hotline (available during business hours) allows policyholders to speak directly with representatives for assistance. Online portals may also facilitate easy updates, enabling policyholders to manage their information securely. This process ensures that vital updates on policy terms or payment reminders reach the insured promptly, maintaining effective engagement throughout the policy period.

Comments