Are you in need of a copy of your insurance policy but unsure how to ask for it? Writing a request letter can feel daunting, but it doesn't have to be! In this article, we'll break down the essentials of crafting a clear and polite letter to your insurance provider. Let's dive in and explore how you can effectively get that important document you need!

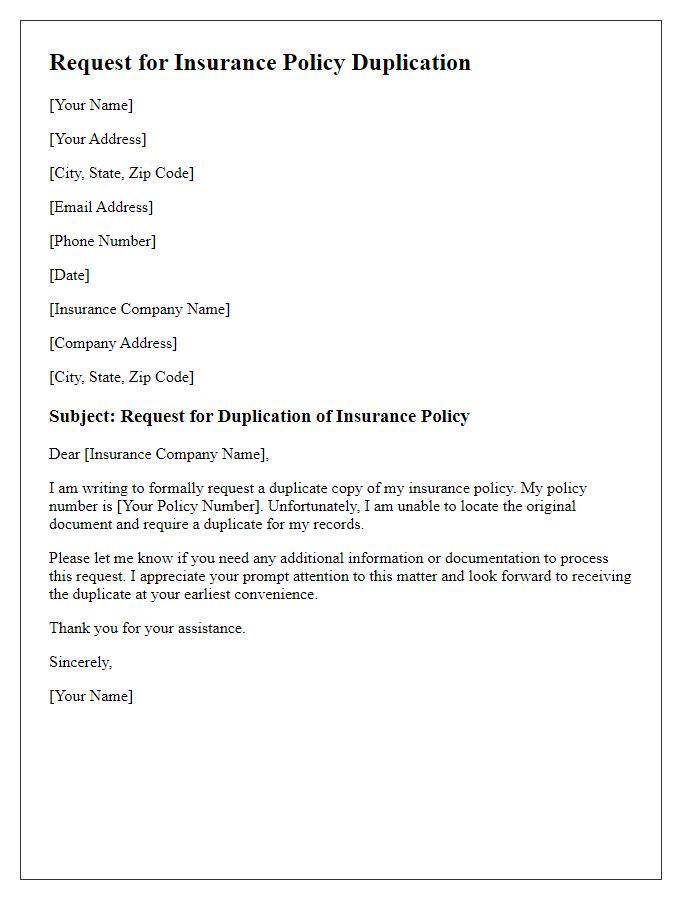

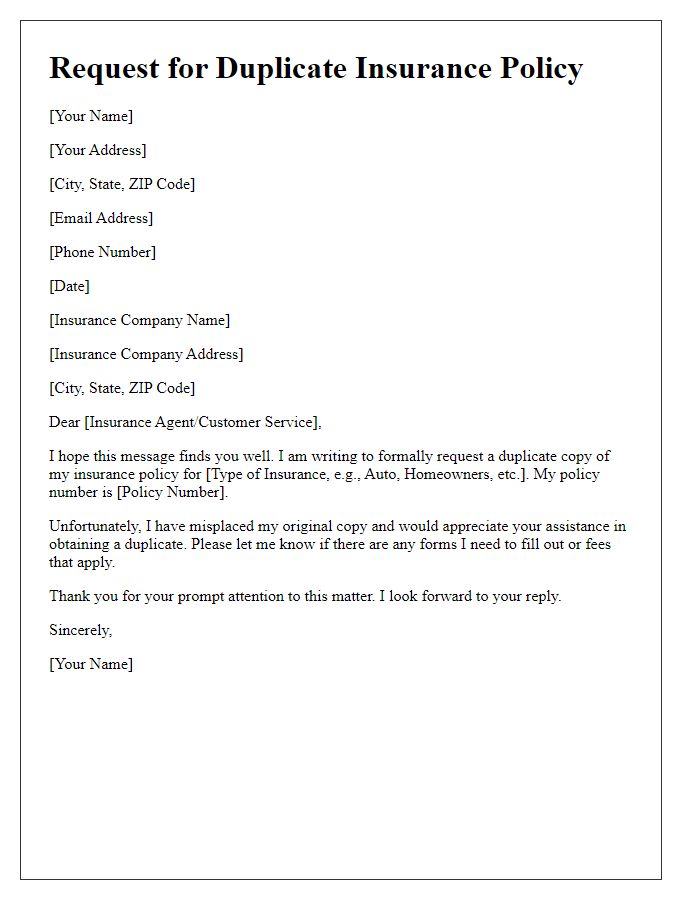

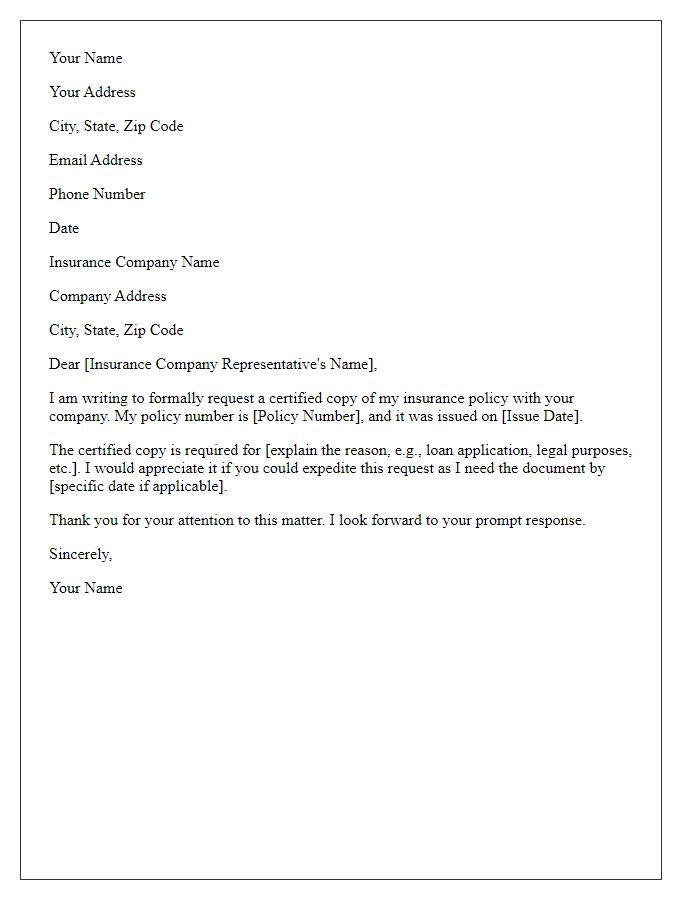

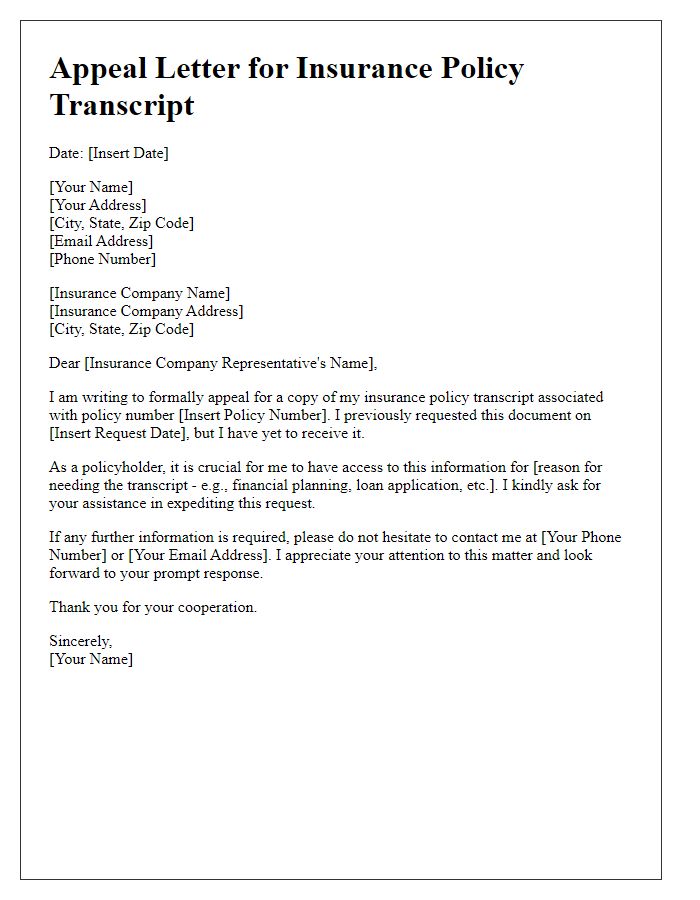

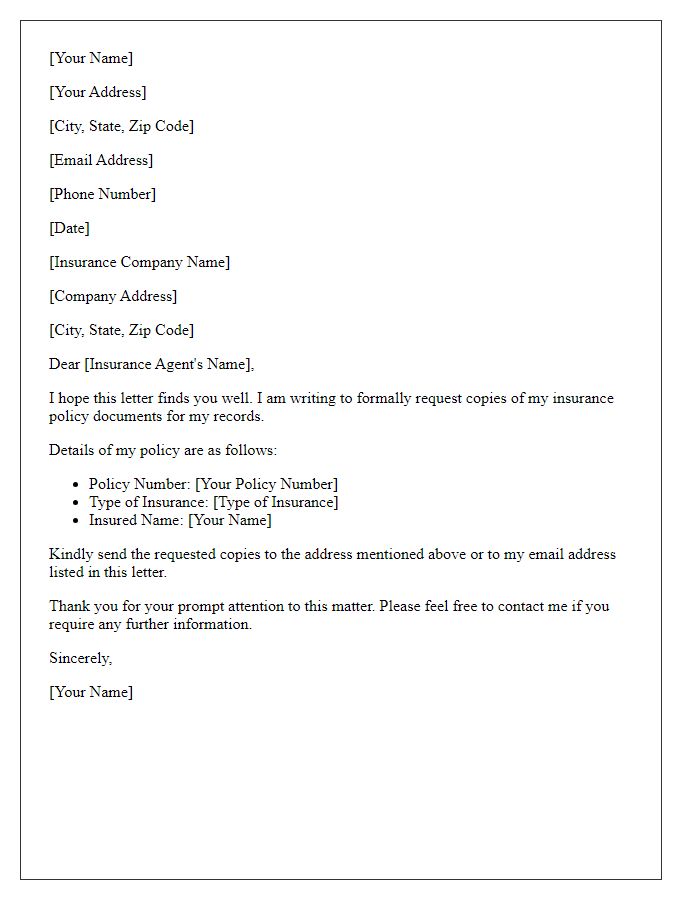

Recipient Information

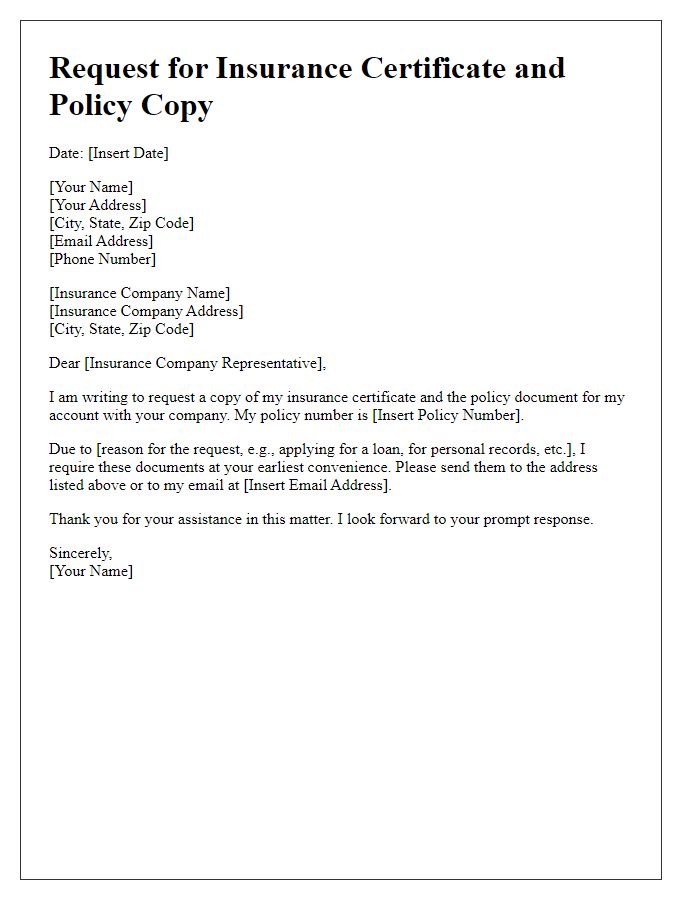

Obtaining a copy of an insurance policy is essential for individuals managing their financial health. Policyholders often find themselves in situations where they need to reference vital details within the document. Insurers like Allstate or State Farm typically maintain records of policy numbers, coverage limits, and beneficiaries. A policy copy may include important dates such as the start of coverage (commonly referred to as the effective date) and expiration or renewal terms. Additionally, having access to a physical or digital copy facilitates timely claims processing in situations like accidents or property damage. Policyholders are encouraged to contact their insurance representatives directly for assistance and verification of personal information when requesting a policy copy.

Policyholder Details

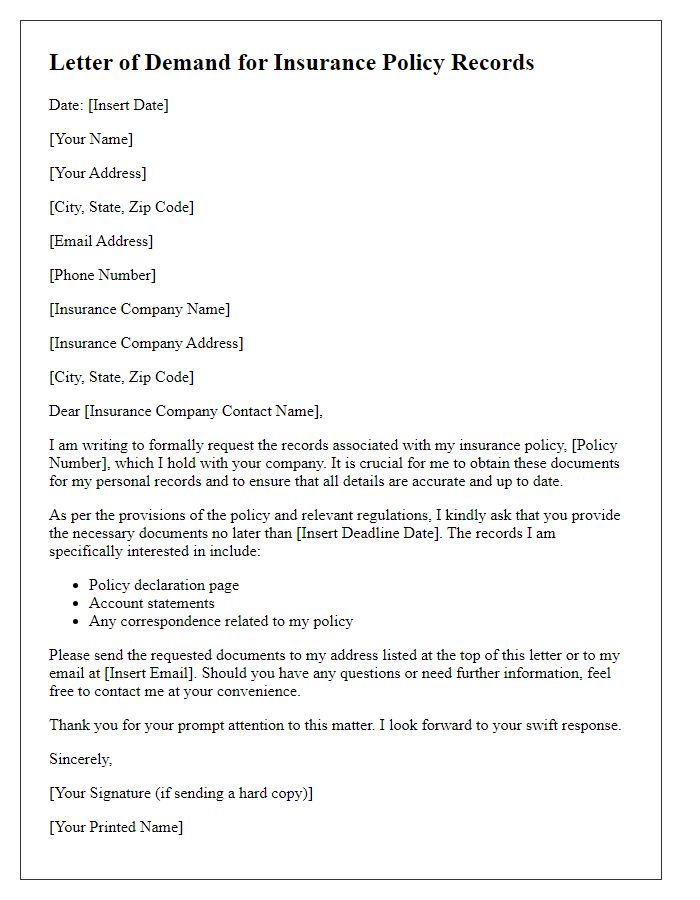

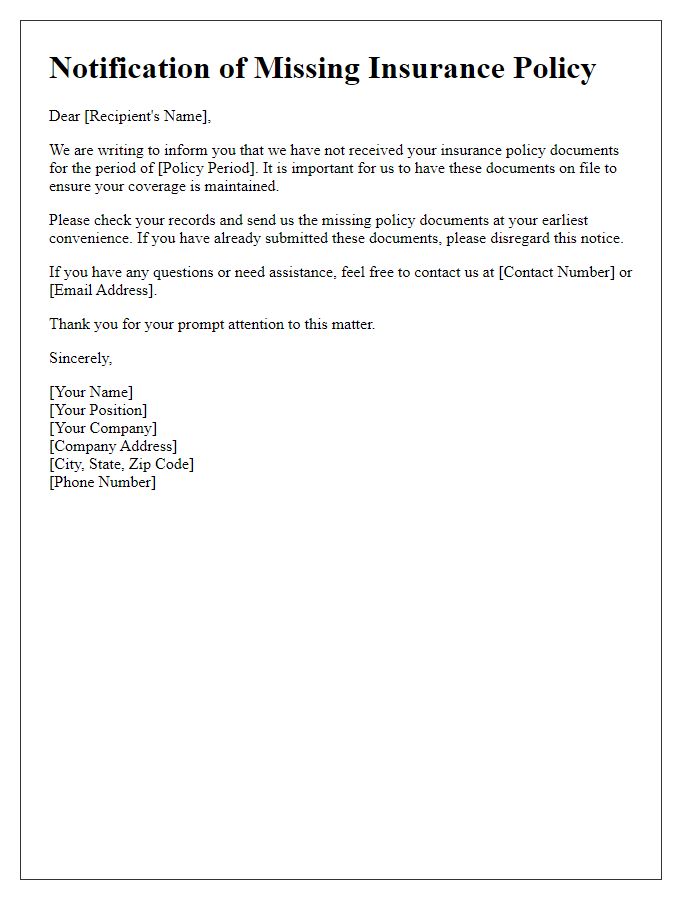

Policyholders often require copies of their insurance policies for various reasons, such as filing claims or understanding coverage details. Insurance companies maintain records related to individual policies, including policy numbers, effective dates, and types of coverage. A request for a policy copy typically includes essential details such as the policyholder's full name, contact information, and the specific policy number associated with the request. Additionally, including details about the reason for the request and any time constraints can expedite the process. It is essential to ensure that the request is sent to the correct department or representative within the insurance company to facilitate a prompt response.

Policy Number

Requesting a copy of an insurance policy is essential for policyholders to have easy access to important information. Policy Number serves as a unique identifier associated with the specific insurance agreement, making it critical to include in any communication with the insurance provider. Many insurance companies, located in various regions, require the policyholder's name alongside the policy number to process the request efficiently. The timeframe for receiving a copy may vary, typically ranging from a few days to several weeks, depending on the issuer's internal processes. Understanding the terms and conditions outlined in the policy can significantly impact coverage and claims, underscoring the importance of obtaining the documented agreement promptly.

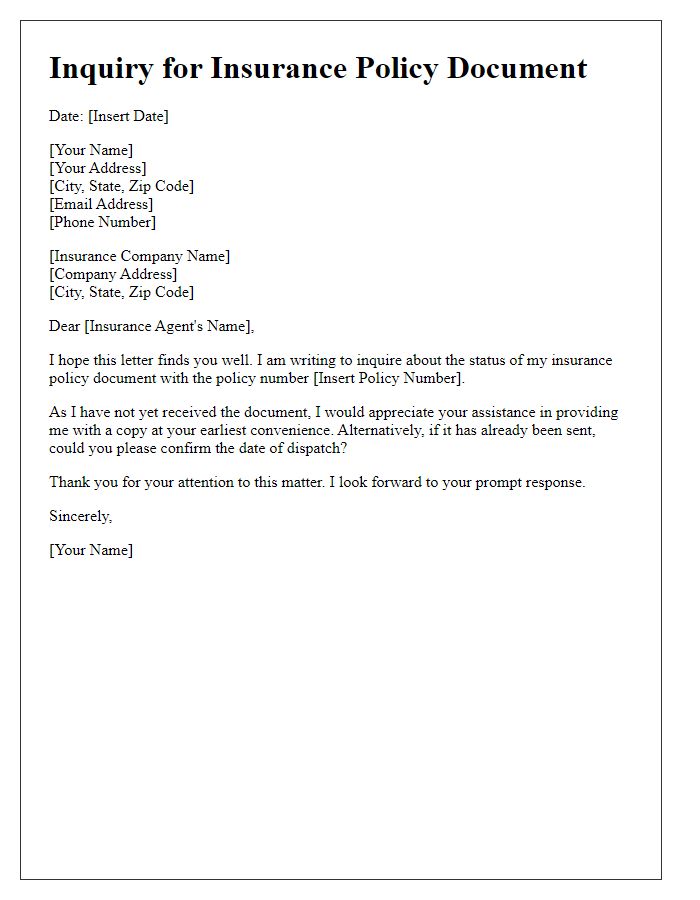

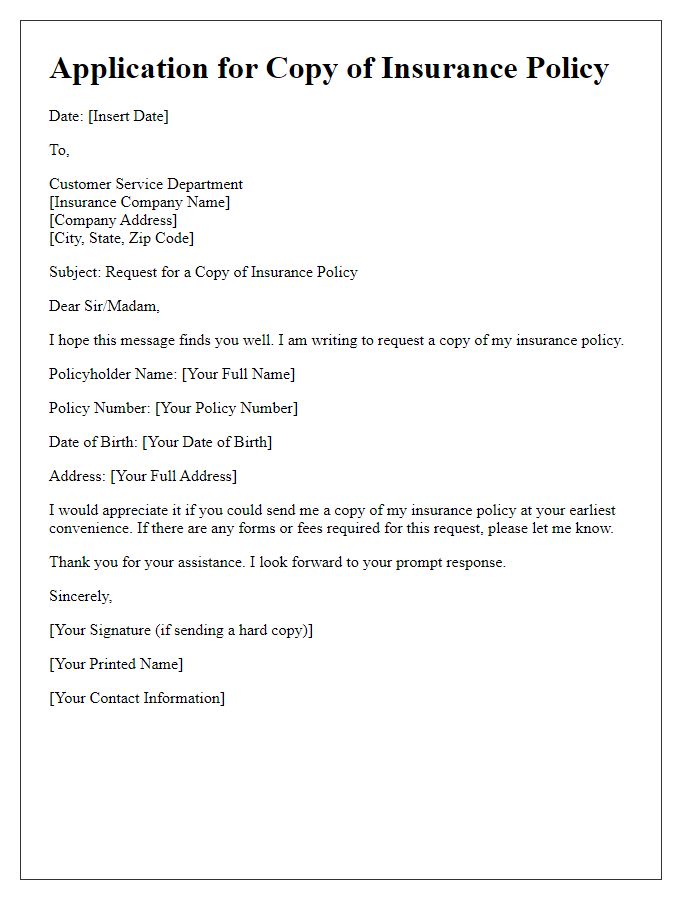

Request Details

Individuals seeking a copy of their insurance policy often need to contact their insurance provider directly, such as Allstate or State Farm. This request usually requires personal identification details like policy number, full name, and date of birth to verify identity. The policy copy serves as crucial documentation for understanding coverage terms and conditions, premiums, and claims processes. Clients can submit requests usually via email, customer service hotline, or online portal, depending on the company's available services. Retrieval of policy copies may also entail a processing time ranging from a few hours to several business days, influenced by company policies and specific situations.

Contact Information

When requesting a copy of an insurance policy, it is important to include relevant information for swift processing. Provide your full name (e.g., John Doe), policy number (e.g., 123456789), and contact details like phone number (e.g., (555) 123-4567) and email address (e.g., john.doe@example.com). Specify the type of insurance (e.g., health, auto) and the issuing company (e.g., ABC Insurance Company) to ensure clarity. Include a request statement such as "Please send me a copy of my insurance policy," along with a preferred method for receiving the document (e.g., email or postal mail). This detailed and clear approach facilitates a faster response from the insurance provider.

Comments