Are you considering increasing your insurance coverage? Navigating the world of insurance can sometimes feel overwhelming, but it's essential to ensure that you and your assets are adequately protected. Whether you're facing new life changes or simply want peace of mind, increasing your coverage can be a smart move. Join me as we explore the key factors to consider when requesting a coverage increase, and discover how to craft the perfect letter to your insurance provider.

Personal Information

Insurance policyholders often seek an increase in their coverage to ensure comprehensive protection against unforeseen events. Factors such as inflation, evolving personal circumstances, and changing market conditions can necessitate this adjustment. For instance, individuals residing in areas prone to natural disasters like hurricanes or earthquakes may require enhanced home insurance. Similarly, car owners with significant life changes, such as acquiring a new vehicle or relocating to urban environments, might need to reassess their auto insurance limits. Financial institutions like State Farm or Allstate encourage regular policy reviews to align with current needs. Noteworthy is the trend for homeowners to increase liability coverage, which can range from $300,000 to $1 million, to protect against lawsuits stemming from accidents on their property. Consulting with an insurance agent can facilitate this process, ensuring that policyholders obtain the appropriate coverage tailored to their evolving situations.

Policy Details

Increased insurance coverage can provide enhanced financial protection for valuable assets such as home properties, vehicles, or health services. Specific policy details should include the current coverage limits in USD ($100,000 for home insurance), deductible amounts (e.g., $1,000), and types of coverage (e.g., comprehensive coverage, liability coverage) offered. Key entities such as the insurance provider, for example, State Farm or Geico, often require updated assessments of the insured items to establish fair value. Furthermore, changes in local market value, such as increased real estate prices in regions like San Francisco or New York City, may necessitate adjustments to coverage limits. It is advisable for policyholders to review their current terms annually or after significant life changes, such as renovations or vehicle purchases, to ensure adequate protection against unforeseen events.

Reason for Coverage Increase

In recent years, the value of residential properties, particularly in urban areas like San Francisco, has increased dramatically, with averages rising by around 20% annually. Rising construction costs, exemplified by material price hikes (often exceeding 10% year-on-year), have also contributed to the necessity for increased coverage. Additionally, natural disasters, such as wildfires in California, have been more frequent, underscoring the importance of comprehensive insurance that can cover rebuilding costs that can reach hundreds of thousands of dollars. Safeguarding against these risks requires an adjustment in coverage limits to ensure adequate financial protection. Regular policy reviews highlight these shifts in the economic landscape and reinforce the need for updates to insurance coverage limits accordingly.

Desired Coverage Amount

To effectively increase insurance coverage, assessing current policies is crucial. For instance, a homeowner may consider elevating dwelling coverage to match the current market value of the property, potentially exceeding $300,000 in areas prone to natural disasters, such as hurricane zones in Florida. Additionally, personal property coverage should reflect the actual value of possessions, with many households accumulating over $50,000 in electronics and furnishings. Liability limits are also important; raising coverage to at least $500,000 can safeguard against lawsuits resulting from accidents occurring on the premises, particularly in densely populated regions like New York City. Increasing coverage seeks to ensure comprehensive protection against financial loss and unexpected events.

Contact Information

Increasing insurance coverage can provide enhanced financial protection and peace of mind. Policyholders should consider reviewing their current coverage limits, particularly in areas like property, health, and liability insurance. For instance, a homeowner might want to increase coverage to match the current market value of their home in a region like San Francisco, where property prices have surged over 10% in the last year. Additionally, understanding personal circumstances, such as the recent addition of a new vehicle or changes in lifestyle, can guide adjustments in auto or health insurance. Key documents, including the insurance policy, assessment reports, and relevant financial records, should be organized for discussion with an insurance representative. This approach ensures sufficient coverage tailored to individual needs and reduces the risk of gaps during unforeseen events.

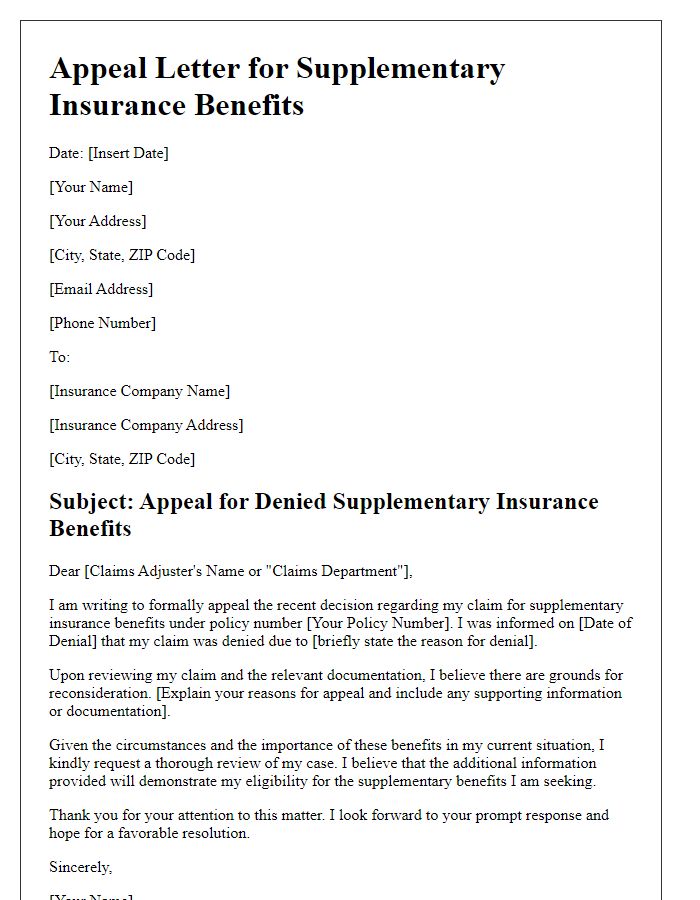

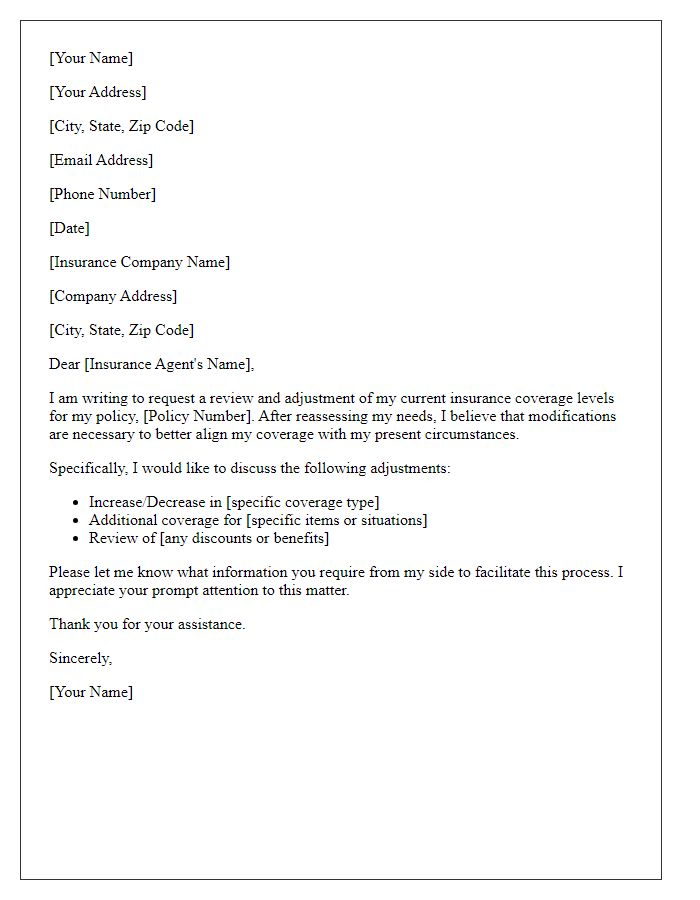

Letter Template For Insurance Coverage Increase Samples

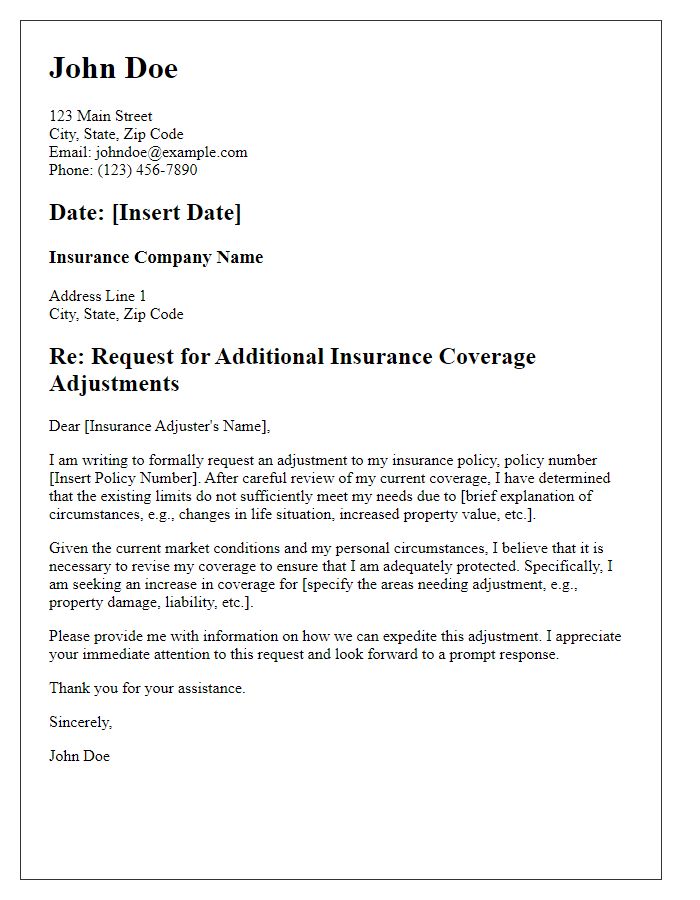

Letter template of demand for additional insurance coverage adjustments.

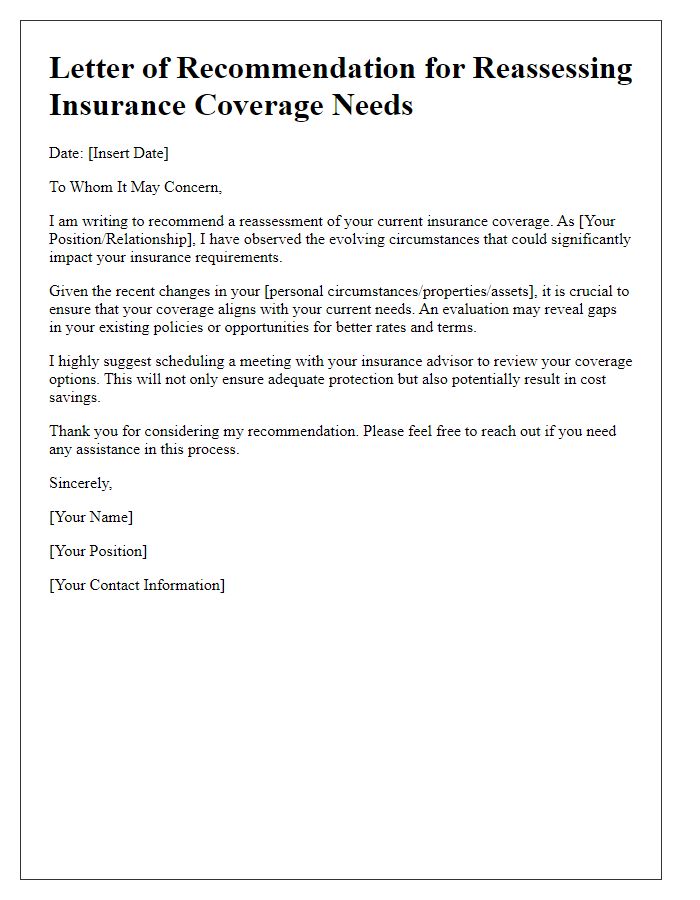

Letter template of recommendation for reassessing insurance coverage needs.

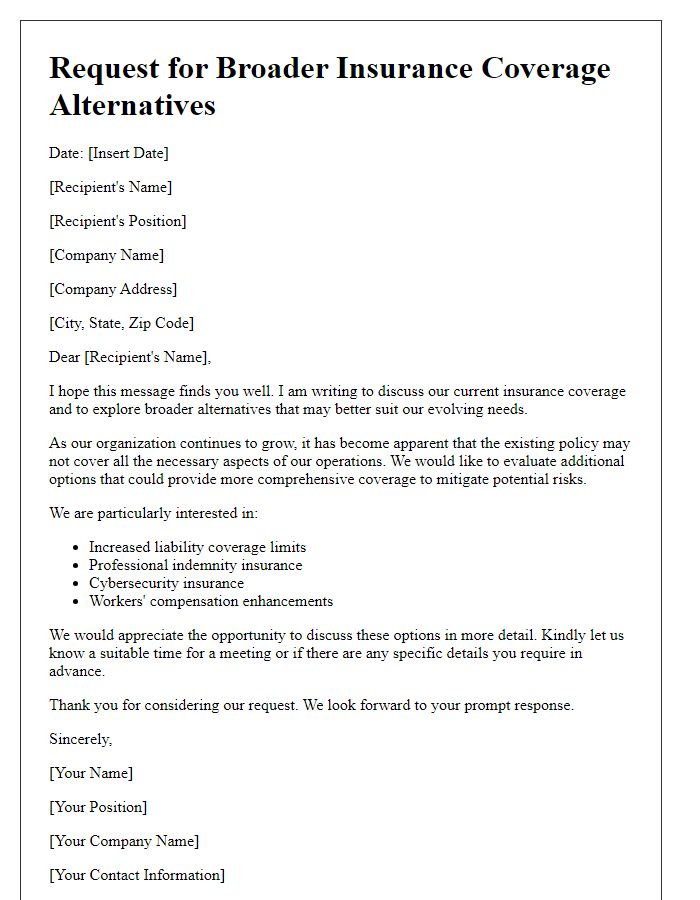

Letter template of solicitation for broader insurance coverage alternatives.

Comments