Welcome to our quick guide on crafting an effective insurance premium invoice letter! Sending a clear and professional invoice is essential for maintaining transparency and trust with your clients. In this article, we'll explore key components to include in your letter, tips for creating a polished layout, and how to communicate any changes in premium rates. Ready to streamline your invoicing process? Let's dive in!

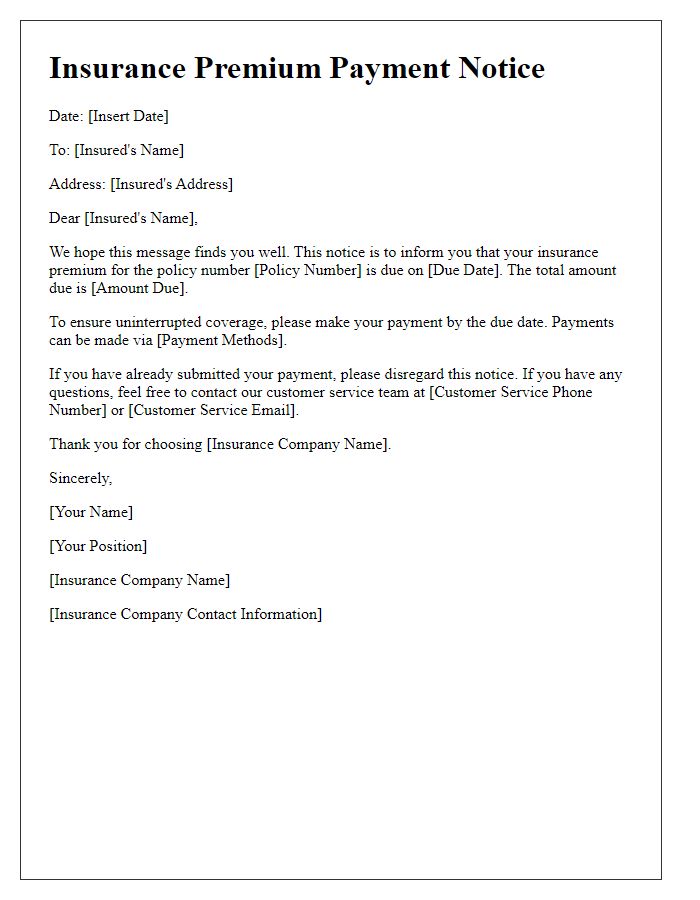

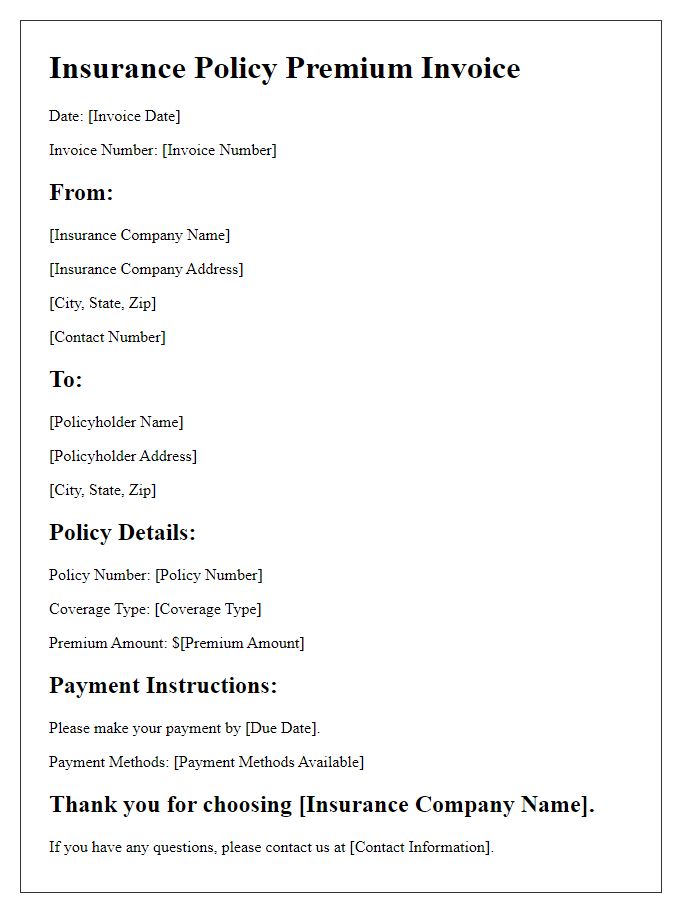

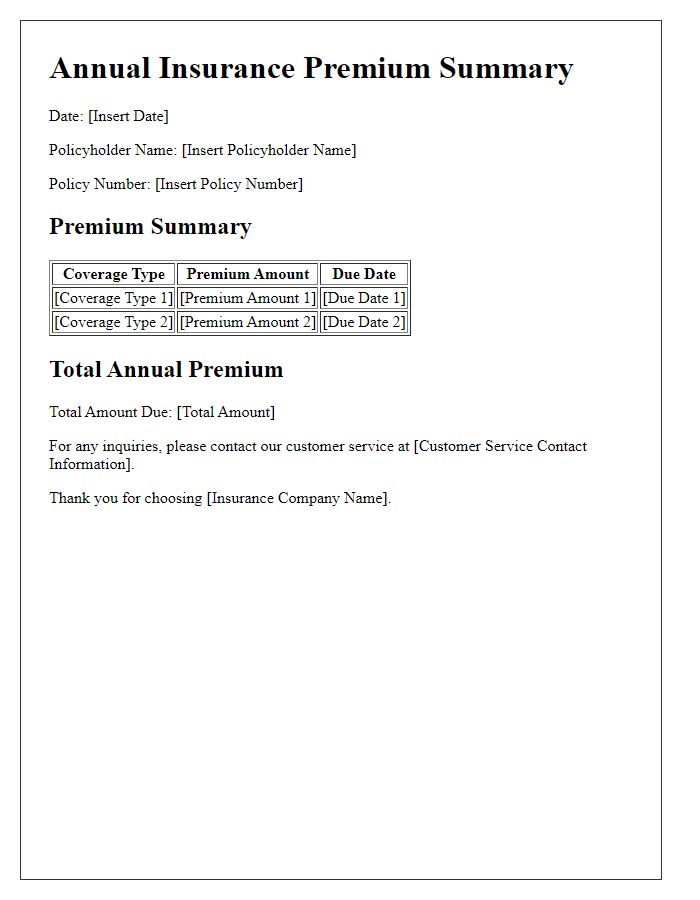

Policyholder Information

Insurance premium invoices typically include critical details such as the policyholder's name (John Smith), policy number (12345678), effective dates (January 1, 2023, to December 31, 2023), and premium amount ($1,200). Additional information may also encompass the type of policy (homeowners insurance) and the insurance provider (XYZ Insurance Company). Contact details, including the policyholder's address (123 Main St, Anytown, USA) and phone number (555-123-4567), are essential for communication purposes. Furthermore, payment instructions and due dates (January 15, 2023) complete the invoice, ensuring clarity and facilitating timely payment.

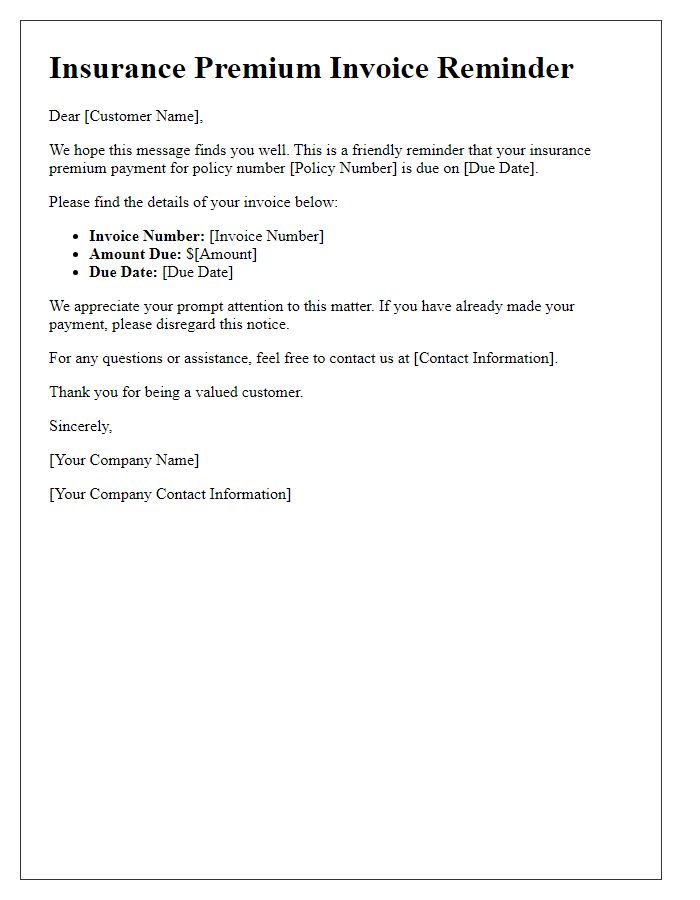

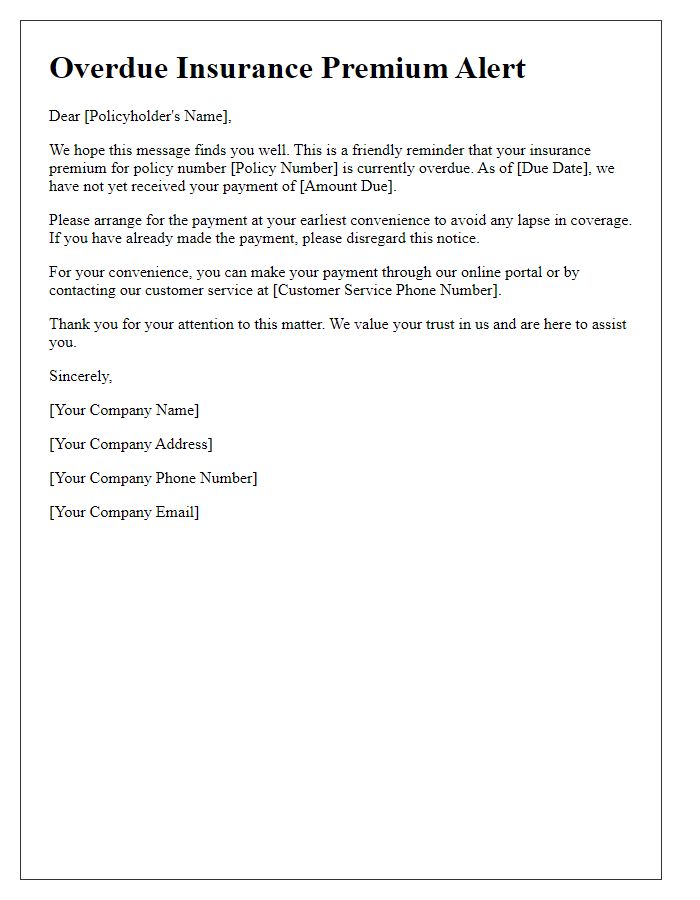

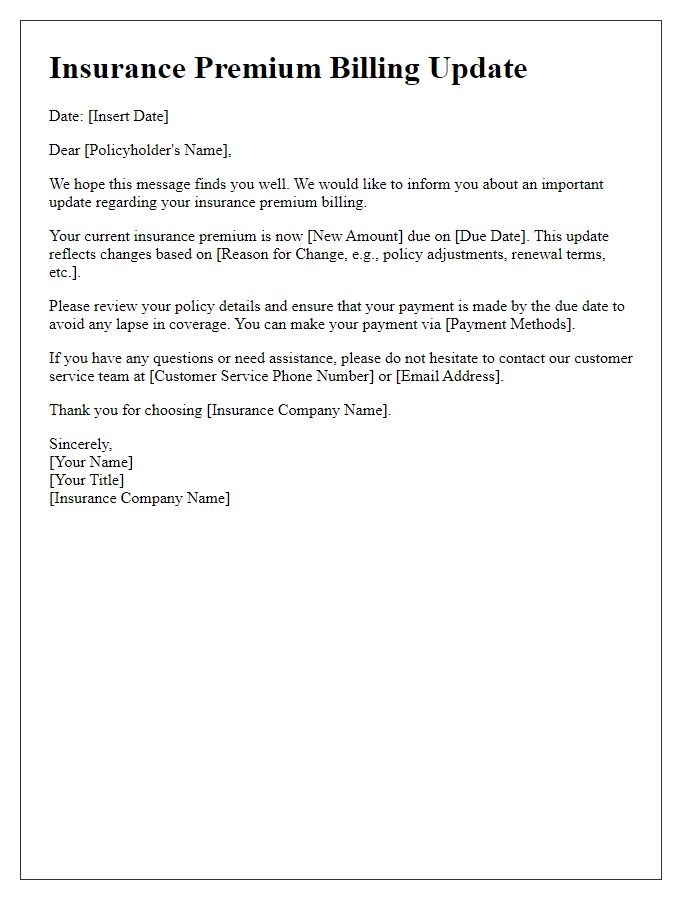

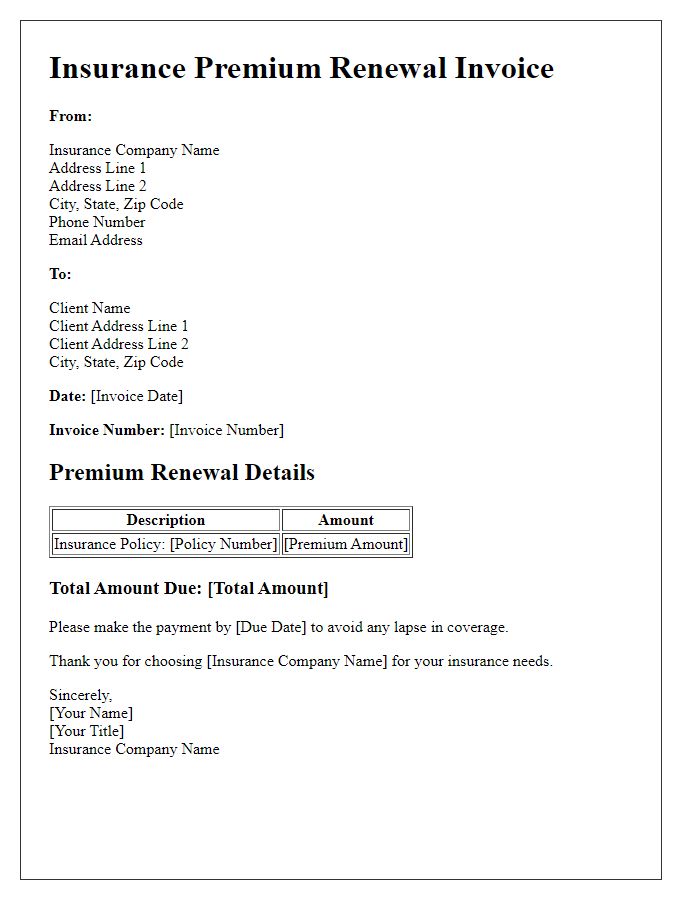

Invoice Details

An insurance premium invoice typically includes various important elements such as the policyholder's name (for instance, John Smith), the policy number (like IN-123456789), the coverage period (e.g., January 1, 2024, to December 31, 2024), the total premium amount due (often specified as $1200), and the due date (e.g., January 15, 2024). This invoice can also feature the insurance provider's name (like ABC Insurance Co.), their contact information, and payment methods accepted (such as credit card or bank transfer). Additionally, notes on late payment penalties may appear, indicating any fees accrued after the due date. It is essential for the invoice to be clear and detailed to ensure the policyholder understands their obligations and the implications of timely payments.

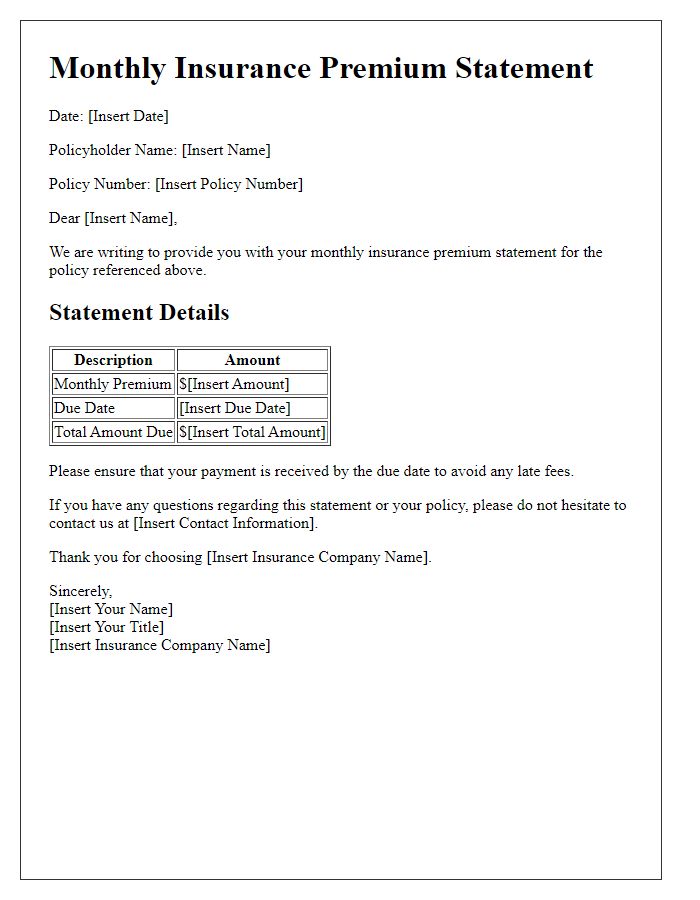

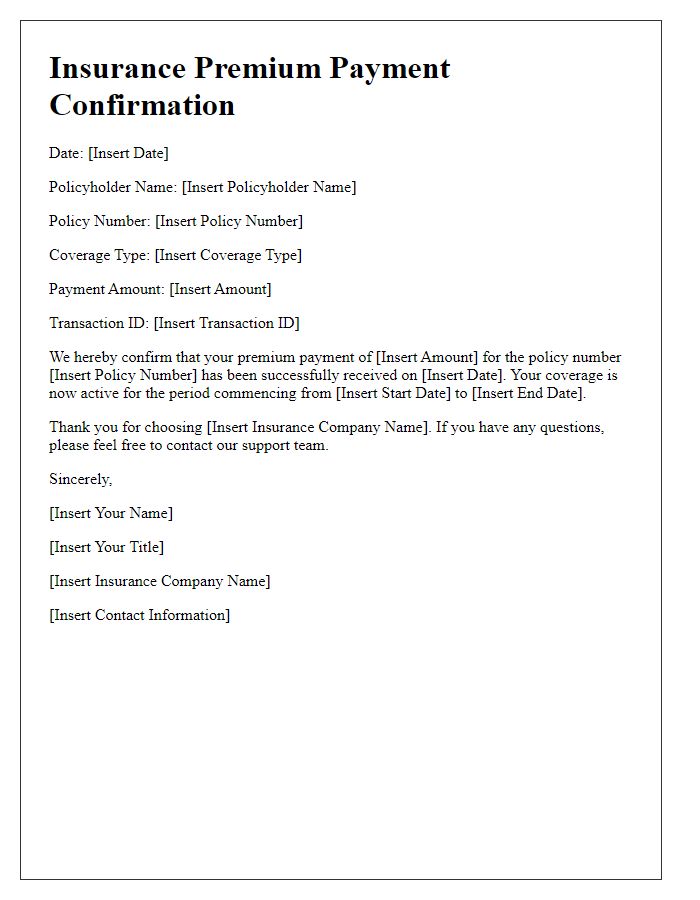

Payment Instructions

Insurance premium invoices often require clear payment instructions to ensure timely processing. Payment options typically include online transactions through secured portals, bank transfers with specific routing numbers, or cheque submissions to a designated address. Deadlines for payments are crucial, often set to 30 days from the invoice date, with late fees outlined for overdue payments, sometimes a percentage of the total premium. For online payments, encrypted payment gateways are utilized to protect personal information, while bank transfers may require a reference number linked to the policyholder's account. Direct mailing to corporate offices, such as AVIVA in Toronto or State Farm in Chicago, should follow specified formats to avoid delays. Such instructions facilitate smooth financial transactions and maintain uninterrupted insurance coverage.

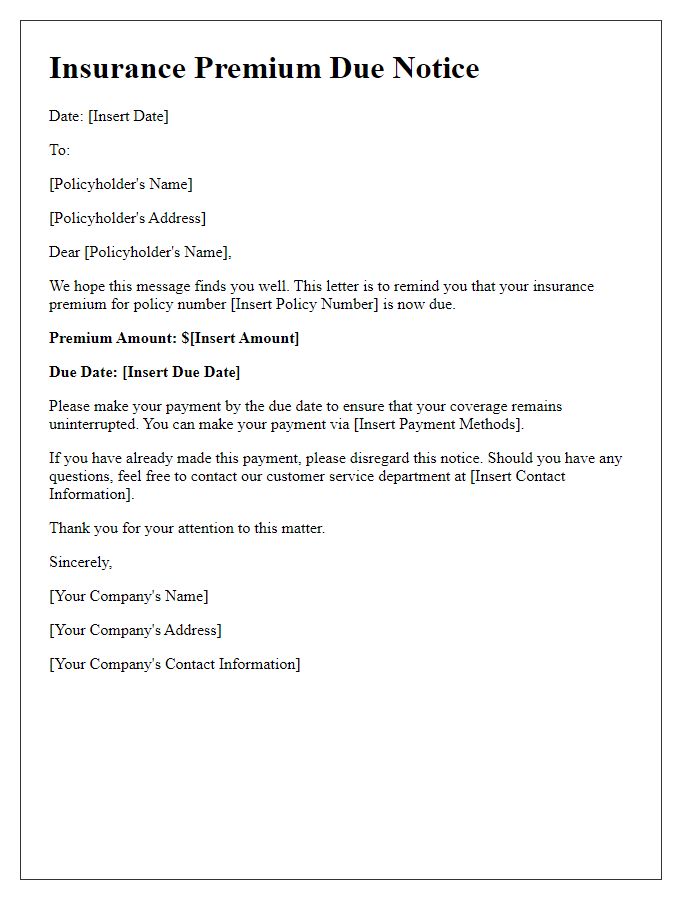

Coverage Summary

Insurance policyholders receive an essential document known as a coverage summary, detailing the scope of financial protection provided by their insurance plan. This summary typically includes information on various types of coverage such as liability, property, and personal injury, highlighting specific limits and deductibles applicable to each category. Policyholders often review this document to understand the terms and conditions of their policy, including effective dates, premium amounts, and renewal options. Key data points like policy number, insurer contact information, and payment methods may also be included for clarity. Accurate assessment of this coverage summary is crucial for understanding financial obligations and risks associated with unforeseen events.

Contact Information

Insurance premium invoices contain crucial details for policyholders. Companies require accurate contact information, including the policyholder's full name, mailing address, and phone number. The invoice should also display the insurance provider's name, address, and customer service contact details. Payment methods, due dates, and invoice numbers enhance clarity, ensuring timely processing. Overall, well-organized contact information streamlines communications and fosters transparency between the insurer and policyholder.

Comments