When navigating the often complex world of insurance claims, having a clear understanding of the guidelines can make all the difference. Whether you're filing a claim for property damage, health issues, or any unforeseen event, knowing the essential steps can streamline the process and save you valuable time. This article breaks down the key considerations and offers practical tips to ensure your claim is processed smoothly and efficiently. Curious to learn more? Let's dive in!

Clear subject line

Insurance claims processes often require clear communication and specific documentation to ensure timely processing. When submitting an insurance claim, start with a concise subject line stating the purpose, such as "Claim Submission for Policy #123456." Include essential details like the type of claim (e.g., auto accident, property damage), the date of the incident (e.g., October 1, 2023), and the claim number if applicable. This helps insurance adjusters identify and prioritize your claim efficiently. Always reference your policy details, and attach necessary documents like photos, repair estimates, and police reports for added clarity and support of your request.

Detailed incident description

In a car accident involving a red 2019 Honda Civic and a blue 2020 Ford F-150, the incident occurred on Main Street near the intersection with Elm Avenue at approximately 3:15 PM on October 10, 2023. The weather conditions were clear with no precipitation, visibility was excellent. The Honda Civic was traveling southbound when the driver, a 35-year-old male, failed to yield at a stop sign, resulting in a collision with the Ford F-150, which was heading east. The impact caused significant damage to the front of the Civic, and the passenger side of the Ford sustained injuries to two occupants aged 28 and 34. Emergency services arrived on the scene within minutes, documenting the incident and providing medical assistance. A police report was filed under case number 4567-890, and both vehicles were towed away for damage assessment. This description outlines the chronology and key details necessary for processing the insurance claim efficiently.

Policy number inclusion

Inclusion of the policy number is essential for processing insurance claims efficiently. The policy number, typically a unique identifier for the insurance contract, ensures that the claim is accurately linked to the correct account (often involving benefits totaling thousands of dollars). When submitting a claim, providing this number helps expedite verification processes. Insurance companies (like State Farm or Allstate) rely on the policy number to access details about coverage, limitations, and specifics regarding deductibles. Omitting this number can lead to significant delays in claims processing, sometimes extending resolution times from days to weeks, impacting the insured individual's financial recovery and support during critical times.

Supporting documents attachment

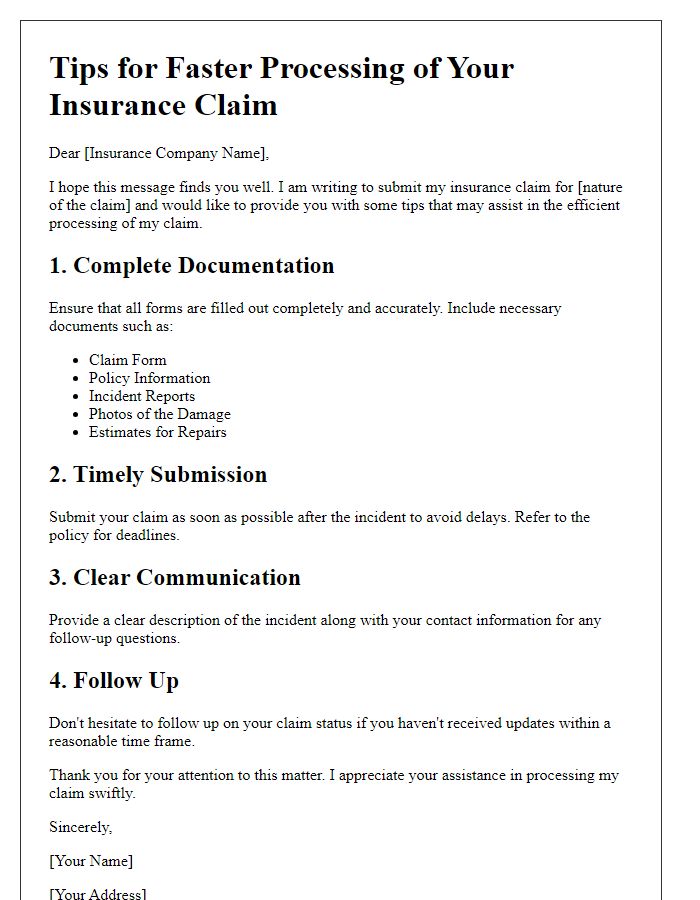

Submitting an insurance claim requires thorough preparation of supporting documents to facilitate a smooth process. Essential documents include the claim form, which details the nature of the loss, along with any photographs illustrating the damage (preferably high-resolution images with timestamps). Additionally, include any police reports if applicable, hospital bills for medical claims, and repair estimates or invoices. Proof of ownership, such as receipts or appraisals for valuable items, is crucial for substantiating claims. It is also important to provide correspondence with the insurance company, maintaining records of any communications such as emails or letters received. Finally, ensure that all documents are legible, organized, and labeled clearly to expedite the review by the insurance adjuster assigned to your case.

Contact information for follow-up

When pursuing an insurance claim, it is crucial to maintain clear contact information for further communication. Insurers typically require your full name, policy number (a unique identifier assigned to your coverage), and current mailing address to ensure efficient processing. Email addresses should include the domain name of your service provider, facilitating electronic correspondence. Additionally, provide a direct telephone number, including area code, for swift follow-up discussions. Be prepared to respond promptly to any requests for further documentation, such as accident reports or medical records, which may be necessary for claim validation. Keeping this information organized can streamline the claims process and help achieve a timely resolution.

Comments