If you've ever submitted a claim for insurance reimbursement, you know the waiting game can be excruciating. Two weeks can feel like two months when you're anxious to get that money back in your pocket. In this article, we'll walk you through a friendly yet effective follow-up letter template that ensures you stay on top of your claim. So, let's dive in and streamline that process together!

Clear and concise subject line

Many individuals face challenges with the insurance reimbursement process, often experiencing delays in receiving compensation for medical expenses, vehicle repairs, or property damage. Insurance companies, such as Aetna or Allstate, may require follow-up inquiries on claims submitted to ensure timely processing. Key details include the claim number, date of submission, and specific amount requested. Documentation like invoices, receipts, and previous correspondence can strengthen the follow-up request. Engaging with customer service representatives effectively can expedite the review process, paving the way for a smooth reimbursement experience and financial relief when needed most.

Policyholder information details

Insurance reimbursement follow-up is a crucial process for policyholders aiming to receive compensation. The policyholder, often identified by unique identifiers such as policy number and social security number, submits claims related to medical expenses, property damage, or other covered events. Insurance companies, like Allstate or State Farm, typically require specific documentation, including receipts, medical records, and incident reports, to verify claims. Follow-up communications might involve contacting customer service representatives or claims adjusters for updates on the status of the reimbursement, which can take several weeks to process. Policyholders should keep detailed records of all correspondence, as these can serve as important references in resolving delays or disputes regarding their claims.

Claim number and relevant dates

Insurance reimbursement claims often require follow-up to ensure timely processing and resolution. For instance, a specific claim number, such as #123456, submitted on January 15, 2023, for medical expenses related to a hospital visit at General Hospital, must be monitored closely. Relevant dates include the initial claim submission date, the subsequent acknowledgment received on January 22, 2023, and any additional documentation requested by the insurance company by February 10, 2023. Tracking communication, such as emails and phone interactions, enhances the follow-up process, ensuring that the reimbursement, which may exceed $5,000, is secured efficiently.

Explicit request and supporting documents

Delayed insurance reimbursements can create significant financial strain for claimants. Specific policies often require explicit requests for funds alongside comprehensive supporting documentation. Essential documents may include invoices, receipts, and medical records that detail incurred expenses, especially for health-related claims in facilities like hospitals or clinics. It is crucial to reference claim numbers and policy details, ensuring clarity in communication with insurance providers. Such follow-ups typically occur within a designated timeframe, often around 30 days after the initial submission. Regular tracking of correspondence, including dates and details of prior communications, can facilitate a smoother resolution.

Contact information for further communication

Insurance claims processing requires clear communication and documentation. Accurate contact information such as phone numbers (preferably direct lines for claims representatives) and email addresses facilitates swift follow-ups. Policyholders need to reference specific claim numbers associated with their submitted requests, as this aids in quick retrieval of claim details. Providing mailing addresses ensures that any necessary documentation or correspondence can be correctly directed. Ensure that the preferred method of communication is indicated, as this streamlines the process, allowing for effective updates on claim status or additional information requests.

Letter Template For Insurance Reimbursement Follow-Up Samples

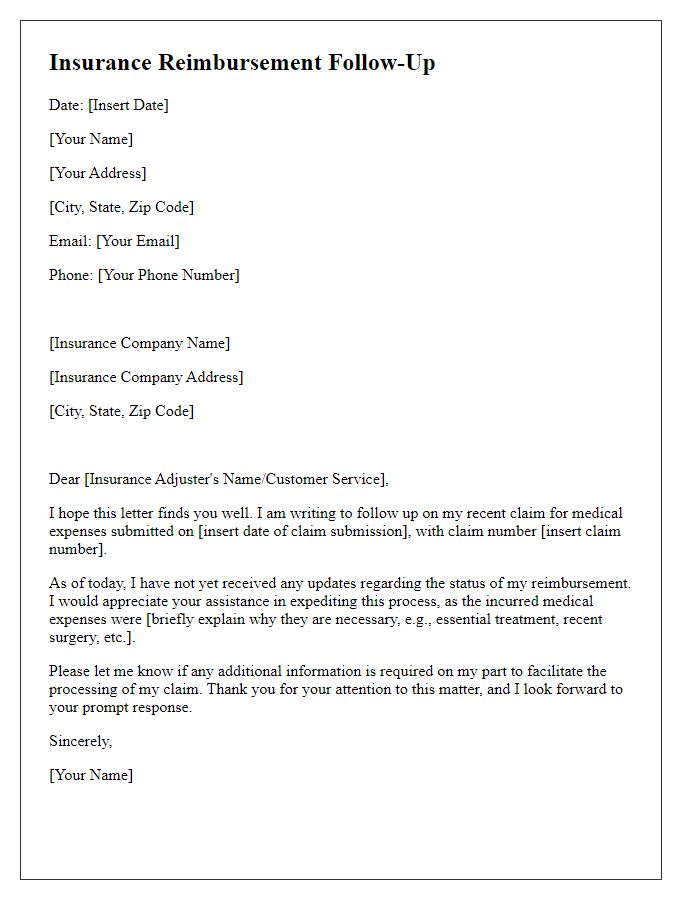

Letter template of insurance reimbursement follow-up for medical expenses.

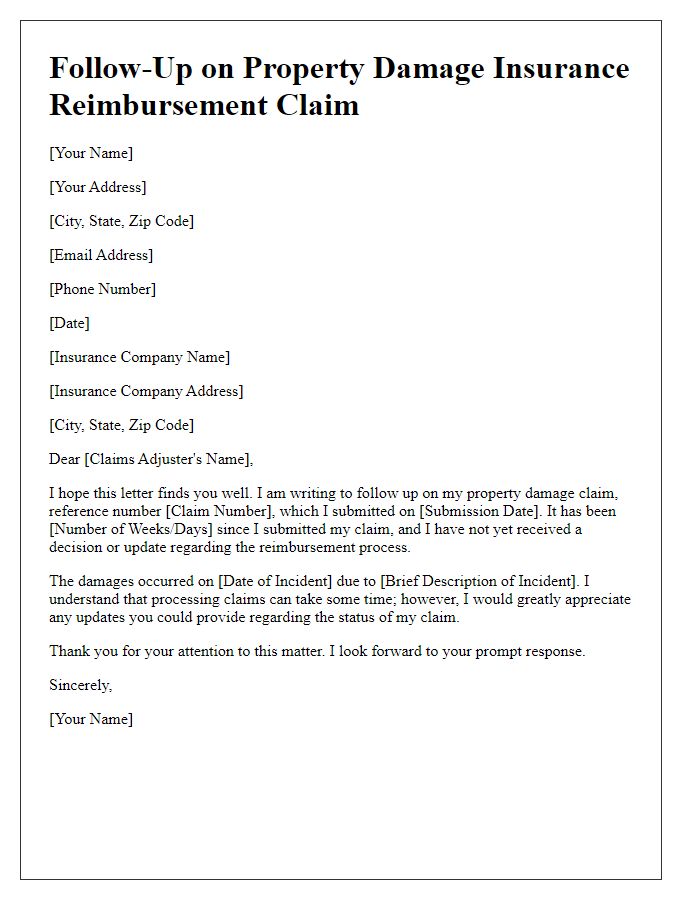

Letter template of insurance reimbursement follow-up for property damage claims.

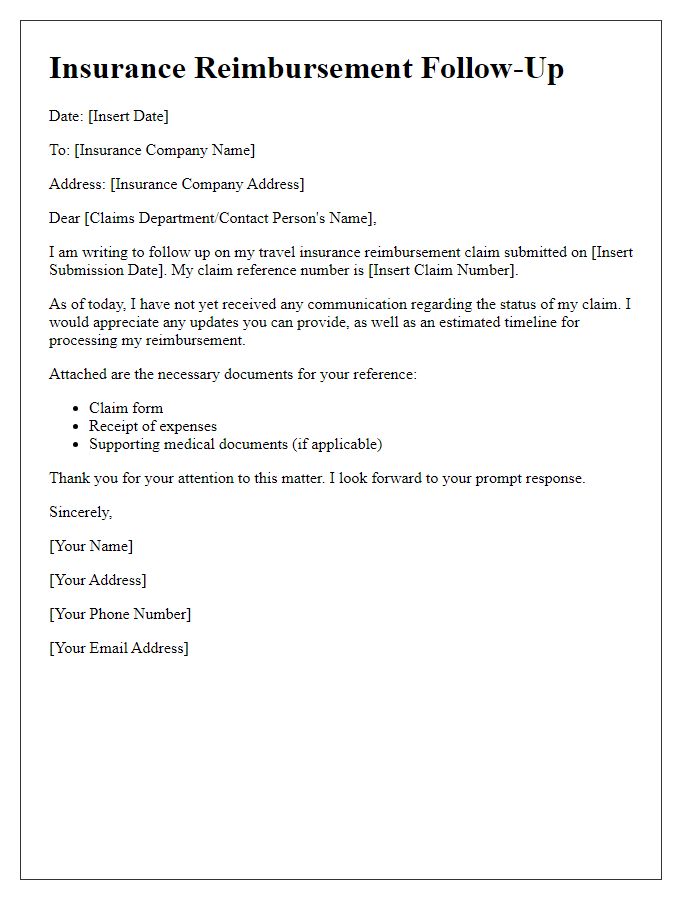

Letter template of insurance reimbursement follow-up for travel insurance.

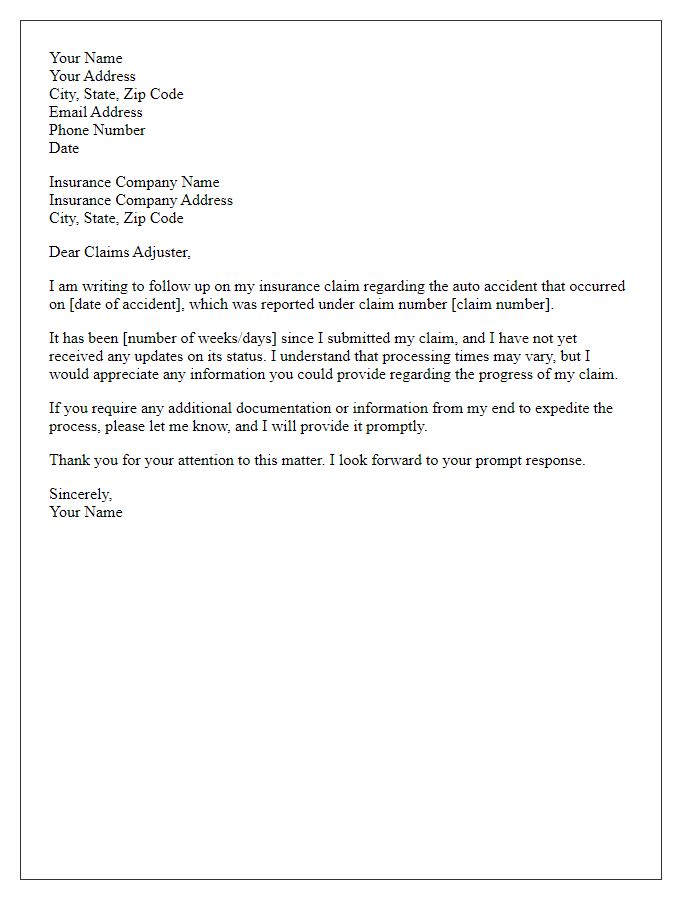

Letter template of insurance reimbursement follow-up for auto accident claims.

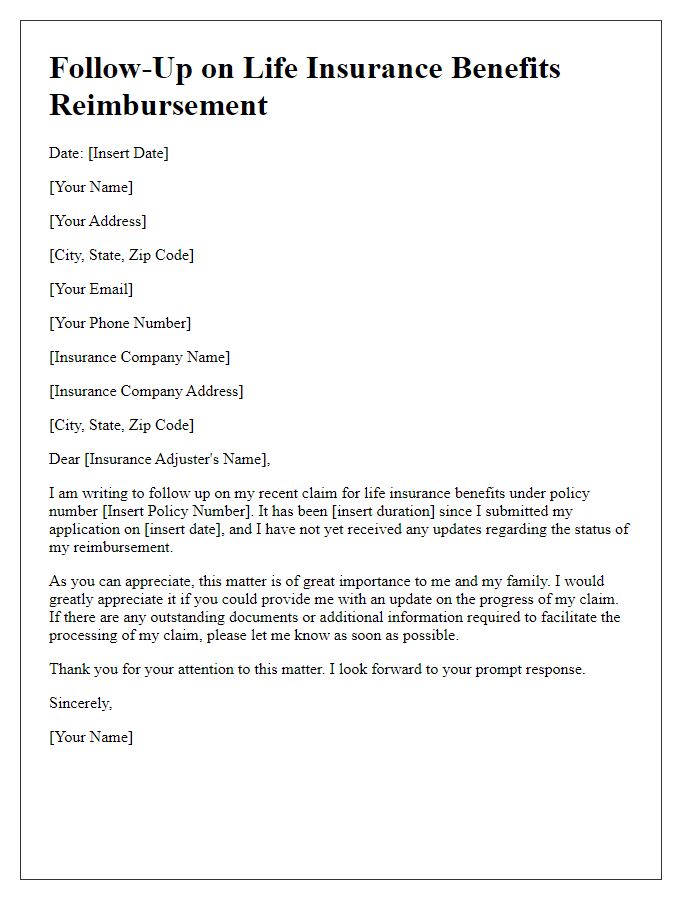

Letter template of insurance reimbursement follow-up for life insurance benefits.

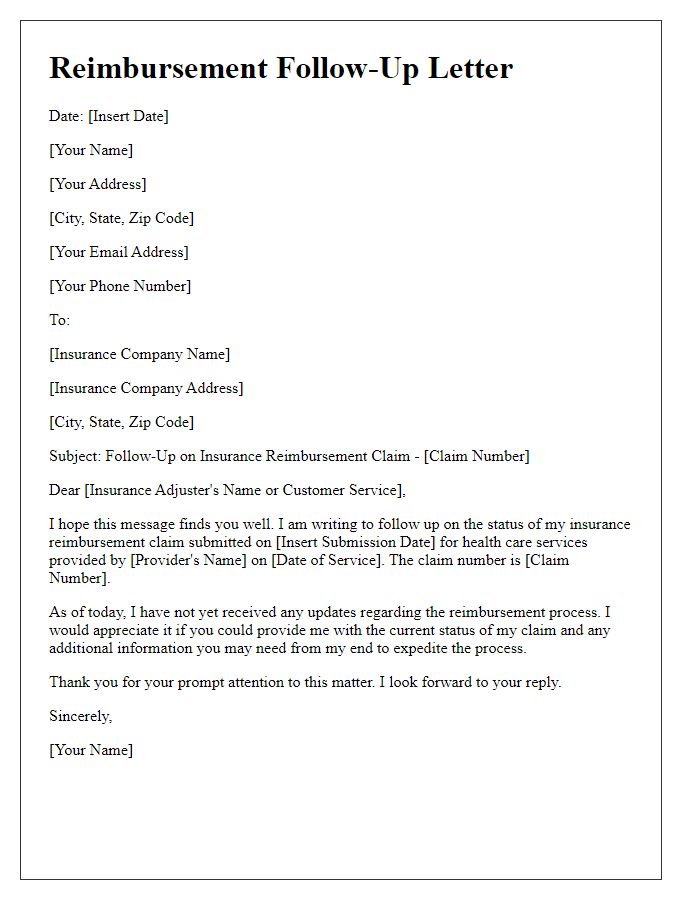

Letter template of insurance reimbursement follow-up for health care services.

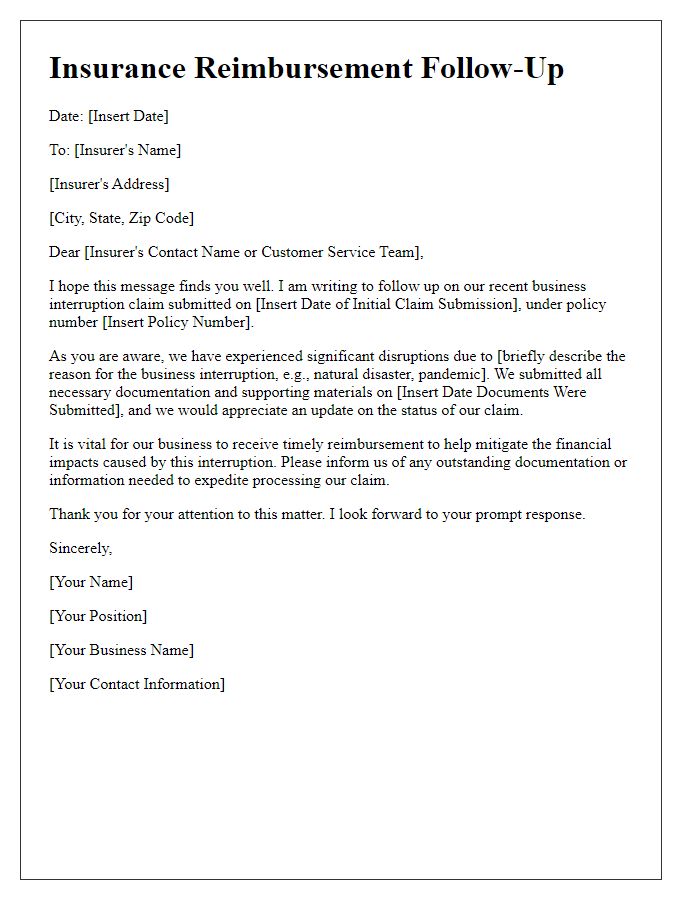

Letter template of insurance reimbursement follow-up for business interruption claims.

Letter template of insurance reimbursement follow-up for workers' compensation.

Letter template of insurance reimbursement follow-up for home insurance claims.

Comments