Are you feeling the pinch when it comes to your insurance premiums? Adjusting insurance premiums is a common concern for many of us, and understanding how to navigate this process can make a big difference in your finances. In this article, we'll break down the reasons for premium adjustments, what steps you can take, and how to communicate effectively with your insurance provider. So, stick around and discover the best ways to manage your insurance premiums!

Customer Information

The insurance premium adjustment process begins with the assessment of customer information, encompassing critical details such as policy number, personal identification number (for verification purposes), and contact information like email and phone number. Essential data also includes coverage type (such as homeowners, auto, or renters insurance), current premium amounts, and any recent claims filed (for example, damage claims from storm events). Additionally, factors such as changes in personal circumstances, including marriage, relocation (to areas with different risk profiles), or the acquisition of new assets (like a newly purchased vehicle) can significantly impact premium calculations, requiring careful evaluation for accurate adjustment. Documentation pertaining to these changes, such as proof of marriage or bills of sale, facilitates the review process, ensuring both accuracy and transparency for the policyholder.

Policy Details

Insurance premium adjustments can arise from various factors, including changes in personal circumstances or shifts in market conditions. A policyholder's specific details, such as the policy number and coverage type, remain crucial in identifying the exact nature of the changes. For instance, adjusting a homeowner's insurance policy due to renovations (increased value) or changes in local crime rates (decreased risk) directly impacts premium calculations. Additionally, discount eligibility (bundled auto and home policies, good driver discounts) can lead to adjustments, illustrating the insurance provider's commitment to fair pricing based on risk assessment. Communication regarding premium changes typically occurs through official notices from the insurance company, allowing policyholders a clear understanding of what influences their rates.

Reason for Adjustment

Insurance premium adjustments can occur for various reasons, including changes in risk factors, policyholder behavior, or adjustments in coverage amounts. For example, if a policyholder installs a security system (such as ADT Security System) in their home (located in California), they may qualify for a reduction in their homeowner's insurance premium. Alternatively, if the policyholder has recently started a new job (with a driving requirement) that results in more mileage driven annually, this could lead to an increase in the auto insurance premium due to heightened risk exposure. Other factors influencing adjustments include claims history, changes in property value, and local market conditions. Regular reviews of these elements help ensure premiums remain aligned with the actual risk presented by policyholders.

New Premium Amount

Adjustments to insurance premiums often arise due to changes in policyholder circumstances or updates in underwriting guidelines. A new premium amount may reflect various factors, including increased coverage limits, changes in property value (for example, a home appraisal indicating a rise from $300,000 to $350,000), or alterations in the risk assessment based on claims history. Additionally, demographic elements such as age, location (like urban versus rural zones), and lifestyle choices can also influence the revised premium, which is essential for ensuring adequate protection against unforeseen events. Regular evaluations usually occur annually or after significant life events, ensuring that policyholders maintain optimal coverage aligned with their current needs.

Effective Date and Payment Instructions

Insurance premium adjustments can significantly influence coverage costs and payment obligations for policyholders. An effective date for the adjusted premium typically signifies the start of the updated payment amount, which may vary depending on factors like claim history or risk assessment. Policyholders should refer to their insurance provider's guidelines for payment instructions, ensuring timely submission via options such as online portals, automated bank transfers, or mailing a check. Maintaining awareness of deadlines is crucial to avoid lapses in coverage that could arise from delayed payments or misunderstandings regarding the new rates.

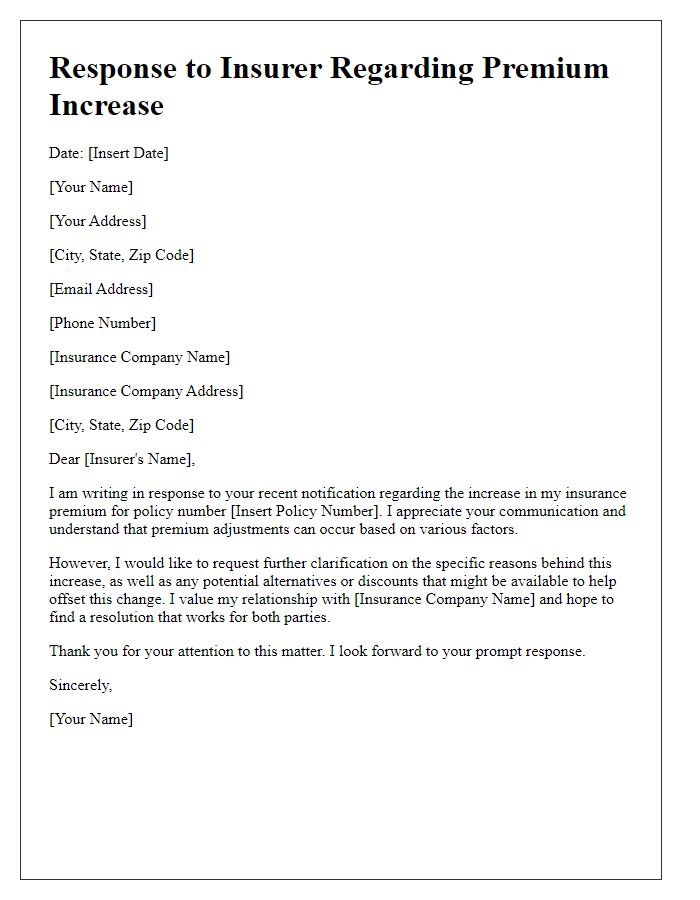

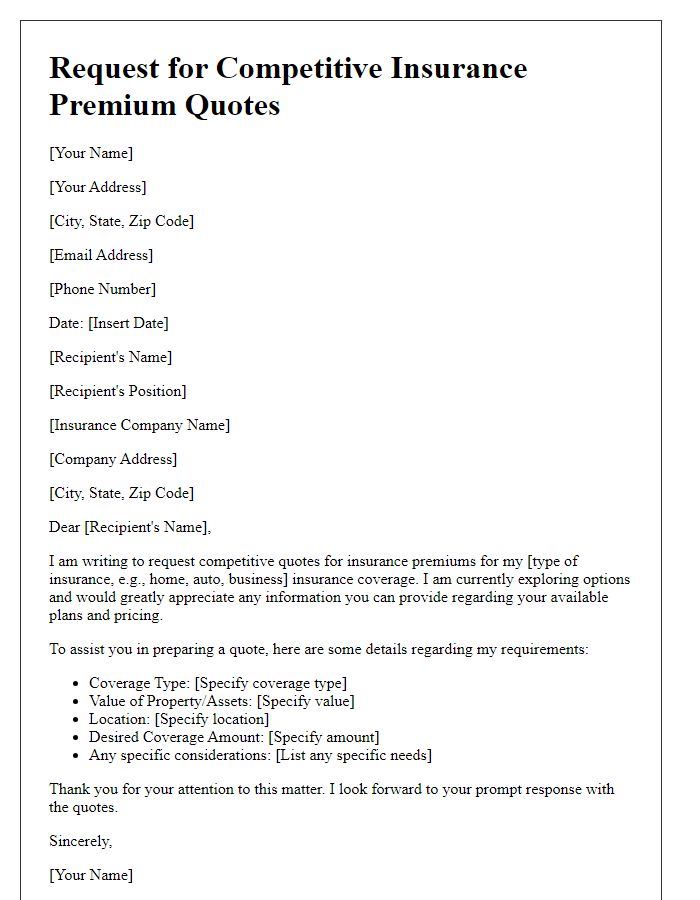

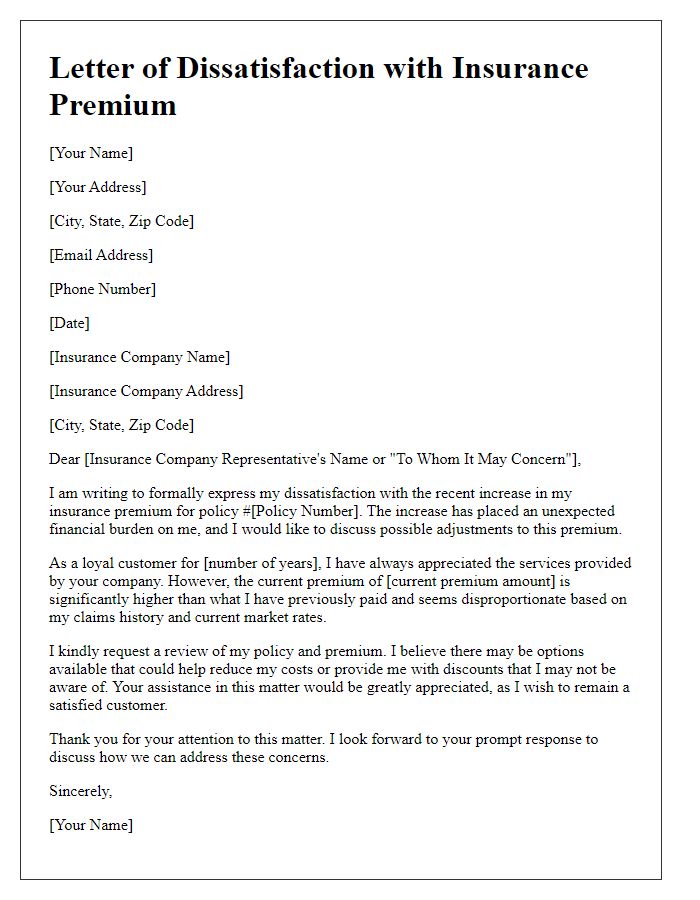

Letter Template For Insurance Premium Adjustment Samples

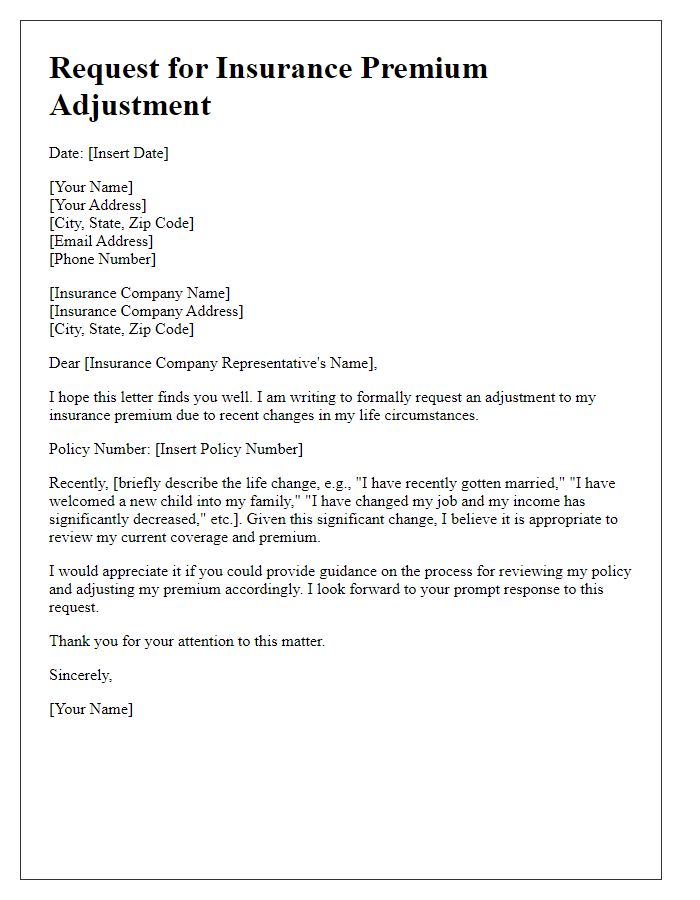

Letter template of request for insurance premium adjustment due to life changes

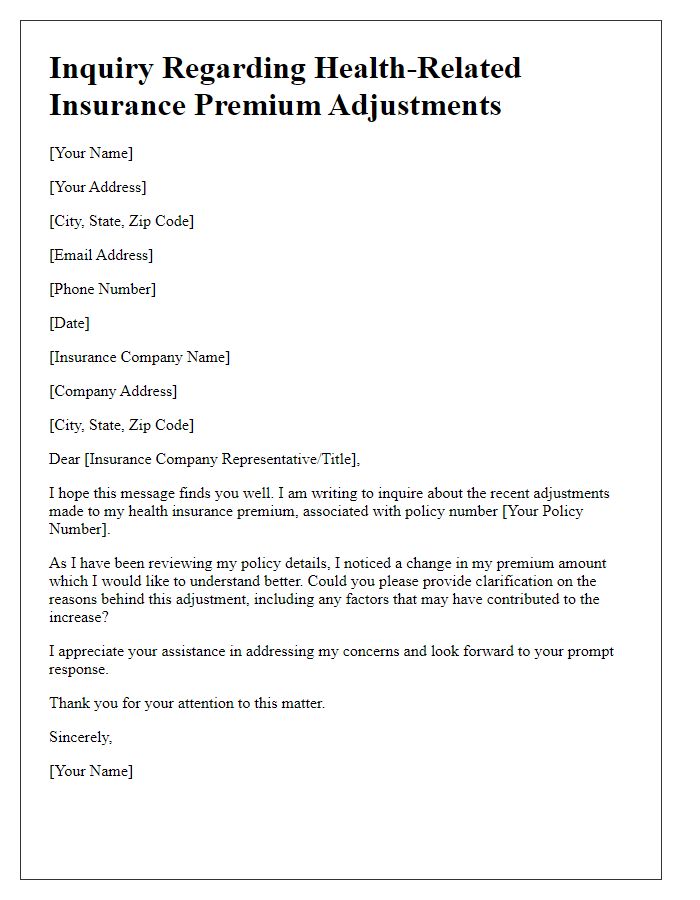

Letter template of inquiry regarding health-related insurance premium adjustments

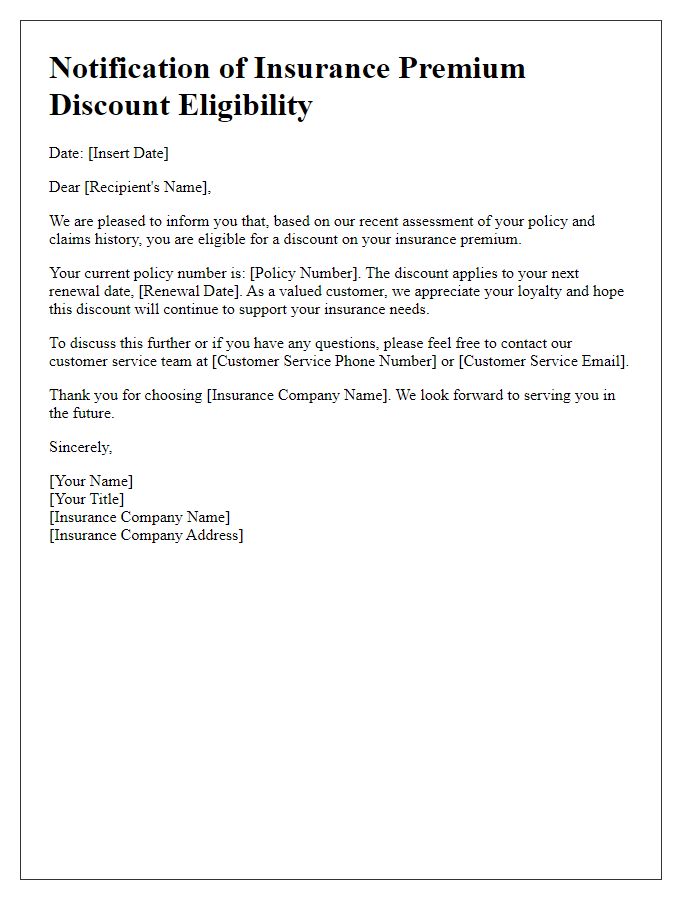

Letter template of notification for eligibility of insurance premium discounts

Letter template of confirmation for adjustments in insurance premium after claim settlement

Letter template of submission for documentation supporting insurance premium reduction

Letter template of update on financial status affecting insurance premium rates

Comments