Hey there! We all know that submitting insurance documents can sometimes feel a bit overwhelming, but it doesn't have to be. In this guide, we'll walk you through a straightforward letter template that makes the process as smooth as possible. By following our tips, you'll ensure that your submission is clear and complete, avoiding any potential hiccups along the way. So, let's dive in and get you that peace of mindâread on to discover more!

Title of the document

Submitting insurance documents requires meticulous attention to detail to ensure all necessary information is precisely outlined. Insurance policies, such as auto, health, or home, often demand specific forms, receipts, and identification. For instance, a homeowner's insurance claim may need photographs of damage, estimates from contractors, and proof of ownership, while health insurance submissions might require doctor's notes and billing statements. Timeliness is crucial, as many insurance companies have strict deadlines for document submission, often ranging from 30 to 90 days after an incident or claimable event. Additionally, understanding the policy number and the claim reference number can expedite the processing of the submitted documents.

Policyholder's details

Insurance documents require accurate policyholder details for effective processing. Essential information includes full name, address, contact number, and email. Specifics like policy number, which acts as a unique identifier for the insurance contract, and social security number are critical for verification. Additional components could involve the date of birth for age-related assessments and bank account information for direct deposit or premium payment purposes. Each detail must align with details on official records to facilitate smooth communication and avoid processing delays. Documentation also necessitates signed consent forms for data sharing and updates.

Policy number

Policy number serves as a unique identifier for an insurance contract, crucial in processing claims and managing coverage details. Insurance companies, such as State Farm or Progressive, rely on policy numbers to retrieve client information, validate coverage, and assess claim history. Clear documentation with the correct policy number expedites submission processes, reducing delays in approvals or payments. Ensuring accuracy in documents submitted, whether for health, auto, or homeowner insurance, helps maintain efficient communication between insurers and clients, ensuring that all parties are aware of the specific terms and protections outlined in the policy.

List of enclosed documents

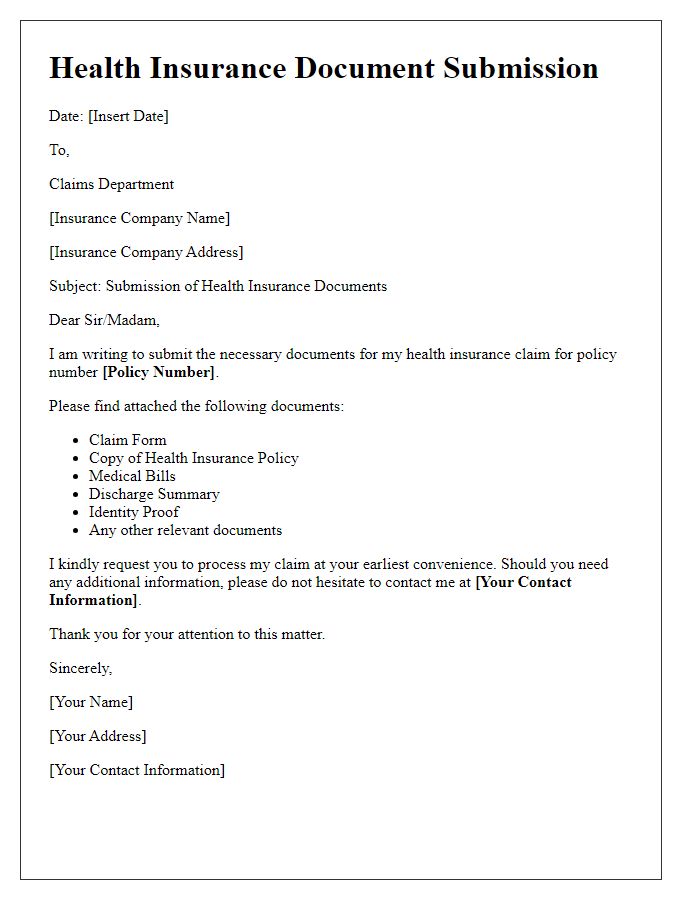

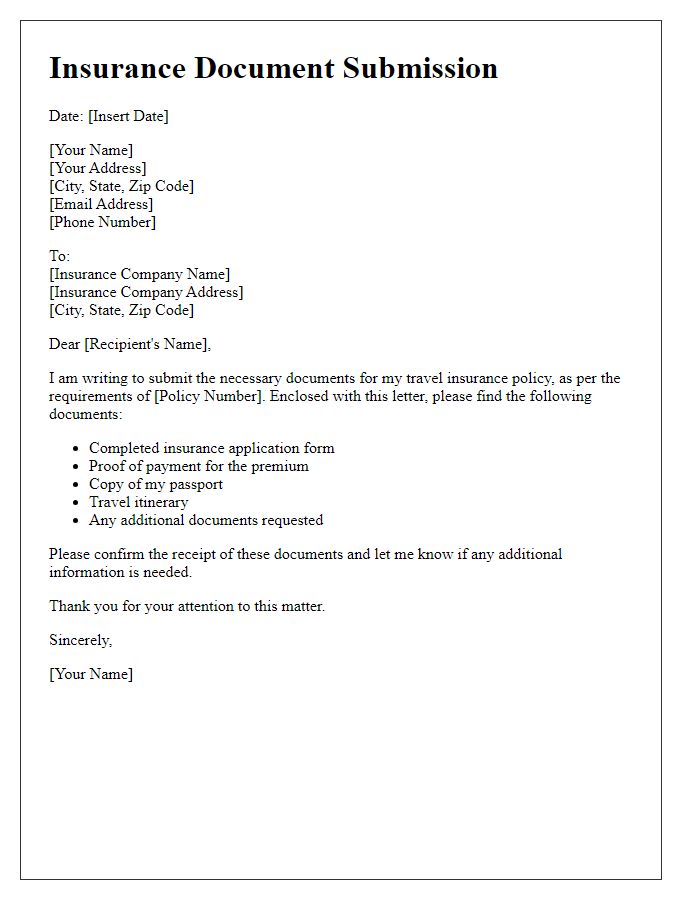

Submitting insurance documents requires thoroughness to ensure all necessary materials are included. Types of documents often requested include identification proof such as a driver's license or passport, policy information detailing coverage, claim forms indicating the nature of the claim, and supporting evidence like photographs or medical reports, particularly in health or auto insurance claims. Additional items, such as accident reports from law enforcement or repair estimates from certified mechanics, may also be necessary. It's important to check the specific requirements outlined by the insurance provider to ensure full compliance and expedite the processing of the submission.

Contact information for queries

For effective communication regarding insurance document submissions, please provide contact information, including the name of the insurance company representative, telephone number (e.g., 1-800-555-0199), and email address (e.g., claims@insurancecompany.com). Response time varies, typically within 24-48 hours during standard business hours (Monday to Friday, 9 AM to 5 PM EST). Ensure to follow up with any necessary documentation, such as claim numbers and policy information, to facilitate quicker responses and resolution of queries.

Letter Template For Insurance Documents Submission Samples

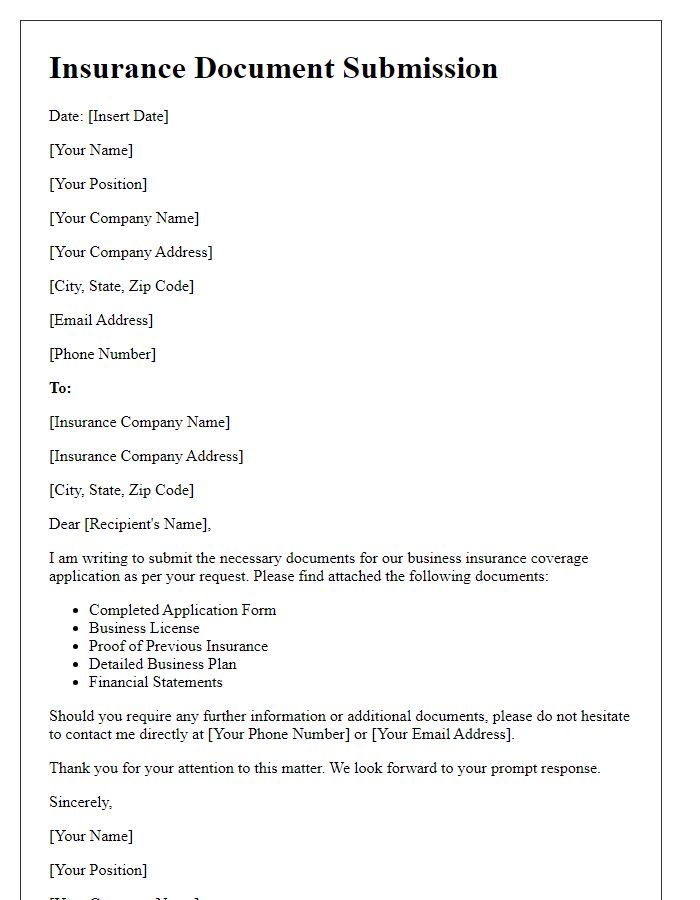

Letter template of insurance documents submission for business coverage.

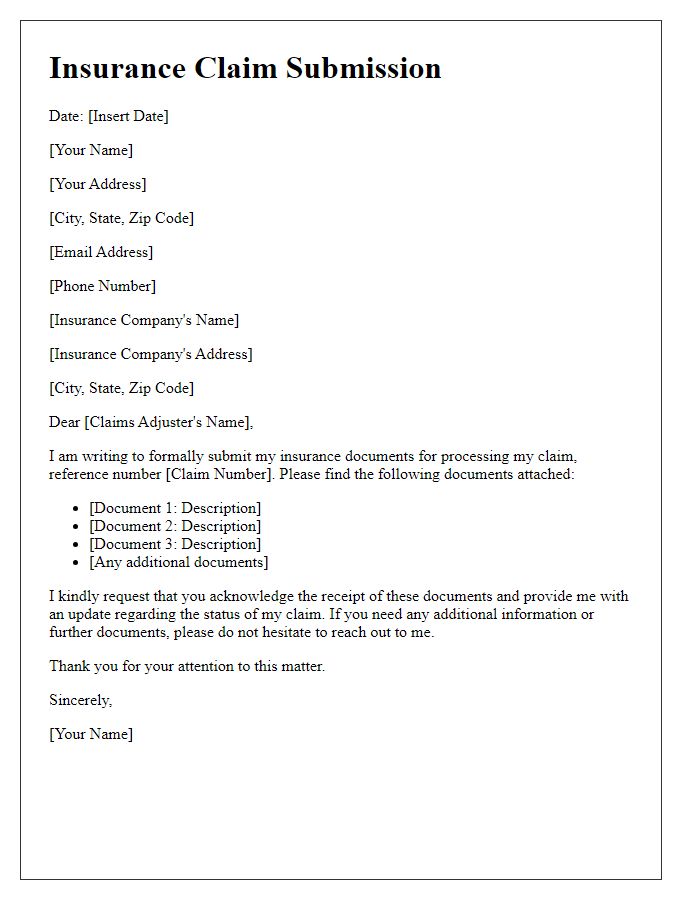

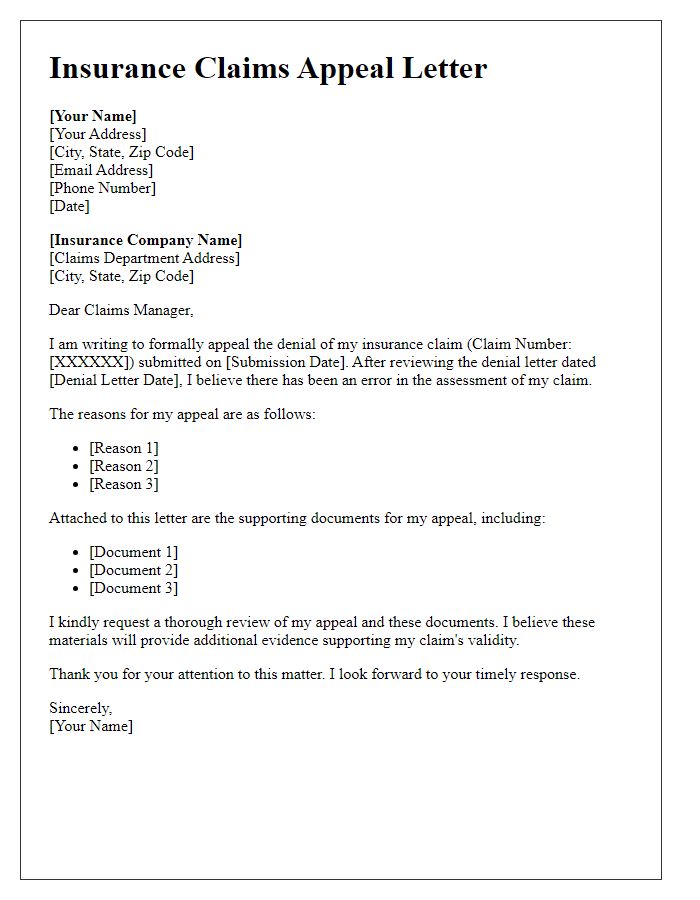

Letter template of insurance documents submission for claims processing.

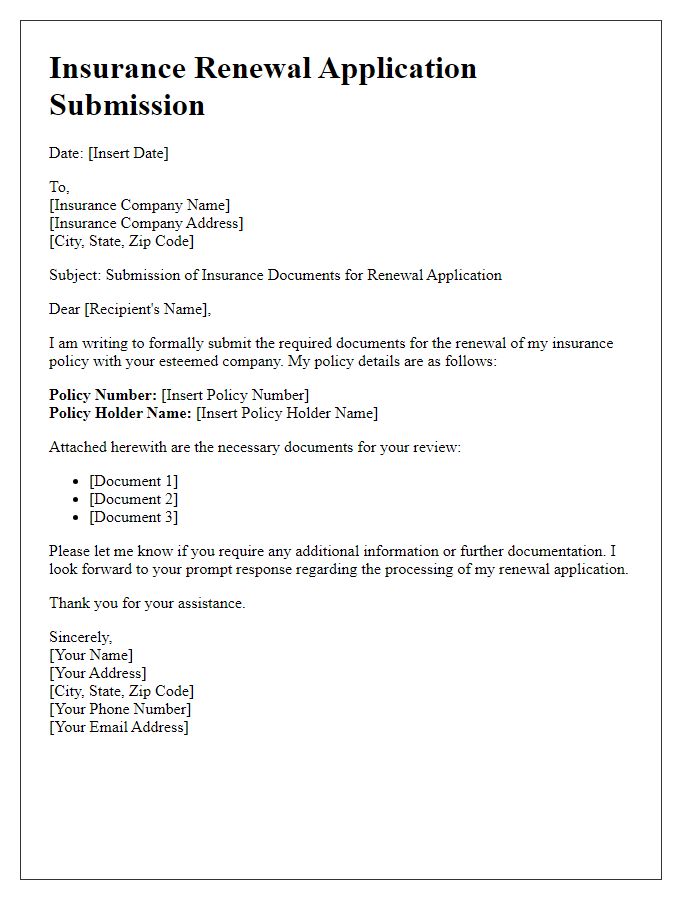

Letter template of insurance documents submission for renewal application.

Letter template of insurance documents submission for policy adjustment.

Letter template of insurance documents submission for beneficiary updates.

Letter template of insurance documents submission for mortgage insurance.

Comments