Writing a letter for an insurance financial guarantee can be a straightforward process, but it's important to ensure all the essential elements are included. In this article, we'll guide you through crafting a compelling and informative letter that highlights the necessary details while maintaining a professional tone. Whether you're seeking coverage for a specific project or ensuring financial security for a client, having the right structure is key. So, let's dive into the essentials of this letter templateâread on for our step-by-step breakdown!

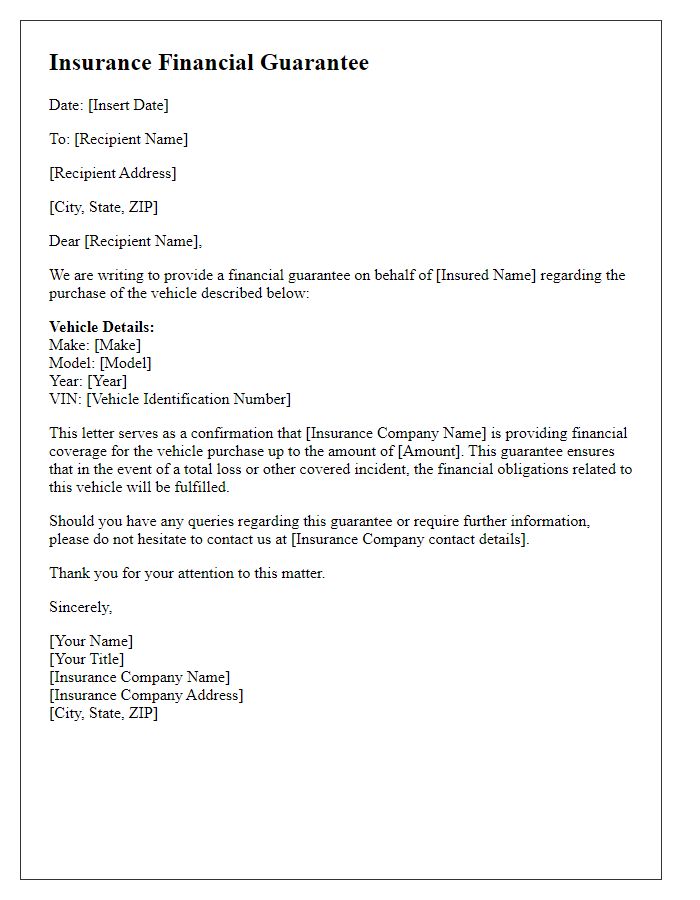

Creditor information

Creditor information, such as the name of the creditor and contact details, plays a pivotal role in financial guarantee agreements. Accurate identification of the creditor, including full legal name and address, ensures that all communications and obligations are properly directed. Furthermore, establishing the creditor's financial background, such as credit rating or previous lending history, can aid in assessing the risk associated with the guarantee. Additionally, the creditor's industry, whether it be real estate, automotive, or healthcare, significantly influences the terms of the financial guarantee, providing context for the potential liabilities involved. Understanding these elements allows for a comprehensive framework to support the guarantee's effectiveness and enforceability.

Debtor details

Debtor details, represented in a financial guarantee context, refer to specific information regarding the party responsible for fulfilling financial obligations within an insurance agreement. This includes the debtor's name, which identifies the individual or entity (such as a corporation) holding the debt, the debtor's address, encompassing the location where the debtor can be reached, and identification numbers, such as Social Security numbers or Tax Identification Numbers, crucial for verifying the debtor's identity. Financial information, such as credit history and outstanding debts, can provide insight into the debtor's potential to meet obligations. The details may also outline the nature of the debt, including principal amounts, interest rates, and repayment schedules, as well as any collateral involved in the guarantee arrangement. Accurate and comprehensive debtor details are essential for assessing risk and enforcing the terms of an insurance financial guarantee.

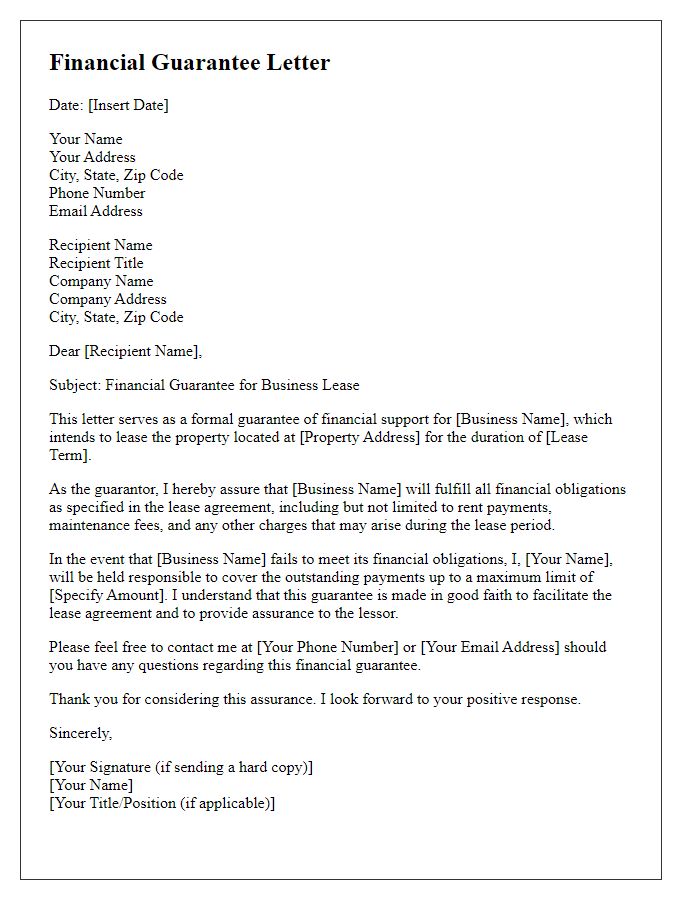

Guarantee terms and conditions

The financial guarantee insurance policy outlines essential terms and conditions governing the agreement between the insurer and the policyholder. Coverage details specify the maximum limit, such as $1 million or other agreed amounts, to ensure protection against specific financial obligations resulting from unforeseen events. The policy period generally spans one year but may extend based on mutual agreement or renewal provisions. Conditions for claims necessitate prompt notification, typically within 30 days of the triggering event, alongside required documentation such as loss verification or detailed invoices. Exclusions apply, including acts of fraud, pre-existing liabilities, and natural disasters like floods or earthquakes, which the insurer will not cover. Premium payments are due annually to maintain active coverage, and failure to pay may result in policy termination. Dispute resolution processes, such as mediation or arbitration, must follow if disagreements occur regarding claims or policy interpretations, ensuring both parties reach a fair conclusion.

Liability limitations

Liability limitations in insurance financial guarantees significantly impact policyholder protections. Insurance policies often contain clauses that explicitly state maximum coverage amounts, including exclusions for specific incidents. For instance, many liability insurance products may limit coverage to $1 million per occurrence or restrict claims related to intentional misconduct. Insurers, such as AIG or State Farm, outline these limitations in policies to manage risk and potential financial exposure. Regulatory bodies, including the National Association of Insurance Commissioners (NAIC), monitor these limitations to ensure consumer awareness and fair practices. Understanding these liability limitations is vital for businesses and individuals to mitigate risks effectively and secure adequate coverage.

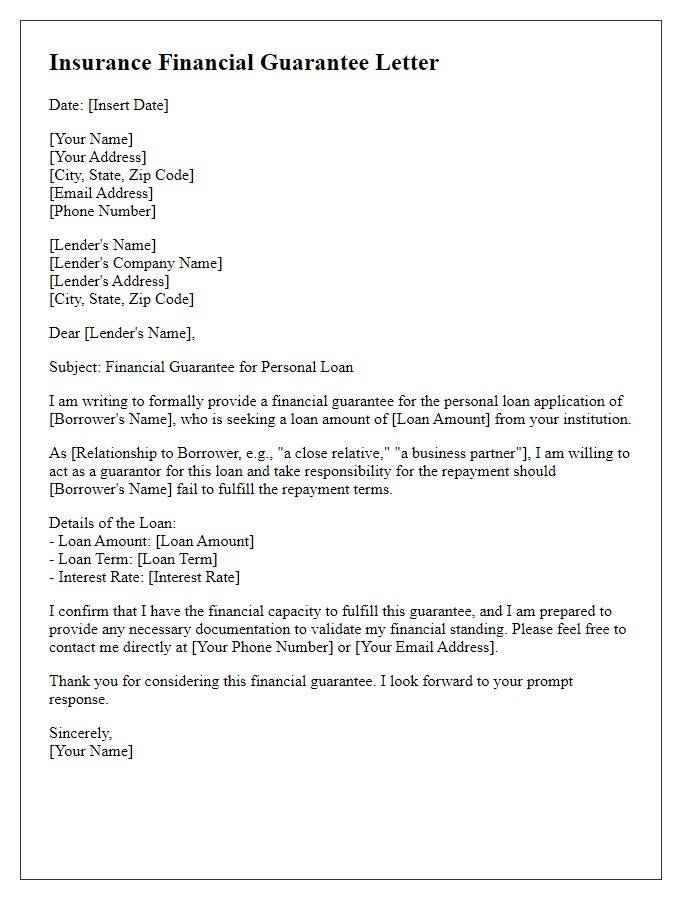

Signature and contact information

Insurance financial guarantees provide assurance to lenders or beneficiaries regarding repayment or fulfillment of obligations, often used in transactions such as real estate purchases or commercial agreements. Important details include the financial institution's name, policy number, and amounts covered, typically ranging from thousands to millions of dollars. Contact information for relevant representatives is crucial, including names, email addresses, and telephone numbers for prompt communication. The signature of an authorized officer from the insurance company legitimizes the guarantee, affirming the institution's commitment to fulfill the warranty terms, which can be significant in high-stakes financial dealings.

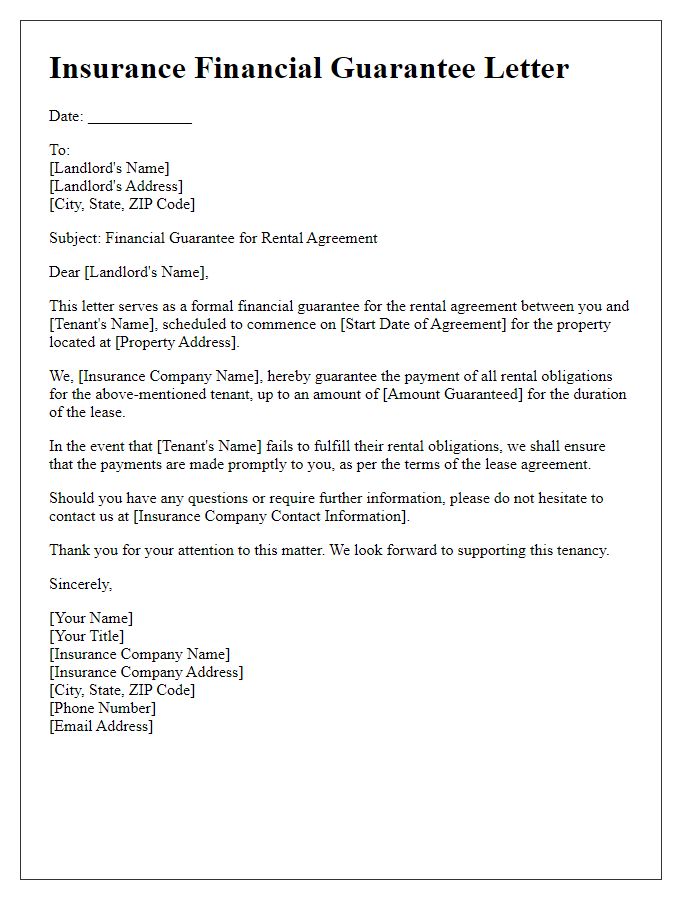

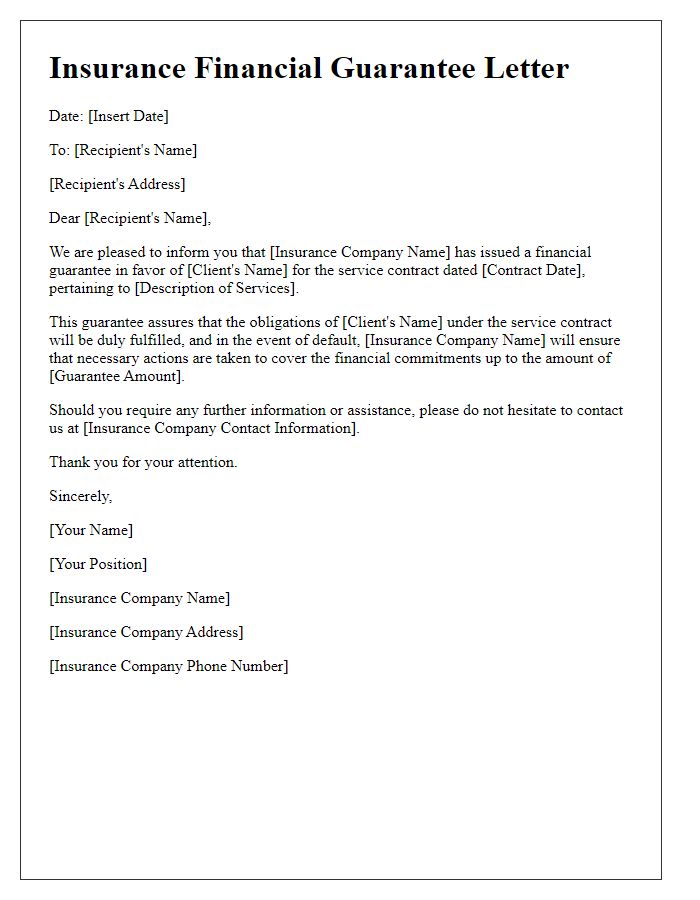

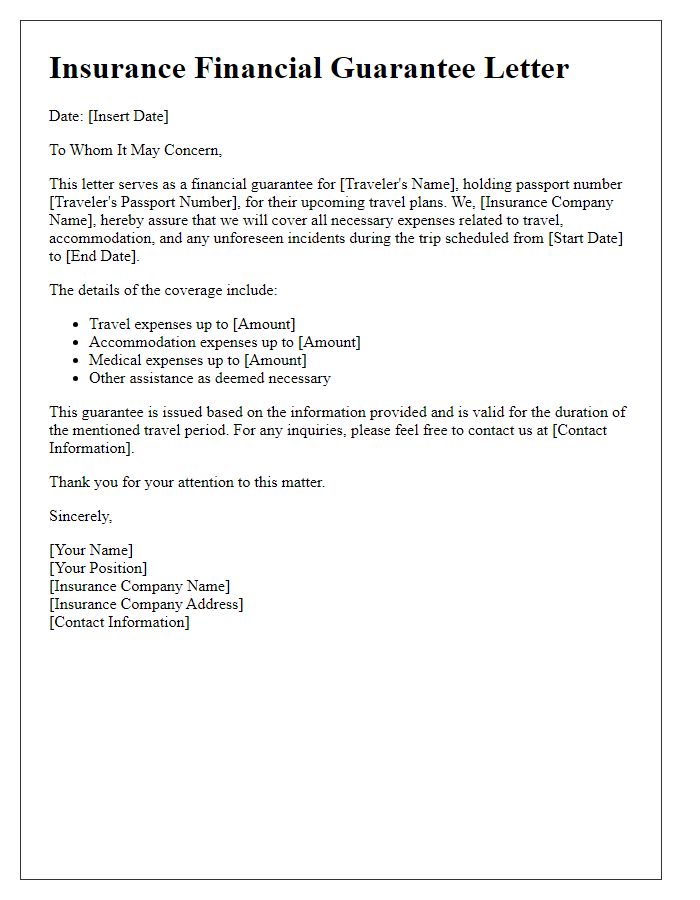

Letter Template For Insurance Financial Guarantee Samples

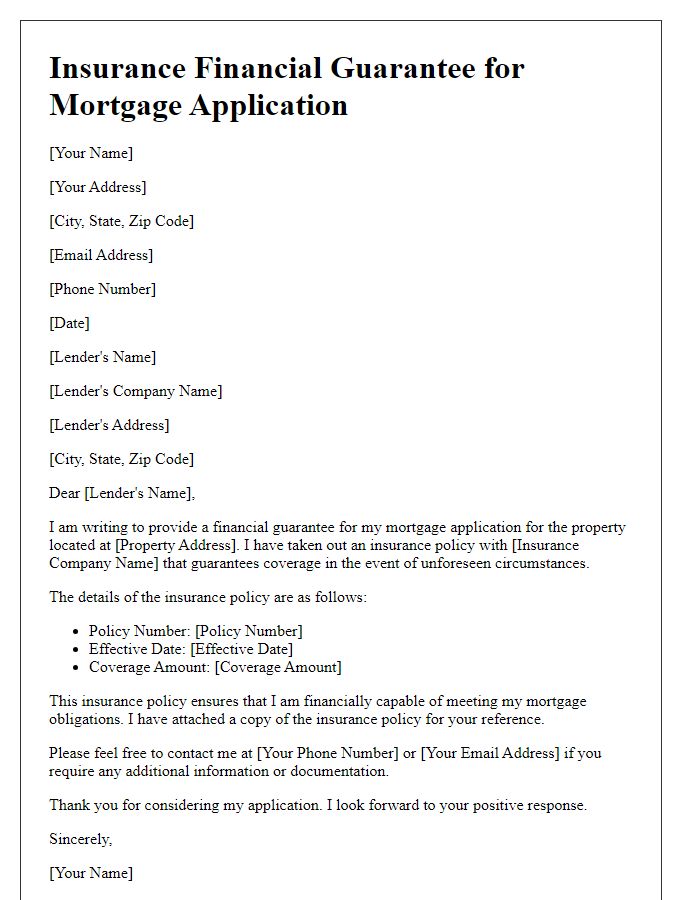

Letter template of insurance financial guarantee for mortgage application.

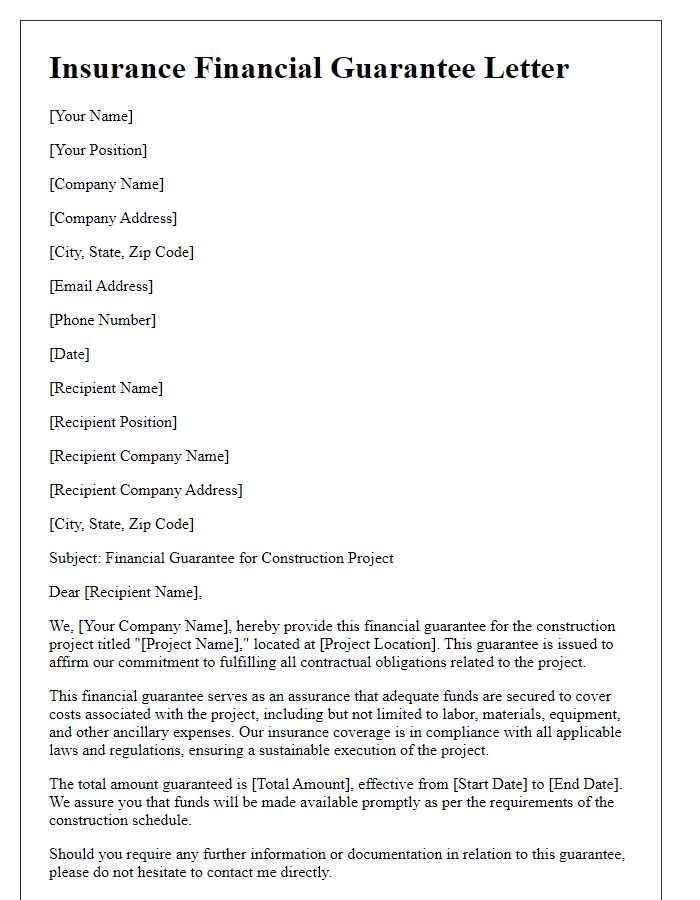

Letter template of insurance financial guarantee for construction project.

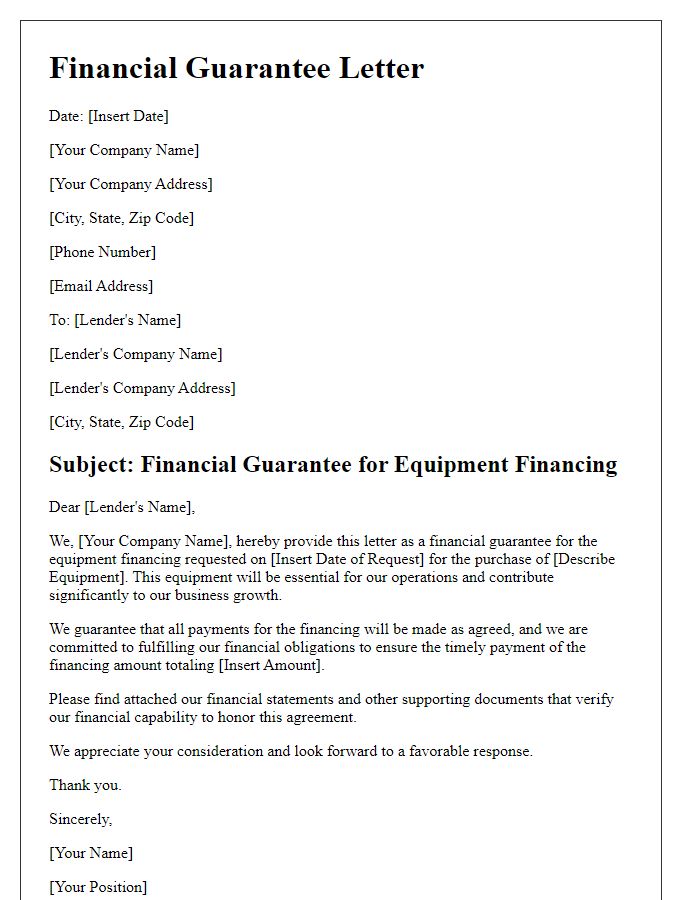

Letter template of insurance financial guarantee for equipment financing.

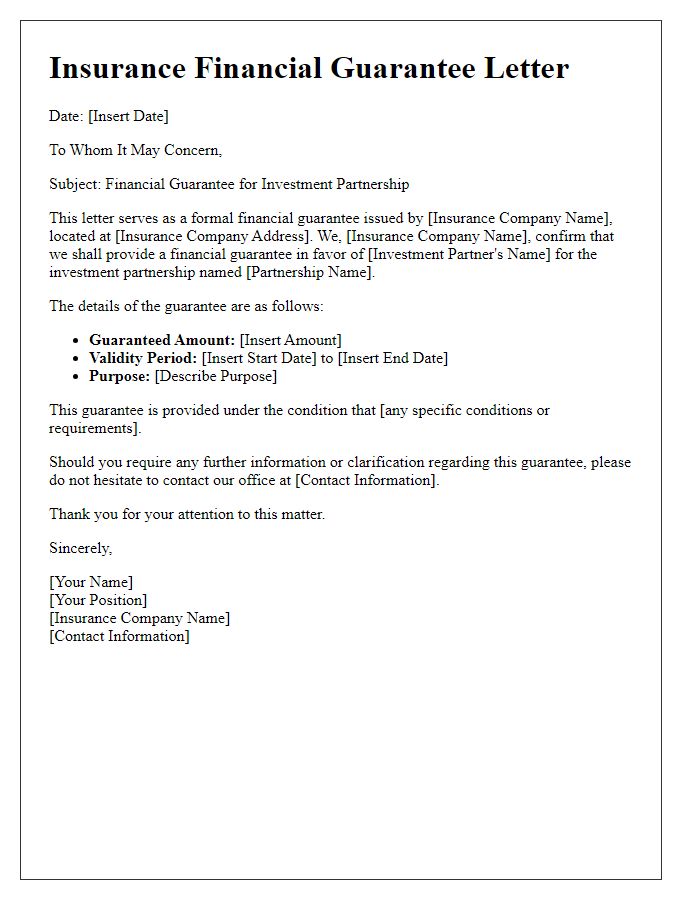

Letter template of insurance financial guarantee for investment partnership.

Comments