Are you staring at your insurance policy renewal letter and feeling a bit overwhelmed? Don't worry, you're not alone! Understanding the fine print and making sure you have the right coverage can be tricky, but it's essential for your peace of mind. Stick around as we break down the key elements of an effective insurance policy renewal letter and guide you through the process!

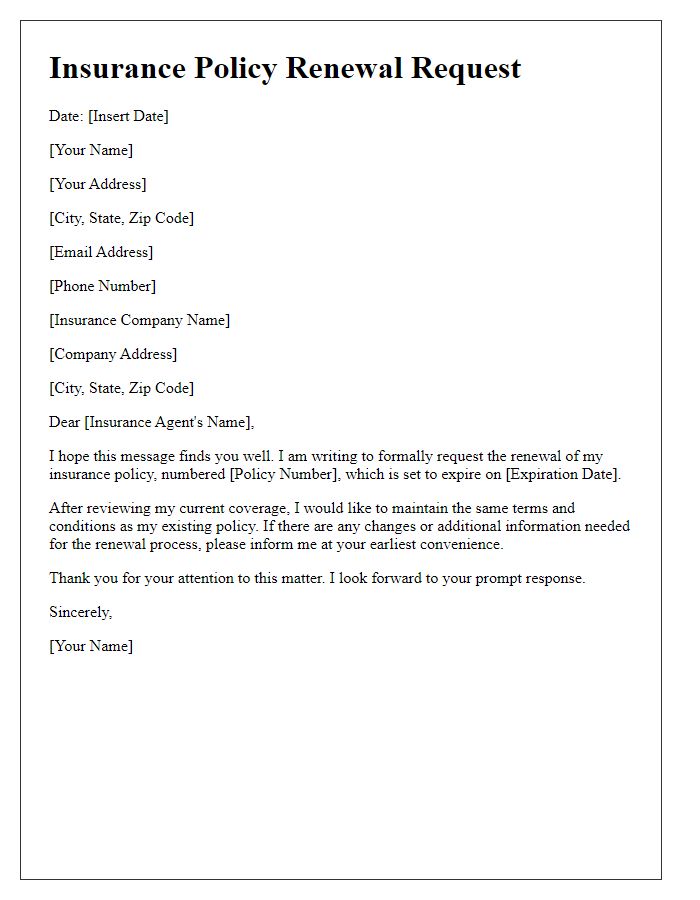

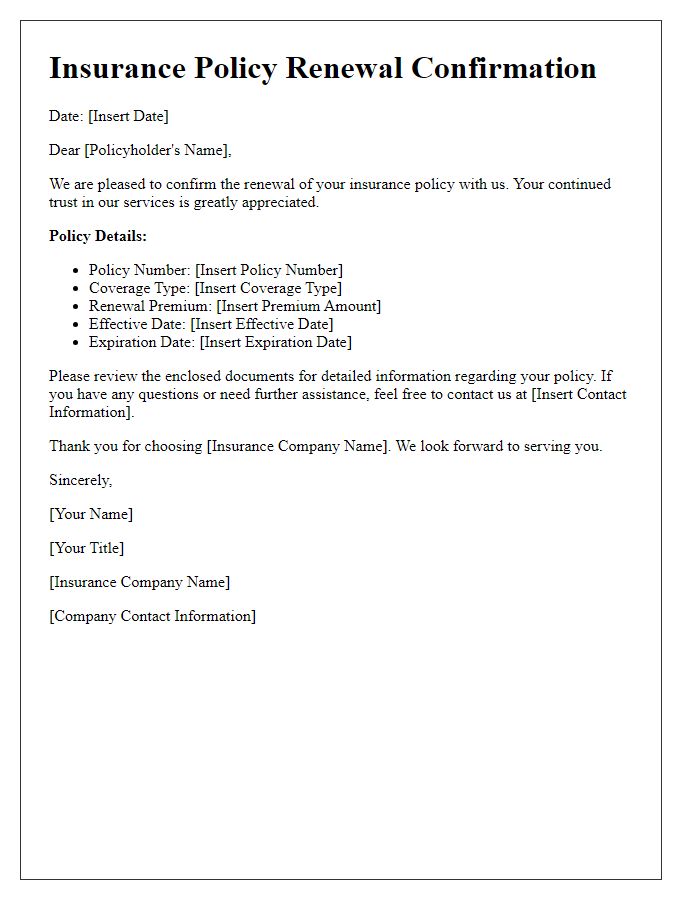

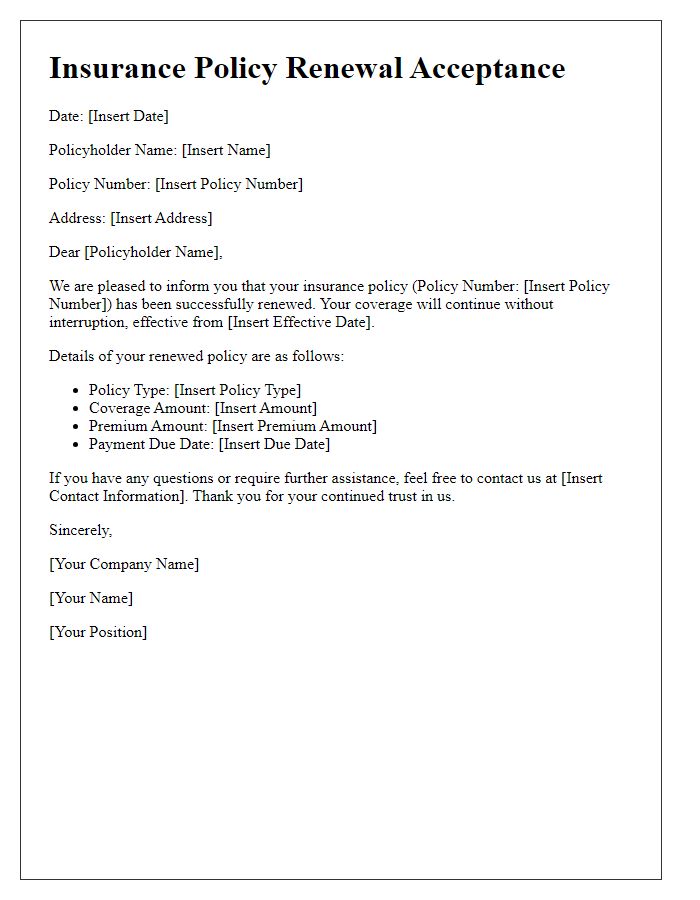

Personalization and Policy Details

Renewing an insurance policy involves personalizing the communication to reflect specific policy details, such as the policyholder's name, policy number, coverage limits, premium amounts, and renewal date. This allows for a tailored approach to each individual, ensuring clarity about renewal terms. Including information about recent changes in coverage options, any discounts applicable based on claims history or loyalty, and providing contact details for customer service enhances engagement. Offering guidance on the renewal process, such as methods for payment and necessary documentation, further streamlines the experience, fostering a sense of accessibility and support. Such attention to detail can build trust and satisfaction with the insurance provider.

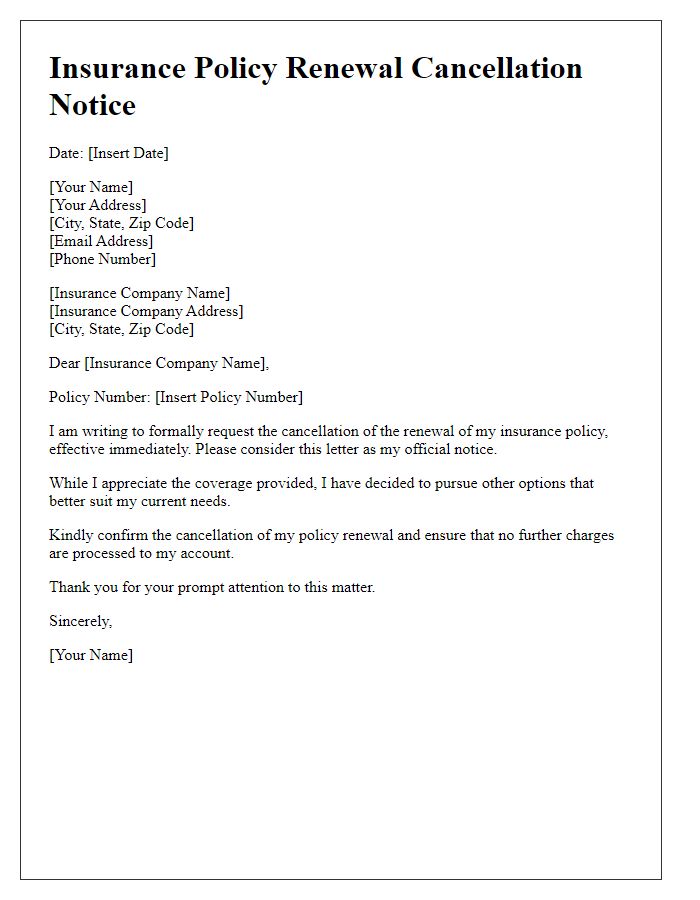

Renewal Terms and Conditions

Insurance policy renewal involves several important terms and conditions that policyholders must understand. Renewal dates typically occur annually on the policy anniversary, ensuring continuous coverage without interruption. Premium adjustments may reflect changes in risk factors, encompassing claims history, property value, and underwriting guidelines. Policy limits, deductibles, and exclusions may also evolve, requiring careful review to align with current needs. The grace period, often 30 days post-renewal date, allows policyholders to maintain coverage despite delays in payment. Compliance with updated regulations, such as state mandates and policy revisions, ensures adherence to legal requirements. Notifying insurers of significant life events, such as major purchases or changes in residency, is crucial to ensure adequate coverage.

Payment Options and Deadlines

Insurance policy renewal provides essential coverage for individuals and businesses. Insurance providers typically offer various payment options, including annual, semi-annual, or monthly plans, allowing flexibility for policyholders. Deadlines for payment are crucial, as failure to meet these dates can result in a lapse of coverage. For instance, many insurance companies require renewal payment at least 30 days before the policy expiration date to ensure uninterrupted service. It is important for policyholders to review their policy documents, often detailing specific payment methods such as credit card, bank transfer, or automatic debit, to avoid penalties and ensure continued protection against risks.

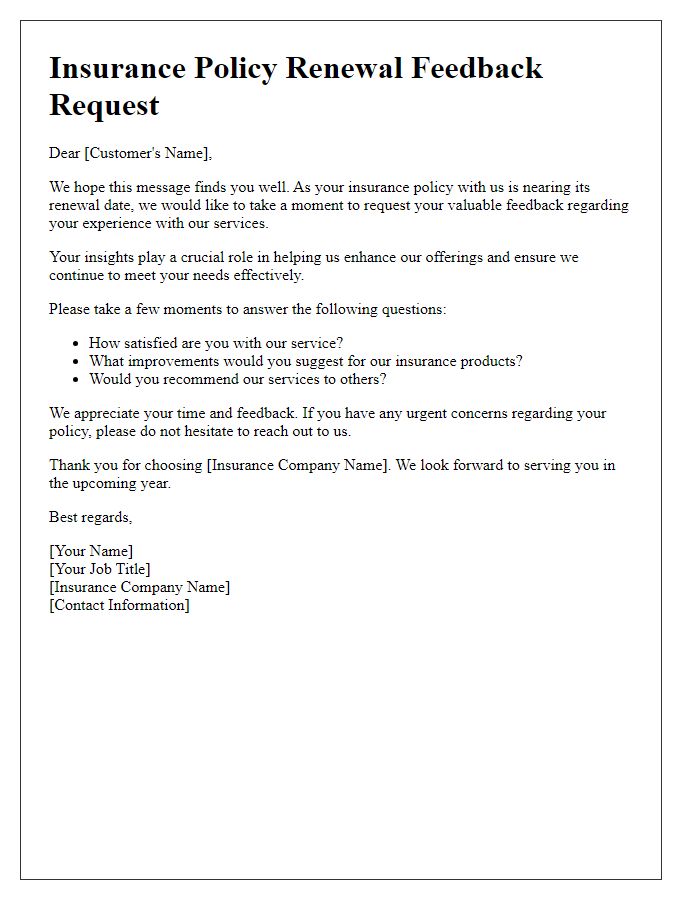

Contact Information for Queries

Contact information for queries regarding insurance policy renewal is crucial for ensuring uninterrupted coverage. Policyholders should reach out to the customer service department of their insurance provider, often located in major cities like New York or Los Angeles. Contact numbers typically include toll-free lines, with many companies offering 24/7 support availability. Email correspondence can also be effective, allowing for documented inquiries. Additionally, some insurers offer live chat services through their websites, enhancing accessibility. Social media platforms, such as Twitter or Facebook, serve as alternative communication channels, providing timely responses. Ensuring that policyholders have multiple avenues for contact can significantly improve customer satisfaction and policy management.

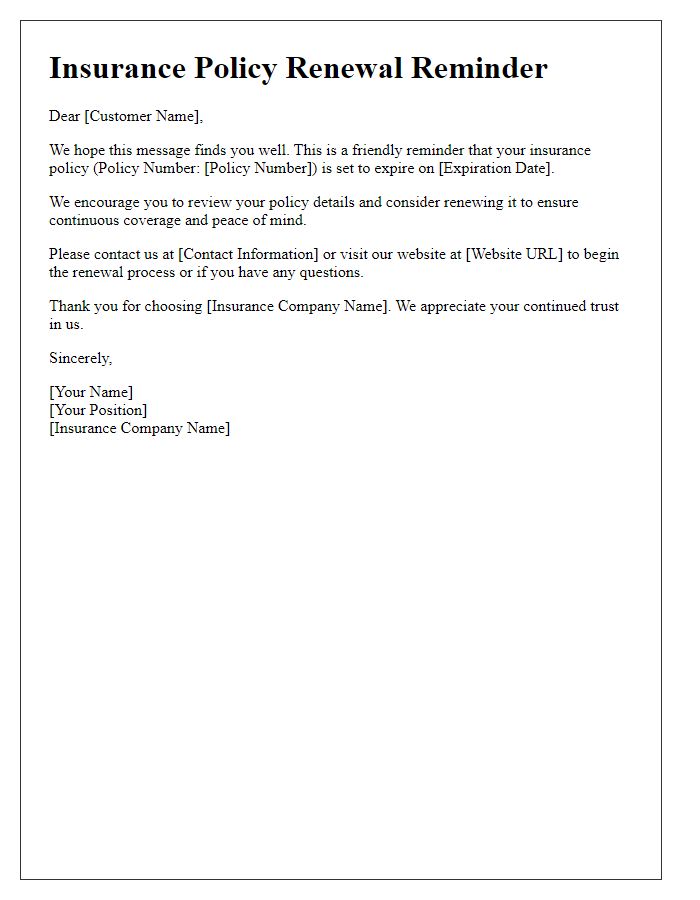

Encouragement for Timely Renewal

Timely renewal of insurance policies, such as auto or homeowner's insurance, is crucial for uninterrupted coverage and protection. Insurance policies typically require renewal annually, with a grace period of about 30 days, during which the policyholder can renew without losing benefits. Failing to renew on time may lead to lapses in coverage, exposing individuals to potential financial risks and liabilities. Insurance companies, like Allstate or State Farm, send notifications via email or postal mail to remind policyholders about upcoming renewal deadlines. This proactive communication helps ensure that essential protections remain in place, safeguarding against unexpected events, such as accidents or natural disasters. Policyholders should review the terms and conditions before renewing, allowing them to adjust coverage limits or add endorsements that reflect their current circumstances.

Comments