When it comes to insurance, understanding your policy endorsements is key to ensuring you have the coverage you need. An endorsement modifies your original policy, adding or changing the terms to better fit your unique circumstances. Whether you're enhancing your coverage or addressing specific needs, being informed is crucial. So, let's dive deeper into the nuances of insurance policy endorsements and explore how they can benefit you!

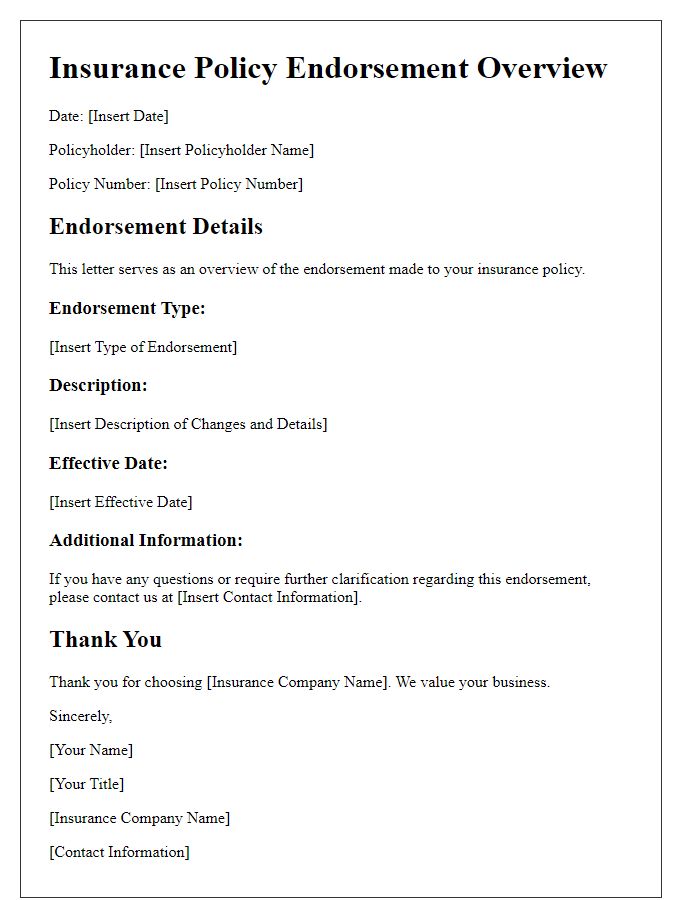

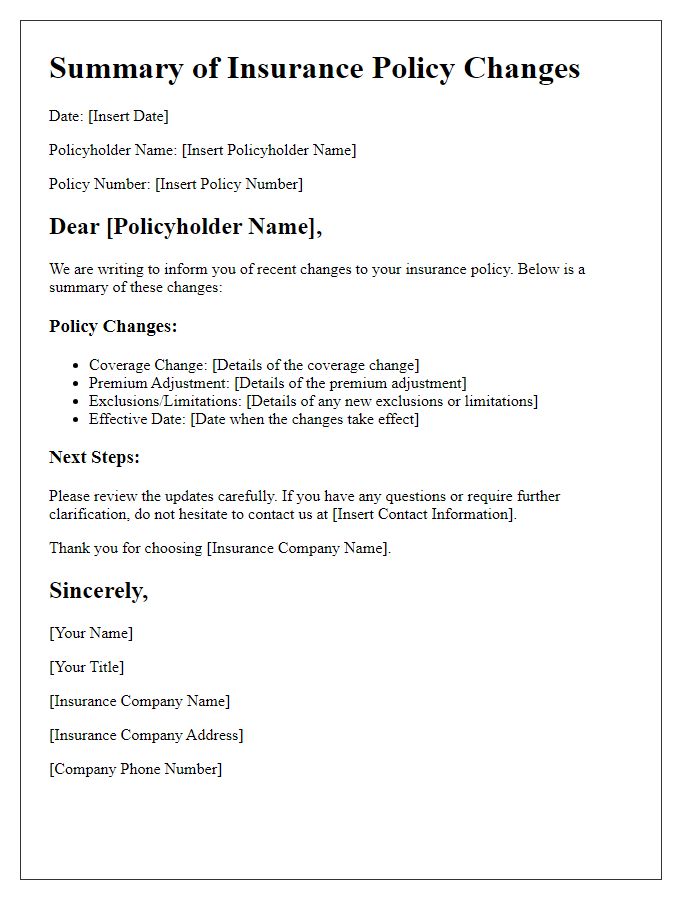

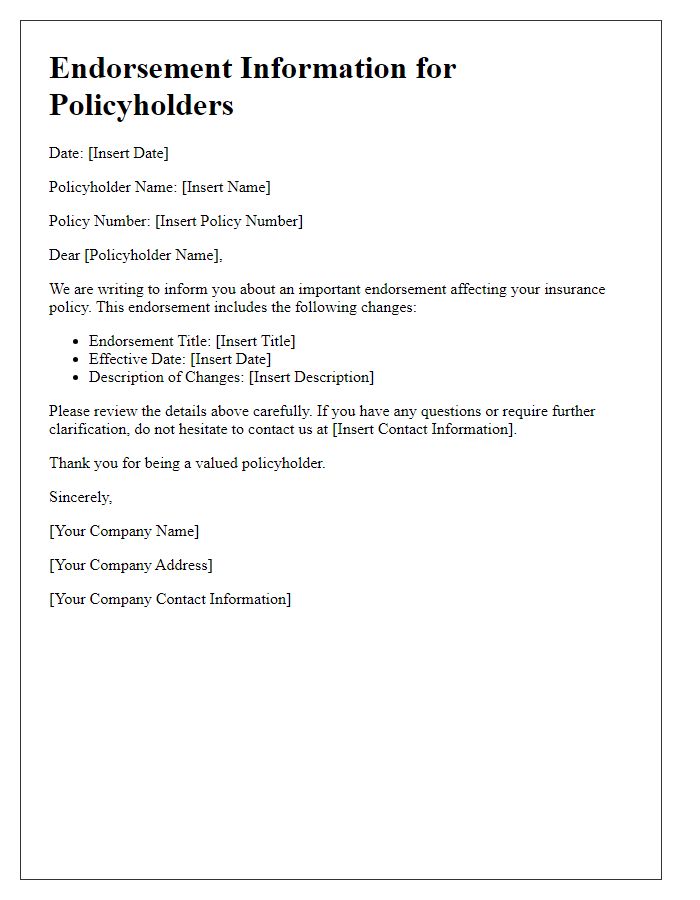

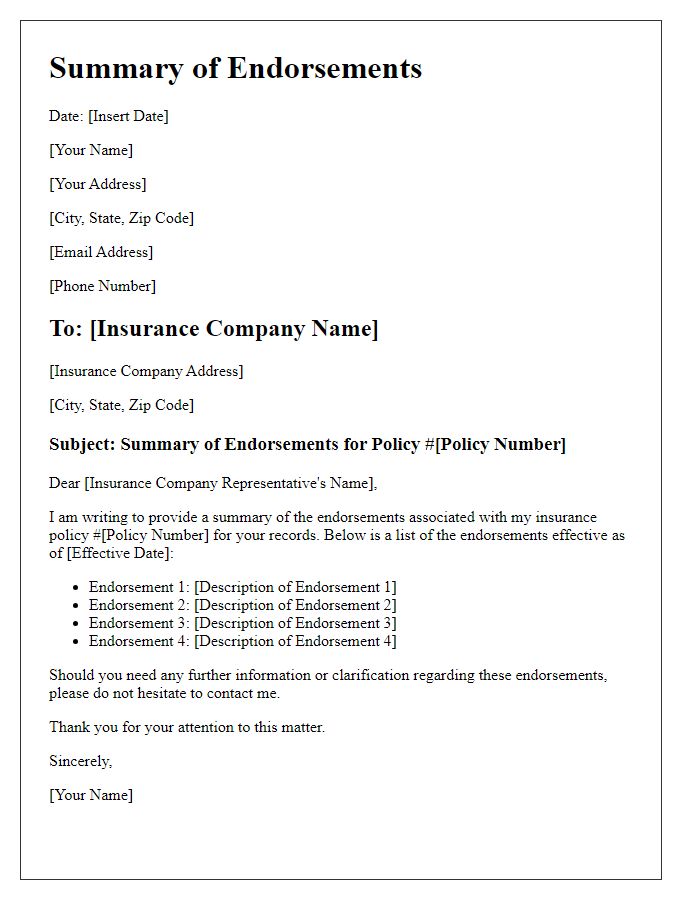

Policyholder Information

The policyholder information section provides essential details about individuals or entities holding an insurance policy. This includes key identifiers such as the policyholder's full name, which could be John Smith, the date of birth, which might be January 1, 1980, and the address, for example, 123 Main Street, Springfield, IL 62701. Additional pertinent information includes the contact number, such as (555) 123-4567, and email address, for instance, john.smith@email.com. Furthermore, policy numbers and types of coverage, like automobile or home insurance, should be clearly indicated for reference. This section forms the foundation of communication and record-keeping for managing the insurance policy through its endorsement summary.

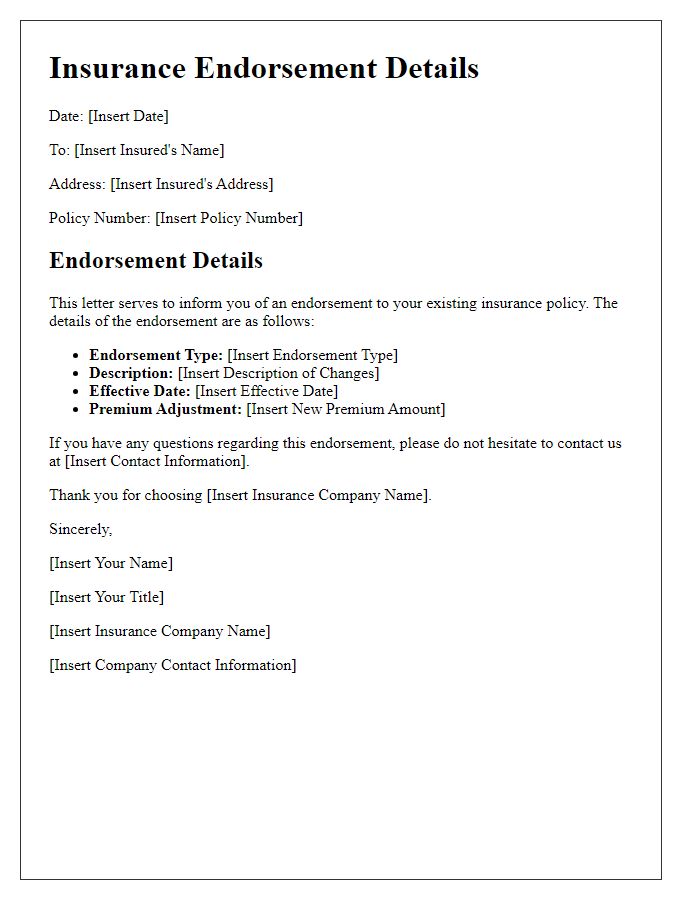

Endorsement Effective Date

An insurance policy endorsement summary provides vital information regarding changes or modifications to an existing insurance policy. Typically included in this summary is the endorsement effective date, which marks the official date when the changes take effect. This date is crucial for both the insurer and the insured as it outlines the timeline of the coverage adjustments. For instance, a change in coverage limits or the addition of a new covered item, such as a high-value piece of jewelry, might have a specific endorsement effective date set to coincide with the start of a new policy period or upon receipt of premium adjustments. Understanding this date is essential to ensure that adequate protection is in place during the specified period.

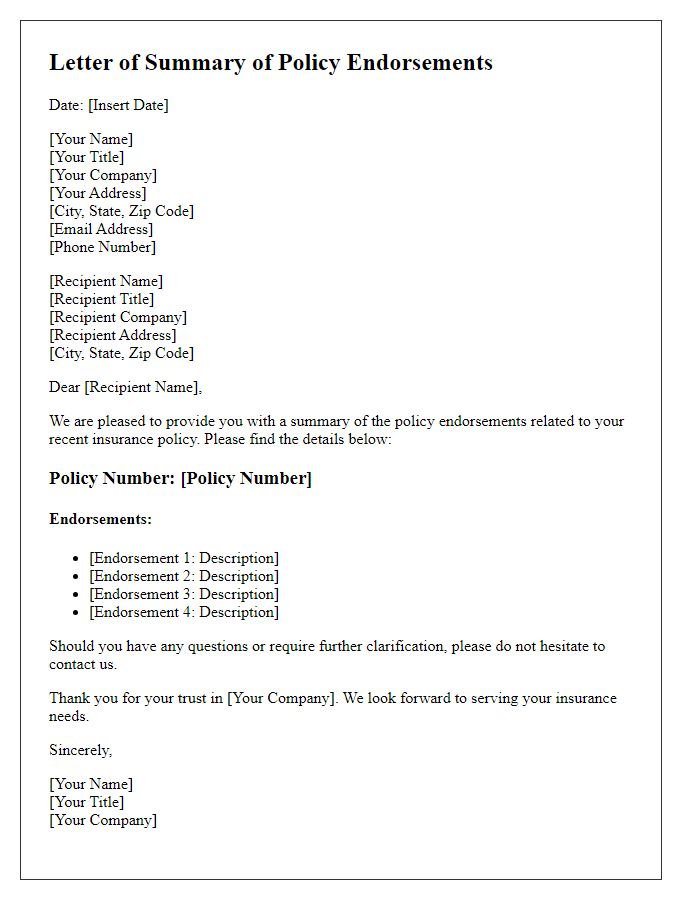

Policy Number

Insurance policy endorsements play a crucial role in updating or modifying coverage details associated with a specific policy number, such as 1234567890. These endorsements can include changes in coverage limits, additional insured parties, or specific exclusions related to claims. Details regarding effective dates, such as January 1, 2023, and expiration dates, like December 31, 2023, provide clarity on the duration of these modifications. It is also vital to mention the reasons for endorsements, such as property renovations or changes in business operations, ensuring that policyholders comprehend the impact on their insurance protection. Careful documentation of these endorsements ensures compliance with legal requirements and facilitates communication between insurance providers and clients.

Description of Changes

Insurance policy endorsements can modify existing coverage, typically involving additions or deletions of specific terms. For instance, a common change is the inclusion of a higher liability limit of $1 million, enhancing protection against personal injury claims. Additionally, a new exclusion may be added, preventing coverage for damages caused by natural disasters such as floods, where the average annual damage exceeds $21 billion in the United States. Endorsements might also introduce new coverage for specialized vehicles, like electric bicycles, ensuring protection against theft or damage while parked. Each modification aims to tailor the policy to the insured's specific situation, ultimately enhancing coverage suitability and risk management.

Contact Information for Further Queries

Insurance policy endorsements provide necessary adjustments or additions to coverage, ensuring alignment with the policyholder's needs. For inquiries regarding policy modifications, coverage limits, or specific endorsements, individuals should reach out to the designated customer service department at the insurance company. Typically, customer service representatives are available Monday through Friday, from 8 AM to 6 PM, providing assistance through various channels, including dedicated phone lines, email support, or online chat services. Important information such as policy number, contact name, and nature of the inquiry facilitates efficient resolution of any questions or concerns. Keep all relevant documentation ready for a smoother experience.

Comments