Hey there! We understand that life gets busy and sometimes important details can slip through the cracks, like your insurance policy. It's crucial to stay on top of these matters to ensure you remain protected and avoid any unexpected gaps in coverage. We invite you to read more about what to do next if you've received a lapse notification and how to get back on track!

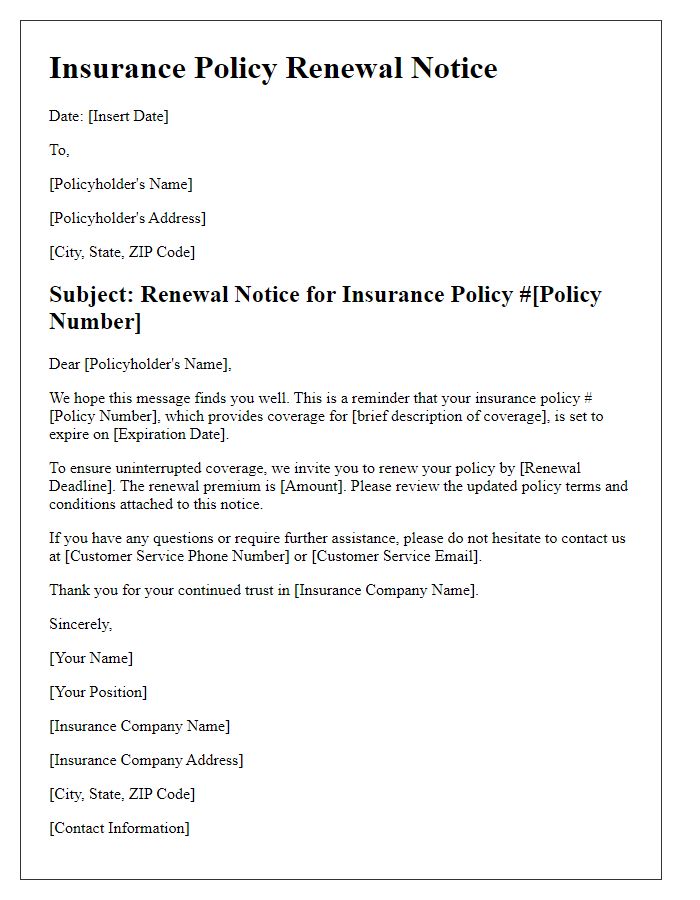

Policyholder Information

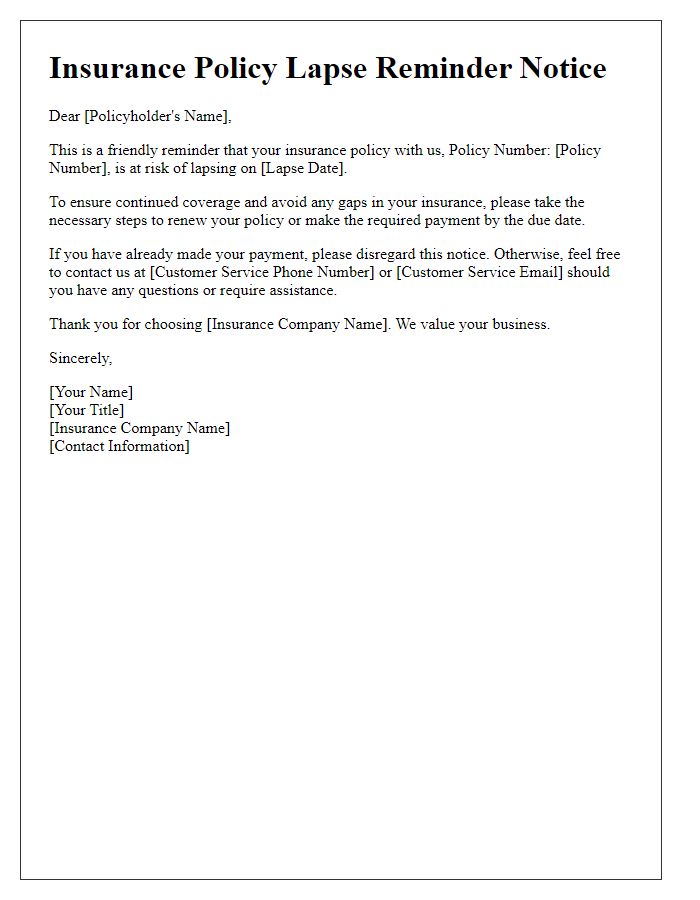

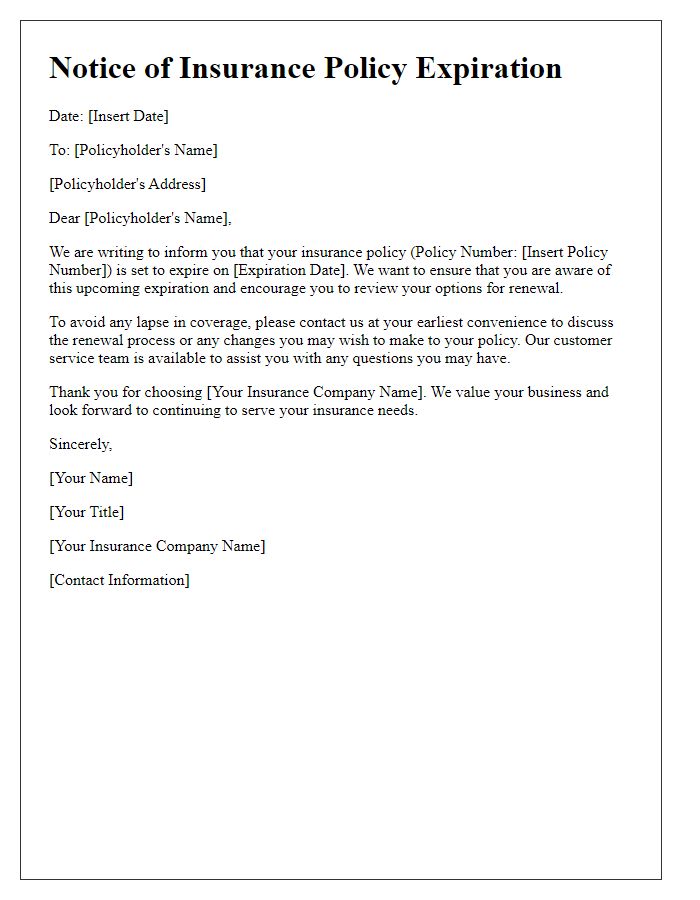

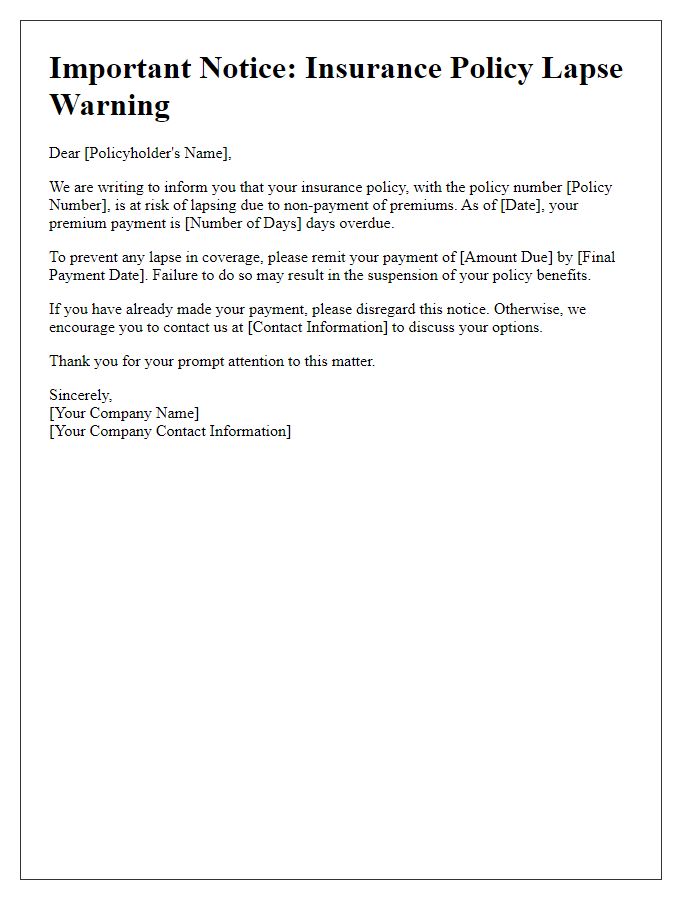

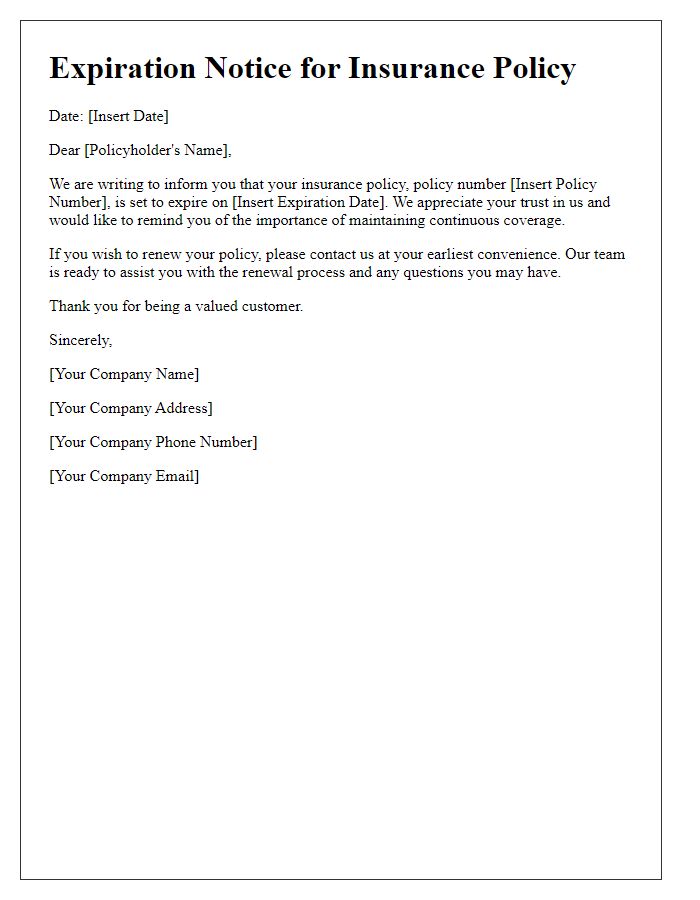

A notification regarding insurance policy lapses serves as a critical communication to policyholders, ensuring they remain informed about their coverage status. Insurance policyholders, often individuals (ages 18 and above) or businesses, typically receive a lapse notification when premium payments (monthly or annual) are overdue, sometimes exceeding a grace period of 30 days. Lapse notifications usually specify essential details, including policy number (a unique identifier), coverage type (like health, auto, or home insurance), and the expiration date (when the coverage officially ends). Additionally, the notification may emphasize the importance of reinstating the policy to avoid gaps in coverage, which can lead to potential financial risks, medical expenses, or liability issues. Properly addressing policyholders by their name and including customer service contact information ensures clarity and facilitates communication for further inquiries.

Policy Details

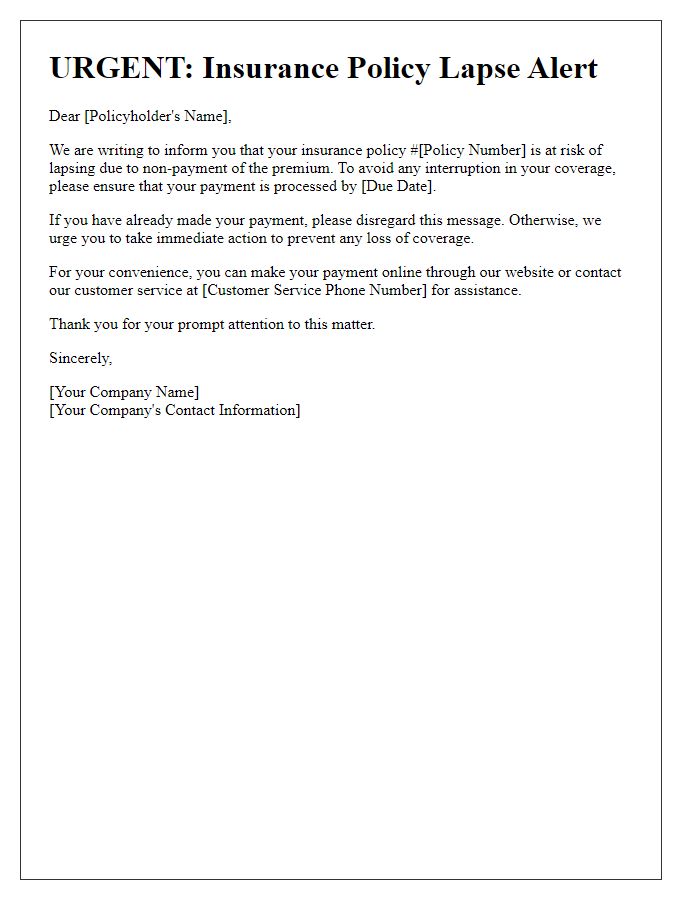

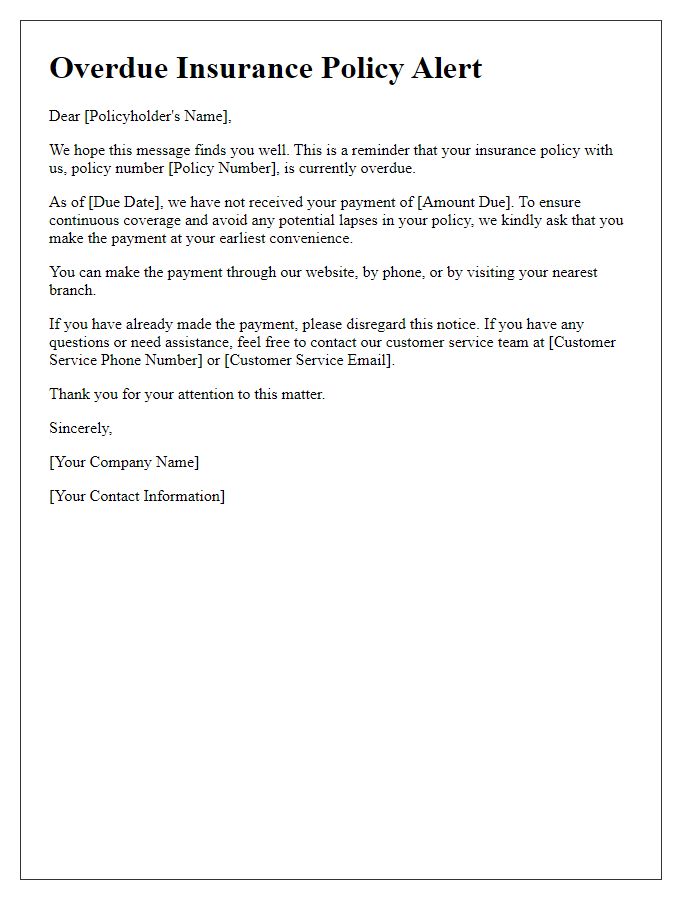

A policy lapse notification typically includes crucial information regarding an insurance policy that has not been maintained due to missed payments. It must highlight important elements such as the policyholder's unique identification number (often referred to as a policy number) associated with the specific coverage, the effective date of the policy indicating when coverage began, and the lapse date signaling when the policy is no longer valid due to non-payment. Details about the grace period, usually ranging from 30 to 60 days, should also be included, which is the time allowed for the policyholder to make the overdue payment without losing coverage. Further, the notification should mention potential consequences of the lapse, including risks of uncovered claims or higher premiums if the policy is reinstated after this period. Essential contact information for customer service representatives should be provided, enabling policyholders to promptly address the situation and possibly reinstate their coverage.

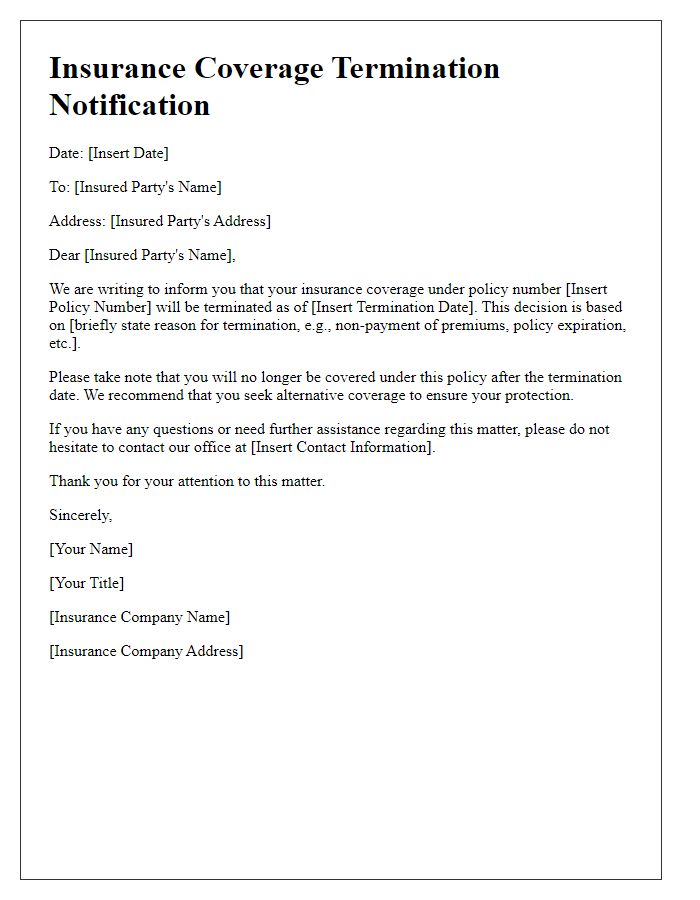

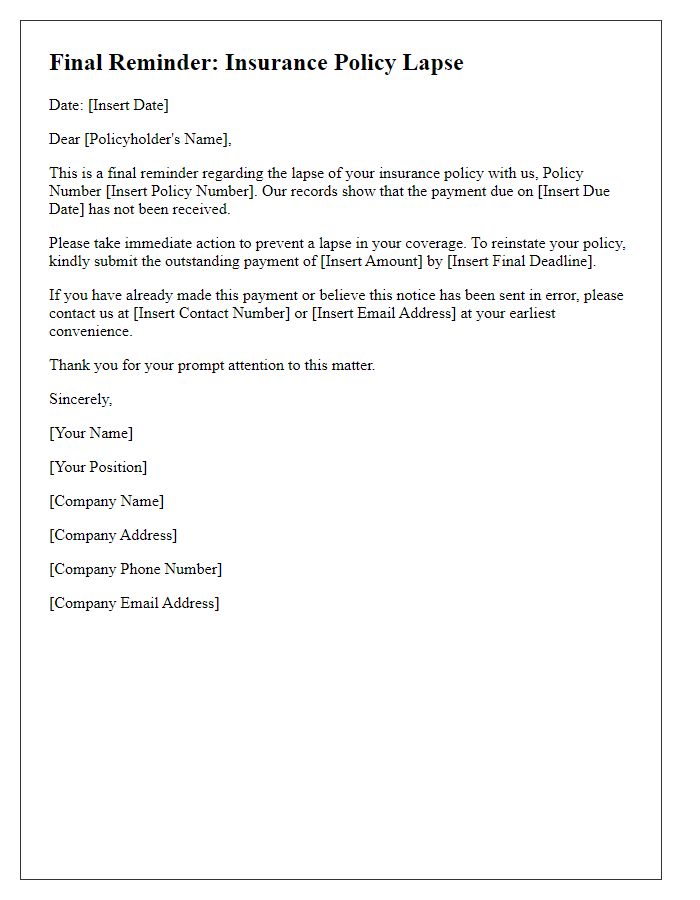

Lapse Notification Date

A lapse notification for insurance policies occurs when premium payments are not received within the specified grace period, typically 30 days. This situation can lead to the termination of coverage in various types of insurance, including life, health, and auto insurance, depending on the insurer's policies. Insurers like Allstate or State Farm may send a notification letter detailing the lapse, reminding policyholders of their responsibility to make timely payments to maintain active protection against risks. Policyholders often receive these notifications via mail or email, containing critical information such as policy number, lapse date, and instructions for reinstatement options, emphasizing the urgency of addressing the missed payment promptly to avoid losing coverage indefinitely.

Consequences of Lapse

A lapse in an insurance policy, such as life, health, or auto insurance, can have significant consequences. Policyholders may face an uncontrolled financial burden following events like accidents or medical emergencies due to the lack of coverage. For instance, in the United States, medical bills can average over $30,000 for a hospital stay (2022 statistics), leaving uninsured individuals in severe debt. Vehicle incidents without auto insurance can lead to legal penalties in states like California, where fines can exceed $1,000 and result in license suspension. Additionally, life insurance policy lapses may trigger the loss of accumulated cash value, which could exceed tens of thousands of dollars, undermining financial security for beneficiaries. Moreover, reinstatement processes often require medical underwriting, potentially increasing premiums for health-related policies.

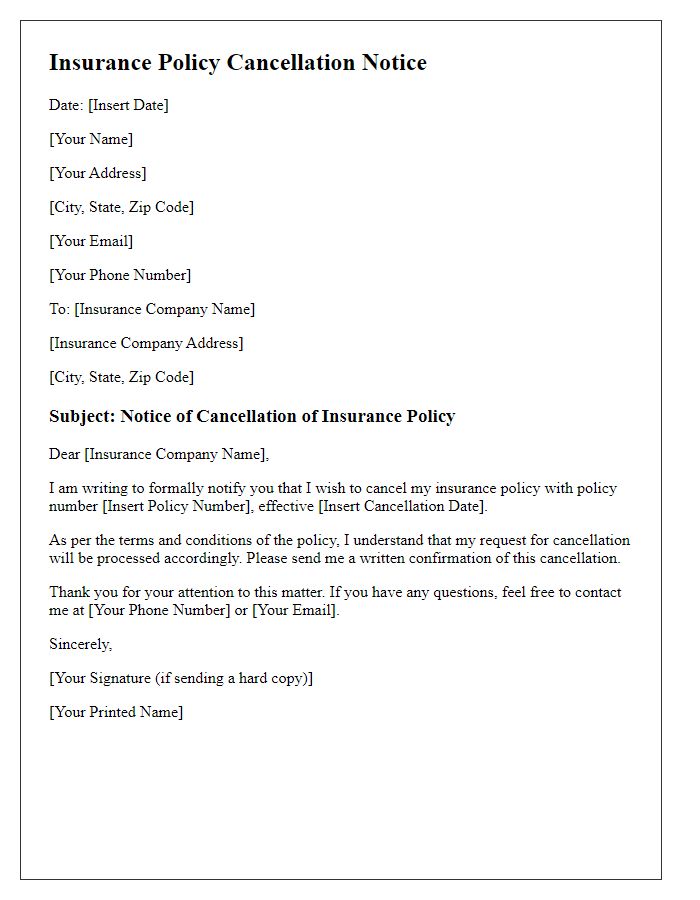

Contact Information for Queries

Insurance policy lapses can lead to significant coverage gaps. Customers should reach out to their insurance provider's customer service line (often found on the policy documentation) for immediate assistance. Policyholders typically have a grace period, often 30 days, to renew their policies without penalty. Contacting the insurer promptly can clarify options to reinstate the policy or understand the reasons for the lapse. Understanding the consequences of a lapse, including potential loss of coverage for events like accidents or natural disasters, is crucial for maintaining financial protection. Documentation such as renewal notices or payment records may be required during discussions with the insurance representative.

Comments