When it comes to changing your insurance policy, crafting the right letter can make all the difference. Navigating the intricacies of policy amendments might seem daunting, but it doesn't have to be! With a clear template and a touch of personalization, you can communicate your needs effectively. Curious about how to streamline this process? Read on to discover our essential tips for writing the perfect insurance policy amendment letter!

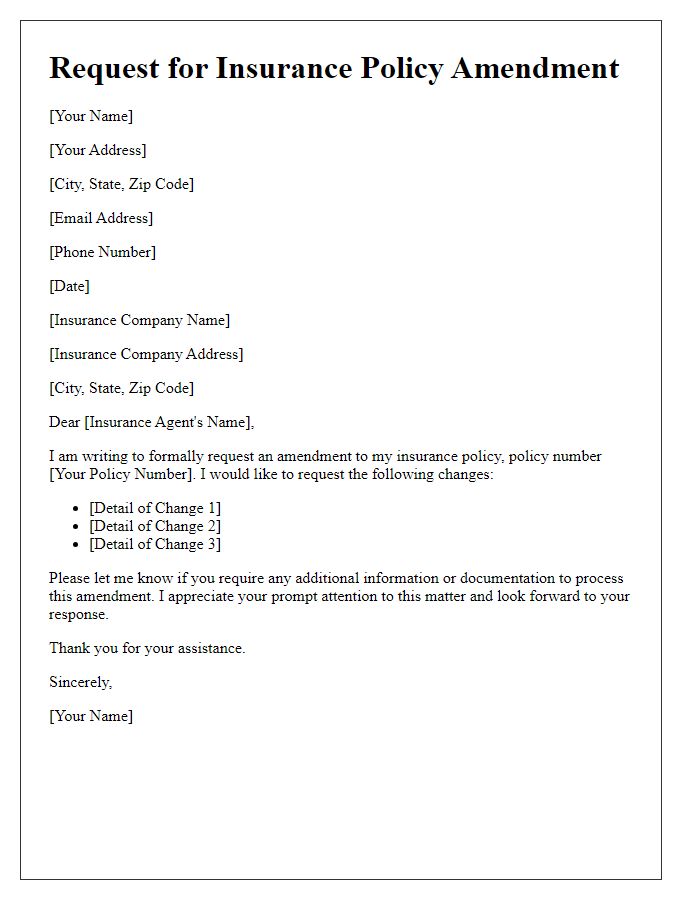

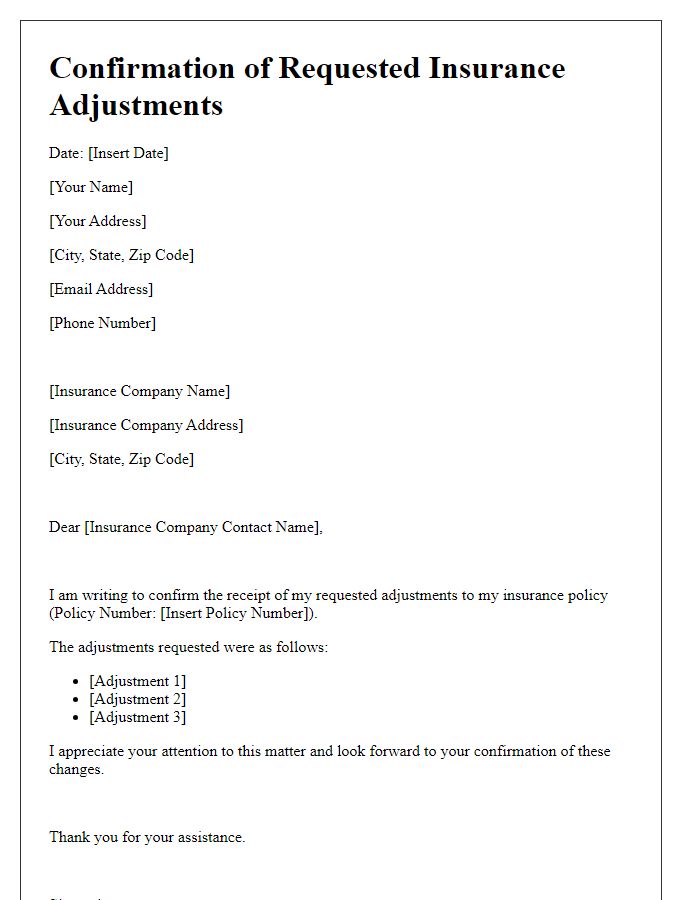

Policyholder Information

The insurance policy amendment process requires an accurate understanding of the policyholder's information, including name, address, and identification number (e.g., Social Security Number or policy number). Correct and detailed documentation helps the insurance company adjust policy terms effectively. Important terms such as coverage type (e.g., auto, health, or home insurance), effective date of the amendment, and specific changes requested (such as increased coverage limits or additional insured parties) must be clearly stated. Ensuring compliance with any state-specific regulations, such as those set by the National Association of Insurance Commissioners (NAIC), is crucial for valid amendments. The amendment should also acknowledge receipt of premium adjustments if applicable, maintaining clarity in the financial obligations of the policyholder.

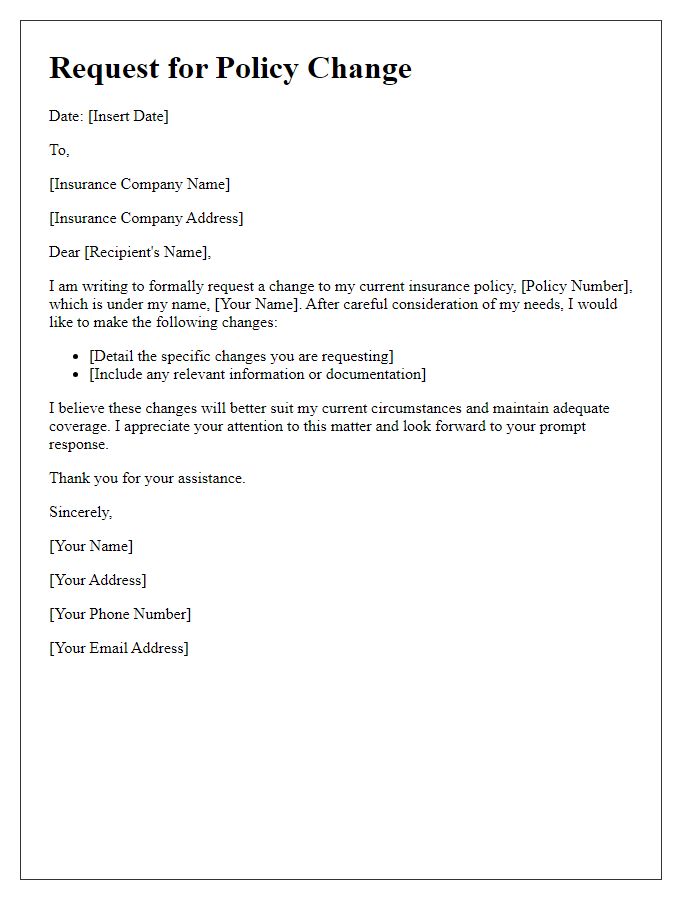

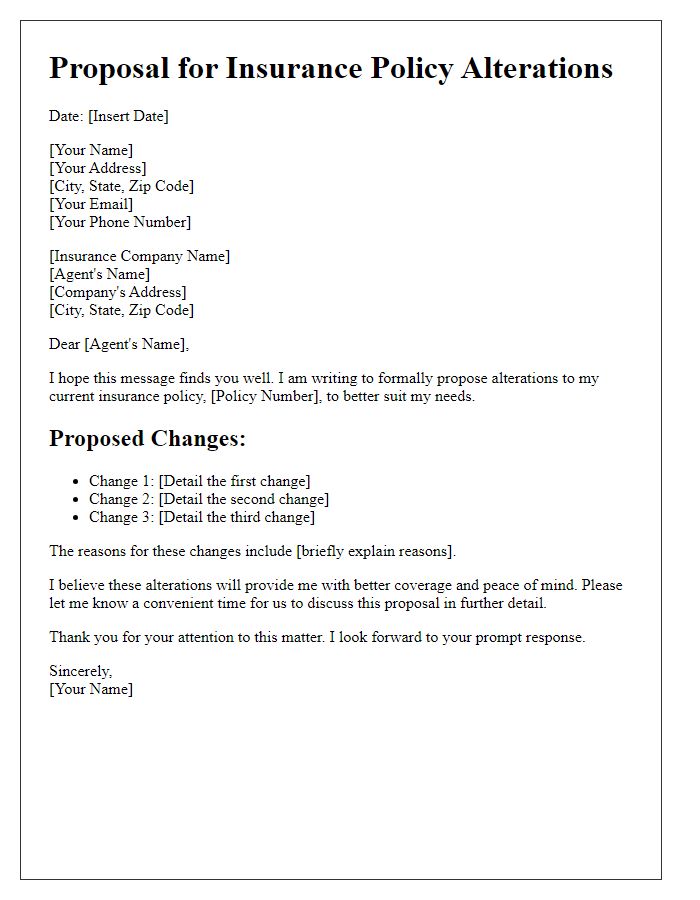

Insurance Policy Details

An insurance policy amendment serves to update important details of the contract. Policyholders may need to adjust their coverage amounts, beneficiary designations, or personal information such as their address. For instance, a homeowner's insurance policy might require a change after renovations that increase the property's value, necessitating an increase in dwelling coverage from $250,000 to $300,000. Additionally, life insurance policies often require updates to beneficiaries following significant life events, like marriage or the birth of a child. These amendments ensure that the insurance coverage accurately reflects the policyholder's current situation and meets their protection needs.

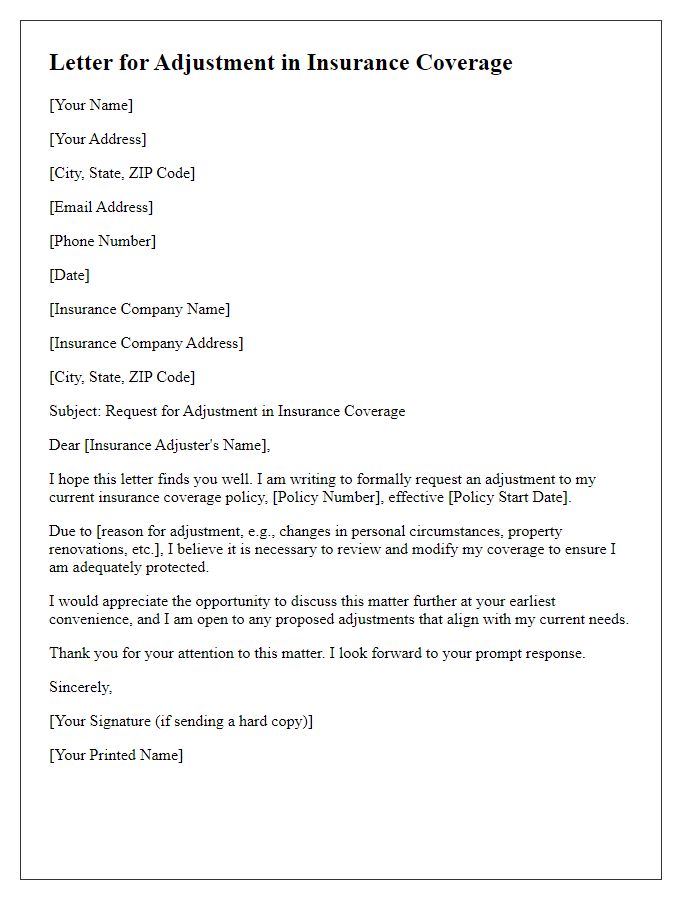

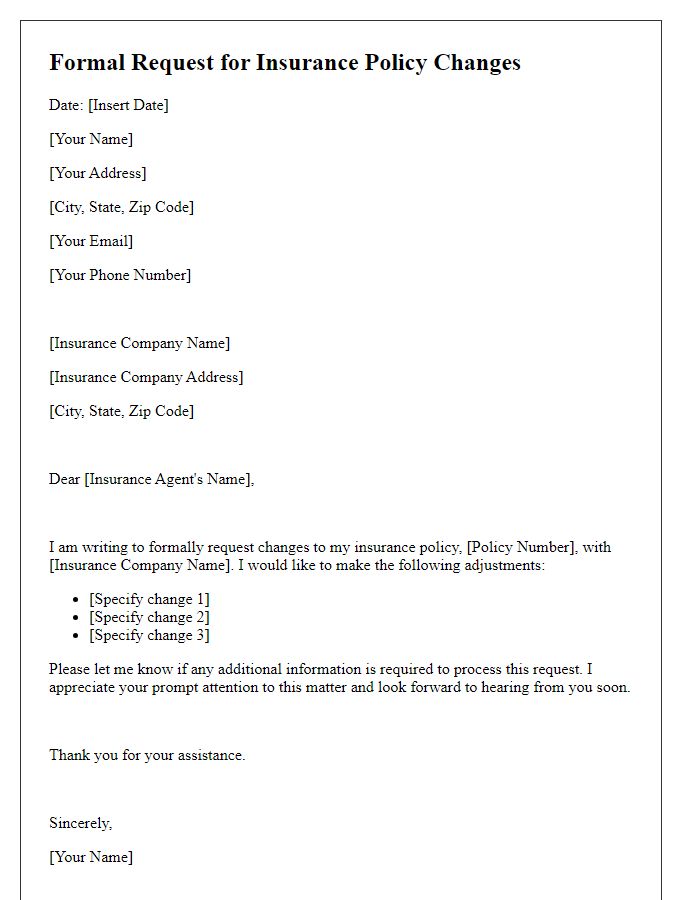

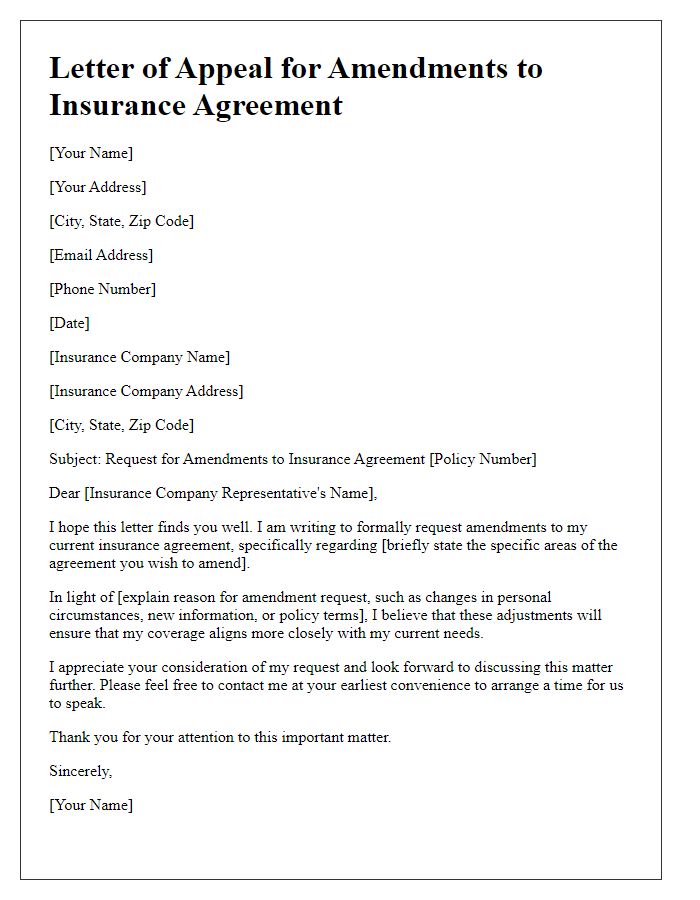

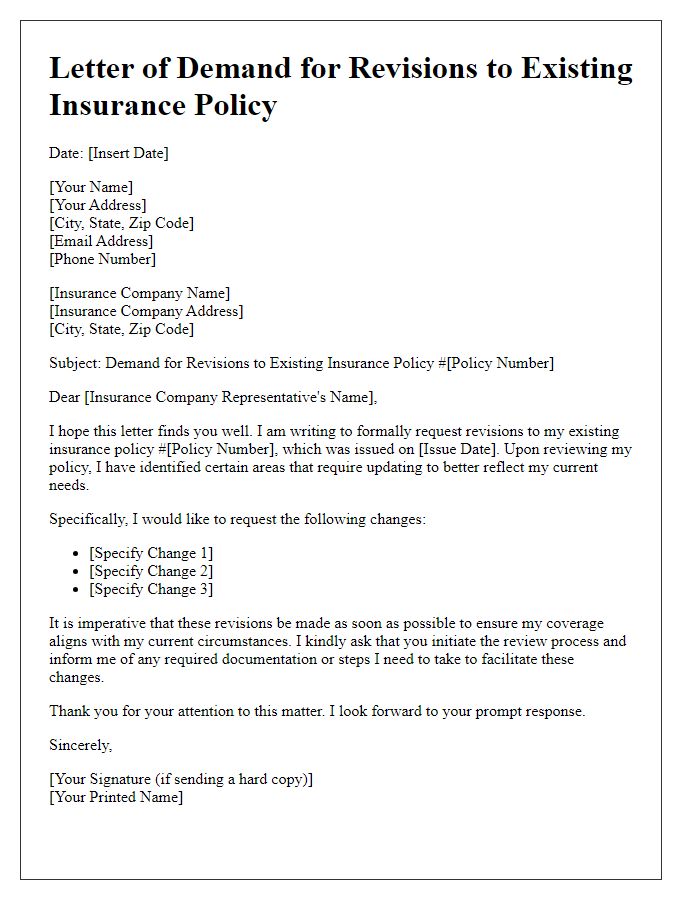

Amendment Request Description

An insurance policy amendment request should clearly specify the desired changes to the existing contract, ensuring all details are accurately conveyed. The policy number (a unique identifier assigned by the insurance company) must be included for identification purposes. It is essential to describe the specific amendments required--such as coverage enhancements, beneficiary updates, or changes in limits--that may be necessary due to life events like marriage, relocation, or changes in asset value. Include relevant dates, such as the effective date of proposed changes, to establish a clear timeline. Clear contact information allows the insurance provider to reach out for necessary clarifications or confirmations regarding the amendment request, streamlining the processing of updates while mitigating potential delays.

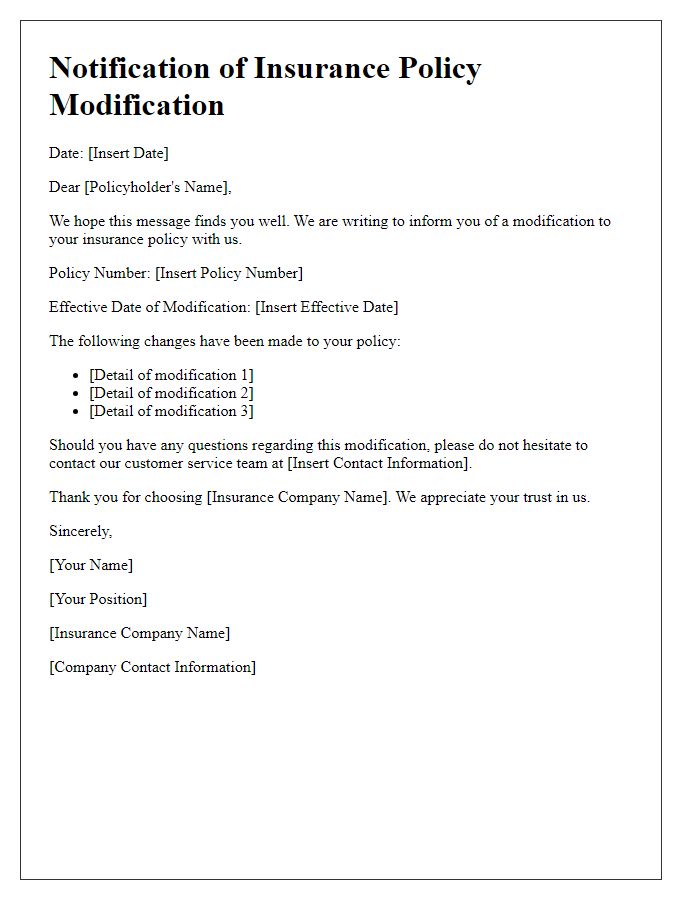

Effective Date of Change

Insurance policy amendments can be crucial for ensuring that coverage remains adequate and reflective of current needs. An effective date of change must be clearly stated to provide clarity on when adjustments in coverage, terms, or benefits take effect. For example, an amendment to a homeowner's insurance policy may specify an effective date of change as January 1, 2024, which marks the start of new coverage provisions, such as increased liability limits or added protection for specific valuable items like art or jewelry. This date is essential for both the insurer (the financial institution providing the policy, like Allstate or State Farm) and the insured (the policyholder) to manage expectations and avoid potential disputes regarding coverage during the transition.

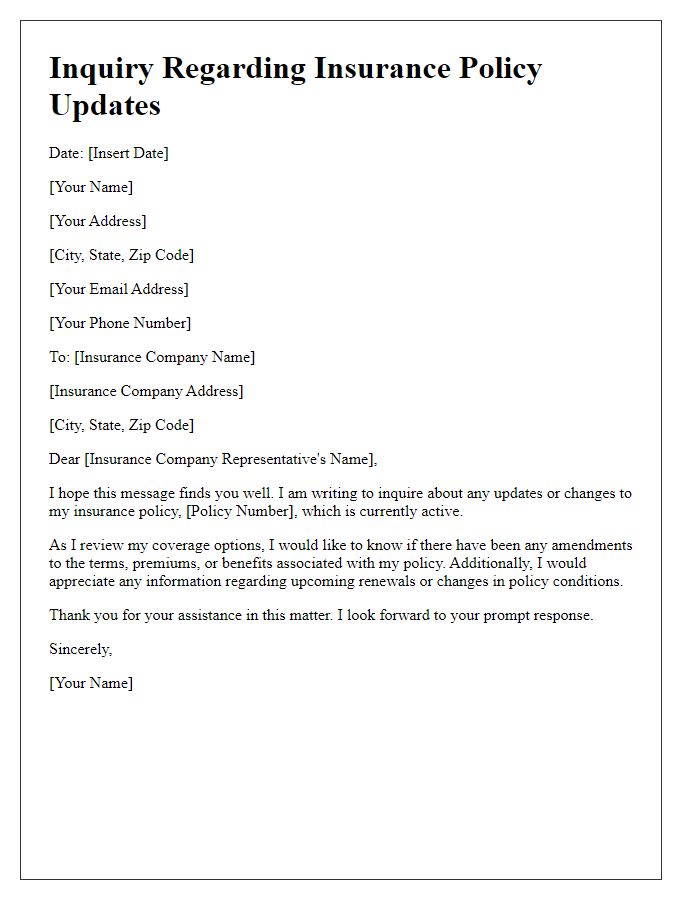

Contact Information for Queries

For insurance policy amendments, it's essential to provide clear and accessible contact information for any queries. Consider including details such as customer service phone numbers, typically available during regular business hours, which may range from 8 AM to 6 PM (local time). An email address specifically designated for policy inquiries can be useful, ensuring prompt responses. Additionally, providing a dedicated section on the company's website with FAQs and live chat options can facilitate easier communication. Including direct links to useful online resources, such as claims processing and policy management, enhances user experience, thus enabling policyholders to navigate amendments efficiently.

Comments