Are you feeling overwhelmed by the insurance claim process? It can be frustrating when your claim gets denied or underpaid, but you're not alone in this journey. Crafting an effective appeal letter is crucial to getting the resolution you deserve, and having a solid template can make all the difference. Let's explore how to create a compelling appeal letter that will grab the attention of your insurerâread on to discover tips and examples that can set you on the path to success!

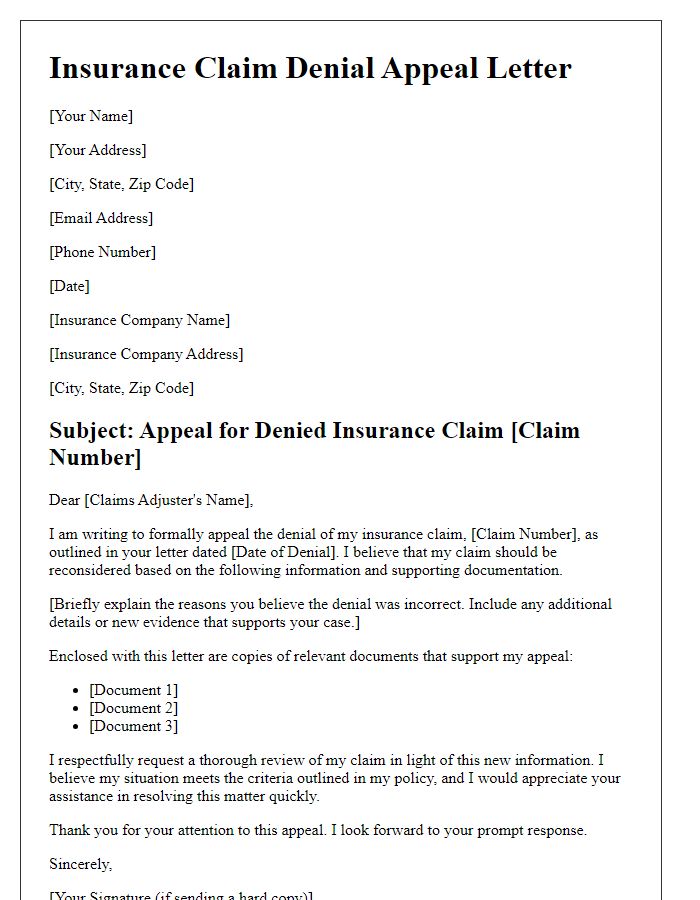

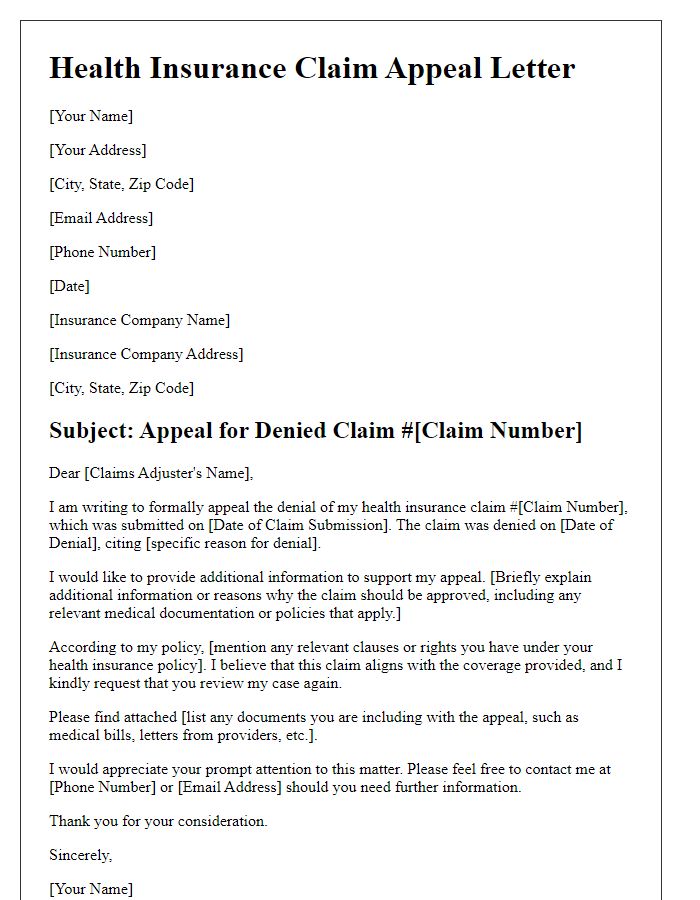

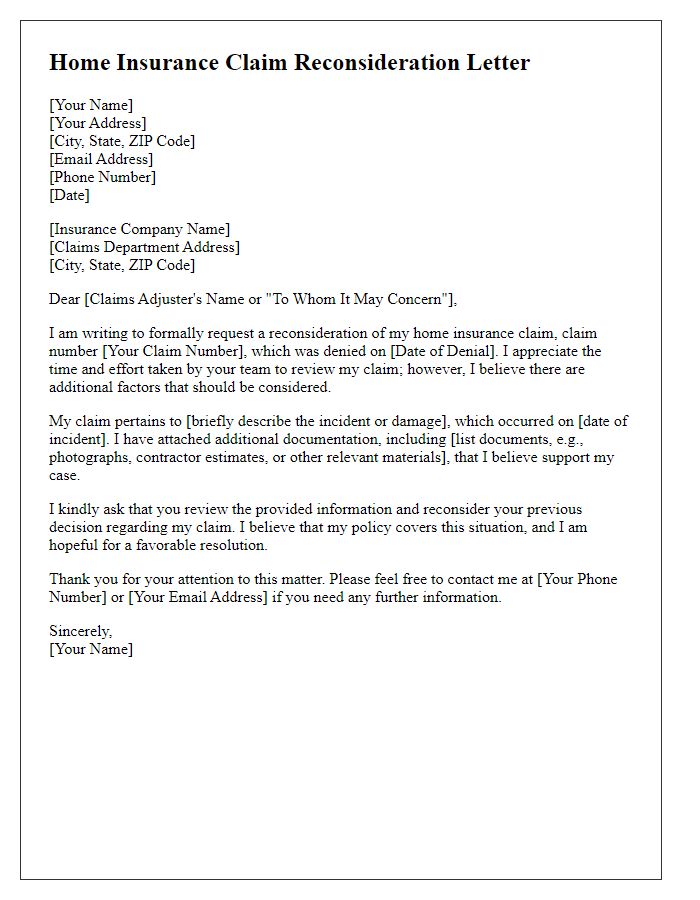

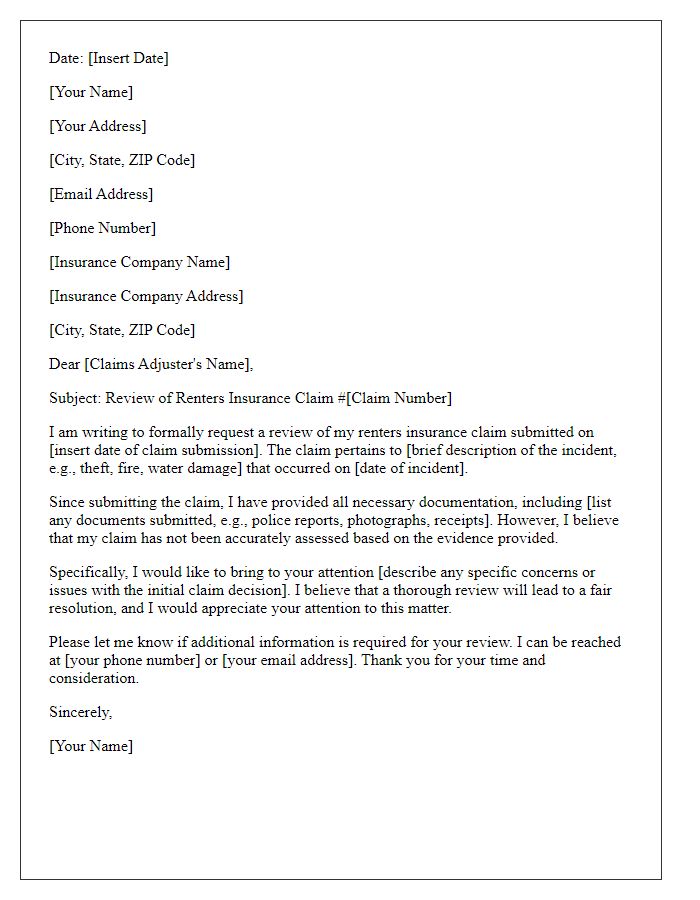

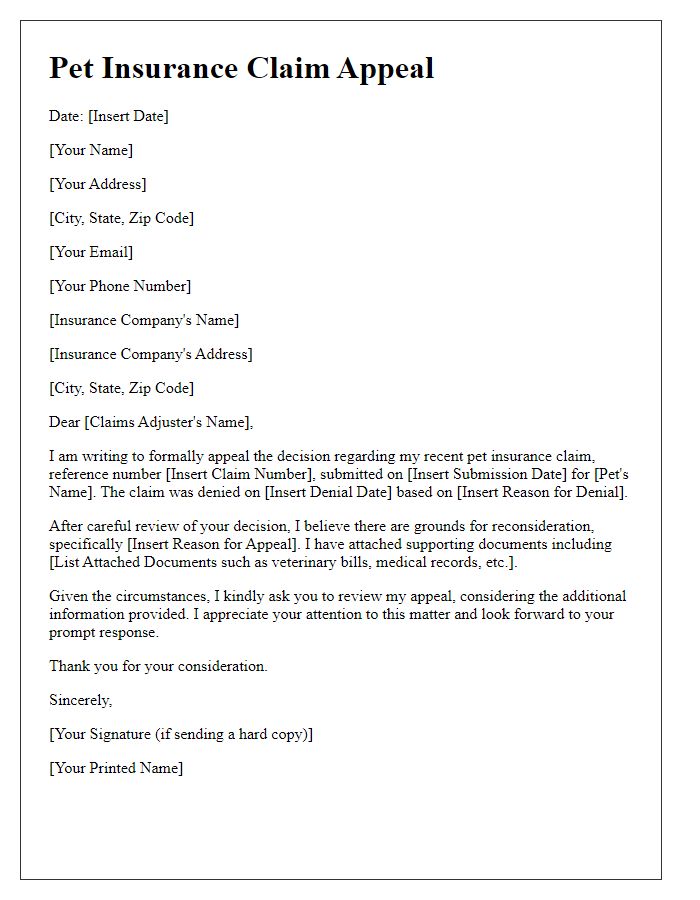

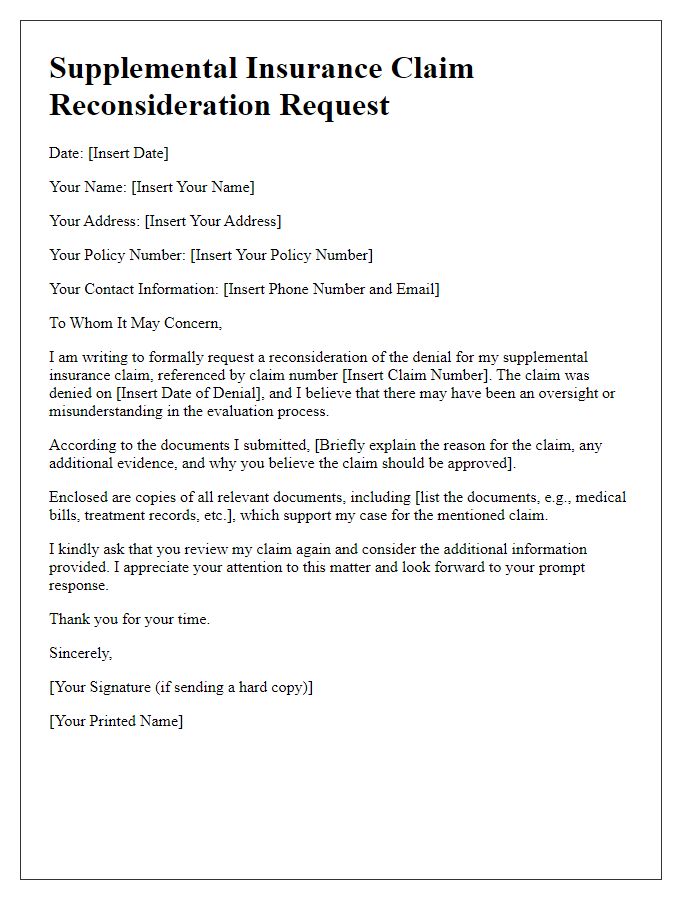

Clear Contact Information

In insurance claim appeals, clear contact information is crucial for effective communication between the claimant and the insurance company. This includes the claimant's full name, residential address, phone number, and email address. Each detail plays a significant role in identifying the case within the insurer's system, facilitating timely responses. For instance, including a specific policy number is essential, as it helps the insurer locate the relevant records and assess the claims history accurately. Additionally, stating preferred hours for contact can alleviate delays. Overall, precise contact information fosters a smoother claims process, ensuring all parties remain informed and involved.

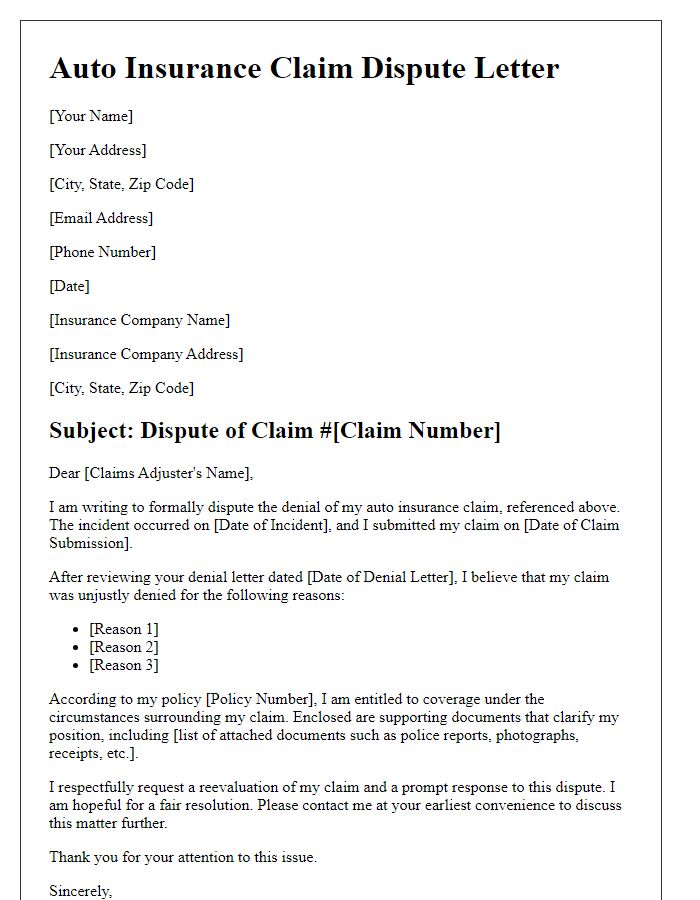

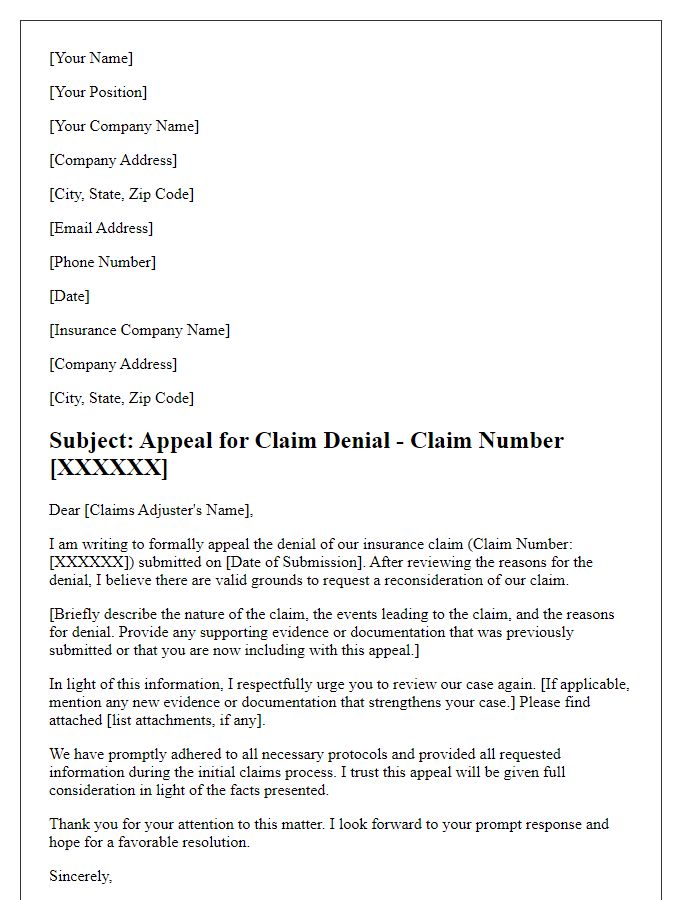

Policy and Claim Details

Submitting an insurance claim appeal requires precise documentation and clear presentation of policy and claim details. Policy number, typically a series of alphanumeric characters, uniquely identifies the insurance contract. Claim details, including the claim number assigned during the initial filing, are crucial to reference for processing. Date of the incident, which can significantly impact the review process, should be included to establish timelines. Key involved parties, such as the names of claimants or insured individuals, must be noted to clarify relationships and responsibilities. The appeal should provide comprehensive reasons for the dispute, supported by evidence, receipts, or estimates from service providers (e.g., repair shops, medical professionals) to enhance the validity of the appeal. All communications should be directed to the appropriate department within the insurance company, typically claims or customer service, ensuring that they are aware of the appeal's intent.

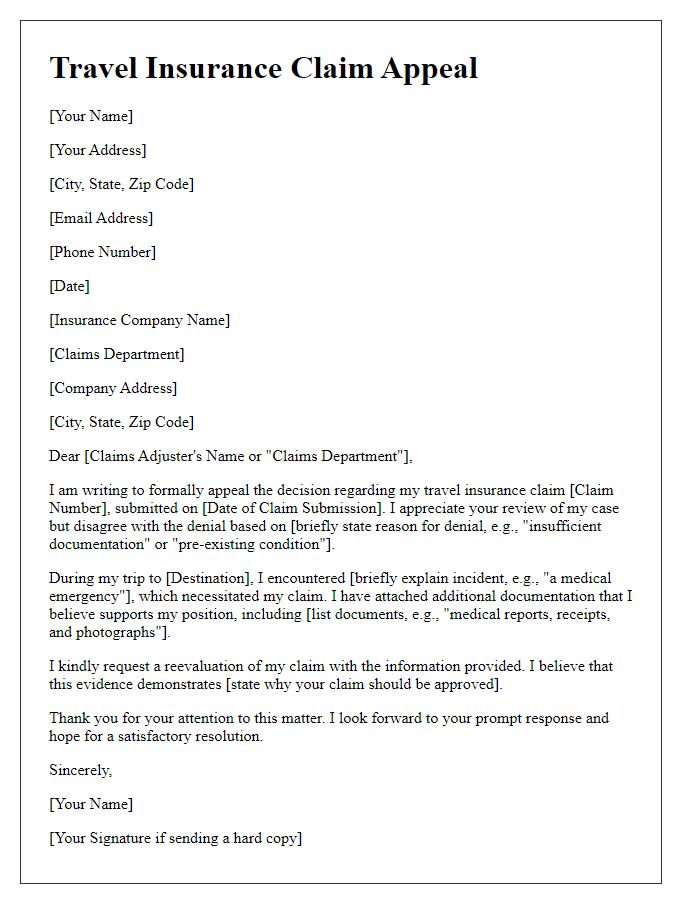

Reason for Denial Explanation

Insurance claim denials often occur due to inadequate documentation, policy exclusions, or failure to meet specific criteria set by insurance providers. For instance, a claim for a medical procedure may be denied if the insurer determines that the service was not medically necessary based on their internal guidelines. Detailed reviews of the policy terms (such as coverage limits and exclusions) may reveal that certain conditions, like pre-existing ailments, are not covered. Additionally, communication issues with the insurance adjuster may lead to misunderstandings regarding the required paperwork, delaying the approval process. Ensuring that all required documents are submitted promptly and accurately can significantly enhance the chances of a successful appeal.

Supporting Documents and Evidence

Supporting documents and evidence are crucial for a successful insurance claim appeal. These can include incident reports, such as police reports from an auto accident in Los Angeles (August 2022), medical records detailing treatment for injuries sustained, photographs capturing damage or evidence (for example, water damage from a flood in Miami, Florida), and repair estimates from licensed contractors. Additional documentation may consist of correspondence with the insurance agent, policy documents outlining coverage, and any witness statements confirming the relevant events. Properly organized documents enhance the clarity of your case, while timestamps and detailed descriptions establish a credible narrative of the circumstances surrounding the claim.

Request for Reevaluation and Desired Outcome

Prolonged disputes over insurance claims can create significant stress for policyholders seeking financial relief. Inequitable assessments often arise during the claims process, leading to appeals directed towards insurance regulatory bodies. Comprehensive documentation, including original policy agreements and detailed incident reports, is essential for substantiating the appeal. Insurance companies such as State Farm and Geico have specific guidelines for submitting said appeals, ensuring a proper reevaluation of the claim. Timely submissions within the stipulated time frames -- often 30 to 60 days post-denial -- significantly increase the probability of favorable resolutions and desired outcomes, including full compensation or coverage reinstatement.

Comments