Are you thinking about extending your insurance coverage but unsure where to start? It can feel overwhelming navigating policy details and options, but don't worry, you're not alone. Many individuals find themselves in the same position, looking for clarity and guidance to make informed decisions. If you're ready to explore your coverage extension options, keep reading for a helpful template that will simplify the process!

Policyholder Information

When seeking an insurance coverage extension, policyholder details can greatly influence the process. The policyholder's full name, such as John Doe, provides clarity and ensures accurate identification within the insurer's records. The policy number, a unique identifier like 123456789, links the request to the specific insurance agreement. Essential contact information, including a personal email address like johndoe@example.com and a phone number such as (123) 456-7890, enables timely communication regarding the extension request. Additionally, the policy start date, like January 1, 2020, and the expiration date, such as December 31, 2022, provide crucial timelines for evaluating the current coverage scope. Specific details about the coverage type--be it homeowner's insurance or auto insurance--reflect the particular needs and obligations of the policyholder, crucial for assessing eligibility for extension.

Current Policy Details

Current insurance policy details include the policy number, which is a unique identifier for the coverage provided by the insurer, the effective date of the policy indicating when the coverage began, and the expiration date specifying when the coverage will end. The insured amount represents the maximum benefit the insurer will pay in case of a claim, while the premium is the amount paid regularly for maintaining the policy. Additional details could include any riders or endorsements that enhance the basic coverage, deductibles that must be paid before claims are settled, and the specific risks that are covered under the policy, such as property damage, liability, or personal injury.

Reason for Extension Request

Insurance coverage extension requests often arise from specific circumstances that warrant additional protection. Common reasons include increased property value, such as renovations on real estate, changes in risk profile, such as acquiring high-value assets like collectibles or vehicles, or unexpected life events, like marriage or the birth of a child, which may necessitate broader coverage. Business owners may seek extensions due to growth, requiring additional coverage for inventory or equipment. Seasonal fluctuations, for instance, businesses preparing for peak seasons, also prompt extensions. For travelers, an extension may be requested for coverage during prolonged international stays or unexpected travel delays. Each situation requires careful consideration of the existing policy limits and the potential risks associated with the changed circumstances.

Desired Extension Period

Insurance coverage extension requests can arise for various reasons, including life events or changes in circumstances that necessitate additional protection. For example, homeowners in areas prone to natural disasters, such as hurricanes or wildfires, may seek to extend their coverage period, especially when facing unpredictable weather patterns. A common desired extension period for these types of insurance policies is typically six months or one year, providing sufficient time to reassess risks and make necessary adjustments to the policy. Policyholders should also consider any specific events, such as upcoming renovations or family expansions, that might warrant additional coverage during these extended periods.

Contact Information and Signature

Insurance coverage extension requests require specific details. Policyholder name (for identification), insurance policy number (for reference), and current contact information (such as email address and phone number) are essential for prompt processing. Include the insurance company's name and address to ensure proper routing. Signature must be included to authorize the request, affirming consent and understanding of additional coverage terms. Timely submission within policy renewal period (often 30 days prior) enhances the likelihood of approval for extended coverage on specific items or protection plans.

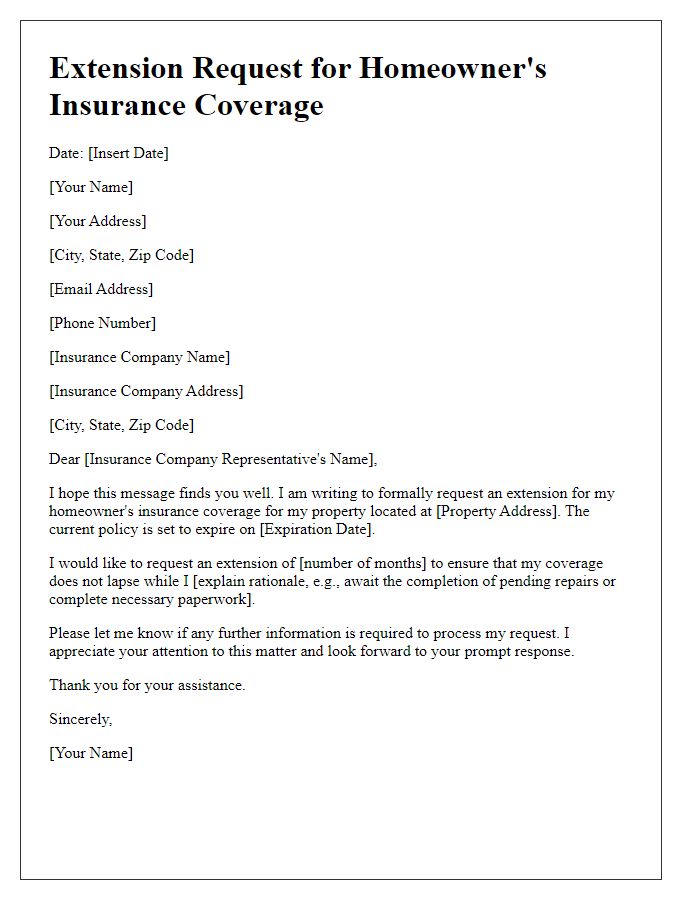

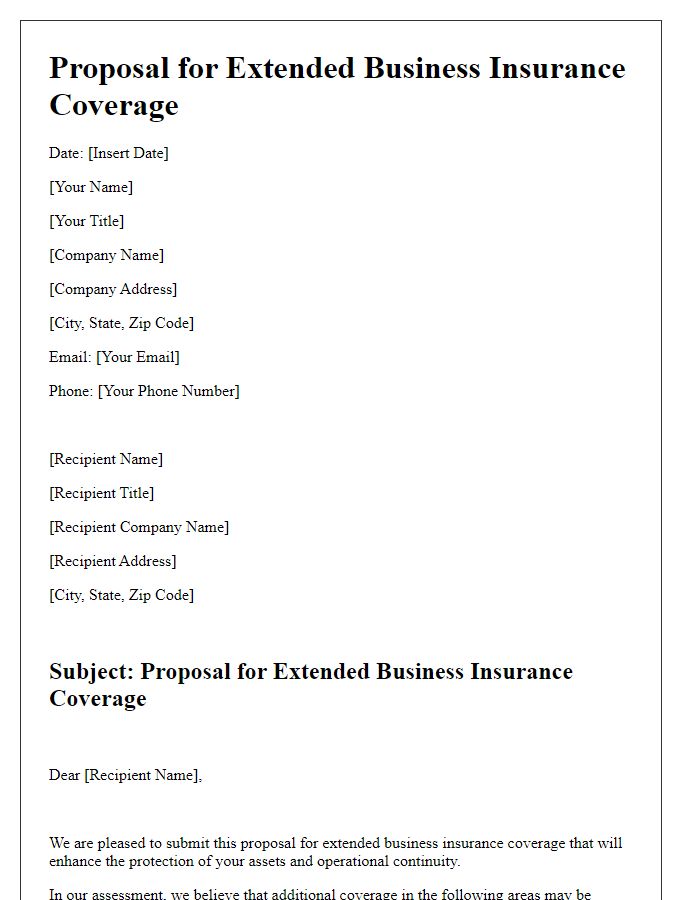

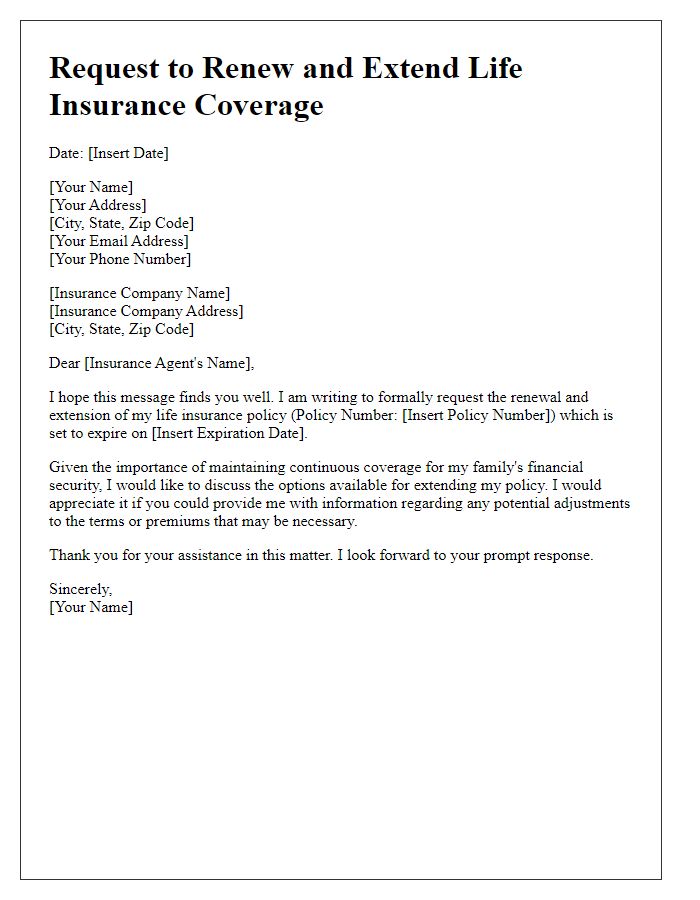

Letter Template For Insurance Coverage Extension Samples

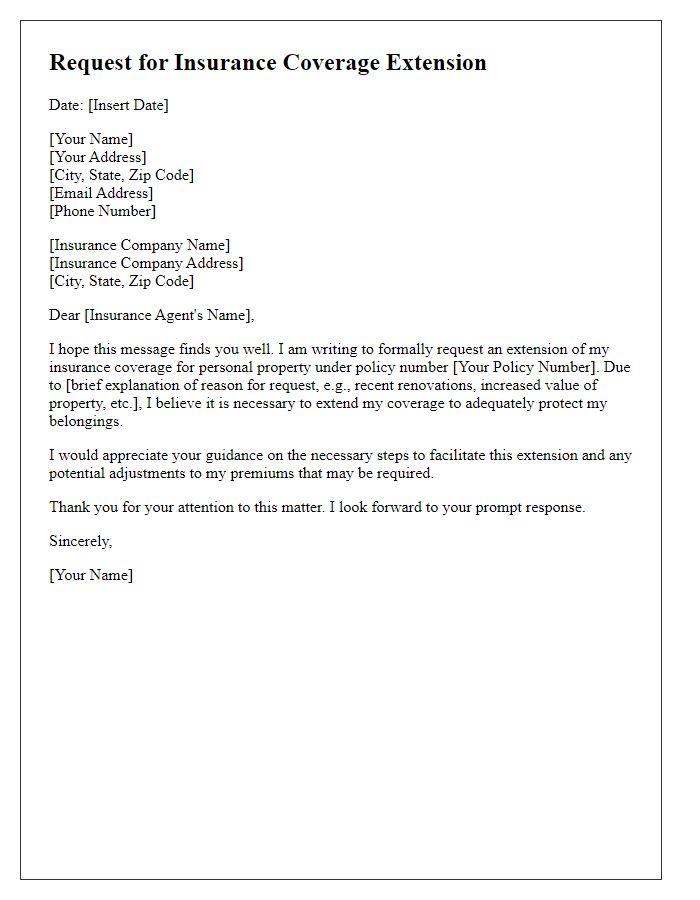

Letter template of request for insurance coverage extension for personal property

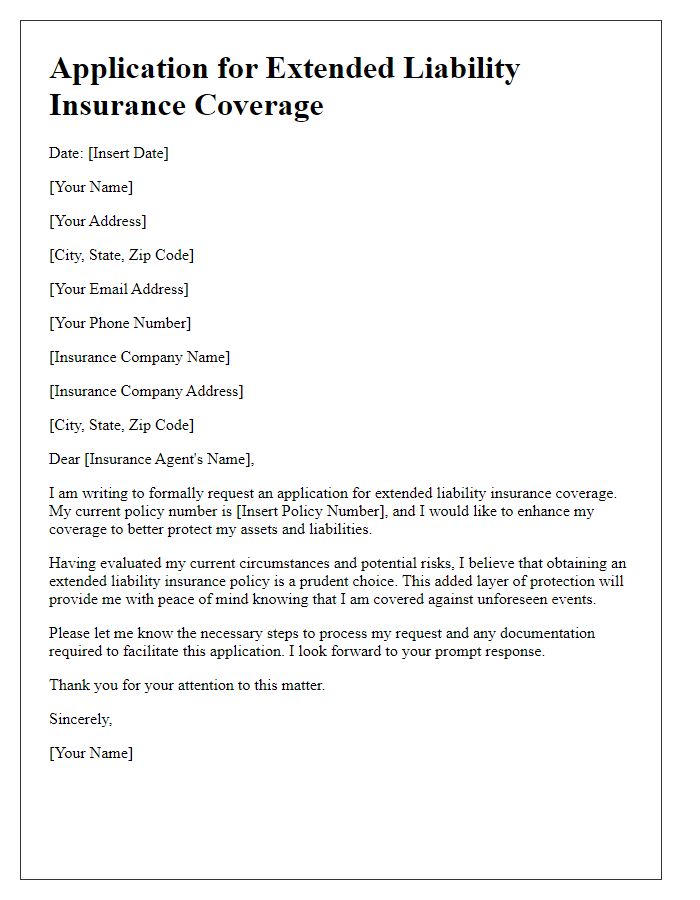

Letter template of application for extended liability insurance coverage

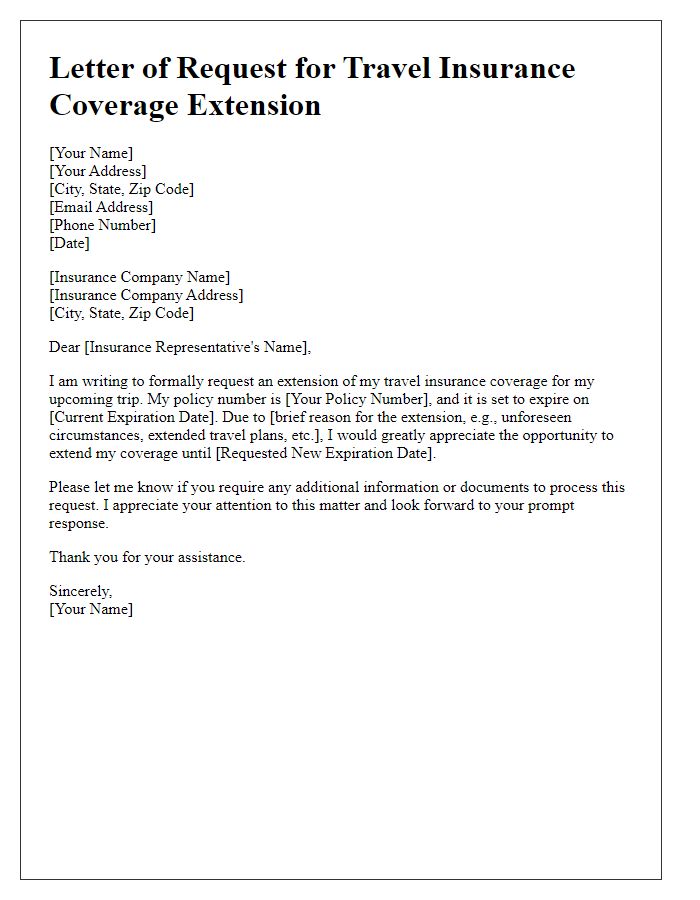

Letter template of formal request for travel insurance coverage extension

Letter template of notification regarding extended automobile insurance coverage

Comments