Hey there! Are you feeling a bit overwhelmed by the complex terms and conditions of your insurance policy? You're not alone! Many people find themselves needing clarification to ensure they're fully protected and making the best decisions. Keep reading to discover a straightforward letter template that can help you reach out to your insurance provider with confidence and clarity!

Policy Details and Reference Numbers

Insurance policies are complex legal documents often containing specific details such as policy numbers, coverage limits, and exclusions. Clarity on terms like premium amounts and deductibles is essential for understanding obligations. For instance, a standard homeowner's insurance policy may reference the document number (e.g., HP123456789) associated with the coverage, which protects against events such as fire or theft. Additional endorsements could specify coverage for high-value items, with limits exceeding typical policy provisions. Understanding these details ensures compliance and maximizes benefits during claims processes.

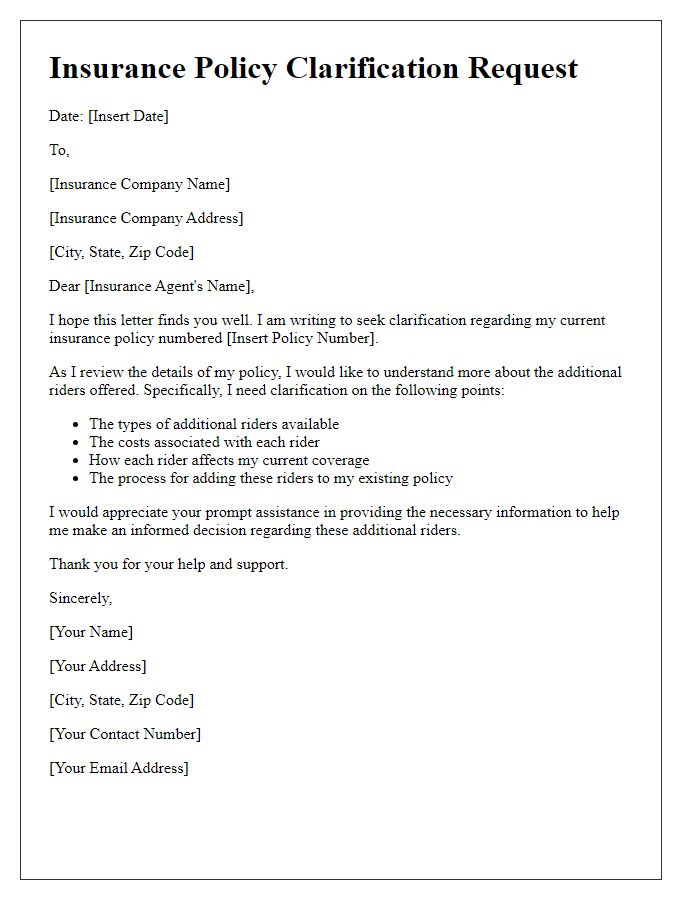

Clear Query or Clarification Statement

A comprehensive insurance policy clarification can ensure that policyholders fully understand their coverage, limitations, and procedures. Insurance documents, often filled with legal jargon, require clear definitions of terms such as "deductible," "premium," and "exclusions." Specific events like natural disasters may have different coverage stipulations compared to accidents or theft. Clear information is essential for understanding the claims process, including necessary documentation and timelines. Policyholders in large insurance firms, such as Allstate or State Farm, should also inquire about customer support services, frequently asked questions, and online resources for additional clarity. Furthermore, customer service representatives can provide guidance on policy changes or upgrades that might affect coverage or premiums.

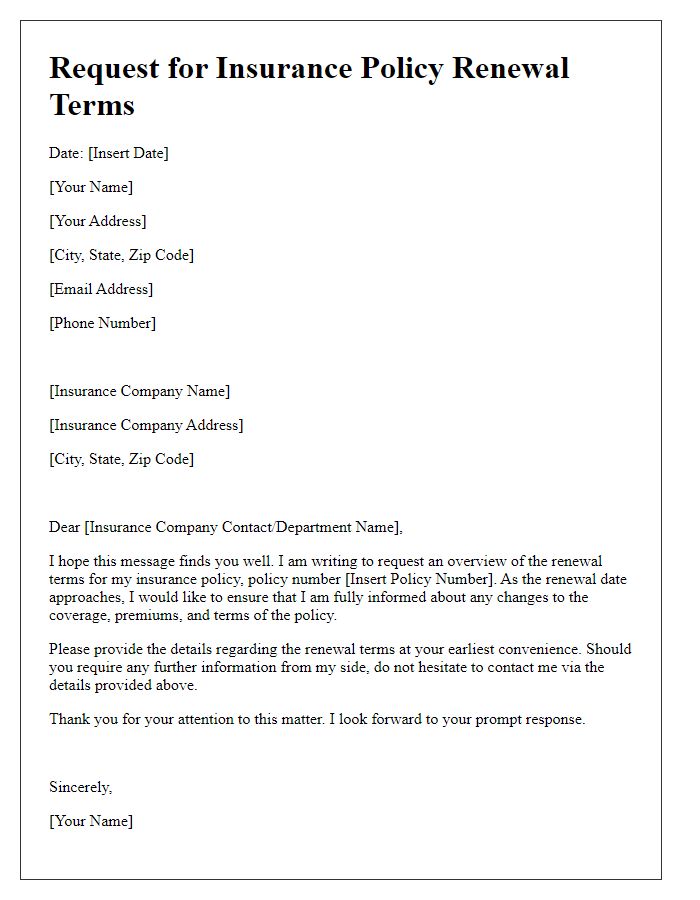

Relevant Dates and Timeline

The precise dates and timeline associated with an insurance policy are crucial for understanding coverage validity and renewal processes. The effective date marks when the policy commenced, which is typically listed on the declaration page; common effective dates may range from January 1, 2023, to December 31, 2023, for annual policies. The expiration date indicates when the coverage will end, necessitating timely renewals to avoid gaps in protection. Additionally, important milestones such as the grace period (often 30 days) for premium payments and the cancellation notice duration (usually 10-30 days) are key aspects that policyholders must monitor. Regular communication with the insurance provider, such as ABC Insurance Company, helps clarify these timelines and ensures that coverage remains uninterrupted.

Contact Information for Follow-up

Insurance policies often contain complex terms, making it essential for policyholders to seek clarification on specific details. Contact information serves as a crucial tool for follow-up inquiries, ensuring that clients reach the appropriate departments promptly. Insurers typically provide a dedicated customer service number, often toll-free, which can be found on official documents or their website. Email addresses for claims or policy management queries are also essential, allowing for written communications, especially when requiring detailed responses. Additionally, some insurance companies offer live chat features on their websites, where representatives assist with questions in real-time. This multi-faceted approach aims to enhance customer satisfaction and provide comprehensive support for understanding policy intricacies.

Request for Written Confirmation or Response

Insurance policy documents often contain intricate terms and conditions that require clear understanding for policyholders, such as the specific coverage limits, premium rates, and deductibles. Policyholders may seek written confirmation for their inquiries regarding claim procedures, exclusions, or potential renewals to ensure all details align with their expectations and needs. Frequent queries include clarification on the scope of coverage for natural disasters, accidents, or liability, particularly as these can vary widely across different insurance providers and local regulations. Timely responses, particularly within a few business days, are essential as they enable policyholders to maintain financial protection and make informed decisions.

Letter Template For Insurance Policy Clarification Samples

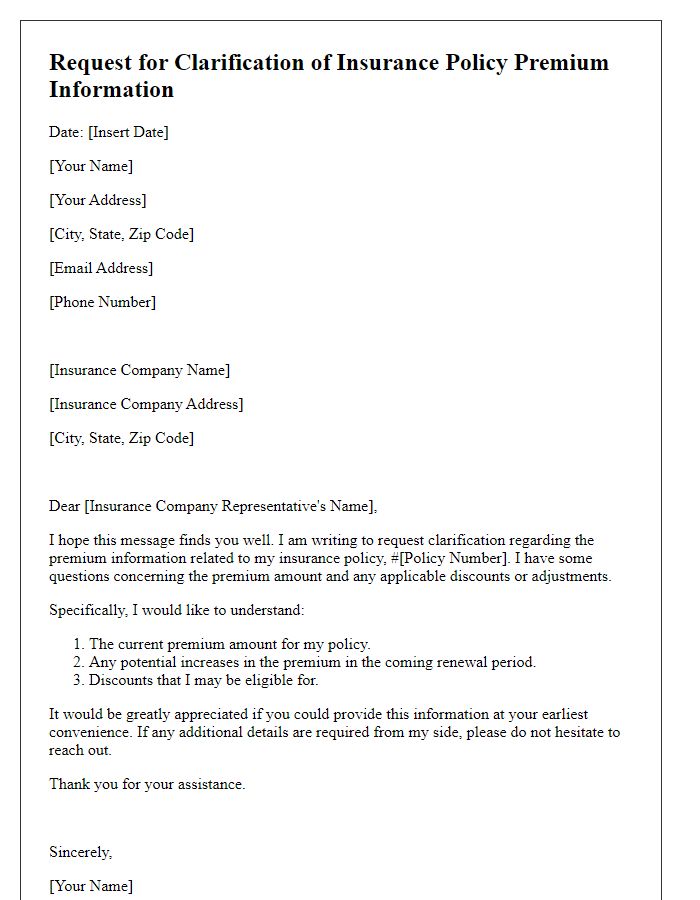

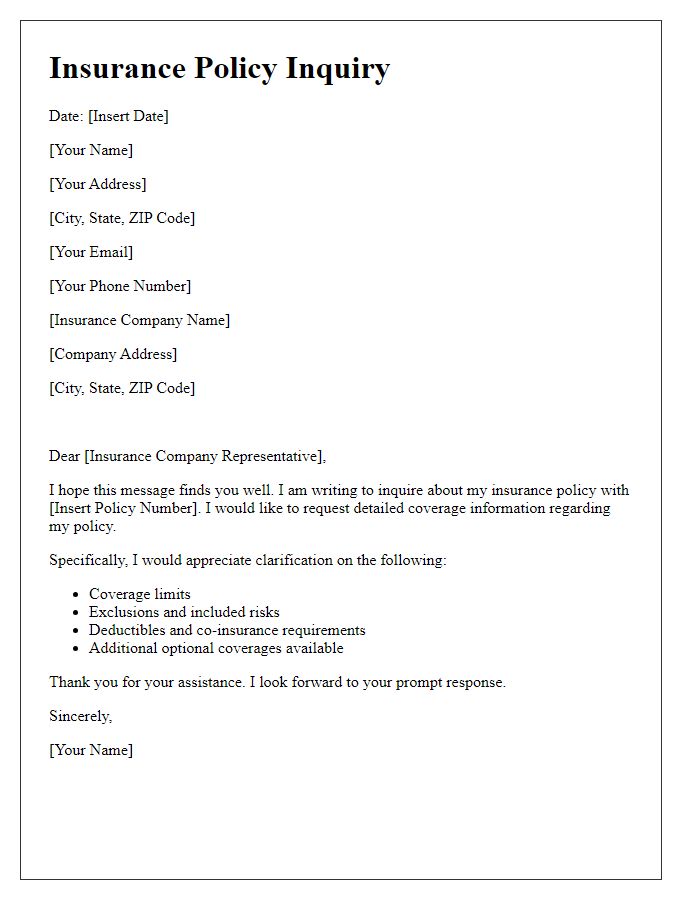

Letter template of insurance policy clarification request for premium information

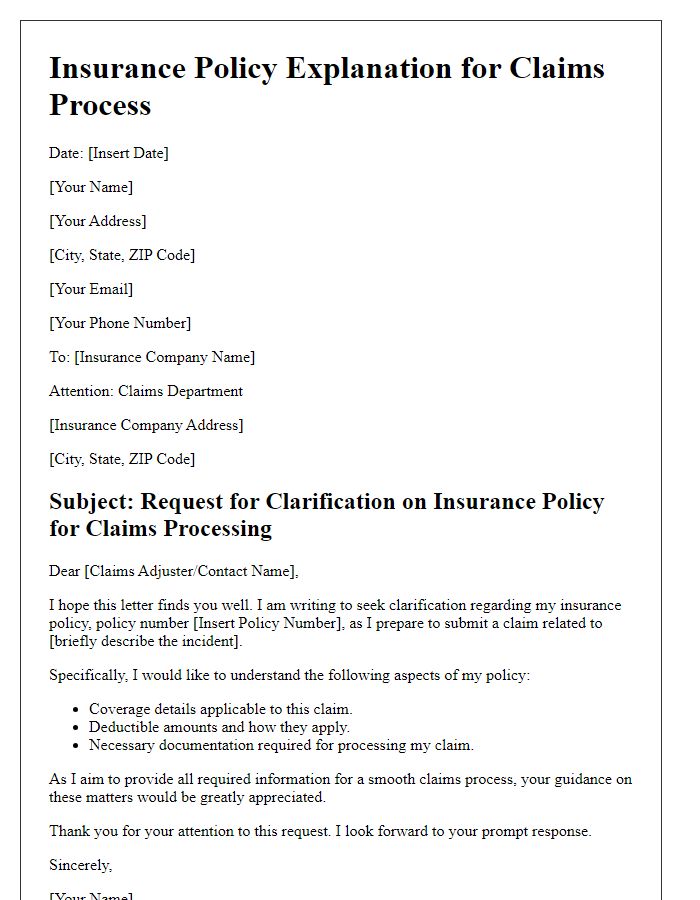

Letter template of insurance policy explanation needed for claims process

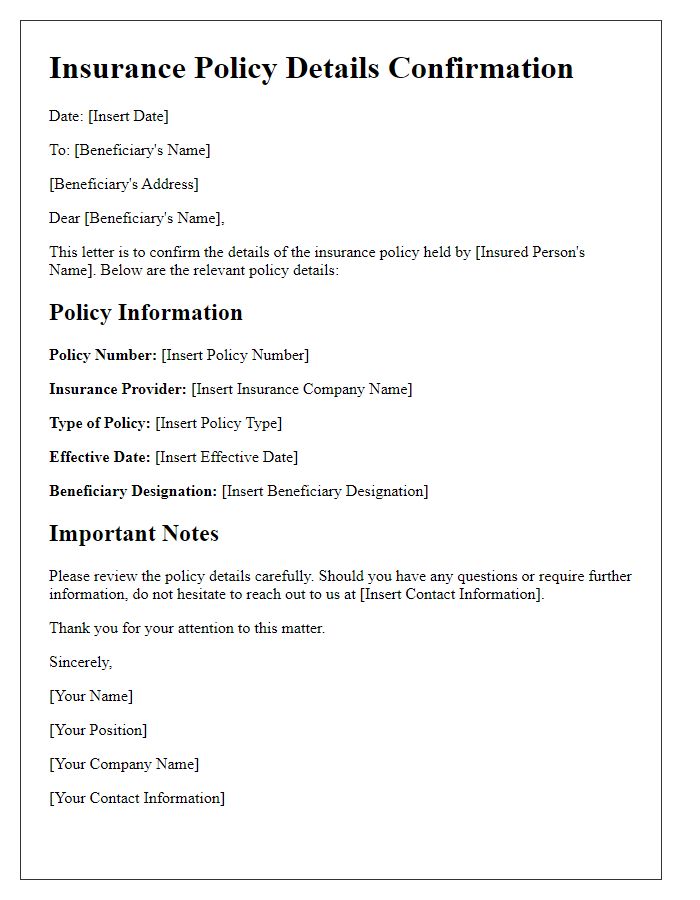

Letter template of insurance policy details confirmation for beneficiary information

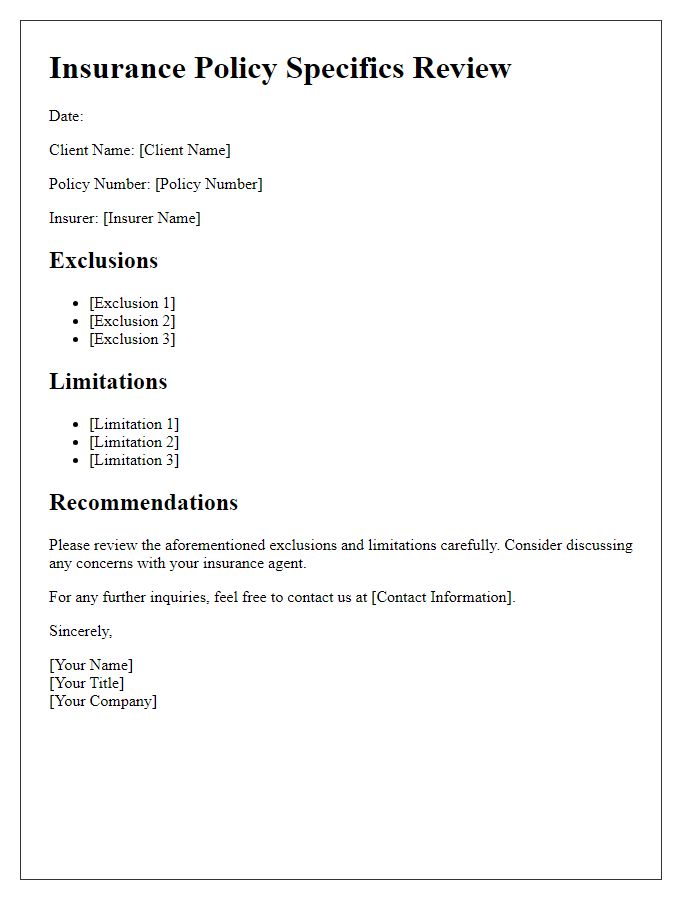

Letter template of insurance policy specifics check for exclusions and limitations

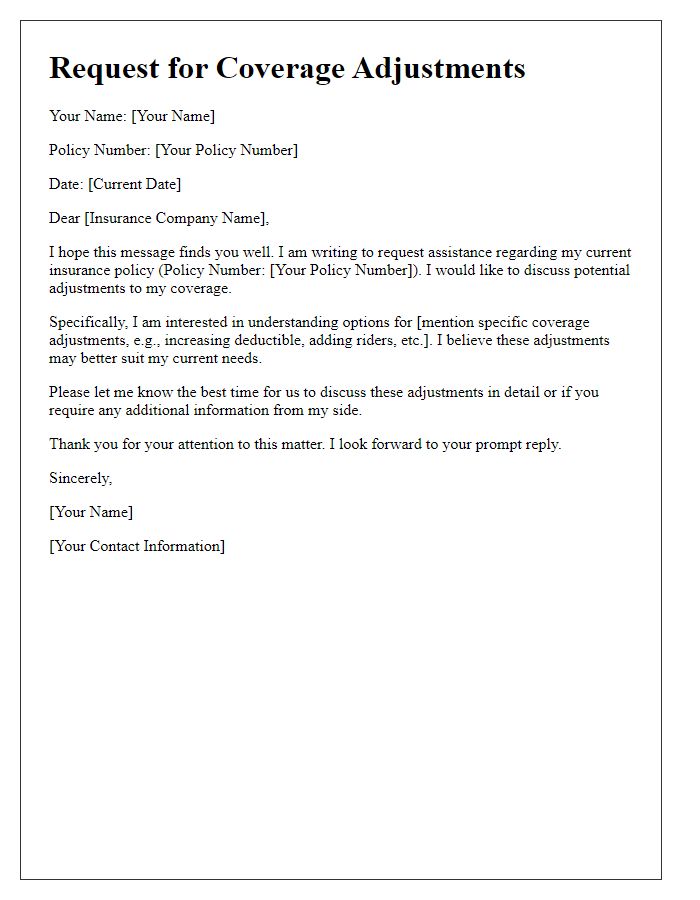

Letter template of insurance policy assistance needed for coverage adjustments

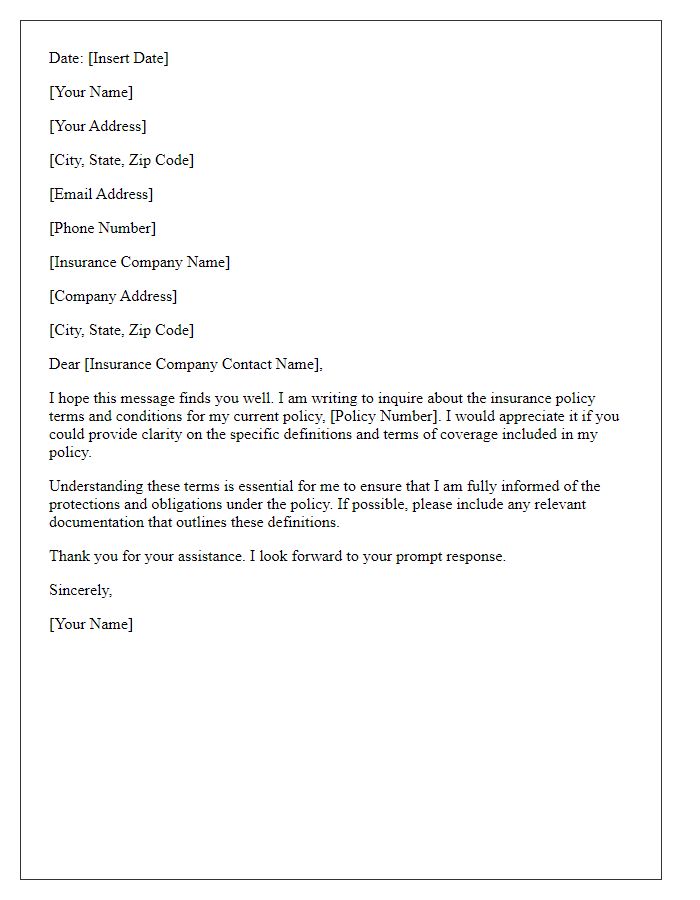

Letter template of insurance policy definition inquiry for terms and conditions

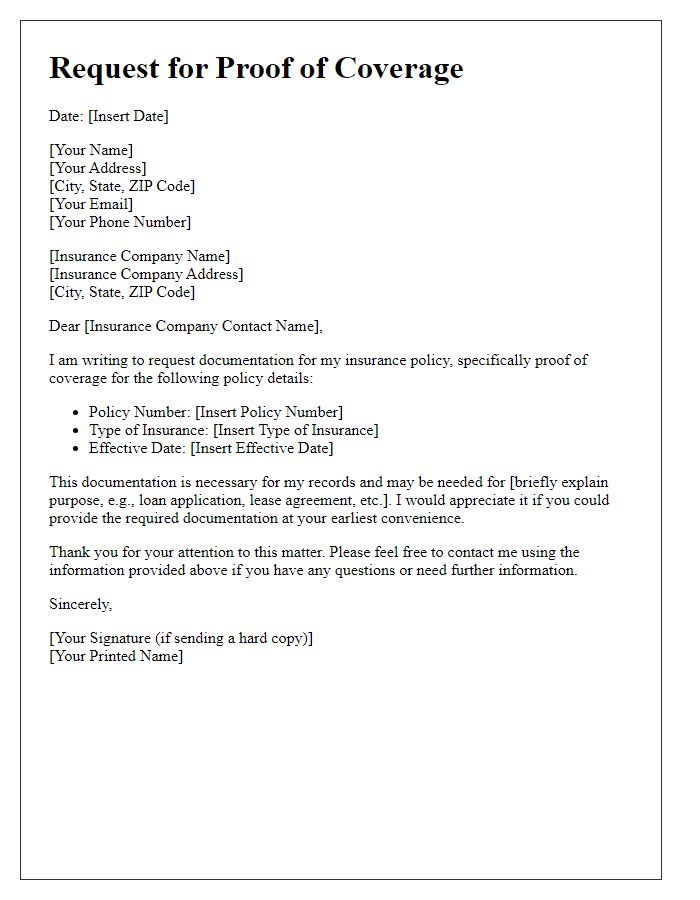

Letter template of insurance policy documentation request for proof of coverage

Comments