Are you seeking a straightforward way to draft an insurance coverage verification letter? Navigating the complexities of insurance can be daunting, but having the right template can simplify the process significantly. In this article, we'll provide you with a clear and concise letter template, ensuring you cover all necessary details with ease. So, let's dive in and explore how you can effectively communicate your insurance needs!

Policyholder Information

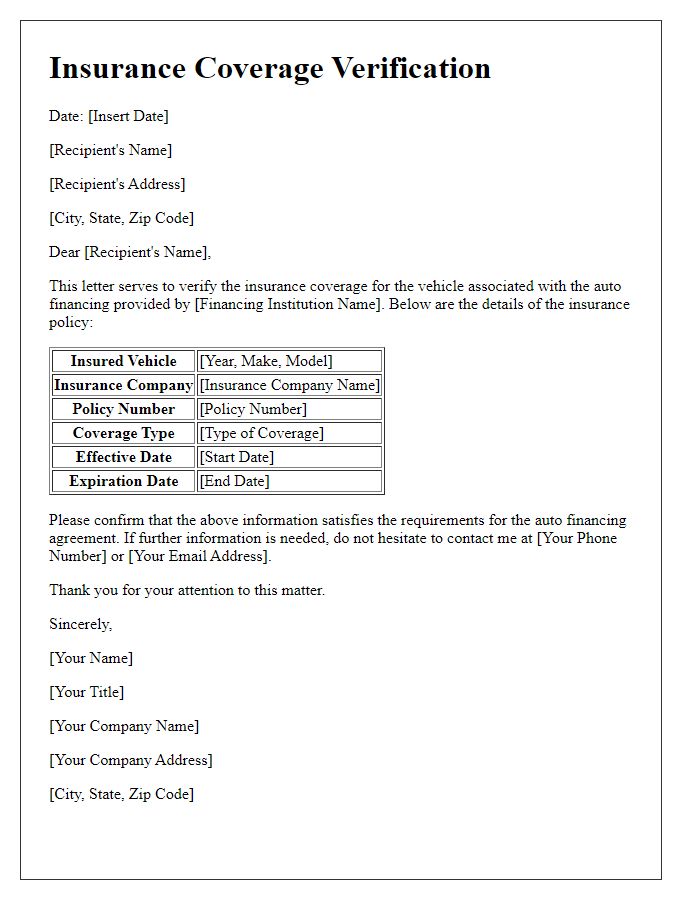

An insurance coverage verification letter outlines the essential details regarding a policyholder's insurance plan, confirming the specifics of their coverage. Policyholder information typically includes the full name of the individual, the policy number for identification purposes, the date of birth for identity verification, and the address reflecting the insured's residence, which helps in confirming policy validity. Additional details might involve the type of coverage, such as health, auto, or homeowners insurance, along with effective and expiration dates, which clarify the duration of the policy. Gathering this information accurately ensures that clients receive the appropriate confirmations needed for medical services, vehicle repairs, or home claims.

Policy Details

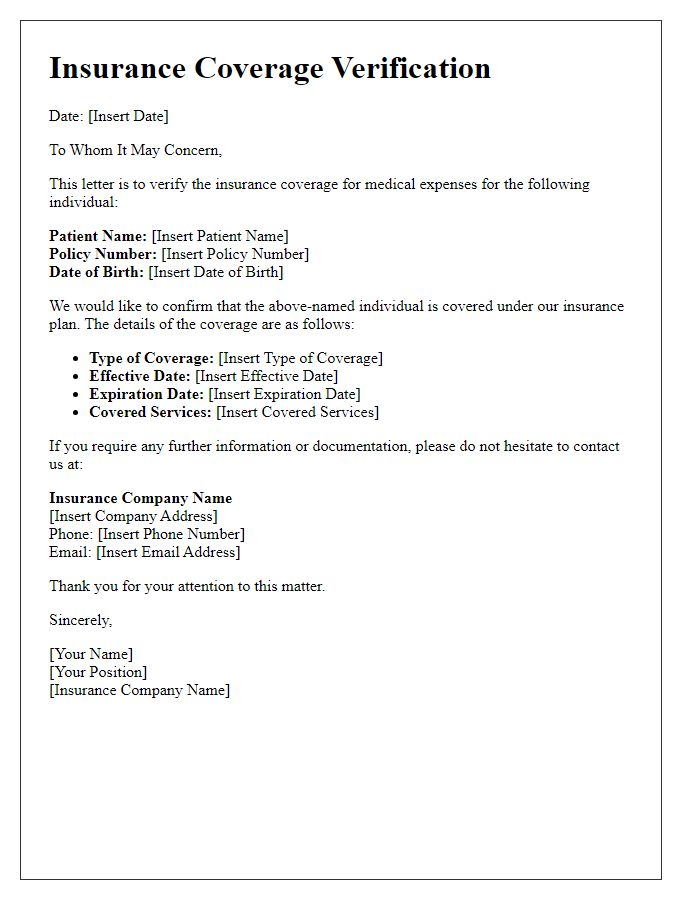

Health insurance coverage plays a crucial role in accessing medical services efficiently, especially for individuals living in urban areas like New York City. Various policy details, such as copayment amounts (often ranging from $10 to $50 per visit), deductible limits (typically between $1,500 and $3,000 annually), and coverage networks (including in-network and out-of-network providers), significantly impact the affordability and accessibility of healthcare. Timely verification of coverage can facilitate necessary treatments and reduce out-of-pocket expenses for policyholders, allowing them to focus on recovery rather than financial concerns. Specific plans, such as Preferred Provider Organizations (PPO) or Health Maintenance Organizations (HMO), also influence the way services can be accessed, with differences in provider selection and referral requirements.

Coverage Period

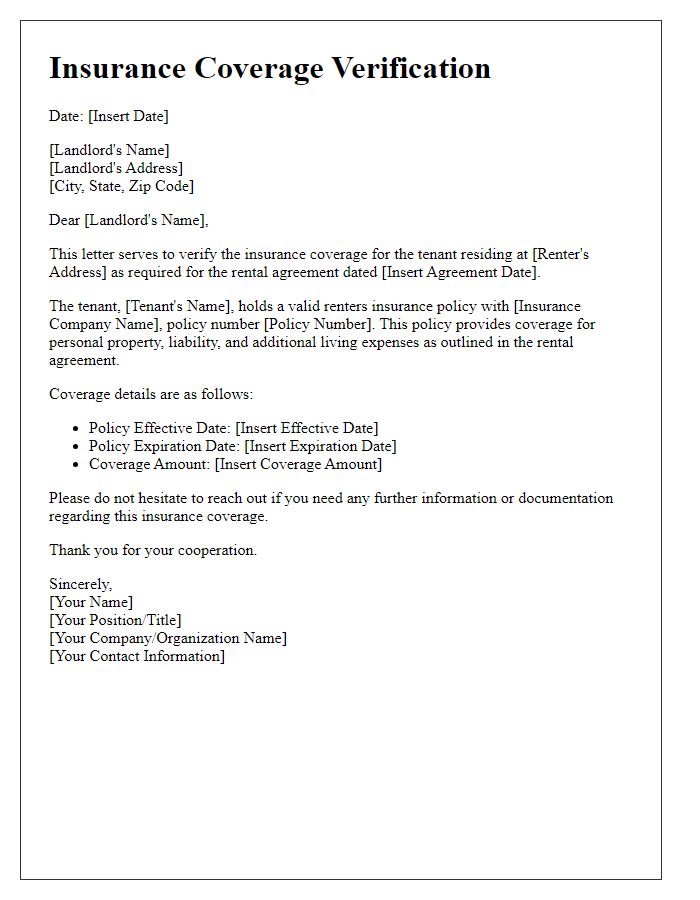

Insurance coverage verification involves confirming specific details regarding the policy between the insurer and the insured. The coverage period denotes the timeframe during which the insurance policy remains active, providing protection against claims. For instance, individuals may have a policy covering medical expenses that starts on January 1, 2023, and concludes on December 31, 2023. Within this annual period, policyholders can seek reimbursement for eligible medical services. Additionally, it is crucial to include information such as the policy number, the insured's name, and the type of insurance--like health, auto, or homeowners--to ensure clarity in communication with the insurance provider. Such verifications are often requested by financial institutions, healthcare providers, or legal entities requiring proof of active coverage.

Contact Information

In the realm of insurance coverage verification, precise contact information is crucial for efficient communication. Accurate details such as individual names, phone numbers, and email addresses must be included. For instance, a direct line of communication could include a representative's mobile number, like 555-123-4567, ensuring prompt responses. Additionally, email communication should reflect the organization's domain, such as info@insurancecompany.com, to verify authenticity. Furthermore, a physical address, such as 123 Insurance Lane, Suite 100, Cityville, State, ZIP 12345, enhances reliability and serves as a formal point of contact for inquiries or documentation requests. Comprehensive contact information streamlines the verification process and promotes effective engagement between insured parties and insurance providers.

Authorized Signature

Insurance coverage verification letters serve as essential documents that confirm the specific insurance policy details for individuals or businesses. These letters include critical information such as the policyholder's name, policy number, effective dates, coverage limits, and types of coverage included, such as liability or property damage. Institutions typically require such letters for processes like mortgage applications, lease agreements, or medical service approvals, ensuring that the necessary insurance is in place. An authorized signature from an insurance representative adds credibility to the letter, confirming that the details provided are accurate and valid as of the date of issuance. This verification process is crucial in various industries, especially where financial risk management is paramount, fostering trust between the parties involved.

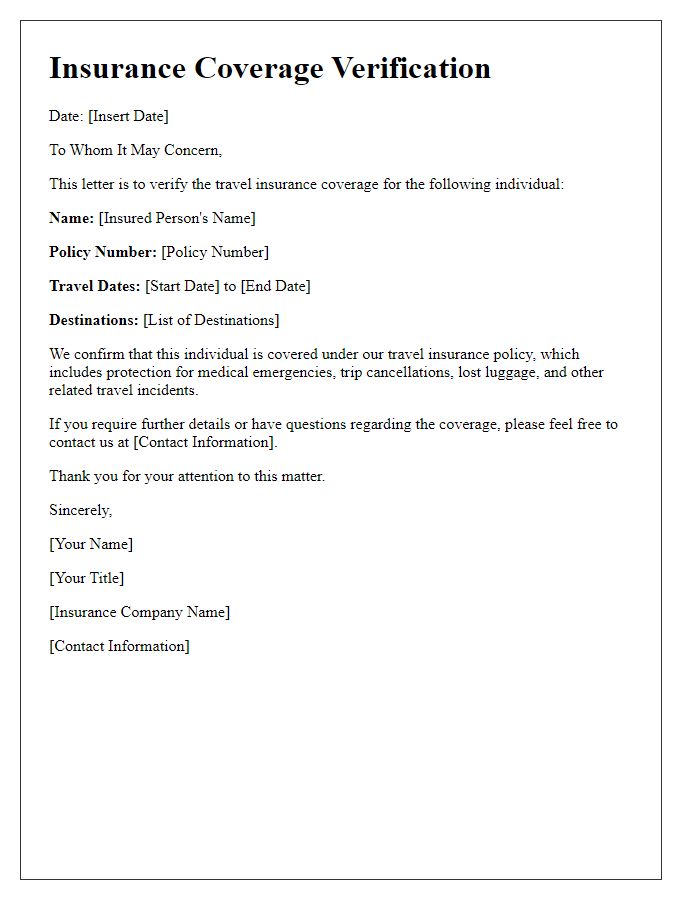

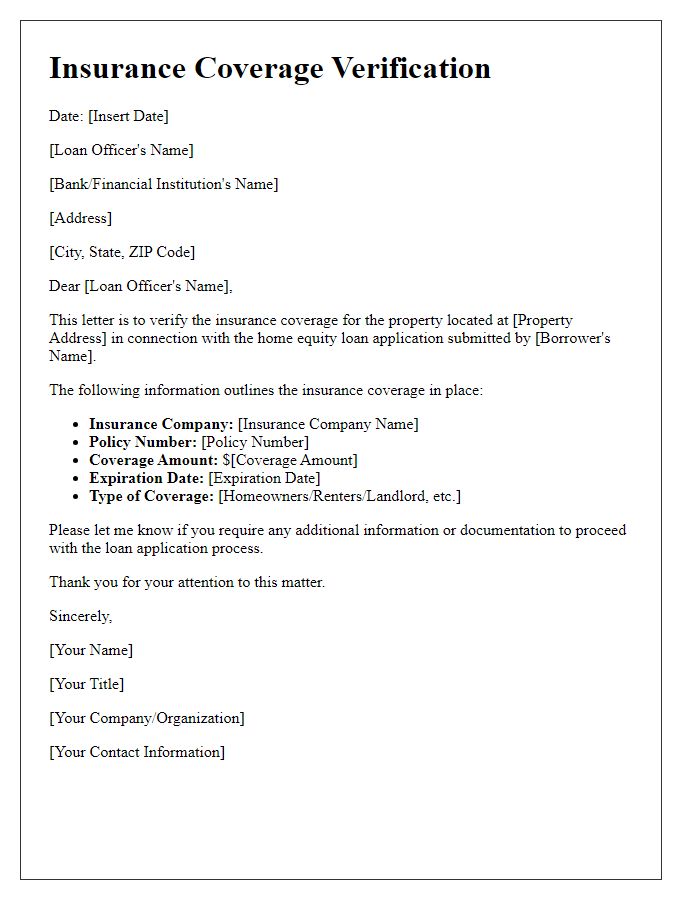

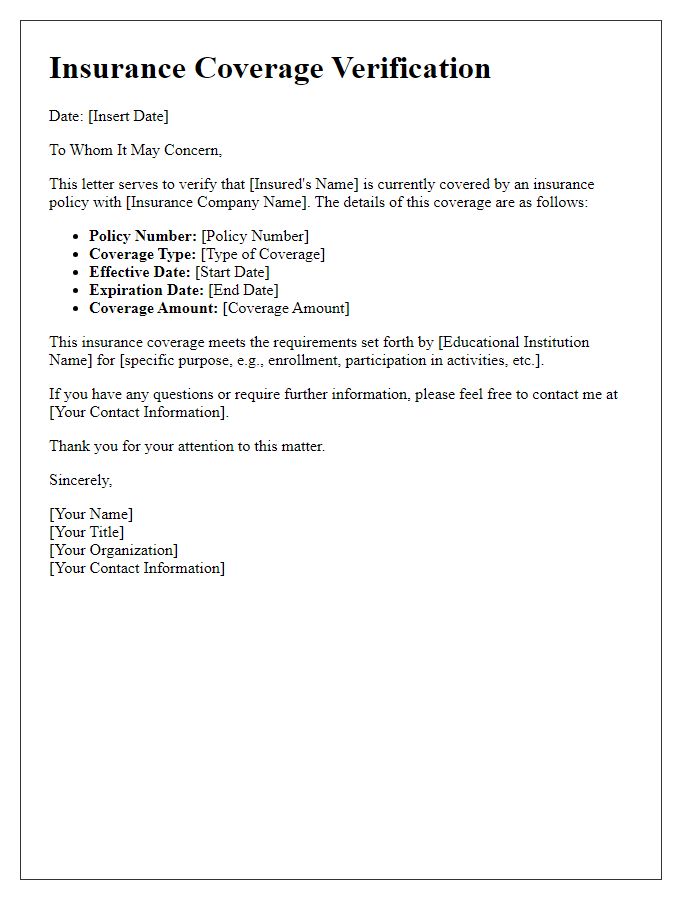

Letter Template For Insurance Coverage Verification Letter Samples

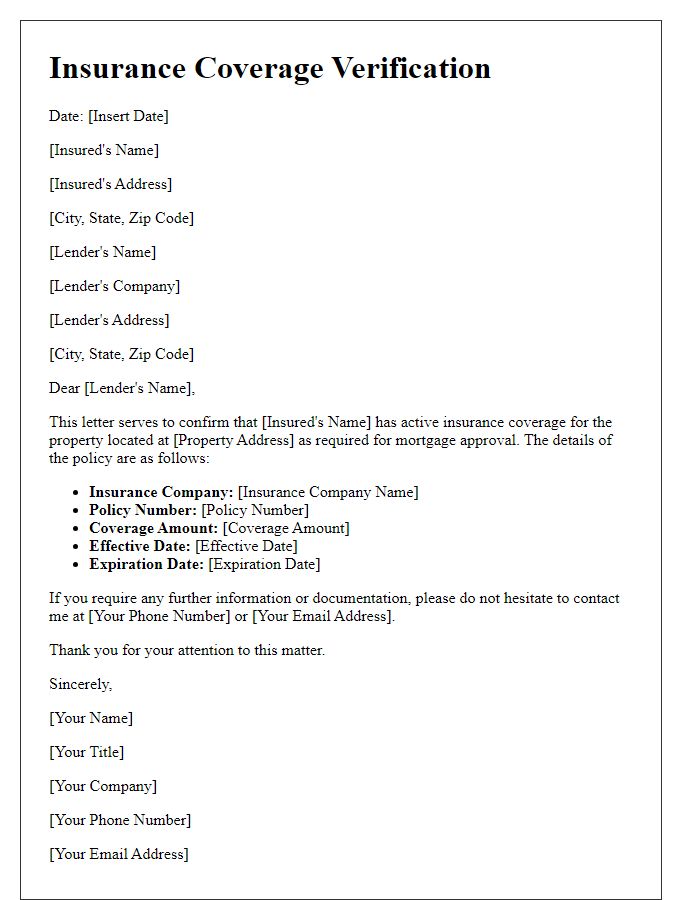

Letter template of insurance coverage verification for mortgage approval

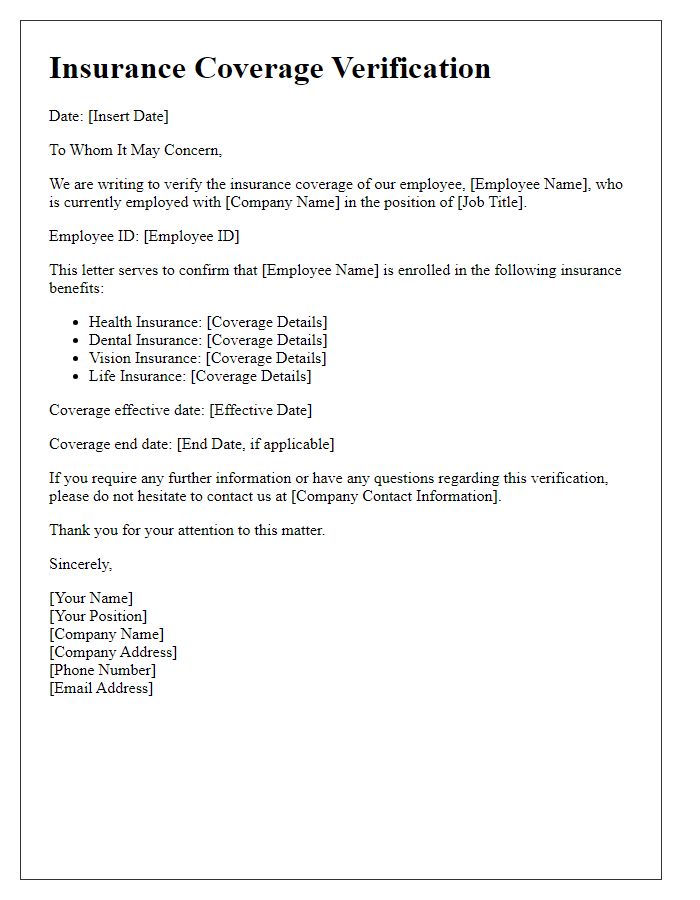

Letter template of insurance coverage verification for employee benefits

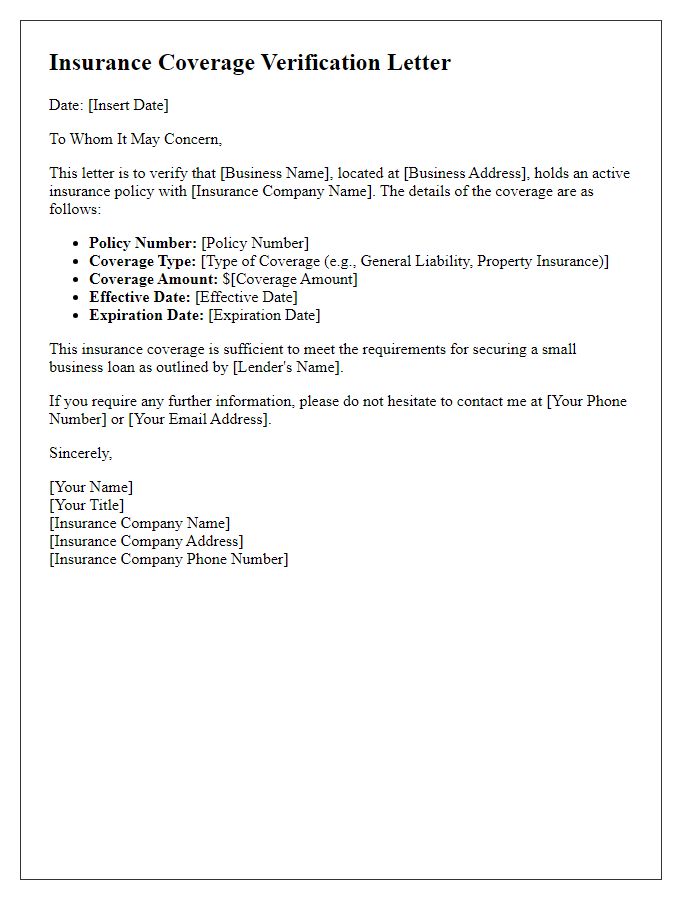

Letter template of insurance coverage verification for small business loan

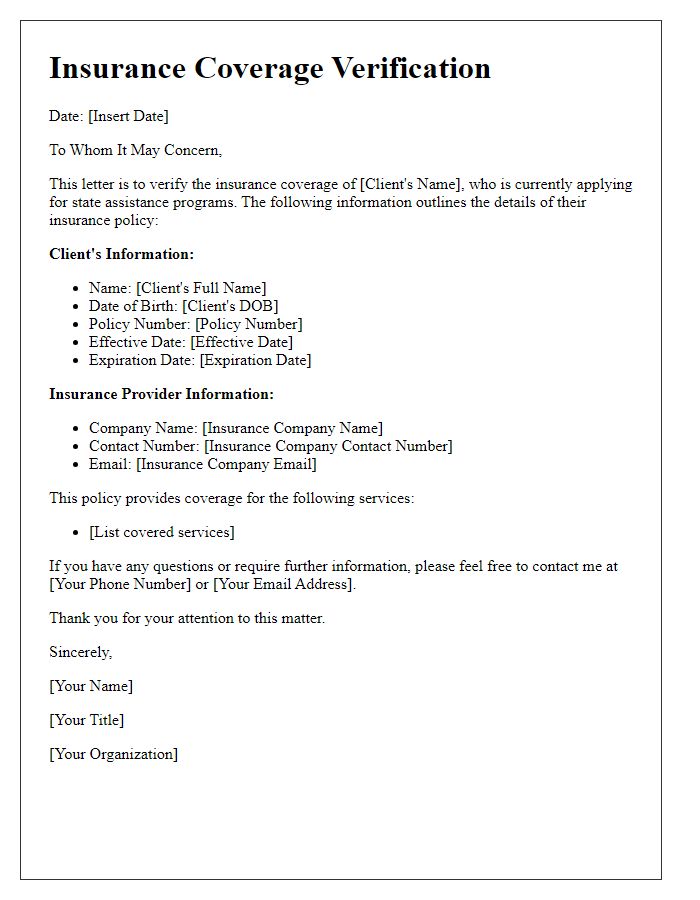

Letter template of insurance coverage verification for state assistance programs

Comments