Are you finding yourself in need of a solid template for an insurance confidentiality agreement? Navigating the intricate world of insurance can be tricky, and ensuring that sensitive information remains protected is crucial. With the right letter template, you can establish clear guidelines and expectations around confidentiality, safeguarding both your business and client relationships. Dive in and discover how to craft an effective agreement that meets your needs and invites peace of mind!

Parties Involved

The insurance confidentiality agreement encompasses multiple parties involved in safeguarding sensitive information within the insurance sector. Key parties typically include insurance providers (such as Allstate, State Farm), clients (individuals or businesses seeking coverage), third-party service providers (like claims adjusters and underwriting firms), and legal representatives (attorneys specializing in insurance law). Each entity plays a crucial role in maintaining the integrity of personal data and proprietary information, ensuring compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) for health-related policies and the Gramm-Leach-Bliley Act for financial privacy. The agreement outlines the responsibilities of each party to prevent unauthorized access to confidential materials, emphasizing the significance of trust in the insurance industry.

Definition of Confidential Information

Confidential Information refers to any proprietary data, documents, or information disclosed or made available by either party, including, but not limited to, client records, insurance policies, premium rates, claims processing information, underwriting guidelines, financial records, and strategic plans (both current and future). This information may be in written, electronic, oral or other tangible form and is deemed confidential regardless of its method of disclosure. Confidential Information excludes information that is publicly available, is independently developed by the receiving party, or is disclosed with written consent from the disclosing party. The protection of such information is crucial for maintaining privacy and compliance with industry regulations, including the Health Insurance Portability and Accountability Act (HIPAA) and the Gramm-Leach-Bliley Act.

Obligations of Confidentiality

Obligations of confidentiality are crucial in insurance agreements, protecting sensitive information from unauthorized disclosure. Insurers and policyholders must adhere to strict guidelines that define how personally identifiable information (PII), financial data, and claims details are handled. The Insurance Information Privacy Protection Act (IIPPA) emphasizes the necessity for both parties to implement secure storage measures, access controls, and encryption protocols. Breaching confidentiality obligations can result in severe consequences, including legal penalties and loss of licensure. Effective training protocols for staff handling confidential information are also essential in maintaining compliance with industry regulations and best practices.

Duration and Termination

The confidentiality agreement between parties typically encompasses a defined duration, ensuring protection of sensitive information. This period may extend for a specific term, often ranging from one to five years, with options for renewal based on mutual consent. Termination clauses outline conditions under which the agreement may be invalidated, including non-compliance or breach of terms. Essential to note, even after termination, confidentiality obligations can remain in effect, especially concerning proprietary information shared during the agreement's validity. Both parties should retain copies of all communications pertaining to the agreement for future reference.

Governing Law and Jurisdiction

The confidentiality agreement regarding insurance information outlines the legal framework under which the agreement operates. Governing law typically refers to the specific set of laws of a particular jurisdiction that will guide the interpretation and enforcement of the agreement. Jurisdiction determines the geographical region or court system where any legal disputes arising from the agreement will be resolved, often specified as the state of New York or California, known for their comprehensive commercial law frameworks. Additionally, the agreement may stipulate that any litigation must occur in a designated court, ensuring clarity for all parties involved. This legal structure serves to protect sensitive information, facilitating trust between parties while complying with regulations.

Letter Template For Insurance Confidentiality Agreement Samples

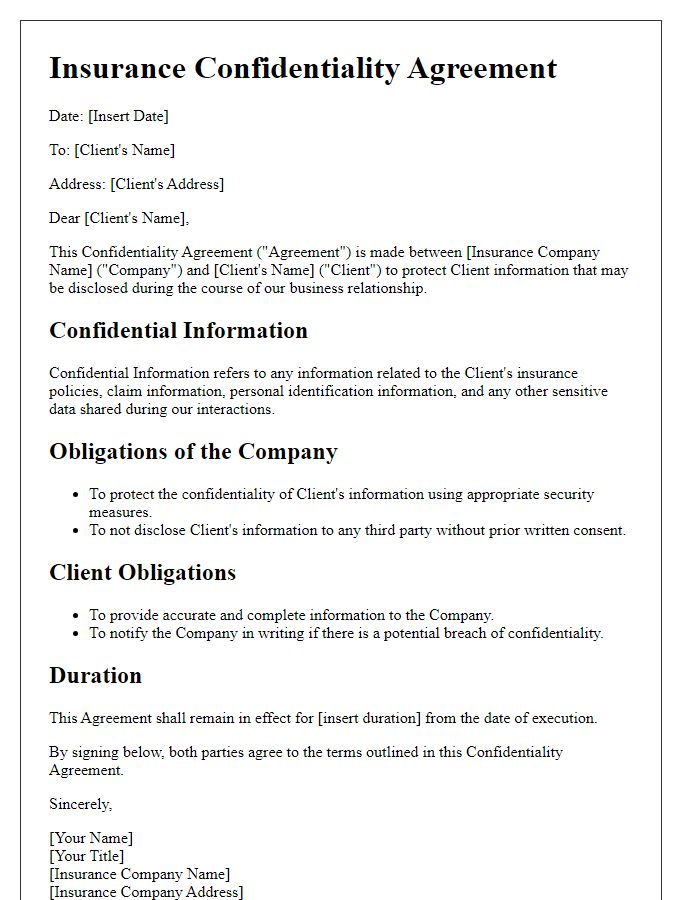

Letter template of Insurance Confidentiality Agreement for Client Information Protection

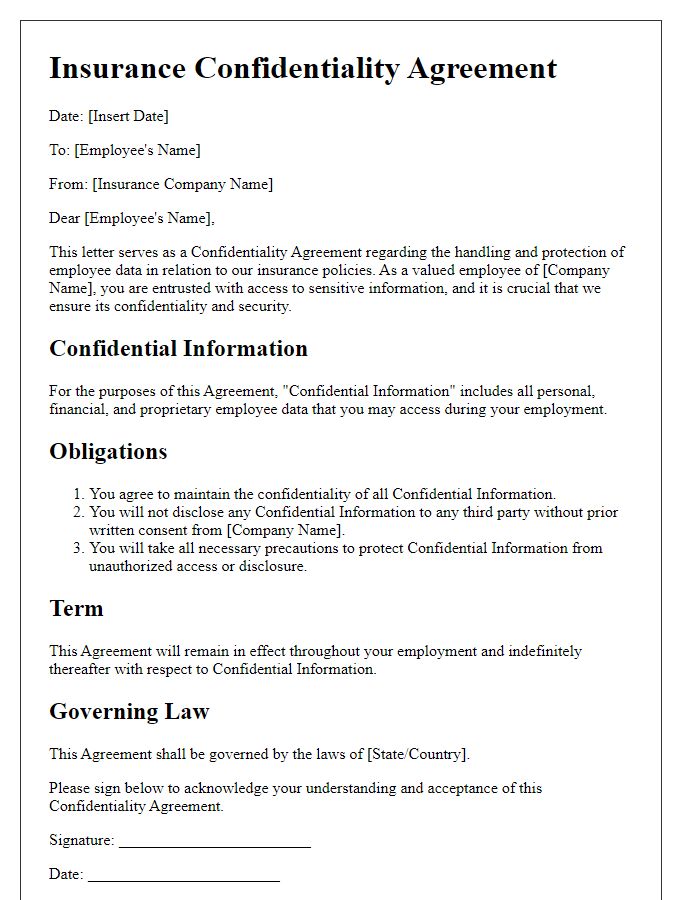

Letter template of Insurance Confidentiality Agreement for Employee Data Security

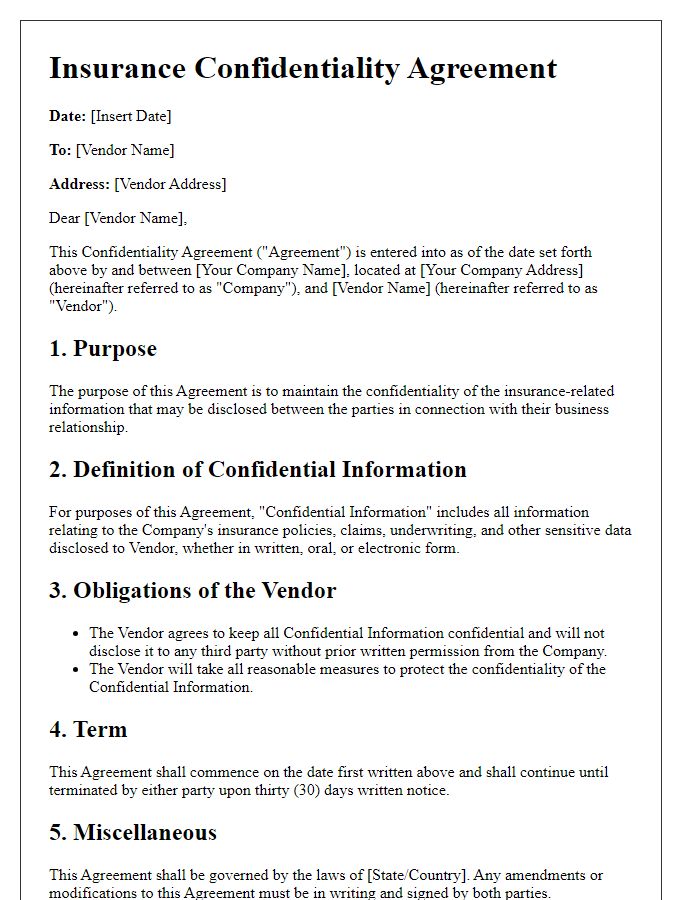

Letter template of Insurance Confidentiality Agreement for Third-Party Vendor Relationships

Letter template of Insurance Confidentiality Agreement for Policyholder Sensitive Data

Letter template of Insurance Confidentiality Agreement for Claims Processing Confidentiality

Letter template of Insurance Confidentiality Agreement for Regulatory Compliance

Letter template of Insurance Confidentiality Agreement for Medical Data Privacy

Letter template of Insurance Confidentiality Agreement for Underwriting Information Security

Letter template of Insurance Confidentiality Agreement for Risk Assessment Confidentiality

Comments